Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

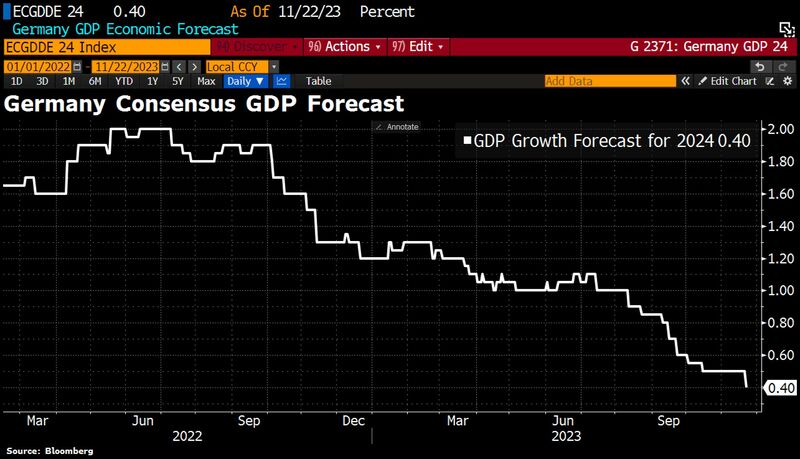

German growth forecasts for 2024 have been cut following the budget chaos after the Constitutional Court declared govt's spending plans unconstitutional

The consensus now expects GDP growth for Germany of just 0.4% for the coming year. Source: Bloomberg, HolgerZ

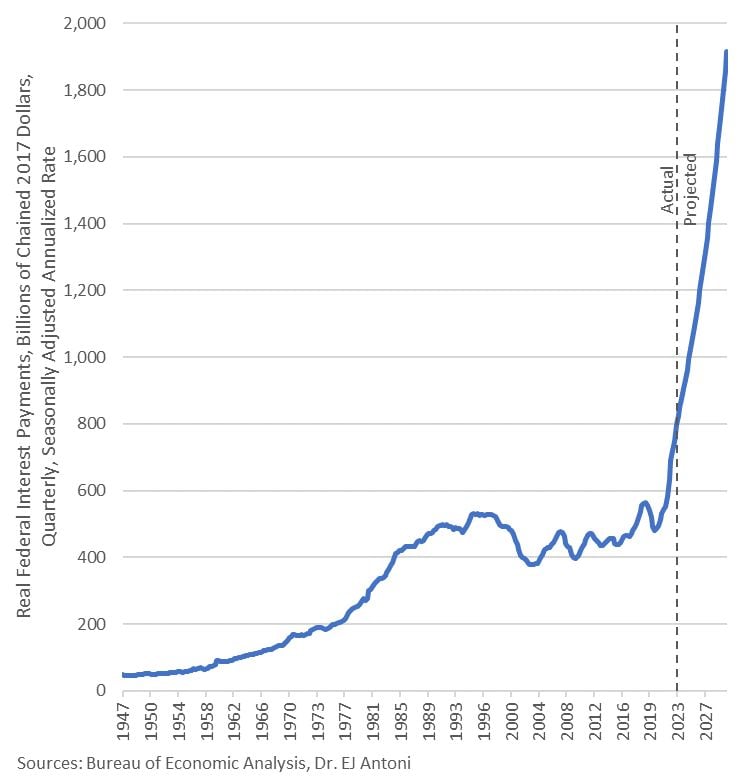

The US government collects about $2.5 trillion per year in personal income taxes. Of that about $1 trillion per year (40%) is being consumed by interest on the national debt

Interest on the debt is growing as old cheap debt matures and gets refinanced at the new higher rates. Plus new debt added every year. Within a few more years, at this pace, 100% of personal income taxes will be going to pay interest on the US national debt. Source: E.J Antoni, WallStreetSilver, BEA

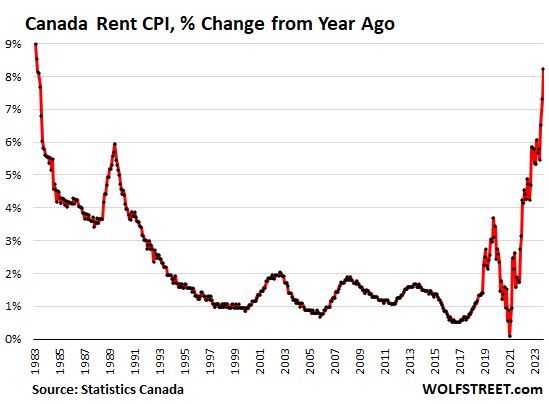

Compared to a year ago, the CPI for rent spiked by 8.2% in October, up from 7.3% in September, and the biggest year-over-year spike since April 1983

Soure: Wolfstreet.com, WallStreetSilver

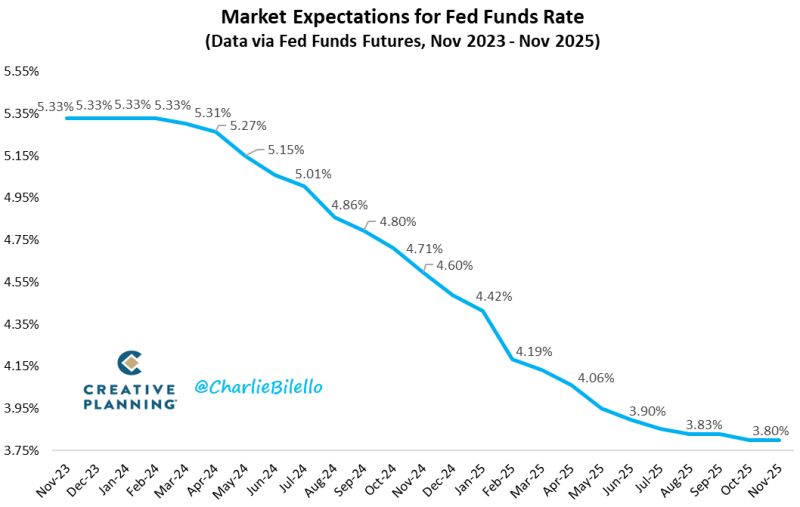

Ahead of Fed minutes... The market is now pricing in a 0% probability of a rate hike in December and rate cuts starting in May 2024

Source: Charlie Bilello

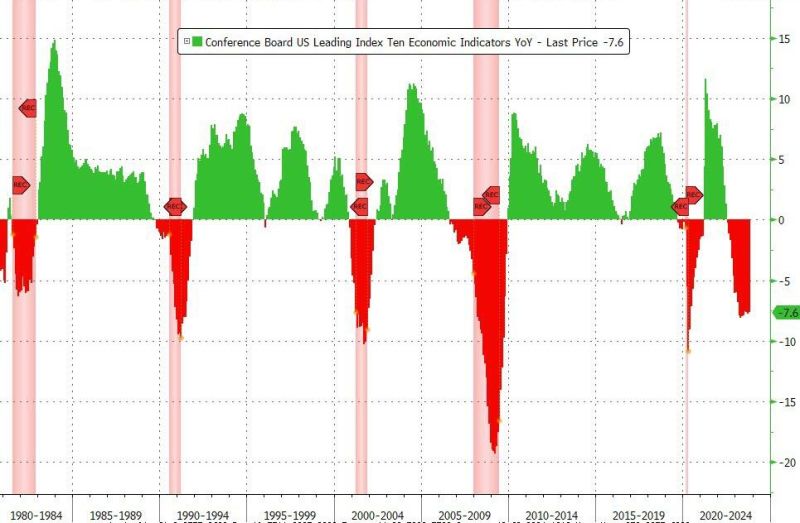

US Leading Indicators Tumble For 19th Straight Month

Worst Streak 'Since Lehman' on a year-over-year basis, the LEI is down 7.6% (down YoY for 16 straight months) - close to its biggest YoY drop since 2008 (Lehman) outside of the COVID lockdown-enforced collapse... Source: Bloomberg, www.zerohedge.com

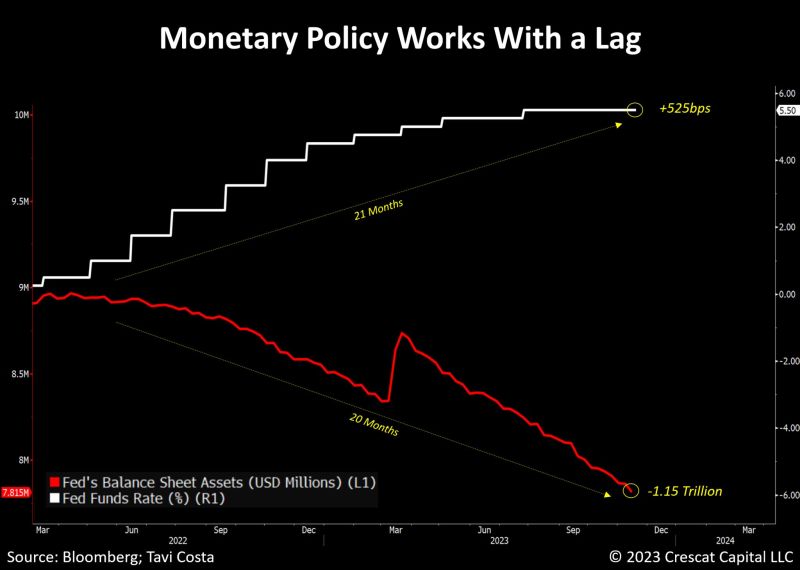

Fed monetary policy tightening (+525 basis points of interest rates hike + $1.15 Trillion of Fed balance sheet reduction) since 2022 has been quite brutal

2023 has been a miracle so far with headline inflation declining to 3% WITHOUT a recession and no increase in unemployment rate. But can it last? What could be the lagged effects of such a tightening? (chart courtesy of Tavi Costa)

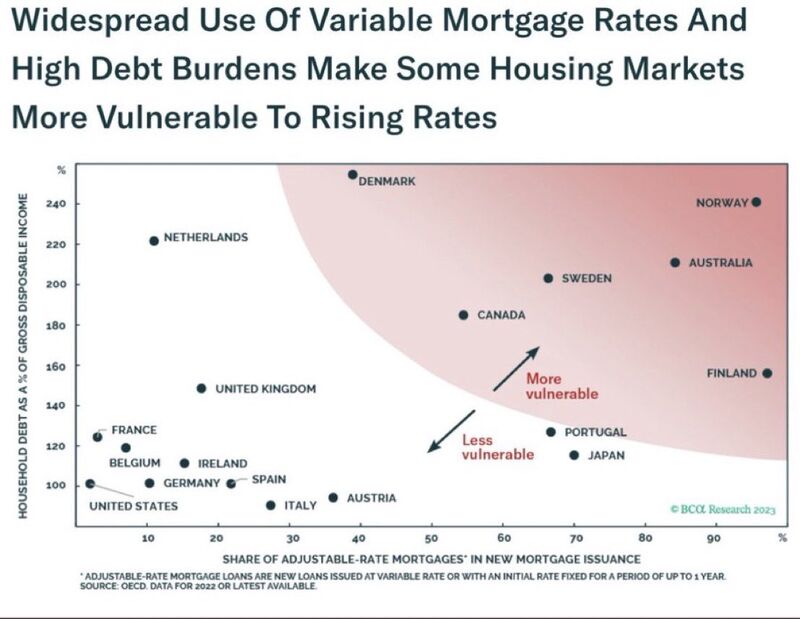

Which countries have the most rate sensitive household sectors?

Source: BCA, The Longview

Investing with intelligence

Our latest research, commentary and market outlooks