Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

US Continuing Jobless Claims Surges To 2 Year High

The number of Americans filing for jobless benefits for the first time last week jumped to 231k (from an upwardly revised 218k), up to its highest since August...Worse still, continuing claims keeps rising, to 1.864mm - the highest since November 2021... Source: Bloomberg, www.zerohedge.com

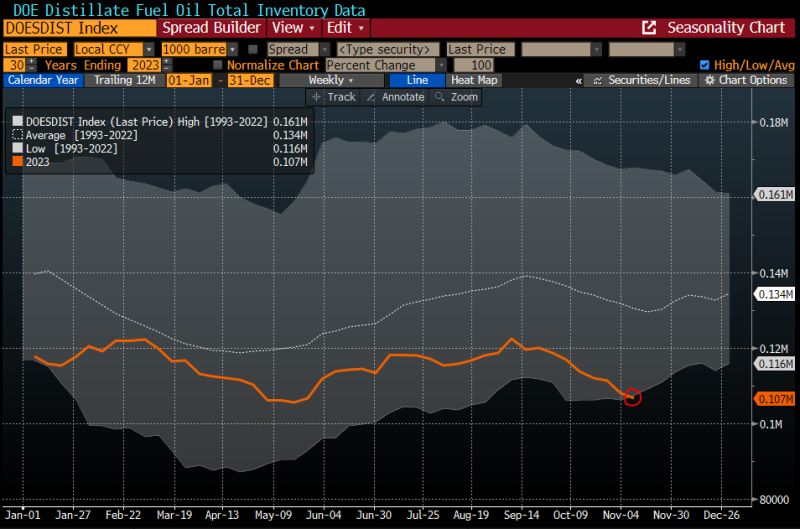

Let's hope the US economy is truly slowing down -- particularly manufacturing --, and that the winter is mild

US stocks of distillate fuel (diesel and heating oil) are ending the fall season at their lowest **seasonal** level in data since 1982 | Source: Javier Blas, Bloomberg

[Tweet by Bob Eliott] china faces the most classic dilemma in macro with an economy that is too weak and in need of additional easing and at the same time a desire for exchange rate stability

After months of keeping money too tight to stabilize the FX, at the first sign of FX strength they eased... Source chart: The Daily Shot

China on Wednesday reported better-than-expected retail sales and industrial data for October, while the real estate drag worsened

- Retail sales grew by 7.6% last month from a year ago, above the 7% growth forecast by a Reuters poll. Retail sales, sports and other leisure entertainment products saw sales surge by 25.7% in October from a year ago, the data showed. Catering, as well as alcohol and tobacco, saw sales surge by double digits. Auto-related sales rose by 11.4% from a year ago. - Industrial production rose by 4.6% year-on-year in October, faster than the 4.4% pace predicted by the Reuters poll. - Fixed asset investment for the first 10 months of the year grew by 2.9% from a year ago, missing expectations for a 3.1% increase. - Investment into real estate fell by 9.3% during that time, a steeper decline than the 9.1% drop reported for the first nine months of the year. - The urban unemployment rate was 5%, the National Bureau of Statistics said. That was unchanged from September. The bureau has suspended reports of the unemployment rate for young people since summer. Source: CNBC

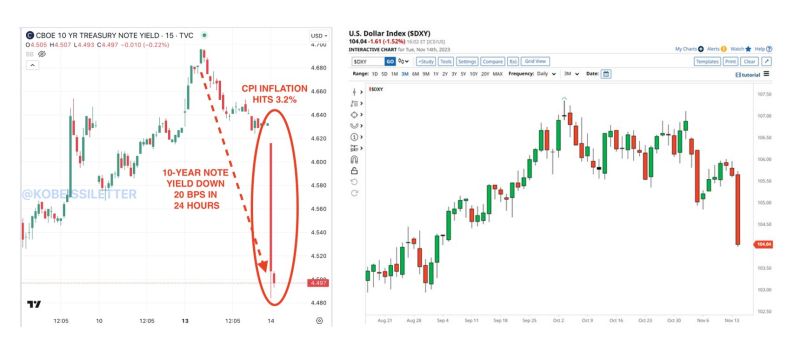

What a day...

The US 10-year note yield fell sharply to 4.49%, after CPI inflation hits 3.2% in October. The 10-year note yield went down 20 basis points in 24 hours. Meanwhile, the U.S. Dollar Index $DXY had its biggest drop in more than a year. Source: The Kobeissi Letter, Barchart

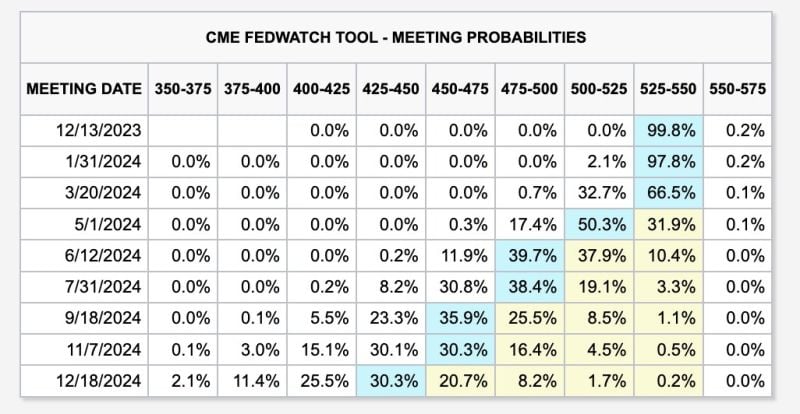

JUST IN: Futures now show a 0% chance of additional rate hikes with rate cuts beginning in May 2024

Prior to today's CPI report, there was a 30% chance of at least one more rate hike ahead. Rate cuts were expected to begin in June 2024. Now, markets are pricing-in at least 4 rate CUTS in 2024. Markets are betting that the Fed is done. Source: The Kobeissi Letter

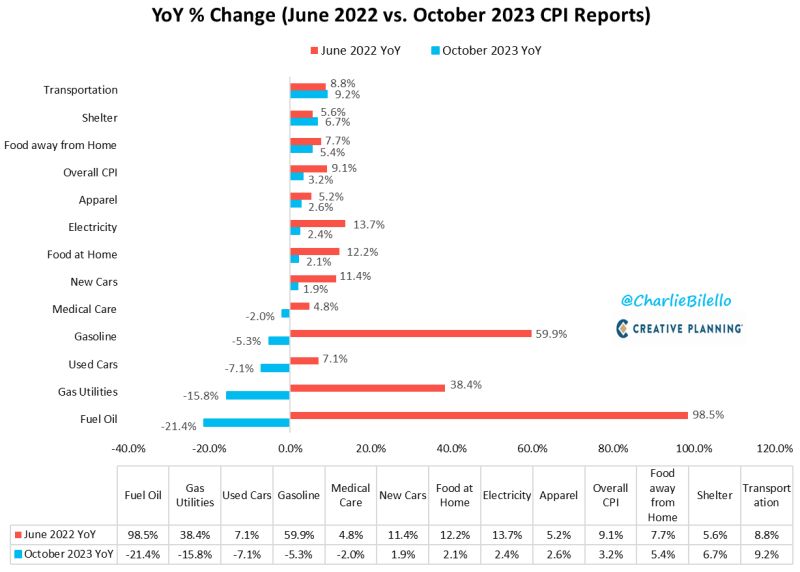

US CPI has moved down from a peak of 9.1% in June 2022 to 3.2% today

What's driving that decline? Lower rates of inflation in Fuel Oil, Gas Utilities, Used Cars, Gasoline, Medical Care, New Cars, Food at Home, Electricity, Apparel, and Food away from Home. Shelter and Transportation are the only major components that have a higher inflation rate today than June 2022. Source: Charlie Bilello

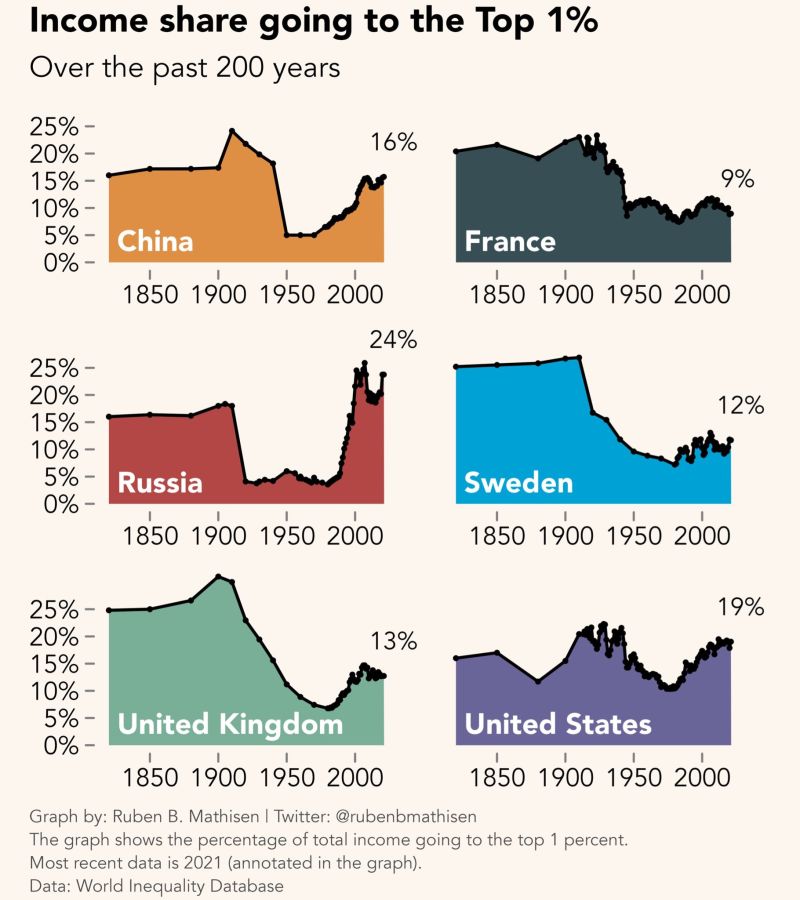

Income & wealth inequality is not just a capitalist country story. Watch Russia and China...

Source: Ruben Mathisen

Investing with intelligence

Our latest research, commentary and market outlooks

![[Tweet by Bob Eliott] china faces the most classic dilemma in macro with an economy that is too weak and in need of additional easing and at the same time a desire for exchange rate stability](https://blog.syzgroup.com/hubfs/1700087239074.jpg)