Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Orange Juice cannot be stopped as it surges to another all-time high.

It's up 18% over the last 2 weeks - source: Barcharts

6 goods & services with a lower price today than a year ago...

Source: HolgerZ, make it

Why a "hawkish hold" by the Fed remains a high probability outcome.

The bar for the Fed to start cutting interest rates is high. It is also worthwhile to remember that Powell job remains a difficult one in light of what has been taking place since the start of the hiking rates cycle and more recently. Indeed, 1) the unemployment rate is exactly where it was when the Fed started hiking last March...(hot job market = wage pressure =higher inflation) - see UPPER CHART BELOW 2) Financial conditions are now far easier than where they were last September... 3) The S&P 500 is back where it was just as the Fed started hiking - see LOWER CHART 4) Meanwhile, commodity prices are starting to ramp up, which could add upward pressure on headline inflation. Bottom line: while markets expect rate cuts to soon follow due to cooling inflation, there is a very decent probability that the Fed might be forced holding tight. Source: Bloomberg, www.zerohedge.com

Latest outlook from IMF shows expectation for global growth this year up to +3% year/year

2024 growth also at +3% … expectation is for U.S. to grow 1.8% this year, 0.2%-point increase from April; China expected to grow 5.2%, unchanged from April. Source: Bloomberg, Liz Ann Sonders

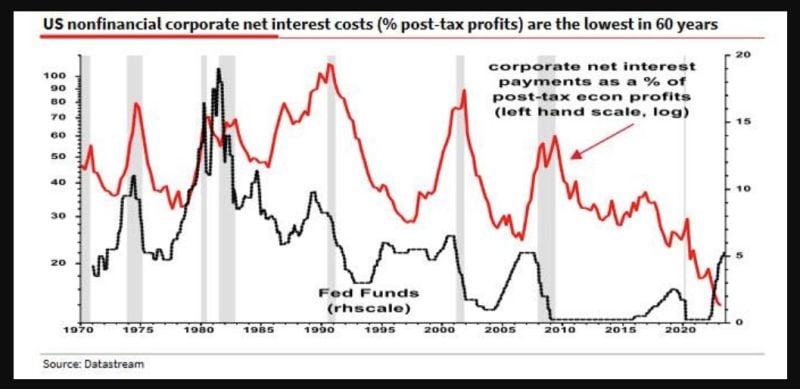

Albert Edwards from SG explains in one chart why this time is different and how the rise #interestrates hasn't triggered a recession yet.

Indeed, as shown on the chart below, Corporate NET interest payments as a % of post-tax economic profits (red line) has been going DOWN despite Fed Funds (black line) going UP! Edwards frames it as such: "We can see clearly from the Fed’s Z1 (table L103) that the US corporate sector is a massive net borrower. Normally when interest rates rise, so too do net debt payments, squeezing profit margins and slowing the economy. BUT NOT THIS TIME. Corporate net interest payments have instead collapsed (...) something very strange has happened, and it helps explain the recession’s tardy." So what has happened? As Edwards concludes, a sizeable proportion of the "huge, fixed rate borrowings during 2020/21 still survives on company balance sheets in variable rate deposits" meaning that corporations continue to benefit from locking in the ultra low rates of 2020 and 2021 even as their cash interest income are soaring. Indeed, as the SocGen strategist adds, "companies have effectively played the yield curve in reverse and become net beneficiaries of higher rates, adding 5% to profits over the last year instead of deducting 10%+ from profits as usual". Putting it all together, Edwards says that "it’s not just ‘Greedflation’ that has boosted US profit margins and delayed the recession (...) Interest rates simply aren’t working as they once did. It is indeed a mad, mad world" Source: www.zerohedge.com, SocGen

Hungary still has an inflation rate of >20%, highest inflation rate in entire EU.

Inflation is driven by food prices (Food CPI +29% YoY) as Hungary has been hit by a drought and this has caused prices to rise. In addition, there is a shortage on the labor market, low labor productivity & very expansionary macroeconomic policies. Source: Bloomberg, HolgerZ

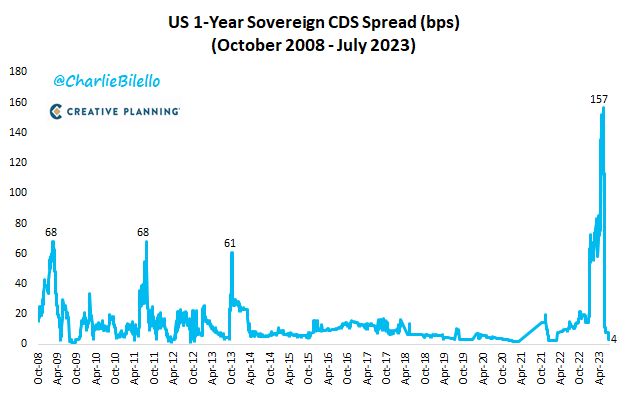

Remember the debt ceiling crisis?

Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks