Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

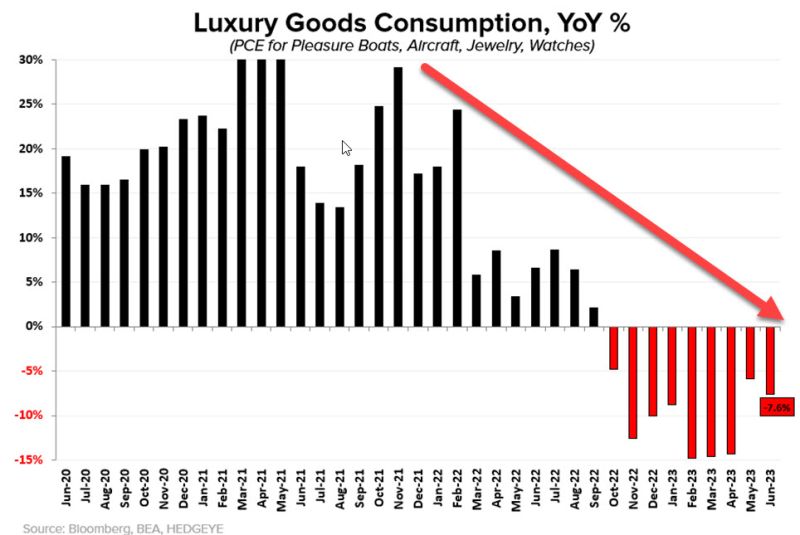

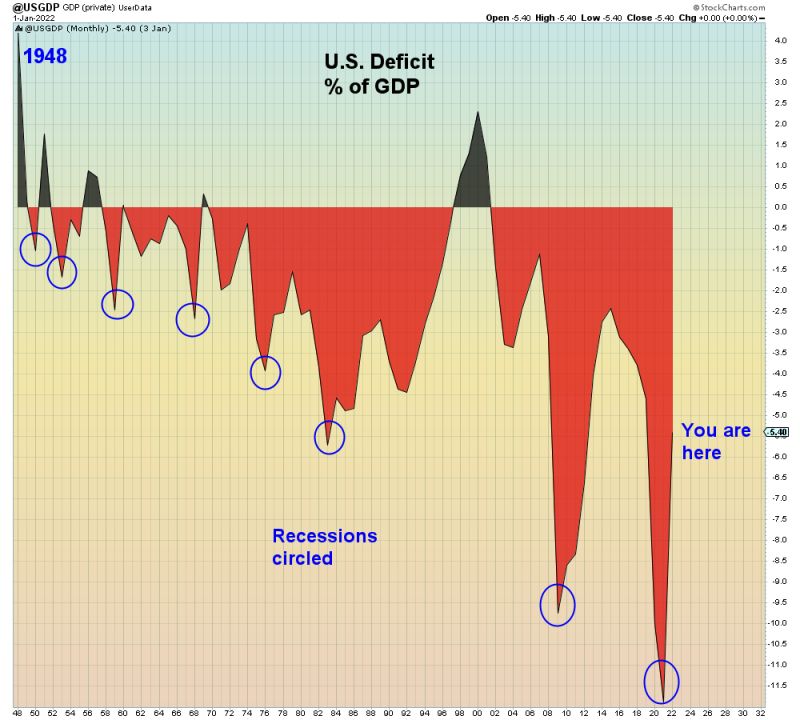

REPORTED RECESSIONS: in US Luxury Goods...

Congruent with dour commentary out of LVMH, luxury spending slowed to a -7.6% Y/Y Recession in June = 9th month of negative Y/Y growth. Source: Keith McCullough

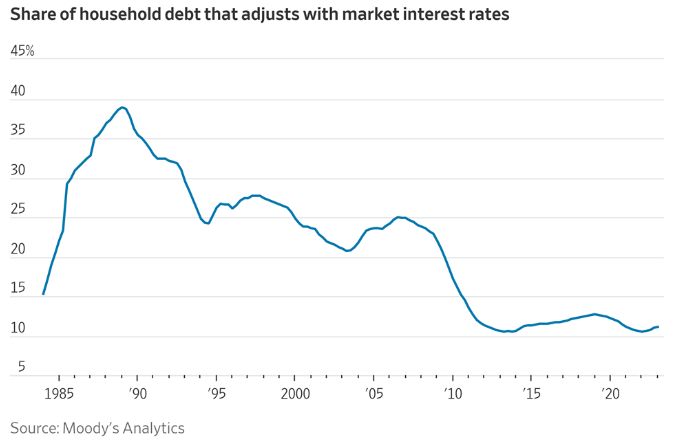

Only 11% of US household debt has an adjustable interest rate

That means the vast majority of Americans with existing fixed rate mortgages/auto loans/student loans have not been impacted by the Fed's 11 rate hikes. Source: Charlie Bilello

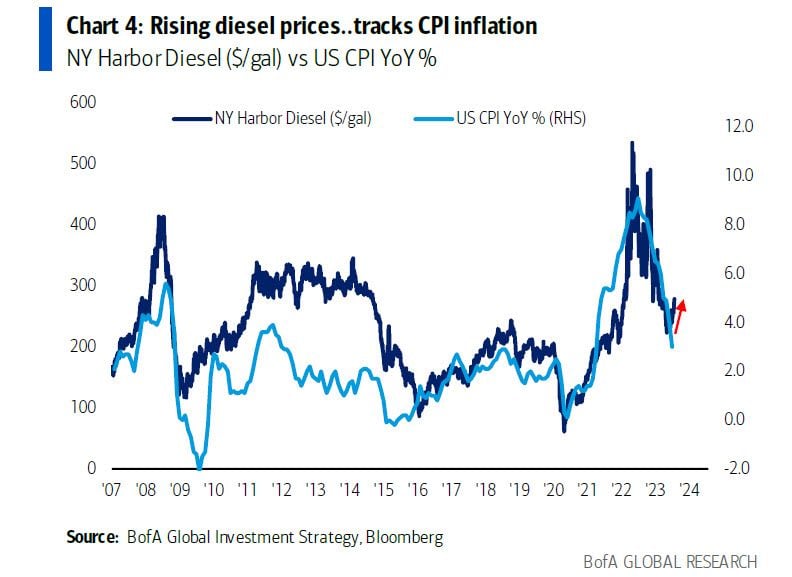

US diesel vs inflation: if history is any guide, recent pop of US diesel prices could imply CPI going back over 4%

Source: BofA

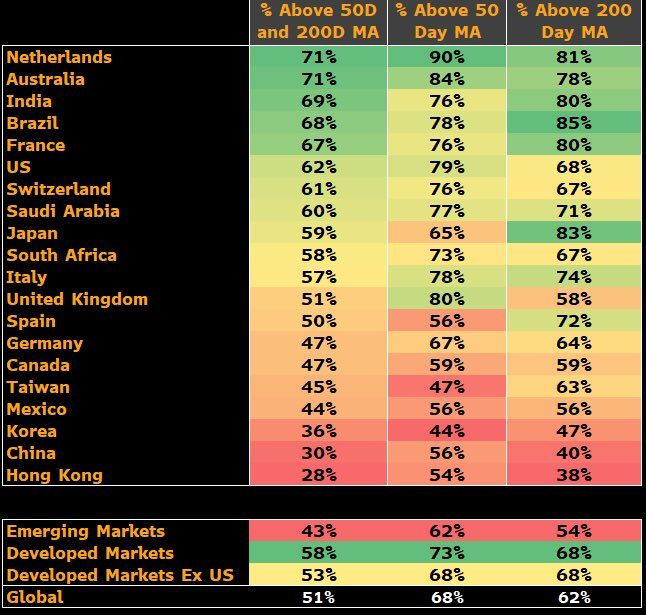

More than half of the major markets in the Bloomberg World Index are now recording positive breadth signals.

Source: Bloomberg, Gina Martin Adams

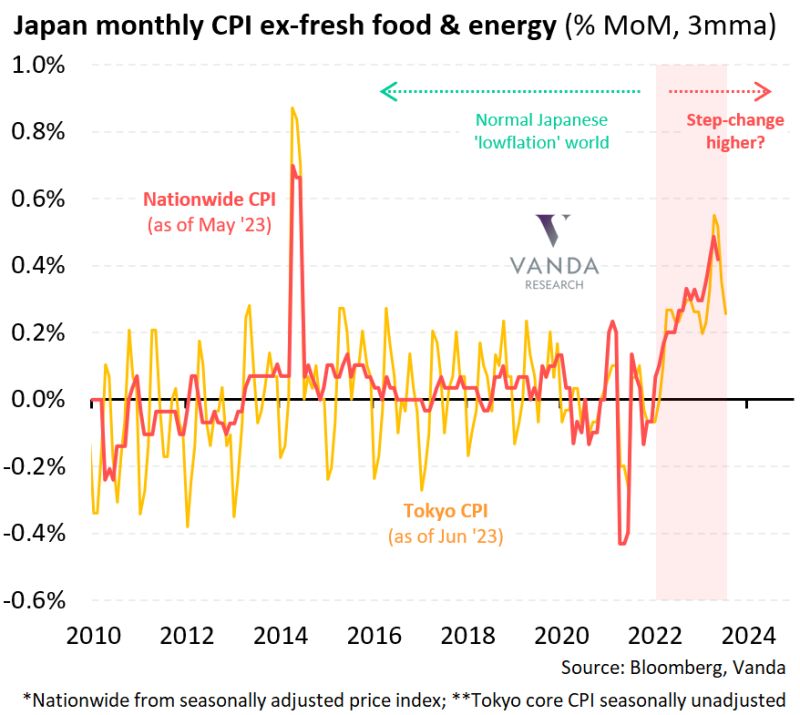

Tokyo core-core CPI inflation printed at +0.575% MoM

That's the 2nd biggest monthly increase since Covid. And one of the biggest monthly increases over the last 30 years outside of sales tax hikes. Inflation is not transitory in Japan... $JPY. Source: Viraj Patel, Vanda Research

ECB raised rates by 25bps as expected

Deposit rate to 3.75pct, higher since April 2001. The main refinancing rate is now 4.25pct, highest since 2008. It is the 9th consecutive hike in a cycle that started exactly one year ago. APP portfolio is declining at a measure and predictable pace. Balance sheet should thus continue to shrink By stating that inflation Is coming down but is staying above target for an extended period means that the ECB keeps the door open to further rate hiles. A slight tweak in the statement: the ECB interest Rates will be SET at sufficiently restrictive levels for as long as necessary … (instead of BROUGHT at sufficiently…) NEW: the ECB decided that going forward, the minimum reserves banks need to hold won‘t receive any interest. In this way, the ECB could prevent the losses of the ECB and the national central banks from increasing too much. Bank shares like DB drop following the News Source: Bloomberg, HolgerZ, www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks