Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

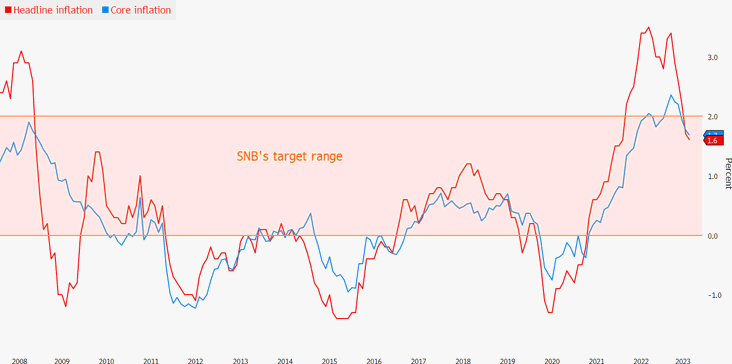

Swiss inflation slows further as SNB mulls september rate hike

Swiss inflation slowed to the lowest rate in one and a half years, testing the determination of SNB officials who have signaled that a further tightening step in September is likely.

Consumer prices rose 1.6% in July from a year earlier, down from 1.7% the previous month.

Source: Bloomberg, Swiss Fed statistical office

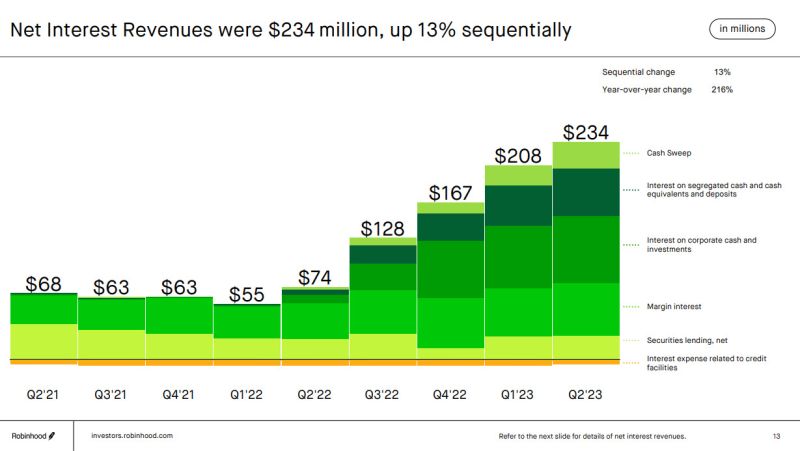

Robinhood now makes much more collecting interest on client cash than from its core business.

This is $234 million that RH's customers should be collecting but they are currently handling to the Trading App. Source: www.zerohedge.com, Robinhood

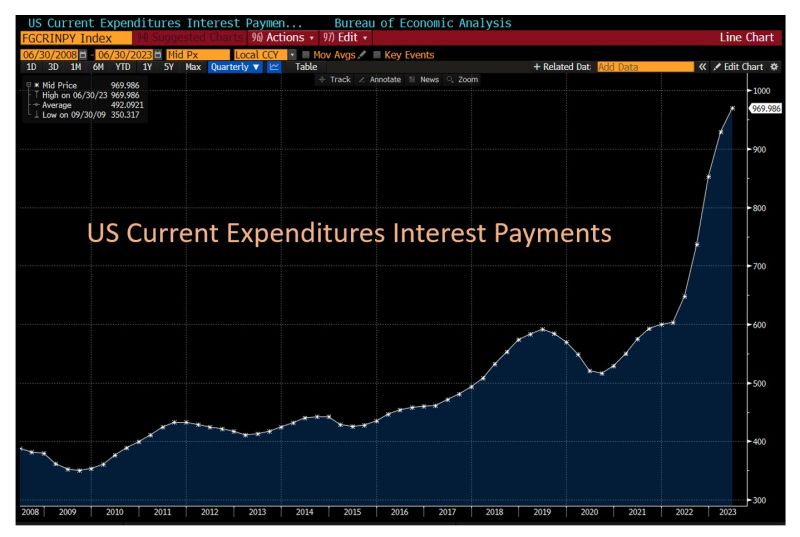

US interest expenses have surged by about 50% in the past year, to nearly $1 trillion on an annualized basis

Source: Lisa Ambramowicz, Bloomberg

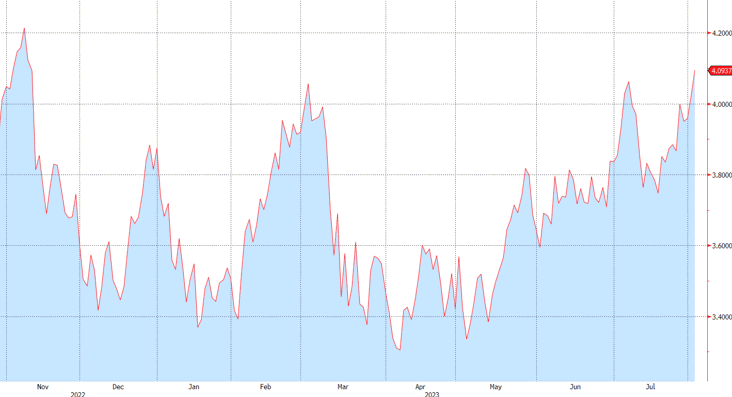

US Treasury 10-Year yield increases to highest level since november 2022

Treasuries fell across the curve, pushing the 10-year yield to the highest level since November as traders digest an uptick in US government issuance, a sovereign credit downgrade and a stronger-than-expected private job report.

Source: Bloomberg

Global Manufacturing PMIs and Global stocks seem to be in disagreement...

Source: Bloomberg, www.zerohedge.com

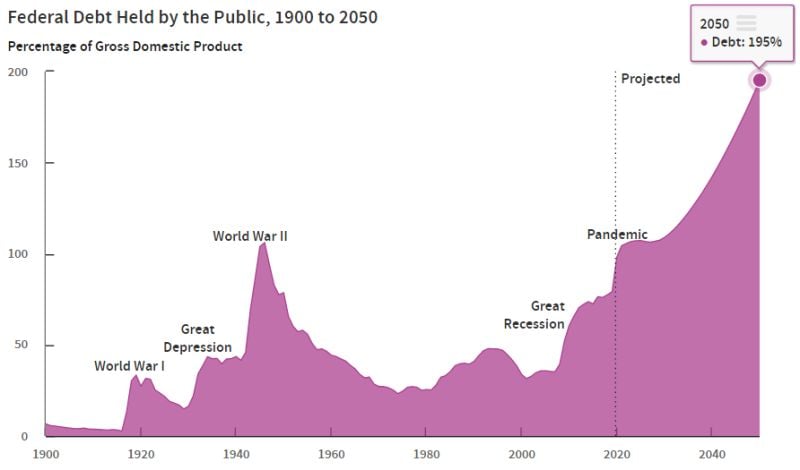

Total US debt levels are expected to rise from 98% of GDP in 2023 to 118% of GDP in 2033

By 2053, Debt-to-GDP in the US is expected to hit an alarming 195%. Hopefully yesterday's downgrade of the US credit rating brings some more attention to this topic. Source: The Kobeissi Letter

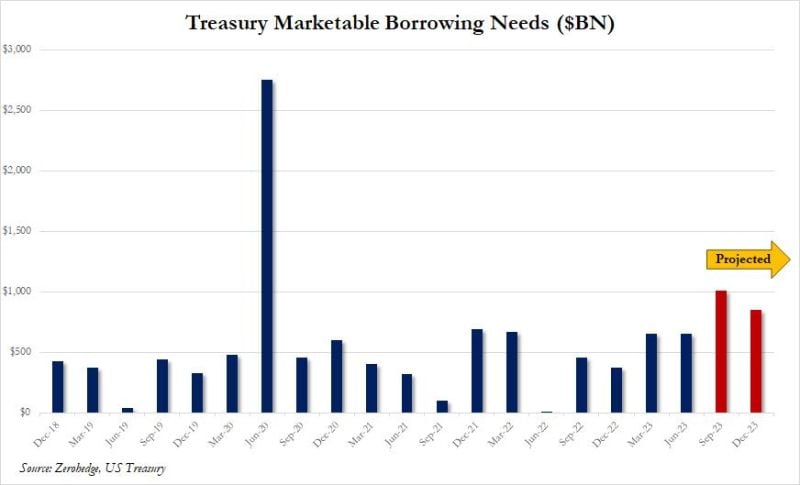

Debt Tsunami Begins: US To Sell $1 Trillion In Debt This Quarter, 2nd Highest In History, As Budget Deficit Explod

The $1.007 trillion in upcoming marketable borrowing is the second highest on record; only the $2.753 trillion in Q2 2020 surpasses it. Source: www.zerohedge.com, US Treasury

The Citi US Economic Surprise Index is at the highest levels since early 2021.

Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks