Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Total credit card indebtedness increased by $45 billion in the April-through-June period, an increase of more than 4%

That took the total amount owed to $1.03 trillion, the highest gross value in Fed data going back to 2003. The increase in the category was the most notable area as total household debt edged higher by about $16 billion to $17.06 trillion, also a fresh record. As card use grew, so did the delinquency rate. The Fed’s measure of credit card debt 30 or more days late rose to 7.2% in the second quarter, up from 6.5% in Q1 and the highest rate since the first quarter of 2012 though close to the long-run normal, central bank officials said. Total debt delinquency edged higher to 3.18% from 3%. Source: CNBC

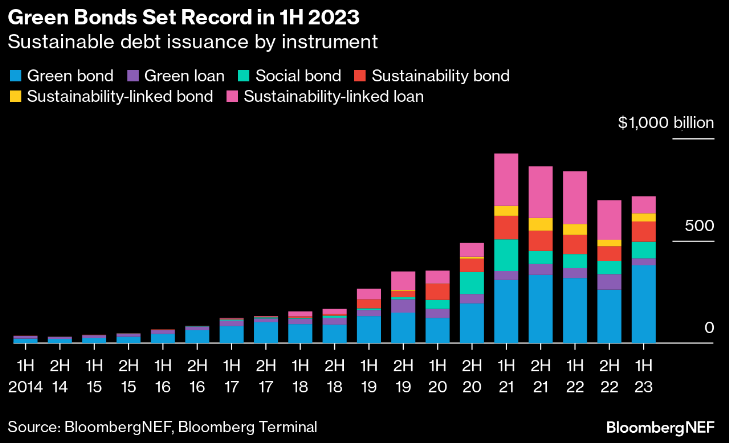

Record green bond sales lift outlook for ESG debt

Green bonds issuance globally hit a record $380 billion in the first half of 2023, rebounding from $261 billion during the prior six months.

Governments and financials are the main contributors. Germany, Italy and Hong Kong governments in combination sold $52 billion green bonds, 150% more than each half of 2022.

Source: Bloomberg

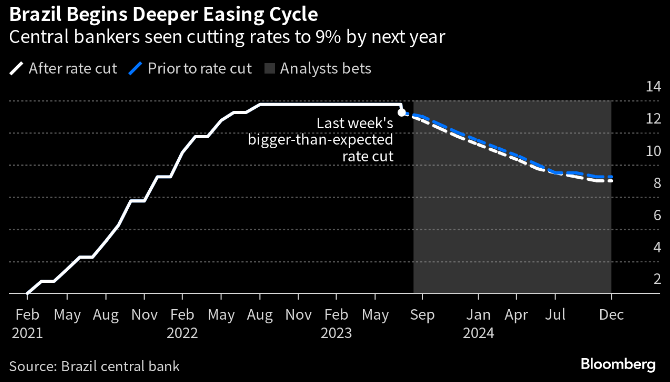

Brazil central bank says faster key rate cuts are Unlikely

“The Committee judges that there is low probability of an additional intensification in the pace of adjustment,” central bankers wrote in the minutes of their Aug. 1-2 meeting published on Tuesday.

Source: Brazil Central Bank, Bloomberg

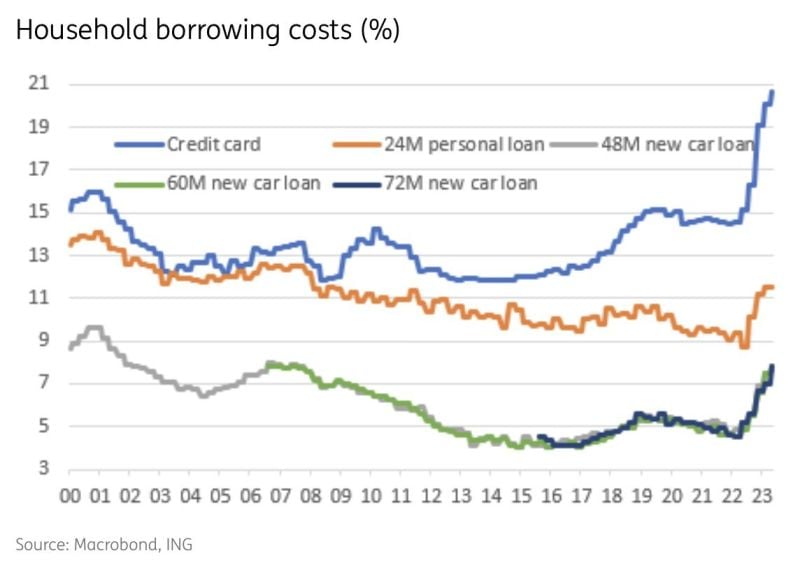

In the US, interest rates on household items are skyrocketing

In just 1 year, the average interest rate on credit card debt has gone from 14% to 21%+. New car loan rates went from 4% to 8% while used car loan rates are at 12%+. Mortgage rates are at a fresh high of 7.2%, up from 2.7% in 2021. Will the US consumer be able to absorb all these debt servicing costs? Source: The Kobeissi Letter, Macrobond, IN

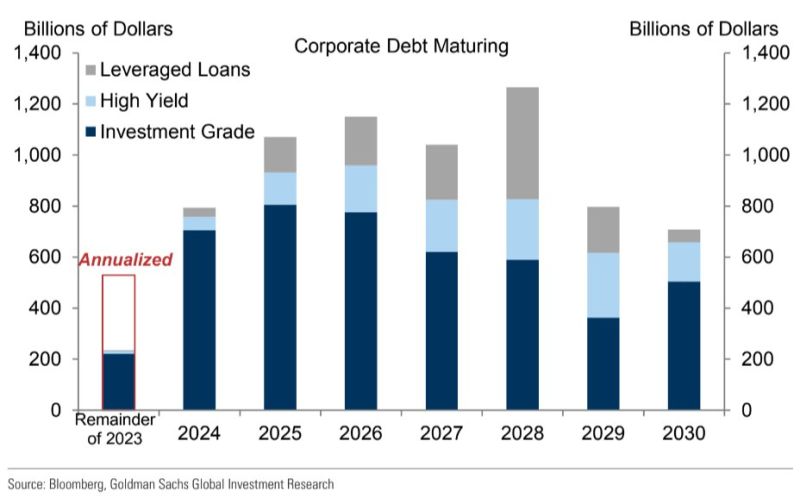

The US Corporate Debt Maturity Wall

$230bn ($525bn Annualized) of Corporate Debt Matures in the Remainder of 2023 $790bn matures in 2024 $1,070bn matures in 2025 Source: Ayesha Tariq, Goldman Sachs

This could be a problem for sugar prices which already hit 12-year highs back in May

Source: Barchart

Market-implied inflation expectations over the next 5-10 years have risen to the highest levels in more than a year

Traders are starting to game out a future with sustainably higher inflation and higher long-term bond yields. Source: Bloomberg, Lisa Abramowiz

The lagging effects of higher interest rates ?

Yellow Corp. filed for bankruptcy and will remain shuttered after the trucking firm’s long-running financial woes (rising bond & loan payments) were compounded by a dispute with its labor force (wage inflation). The firm closes after nearly 100 years and leaves 30k employees jobless (this will likely be reflected in a lower payroll print for August). Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks