Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

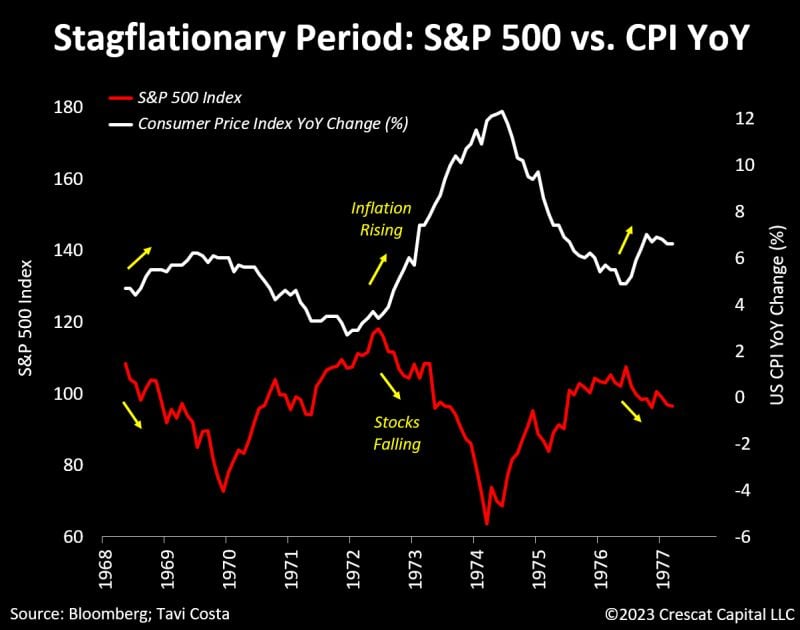

During stagflationary periods, the SP500 index tends to be inversely correlated with inflation

Tavi Costa: "From the late-1960s to the mid-1970s, equity markets declined whenever CPI rates re-accelerated to the upside. The primary driver behind this negative correlation stems from the market's growing concern about the potential for a tighter monetary policy to address the persistent increase in consumer prices". Source: Crescat Capital, Bloomberg

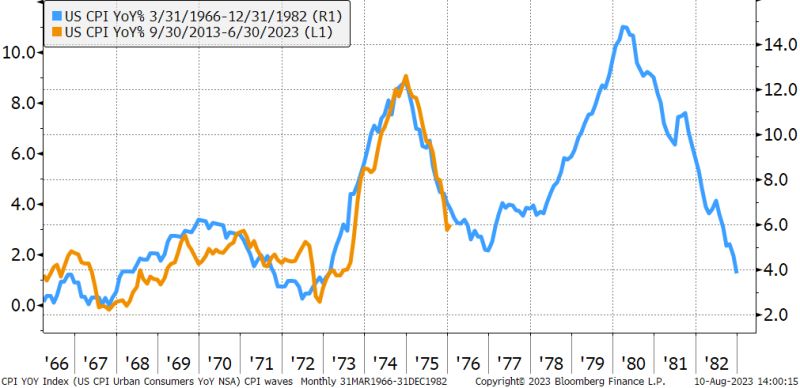

Will US inflation move in waves as it did in the 70's?

Source: Bloomberg, www.zerohedge.com

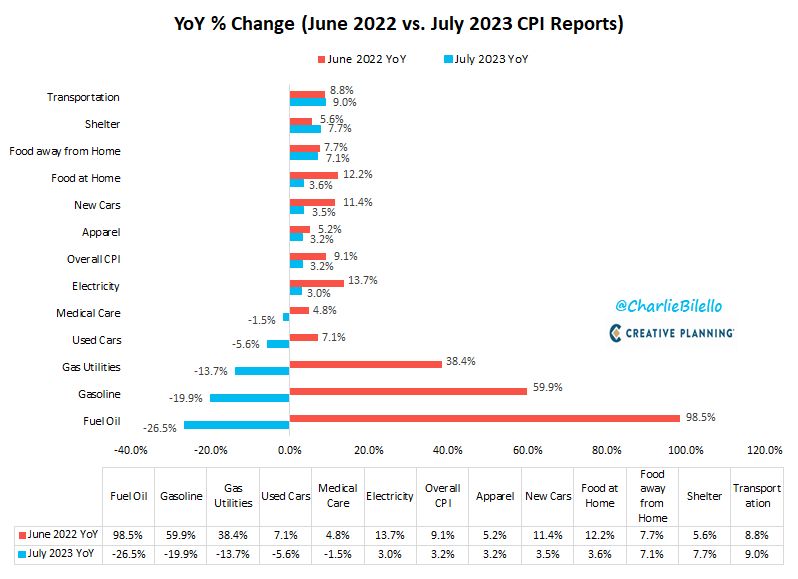

US CPI has moved down from a peak of 9.1% in June 2022 to 3.2% today. What's driving that decline?

Lower rates of inflation in Fuel Oil, Gasoline, Gas Utilities, Used Cars, Medical Care, Electricity, Apparel, New Cars, Food at Home, and Food away from Home. Shelter and Transportation are the only major components that have a higher inflation rate than June 2022. Source: Charlie Bilello

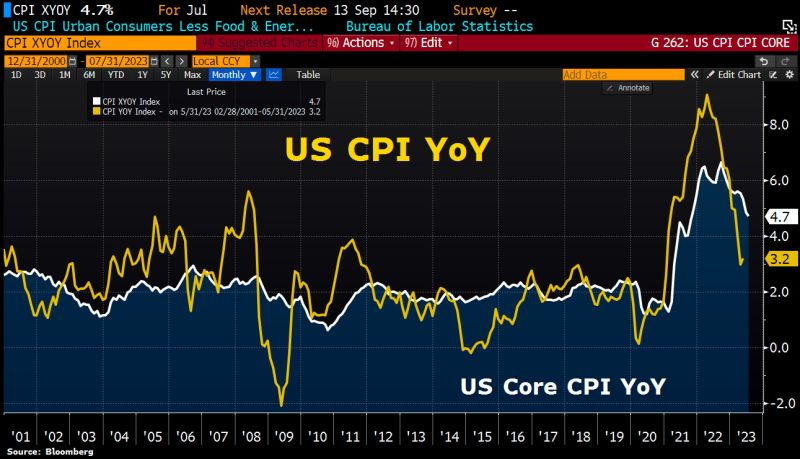

US inflation a tad lower than what economists expected: US July CPI accelerates to 3.2% YoY from 3% in June vs 3.3% expected, BUT the first acceleration after 12 consecutive months of decline

Both Goods and Services inflation (YoY) slowed in July - but Services remain extremely high at +6.1%... Core CPI slows to 4.7% YoY from 4.8% in June as expected. Shelter costs contributed to about 90% of the increase in July CPI. Note that #Fed's favorite inflation indicator - Core Services CPI Ex-Shelter - remains sticky' as it reaccelerated in July (+0.2% MoM, and from +3.9% to +4.0% YoY)... Fed Swaps price in lower odds (20%) of another rate hike this year. Source: Bloomberg, HolgerZ, www.zerohedge.com

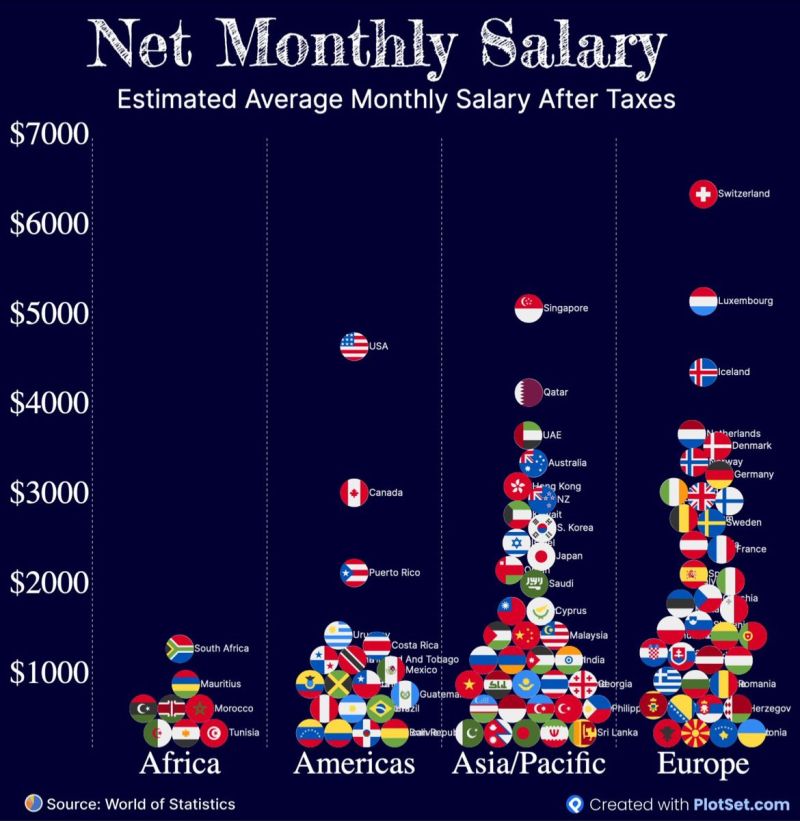

Average monthly salary after tax:

Source: World of statistics

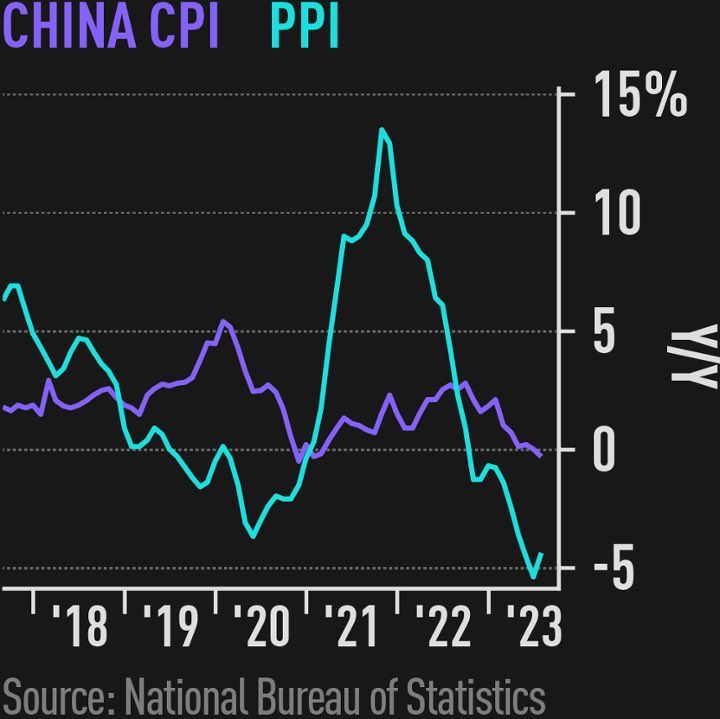

China's consumer and producer prices both declined in July for the first time since November 2020, a sign of deflation pressure amid weakening demand

CPI dipped 0.3% from a year earlier while PPI retreated for a 10th consecutive month, sliding 4.4%. "China is in deflation for sure," said Robin Xing at Morgan Stanley. "The question is how long." The statistics bureau attributed the CPI decline to the high base of comparison, saying the dip is likely to be temporary. Source: J-C Gand

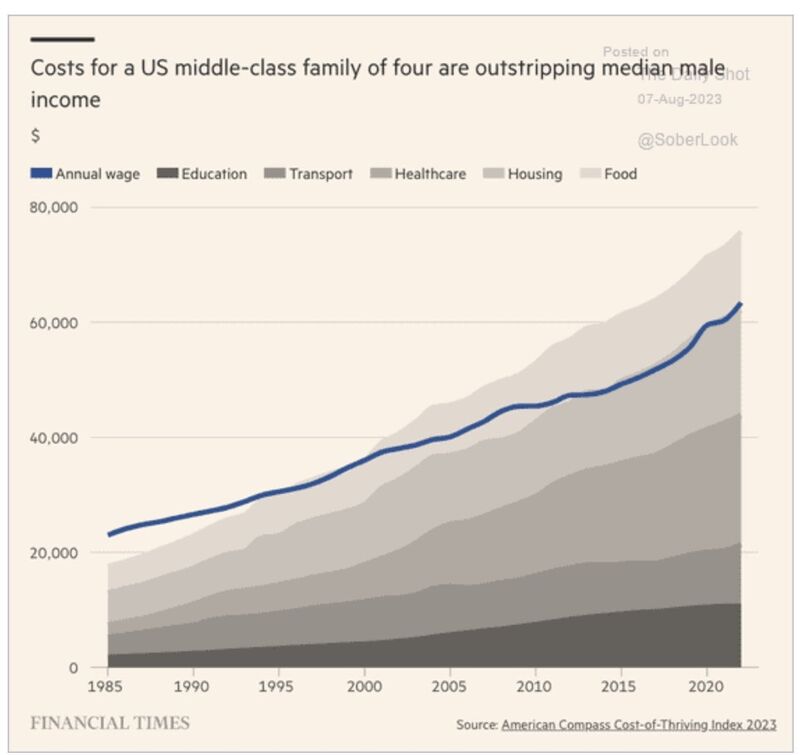

Financial demands of supporting a US family of 4 have surpassed what a single salary can adequately provide

Source: FT

Investing with intelligence

Our latest research, commentary and market outlooks