Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

European gas spikes on market jitters over LNG strike risk

European natural gas futures spiked for the second time in less than a week, with market tensions running high over the possibility of strikes in Australia that could severely tighten the global market.

Source: Bloomberg

Michael Burry is an outstanding contrarian investor and did exceptionally well during the 2006-2008 US housing crash

However, performance is not always repeatable and his next bets haven't paid off that well (at least the market views shared publicly - hedge fund long-term performance looks quite strong on a sharper ratio basis). Adam Khoo had a look at all of Michael Burry's recent predictions and he shared it with a chart on X. Here's a summary: In 2005, Predicted the collapse of the subprime mortgage market -> Housing market crashes in 2008, Global Financial Crisis. On Dec 2015, he predicted that the stock market would crash within the next few months. -> SPX +11% Next 12 months. On May 2017, he predicted a global financial meltdown-> SPX +19% Next 12 months. On Sept 2019, he predicted that the stock market would crash due to a bubble in index ETFs -> SPX +15% Next 12 months. Source: Adam Khoo Trader

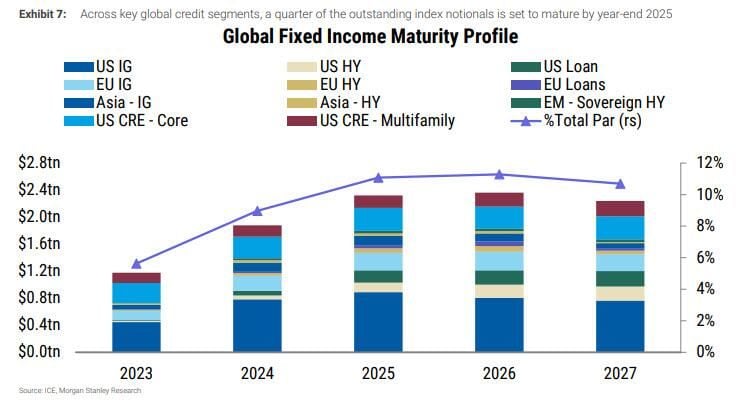

We are approaching quite a formidable global #debt maturity wall...

Source: Markets & Mayhem, Morgan Stanley

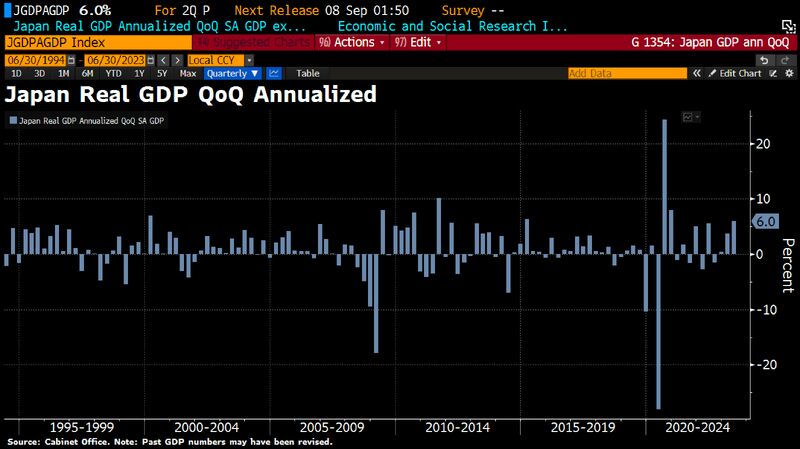

Japan GDP grew 6%, handily beating expectations on robust exports - but domestic demand disappoints

Japan Q2 GDP improves to 1.5% QoQ vs 0.8% expected and 0.1% prior, meaning Japan grows 6.0% on annualized basis, far more than expected (+2.9% yoy). However, some details of the report weren’t as impressive as the headline. As pointed out by analysts in CNBC report, nearly all of the increase in output was driven by a 1.8%-pts boost from net trade. That marked the second-largest contribution from net trade in the 28-year history of the current GDP series, with only the bounce back in exports from the first lockdown at the beginning of the pandemic providing a larger boost. Exports rebounded 3.2% from the previous quarter — largely driven by the spike in car shipments — while imports plunged 4.3% over the time period. Source: Bloomberg, HolgerZ, CNBC

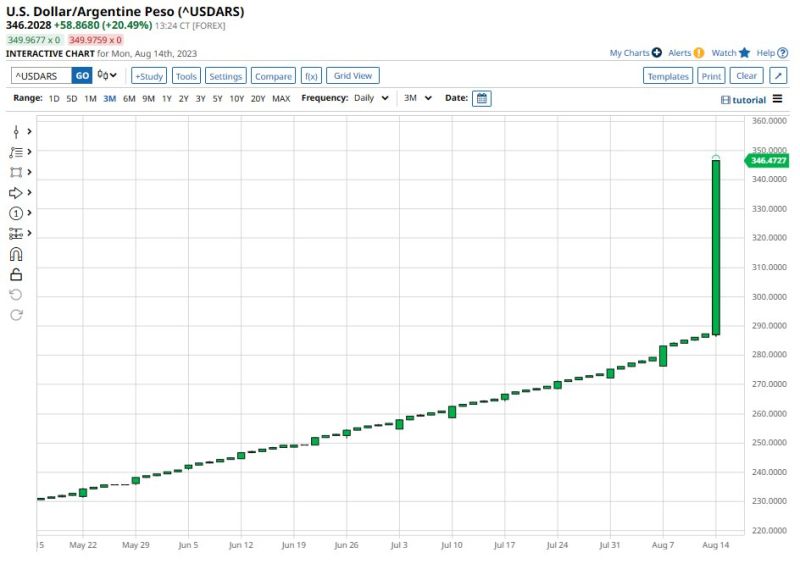

Argentine Peso having a rough day. An 18% devaluation to 350 pesos per dollar (chart) accompanied by a 21 percentage point hike in interest rates to 118% …

Source: Barchart

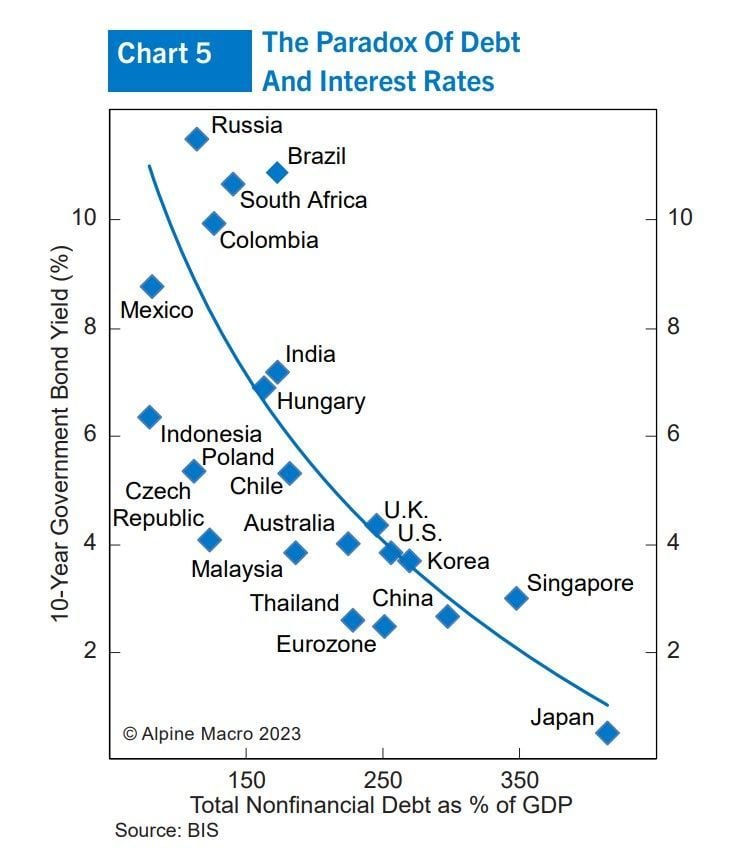

The countries that have rarely borrowed, such as Brazil or Mexico, often pay much higher interest rates than those that have much higher debt ratios, like Japan or China.

Intriguing chart by Alpine Macro

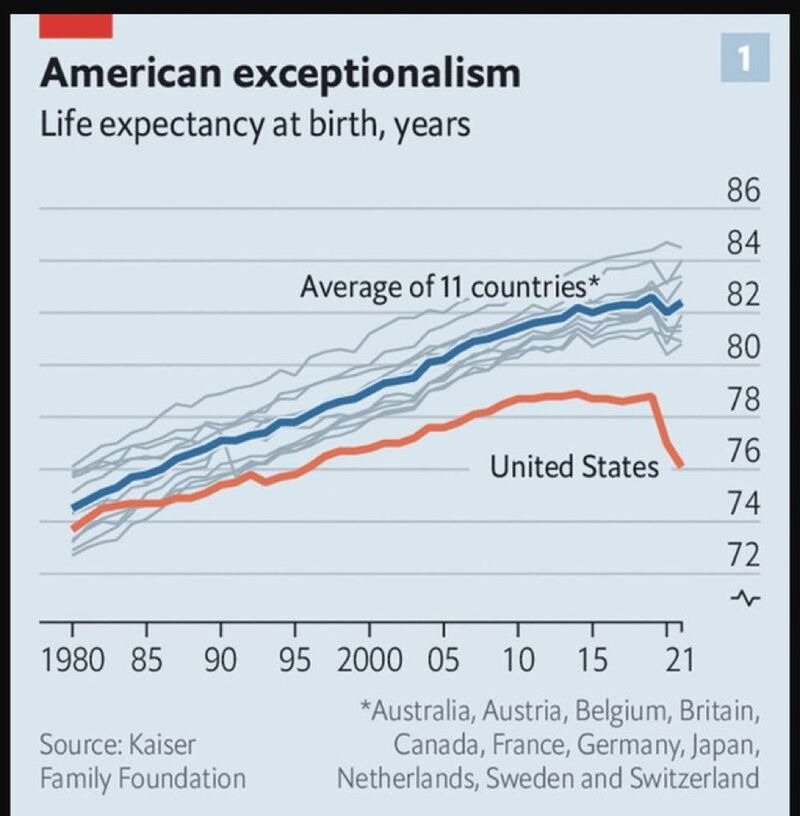

Comparable countries bounced post-COVID, but US did not

~1 million Americans have died of OD’s just since 2010; that’s more than the # of Americans that died in all wars America has ever fought in. Source: The Economist Via Dan R Dimicco thru Luke Gromen

The clearest signal that Russia is losing this war?

The Russian ruble slid past 100 to the U.S. dollar on Monday, nearing a 17-month low as President Vladimir Putin’s economic advisor blamed loose #monetarypolicy for the rapid depreciation. The ruble has lost around 27% against the greenback since the turn of the year. It also has lost 23% vs Chinese Yuan, which Russia is embracing for trade as it seeks to ditch Western currencies. The Bank of Russia has blamed the country’s shrinking balance of trade, as Russia’s current account surplus fell 85% year on year from January to July. This slide that threatens to stoke inflation in an economy that has been kneecapped by Western sanctions. Source: HolgerZ, Bloomberg, DJ, CNBC

Investing with intelligence

Our latest research, commentary and market outlooks