Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Treasury 10-Year real yield tops 2% for first time since 2009

The yield on 10-year inflation-protected Treasuries extended its ascent from year-to-date lows near 1%.

Rising real yields reflect firmer economy and higher deficit.

Source: Bloomberg

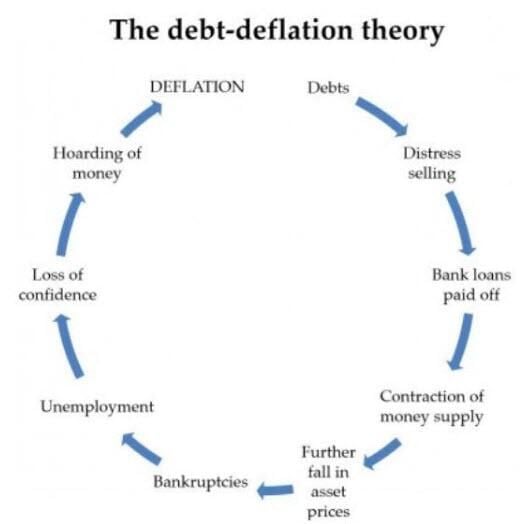

In 2009 China sparked global reflation. In 2023, could China to spark global deflation?

Source: www.zerohedge.com

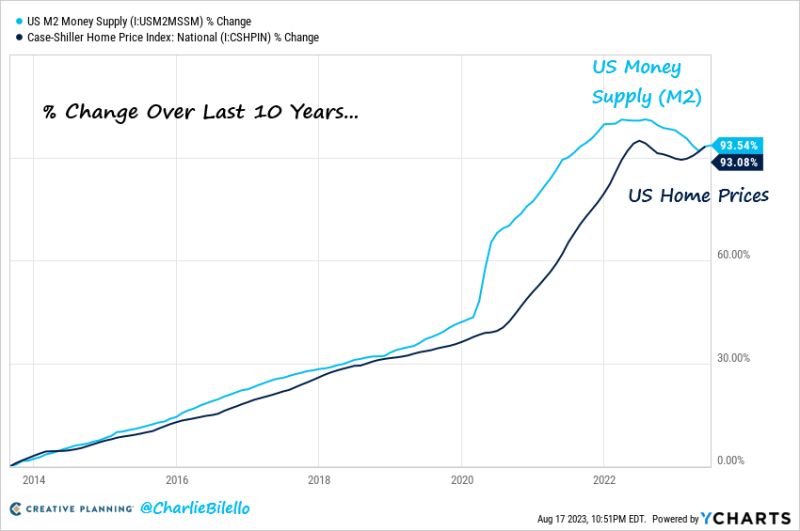

"inflation is always and everywhere a monetary phenomenon." - Milton Friedman

Source: Charlie Bilello

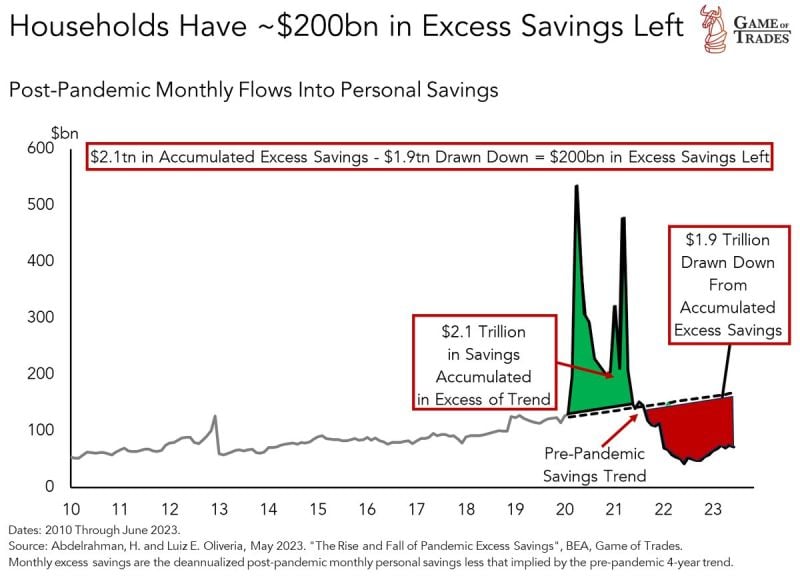

Are US consumers heading for trouble?

Only $200 billion is left in excess savings, which is keeping households afloat. 2 months ago, this number was at $500 billion. At current rate, savings will be depleted by September 2023 Source: Game of trades

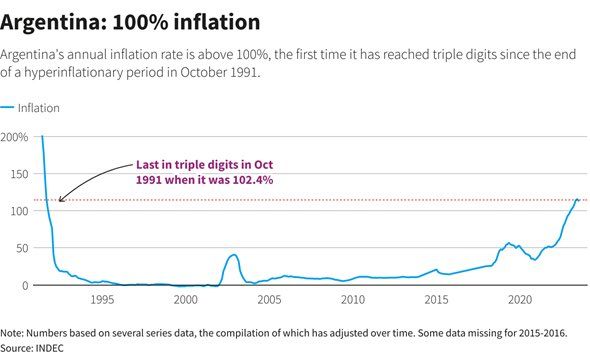

Unprecedented times in Argentina

- On Monday, Argentina’s central bank raised interest rates to 118%. - Forex: you now get a record 350 Argentine Pesos for each US Dollar. - Argentina 30-year mortgage is now at a record 82.2%. - For the first time since 1991, their inflation rate is above 100%. Source: The Kobeissi Letter

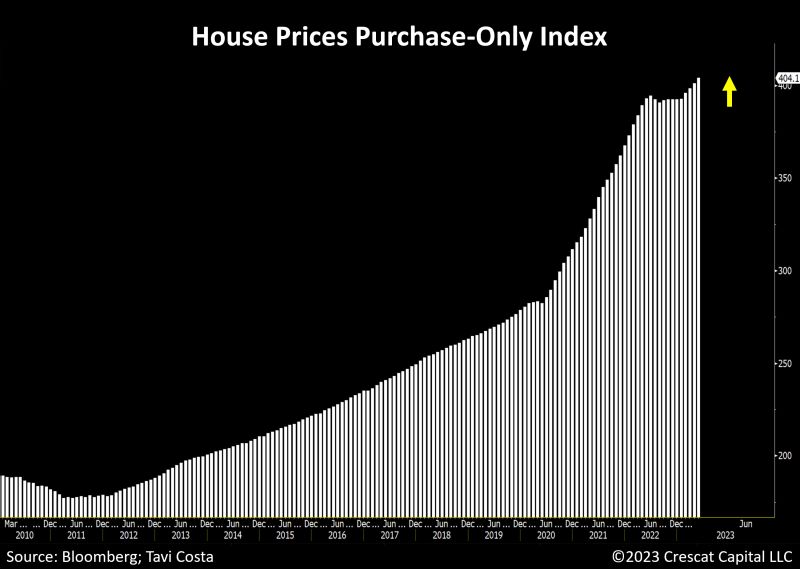

Looking at the recent sales transactions, house prices have accelerated significantly in the last 4 months to record levels, now growing at almost a 10% annualized rate

As a remainder, shelter costs / rents jave been putting upward pressure on core CPI and are expected to ease. Really? Source: Tavi Costa, Crescat Capital, Bloomberg

Soccerflation...Perks that Neymar Júnior will receive in Saudi Arabia:

• €100M-a-year salary • House with 25 bedrooms • 40x10 meter swimming pool and 3 saunas • 5 full-time staff for his house • Bentley Continental GT • Aston Martin DBX • Lamborghini Huracán • 24-hour driver • all bills for hotels, restaurants and various services during his OFF days will be sent to the club headquarters to be paid • Private plane at his disposal for his travels • €500,000 for each social media post that promotes Saudi Arabia Source: The world of Statistics

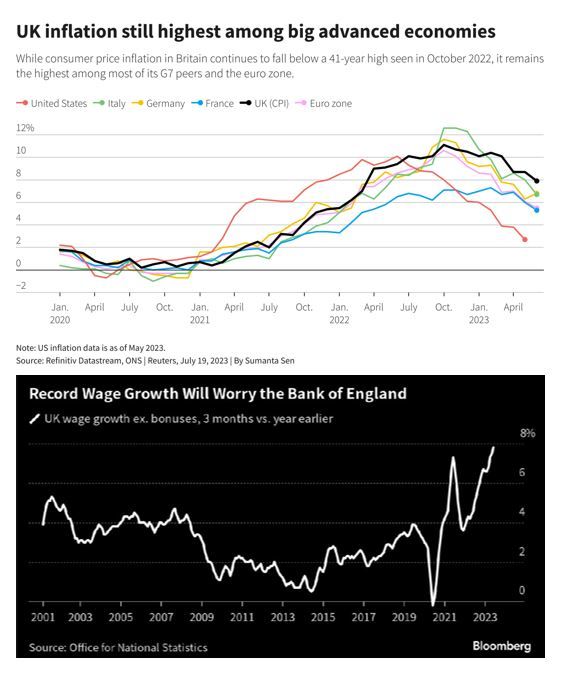

UK headline inflation cooled sharply in July to an annual 6.8%, but the core consumer price index remained unchanged, posing a potential headache for the Bank of England

The headline CPI reading was in line with a consensus forecast among economists polled by Reuters, and follows the cooler-than-expected 7.9% figure of June. Despite the decline, UK inflation is still the highest among "advanced" economies (see upper chart below). On a monthly basis, the headline CPI decreased by 0.4% versus a consensus forecast of -0.5%. However, core inflation — which excludes volatile energy, food, alcohol and tobacco prices — stayed 6.9%, unchanged from June and slightly above a consensus forecast of 6.8%.

Investing with intelligence

Our latest research, commentary and market outlooks