Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Disinflation is on the way in Germany

Disinflation is on the way in Germany. Wholesale prices dropped 2.9% YoY in June, an acceleration from the 2.6% decline from May & the biggest annual decrease since June 2020. Lower wholesale prices could translate to falling #inflation in Germany. Source: HolgerZ, Bloomberg

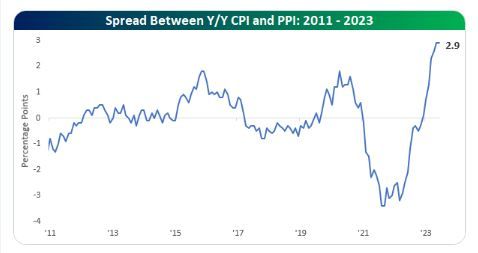

The spread between US CPI and PPI is a good omen for corporate profit margins

The spread between US CPI and PPI is a good omen for corporate profit margins. This is key to widening profit margins. Companies are able to boost the prices they charge consumers more and more relative to their input cost. The spread between y/y CPI and PPI remains at the widest levels since the current incarnation of PPI started in 2011. Source: Bespoke, Lisa Abramowicz

More disinflation in the offing: US PPI slowed to 0.1% YoY in June, from 0.9% in May and lower than expected

More disinflation in the offing: US PPI slowed to 0.1% YoY in June, from 0.9% in May and lower than expected. This is smallest pace since Aug 2020 and is down from the all-time high of 11.7% YoY from March 2022 in a promising sign for CPI. Source: Bloomberg, HolgerZ

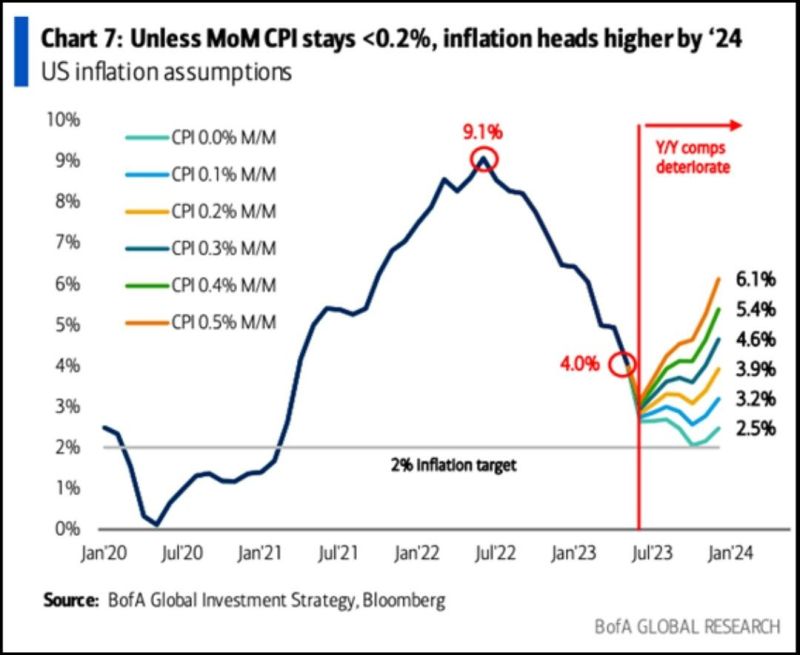

The easy part is over for disinflation as disinflationary base effects are behind us

The easy part is over for disinflation as disinflationary base effects are behind us. The MoM CPI now needs to be lower than 0.2% for #inflation to continue moving lower. Source: BofA

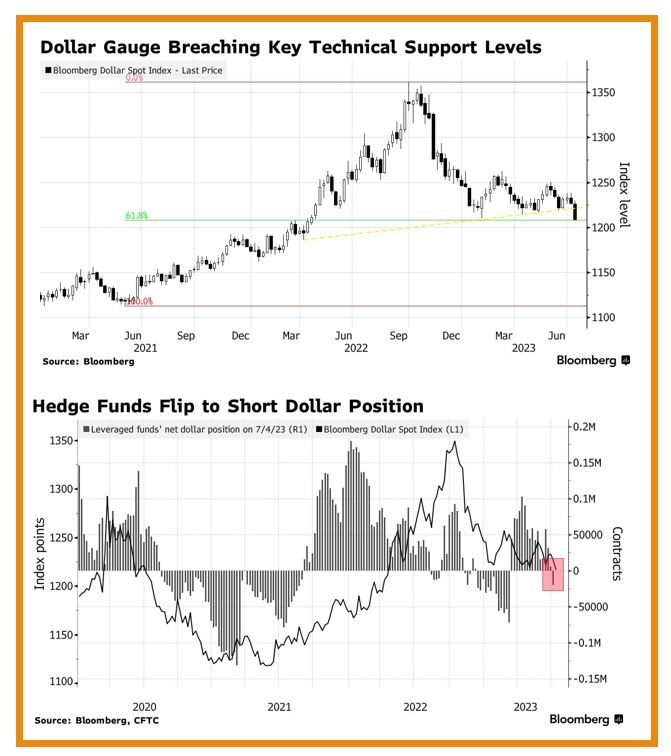

The Bloomberg Dollar Spot Index slumped to a 15-month low, with the gauge now down over 11% from a September peak

The Bloomberg Dollar Spot Index slumped to a 15-month low, with the gauge now down over 11% from a September peak. hedgefunds had been bracing for weakness, as they turned net sellers of the dollar for the first time since March, according to data from the Commodity Futures Trading Commission aggregated by Bloomberg. The dollar’s resilience has confounded bears who had warned that the currency was headed for a multi-year decline following a surge in 2022. But there’s a growing conviction that they may finally be proven right as easing inflation backs the case for the us central bank to wrap up its rate-hike campaign in the coming months. Source: Bloomberg

3 reasons why the fed will hike this month (despite the lower us cpi print)...

Source: C. Barraud

On the back of the lower us cpi print, Euro rose sharply against dollar

On the back of the lower us cpi print, Euro rose sharply against dollar, closing at the highest level since March 2022, completely decoupled from its macro data.. Source: Bloomberg, www.zerohedge,com

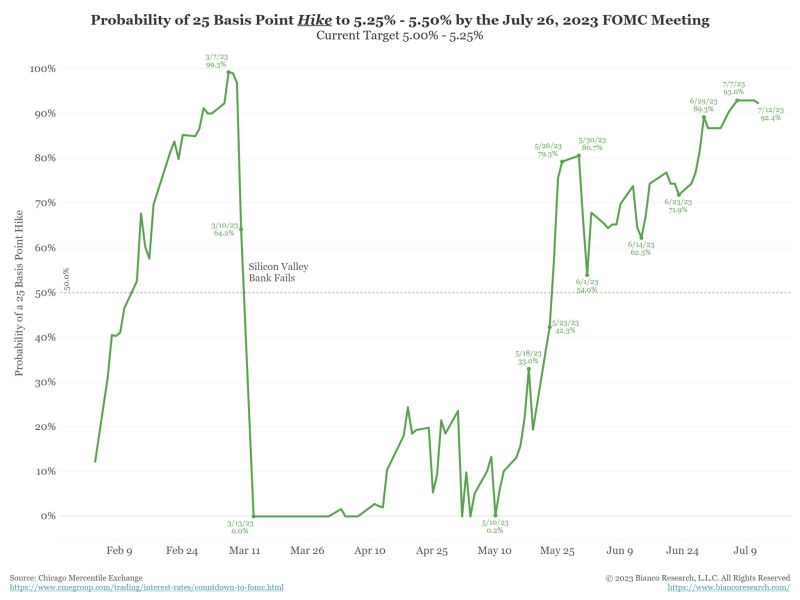

The probability of a July 26 rate of 25 basis points to 5.25% to 5.50% barely moved

Despite the better-than-expected CPI report today, the probability of a July 26 rate of 25 basis points to 5.25% to 5.50% barely moved. The market is strongly expecting a hike in two weeks. Source: Jim Bianco

Investing with intelligence

Our latest research, commentary and market outlooks