Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

US inflation eased further in June w/core & headline coming in each at 0.2% MoM (v.s 0.3% expected).

Headline CPI slowed to 3% YoY vs 3.1% expected (and lowest since March 2021), core dropped to 4.8% YoY vs 5% expected. This is the 12th straight month of YoY declines in headline CPI - equaling the longest streak of declines in history (since 1921)... Source chart: Bloomberg

US 30 year Mortgage Rate

The US 30 year mortgage rate has hit a new decade high at 7.38%, up 23 bps since last week, per BankRate

With fiat currency, it is as simple as this...

With fiat currency, it is as simple as this... Source: Wall Street Silver

New cobalt, copper, lithium and nickel mines needed

Per a McKinsey report, the current 500 cobalt, copper, lithium and nickel mines operating today will need to almost double to 900 in order to meet battery demand. Almost 80% increase in mines needed.

Israel pauses after 10 rate hikes but signals it may not be done

Israel’s central bank left interest rates

unchanged for the first time in over a year, halting an

unprecedented cycle of monetary tightening but signaling it’s

still on alert for the threat of faster inflation.

Source: Bloomberg

China's Inflation Rate Eases to Zero

Deflation in China? China's Consumer Price Index (CPI) year-on-year growth rate in June dropped to 0% (prev. 0.2%). Producer Price Index (PPI) year-on-year growth rate dropped to -5.4% (prev. -4.6%). Source: Bloomberg

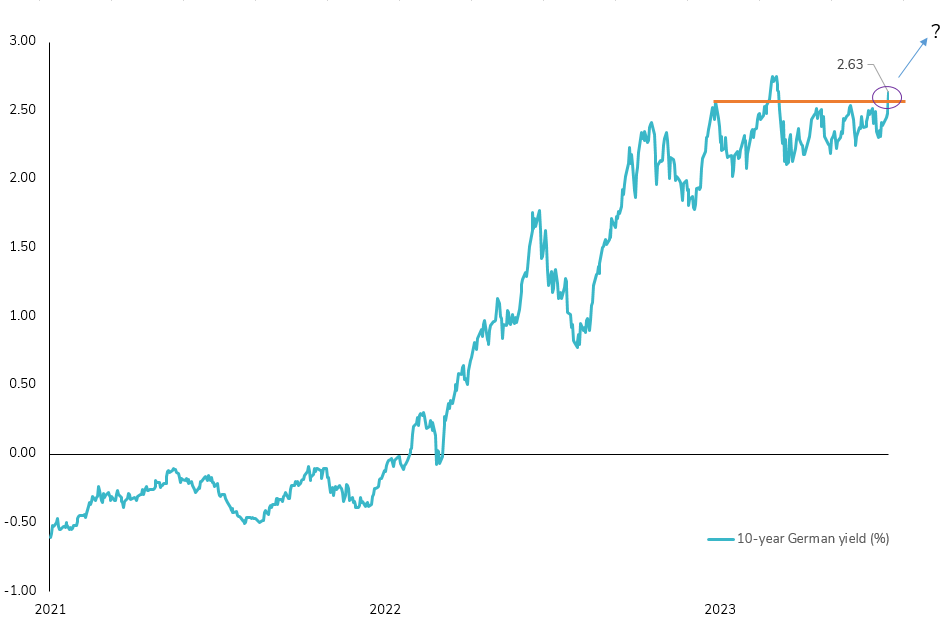

10-year German yield : a key technical breakout triggered?

The German 10-year yield has experienced a significant surge of almost 30 basis points since the start of July, marking a notable technical breakout. This breach of the 2.5% resistance level has the potential to alter short-term market sentiment and pave the way for higher rates. The upward momentum has been fueled by several factors, including the synchronized hawkishness observed in developed countries such as the US, Eurozone, and the UK last week. Additionally, hawkish FOMC minutes (release yesterday) and resilient hard data, including strong employment figures in the US and robust industrial production in Europe, have contributed to the yield's upward trajectory. It is worth noting the emergence of a catching-up effect in soft data, as indicated by the latest report on the U.S. ISM composite index. Tomorrow's release of the June NFP report could further ignite the discussion. Will we test the year's highs (2.75%) in this early summer period?

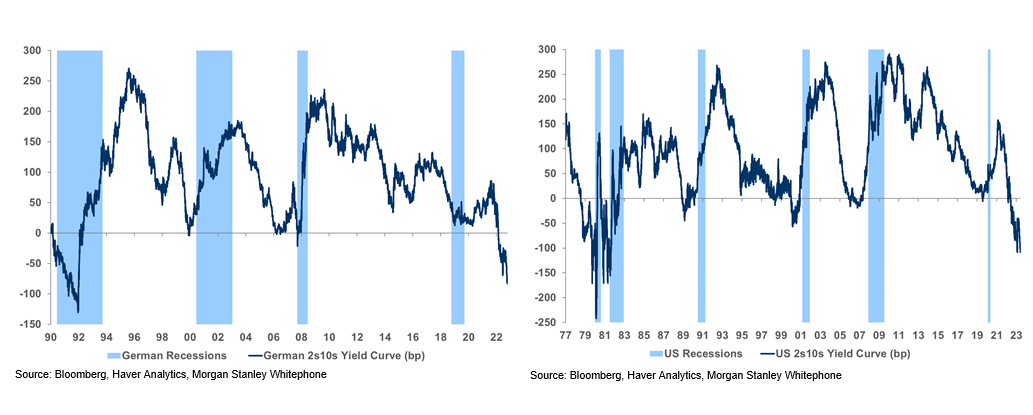

German and US yield curves are deeply diving into low levels of inversion

US Curves flattened further, with the 2s10s curve hitting -109bp, in-line with the lowest level in 42 years.

Bund yields rose, while the 2s10s curve dropped to -83bp, the most inverted level in over 30 years.

Source: Bloomberg, Haver Analytics, Morgan Stanley Whitephone

Investing with intelligence

Our latest research, commentary and market outlooks