Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

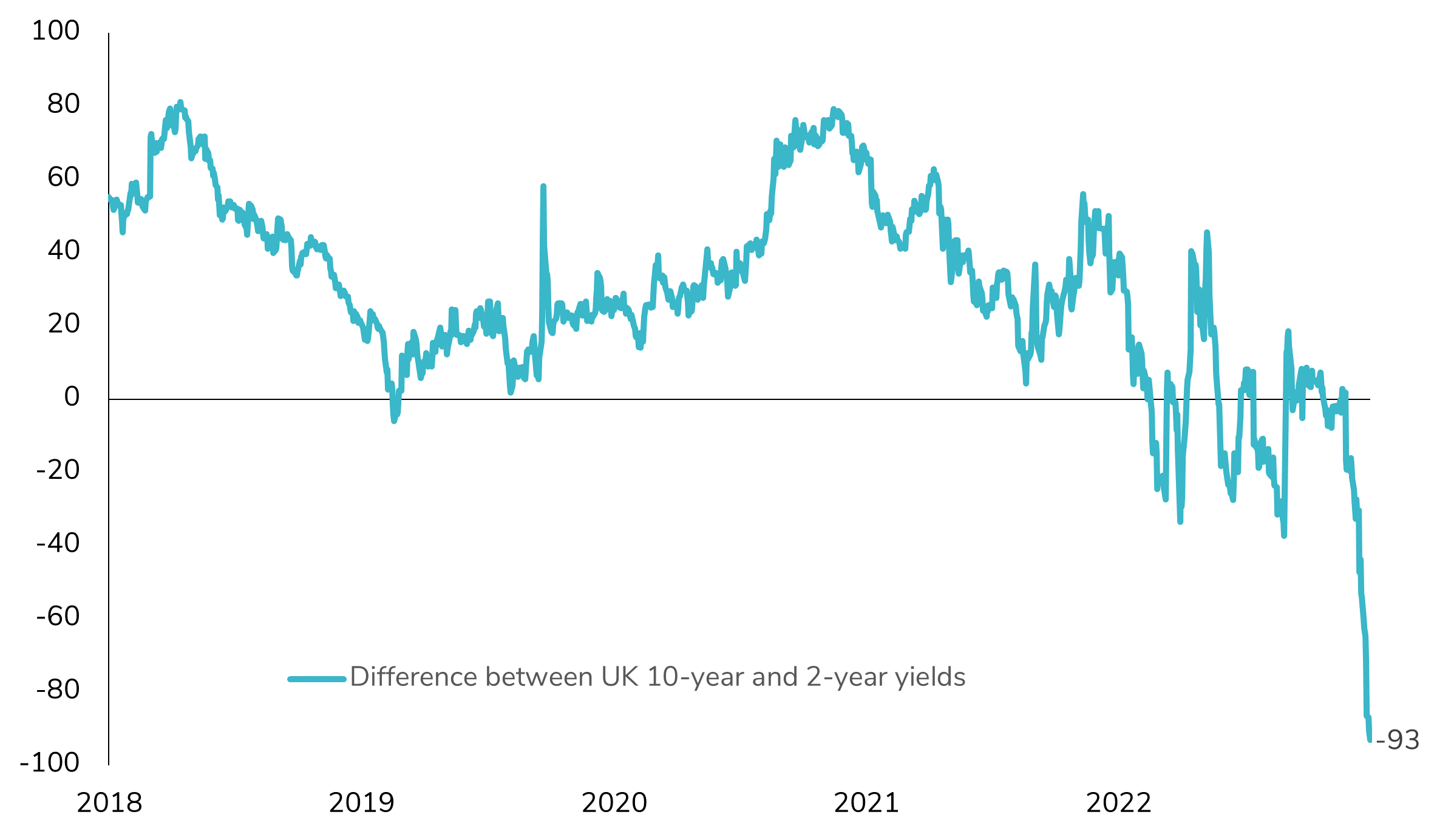

UK bond market is sending a signal!

The recent developments in the UK bond market have caught the attention of investors. In June, the UK yield curve (2s10s) experienced an unprecedented decline, marking one of the steepest drops in decades, and it is now approaching -100bps. This significant shift reflects the market's conviction that the Bank of England (BoE) will take decisive measures to combat inflation. However, it also raises concerns about the potential impact on the UK economy and its medium-term growth prospects. Should the BoE keep pushing the limits (rate hikes) until something breaks?

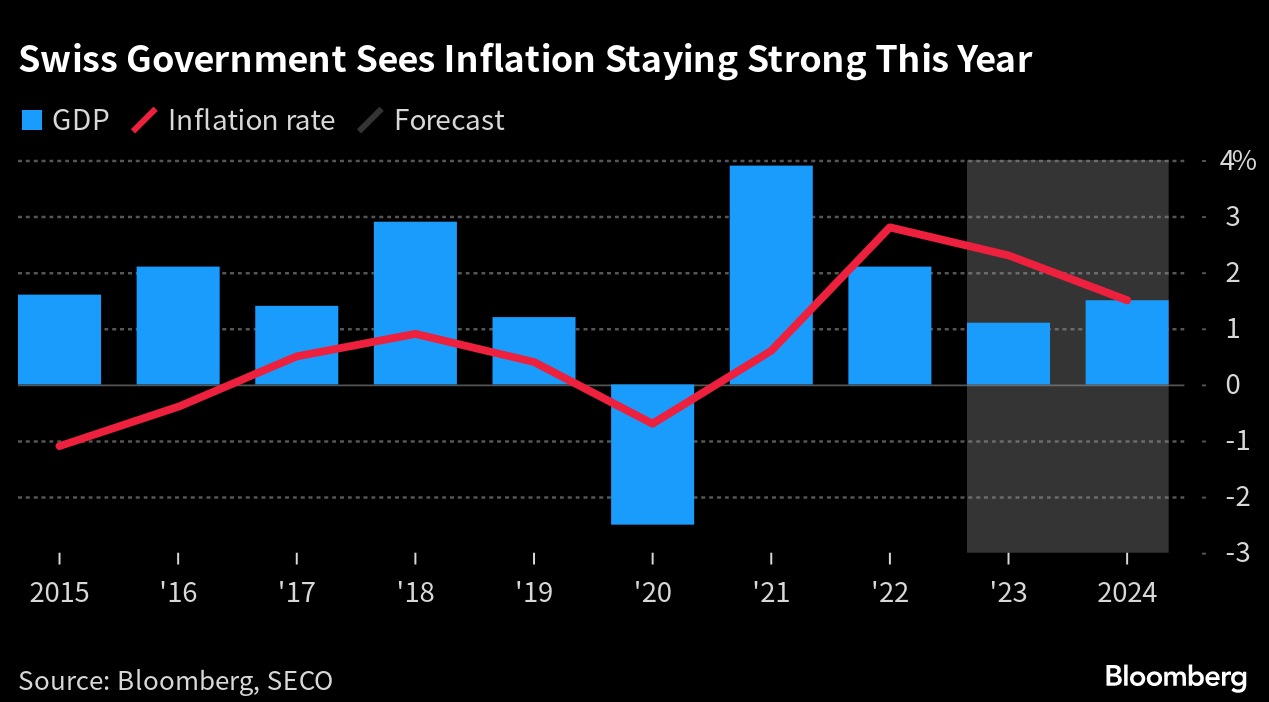

SNB won’t let slowing inflation stop a rate hike

Source: Bloomberg

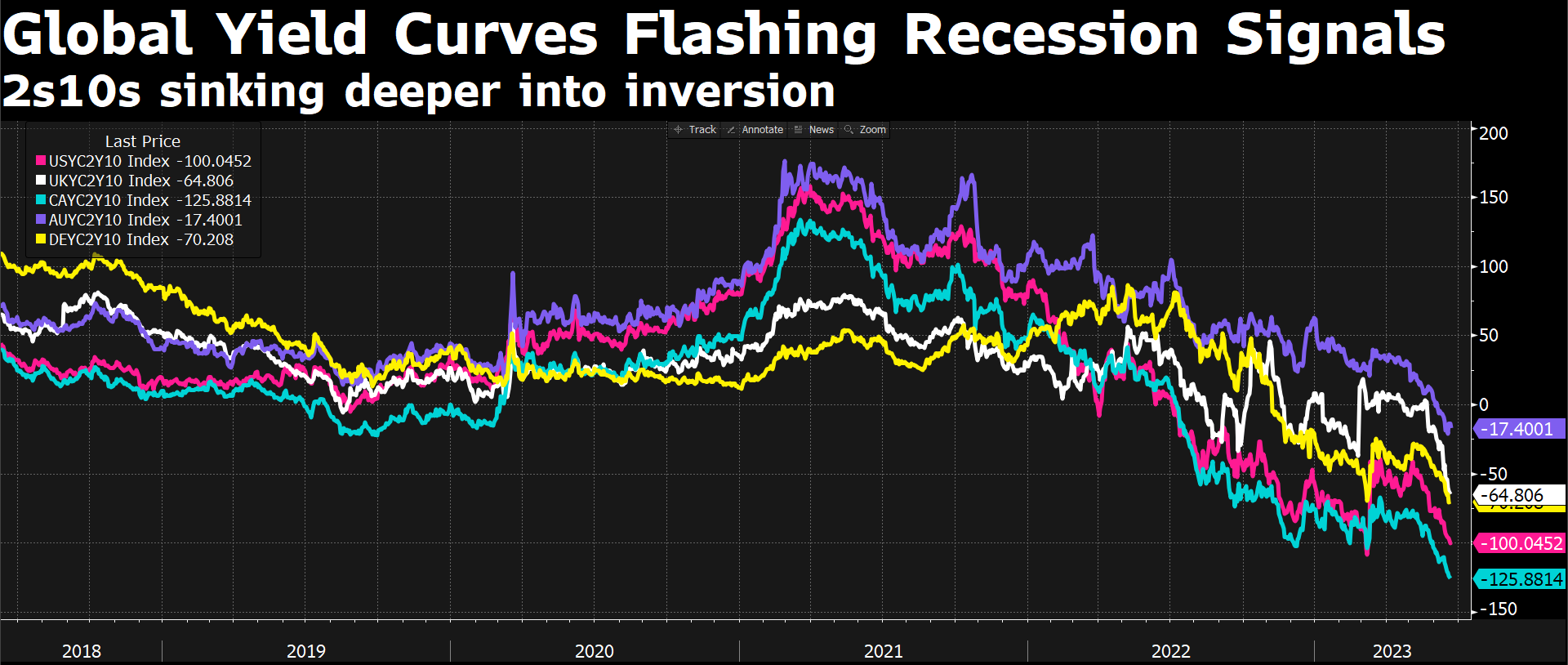

Global Yield Curves' (2s10s) inversion deepens, flashing recession signals

Source: Bloomberg TV Chart

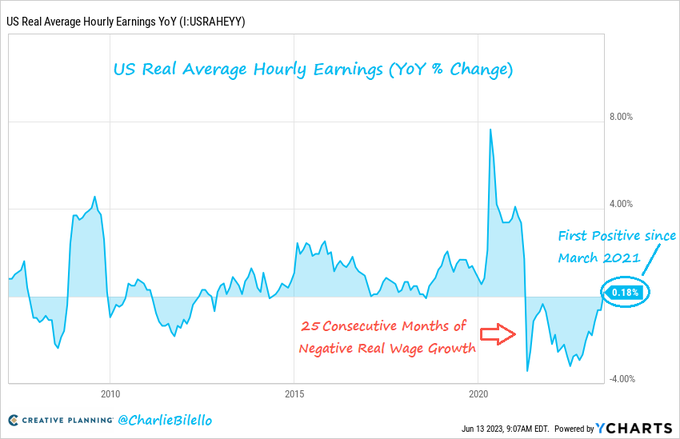

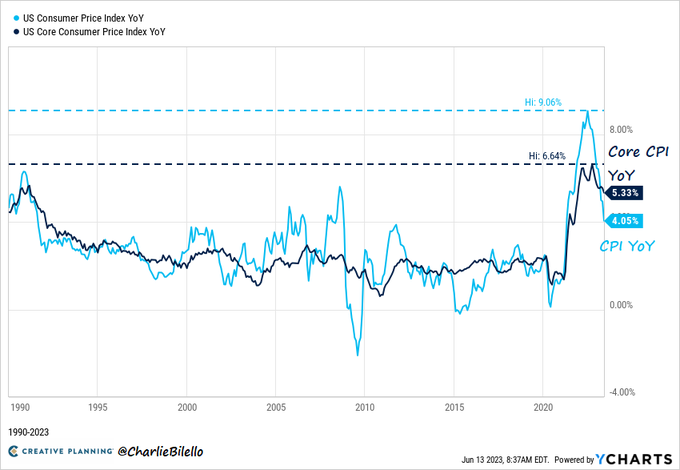

US real average hourly earnings turn positive again

US wages outpaced inflation on a YoY basis in May by 0.2%, ending the ignominious streak of 25 consecutive months of negative real wage growth. Source: Charlie Bilello

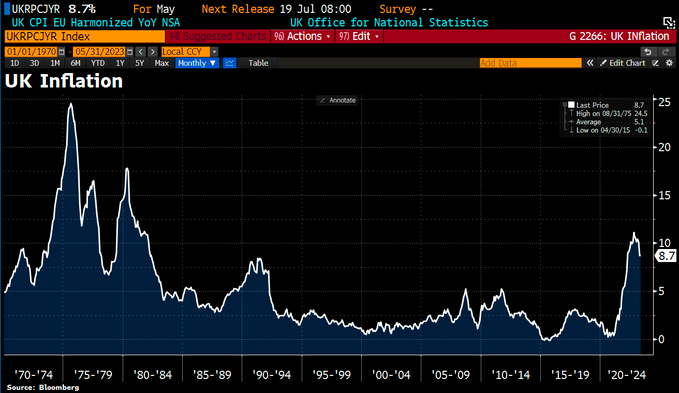

UK inflation stays stuck at 8.7% while economists had expected a decline to 8.4%.

Source: HolgerZ, Bloomberg

Switzerland’s new inflation forecast supports another SNB hike

The government expects inflation to be above the central bank’s target this year which reinforces a likely interest-rate hike next week. The SECO said consumer prices will rise 2.3% this year. That down from 2022’s 2.8%, and also slightly lower than a March prediction of 2.4%.

Source: Bloomberg, SECO

US CPI continues to cool down

Overall US CPI moved down to 4.0% in May, the 11th consecutive decline in the YoY rate of inflation and the lowest level since March 2021. US Core CPI (ex-Food/Energy) moved down to 5.3% YoY, the lowest reading since November 2021. Source: Charlie Bilello

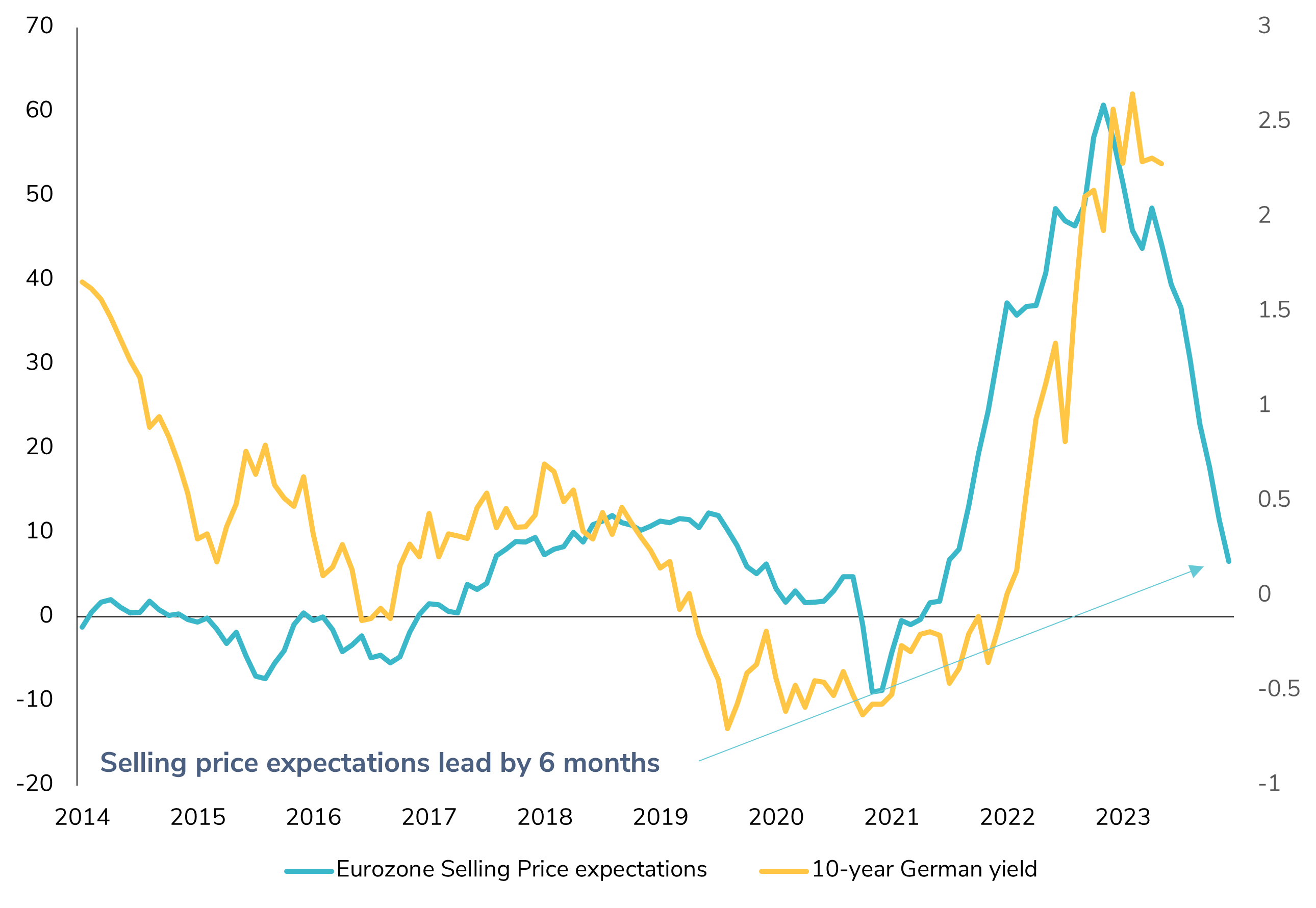

Is it time to increase duration in EUR bonds?

The latest European Commission survey on Eurozone selling price expectations shows a significant decline, suggesting that inflation should continue to decrease in the coming months, alleviating pressure on the ECB to tighten its monetary policy. After a possible one or two final tightening moves by the ECB in June and/or July, is it worth considering a higher allocation to European rates, particularly core bonds? Source : Bloomberg.

Investing with intelligence

Our latest research, commentary and market outlooks