Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

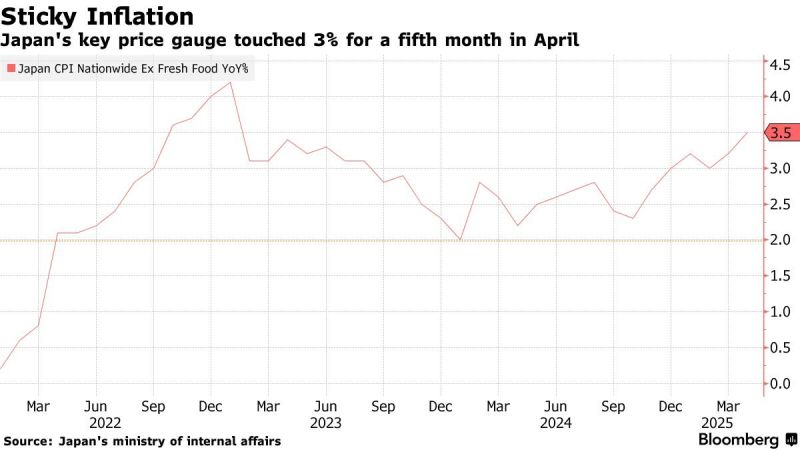

Japan’s CPI pickup, rice price surge raise pressure on Ishiba

Bloomberg

Poland standard of living will surpass Japan this year.

Free market, hard work and entrepreneurial spirit do pay off. Congratulations Poland.

The Conference Board Leading Economic Index FELL to the lowest level in 11 YEARS.

The drawdown since the peak has been 17.3%, the biggest since the Great Financial Crisis. Such a drop has never been seen outside of recessions and is higher than in 2001. Source: Bloomberg, Liz Ann Sonders, Global Markets Investor

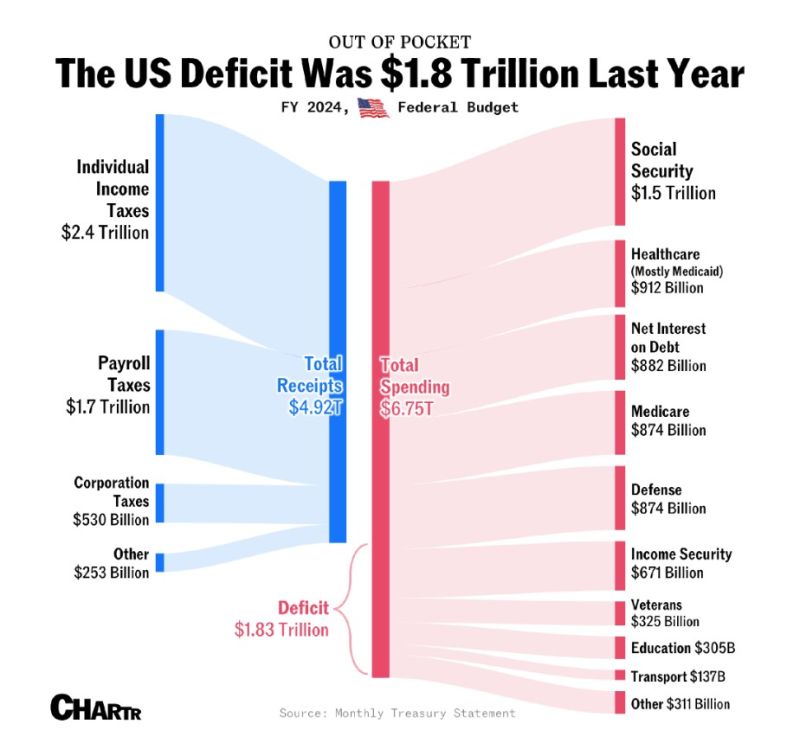

‼️ Let's be realistic.

Trump 2.0 and the next administrations are never going to become fiscally responsible by cutting spending at the risk of sending the economy into a recession. 🎯 They have no other choice than devaluing the real value of your bonds. Consequence is loss of purchasing power / money debasement for those stuck in cash and bonds. What are the options available to investors / savers? 1) Spend their money now 2) Invest into high quality stocks because they’re the ones receiving all this excess spending 3) Accumulate store of values

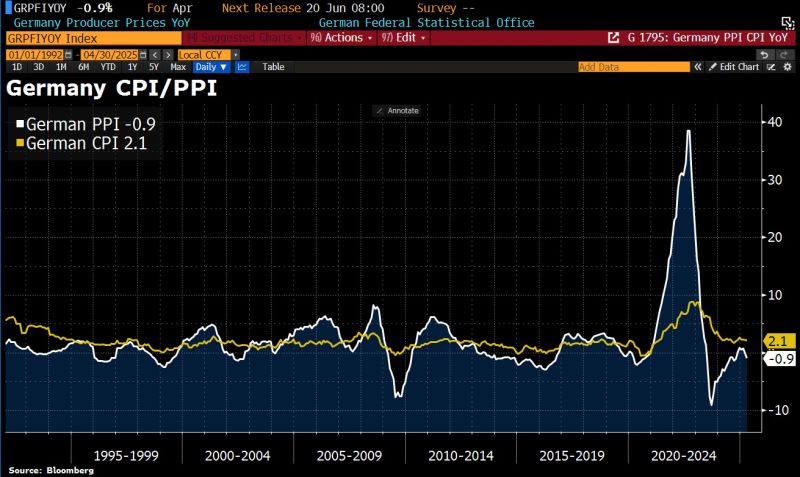

In Germany, Producer price deflation is picking up speed.

Producer Price Index (PPI) dropped by 0.9% YoY, driven mainly by a strong Euro and possibly early impact of US tariffs. PPI is an important leading indicator for consumer inflation, so this drop could signal further cooling in prices. Source: Bloomberg, HolgerZ

With the clock ticking on America’s $36 trillion debt ceiling (which could be breached as soon as August), the national debt continues to climb, as it has for decades.

According to the Congressional Budget Office, the US public debt stood at 98% of GDP last year, and is set to surpass the WWII peak by 2029, hitting 119% by 2035. 🔴 What might be of particular concern to the number crunchers at Moody’s is not just the current level of federal debt, but how quickly it’s growing. Last year, the deficit was $1.8 trillion, more than 6% of GDP. The interest payments on debt alone were some $882 billion, greater than the defense and Medicare budgets. 😨 The latest tax cuts and spending push — or, as President Trump calls it, “the big, beautiful bill” — could add another ~$4 trillion to the federal deficit over the next decade, with Moody’s now projecting that the debt-to-GDP ratio could surge to 134% by 2035. In an interview with NBC yesterday, Treasury Secretary Scott Bessent shrugged off the downgrade, calling Moody’s a “lagging indicator.” But the markets took note, with the 30-year Treasury yield topping 5% this morning, a level last seen in late 2023.

The People’s Bank of China trimmed the 1-year loan prime rate to 3.0% from 3.1%, and the 5-year LPR to 3.5% from 3.6%.

A slew of state-backed commercial lenders moved to cut their deposit rates by as much as 25 basis points earlier Tuesday. As mentioned by Mo El Erian, the question remains: will this prolonged period of policy incrementalism reach a critical mass that fundamentally alters household sentiment and consumer behaviour? So far, it has failed to do so. Source: Bloomberg, CNBC

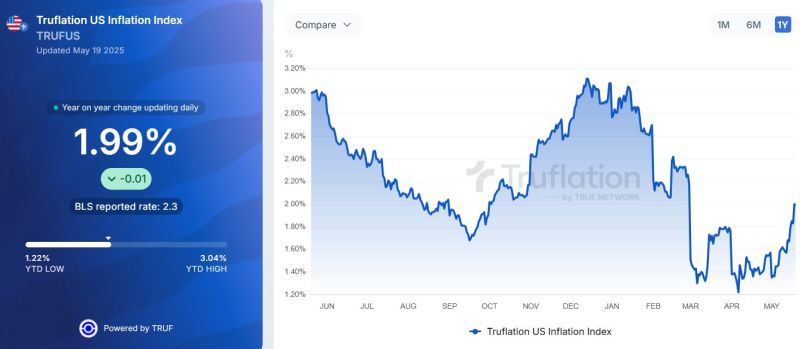

+0.64 PERCENTAGE POINTS!

This was the INCREASE in INFLATION over the last 18 days. If inflation is not controlled, interest rate cuts will be postponed, and this could have a strong impact on the markets.

Investing with intelligence

Our latest research, commentary and market outlooks