Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

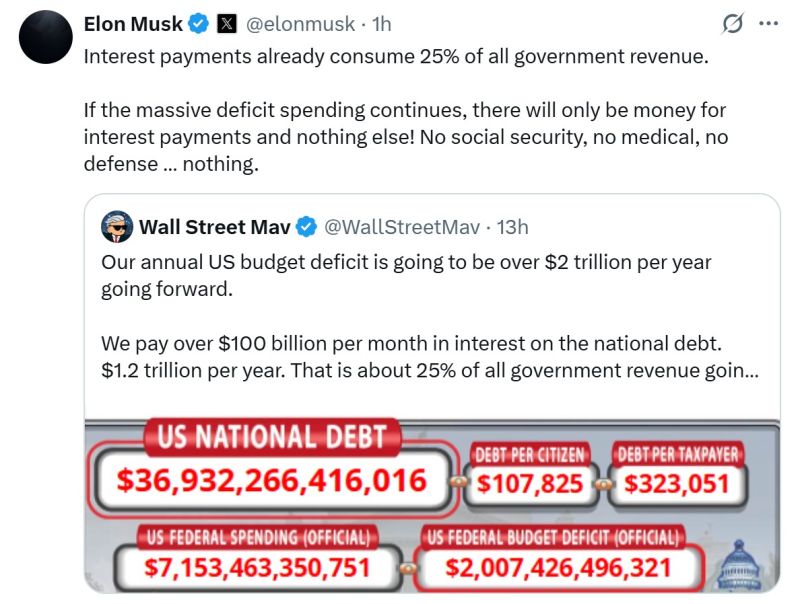

Elon keeps pounding the table on the fiscal & debt side...

He probably feels that D.O.G.E didn't go far enough...

China's manufacturing activity plunges to lowest level since September 2022 📉

Source: Barchart, LESG

An intentional leak to give markets further hope?

Source: Adam Taggart @menlobear on X

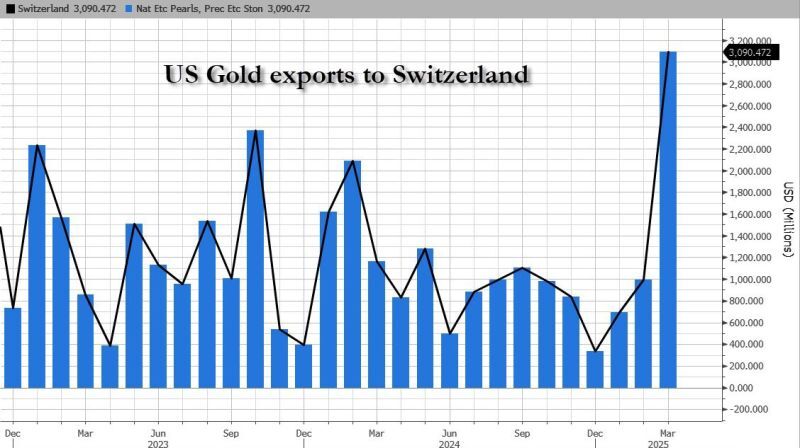

The Atlanta Fed was forced to adjust its entire tracker to exclude gold imports which were skewing GDP by 1.5%.

How long until the Atlanta Fed also excludes soaring physical gold EXPORTS TO Switzerland to reduce the surge in Q2 GDP??? Source: zerohedge

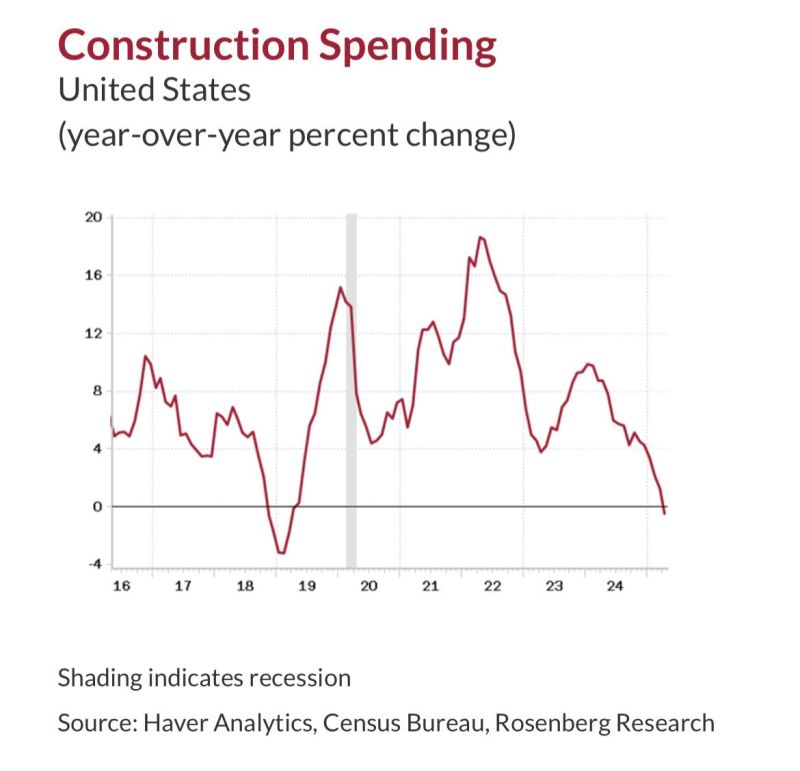

Are US soft data starting to feed into hard data?

Source: Haver Analytics, Rosenberg Research

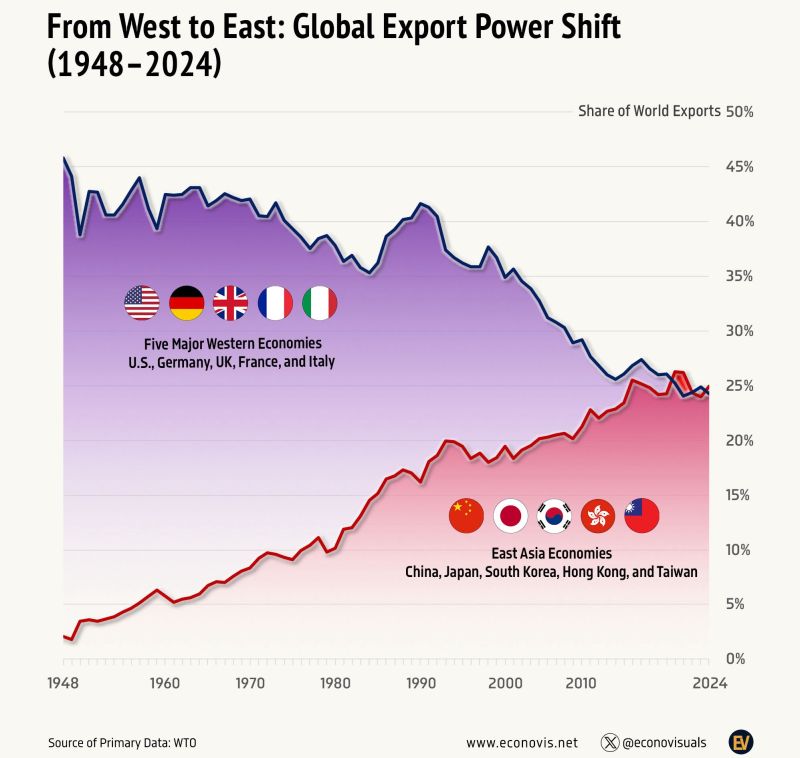

Is it time for the West to rethink its economic model?

Chart @econovisuals thru Michel A.Arouet

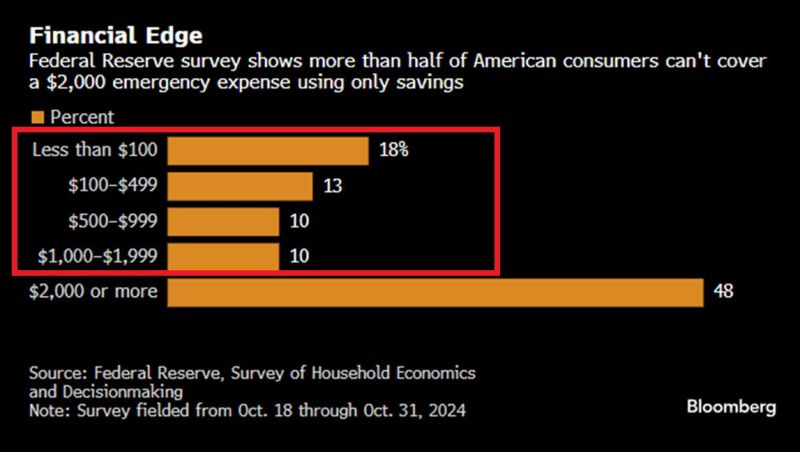

⚠️US consumers are struggling: More than 50% of US consumers are not able to cover a $2,000 emergency expense using only savings.

Nearly one-third cannot cover $500, according to the Fed survey released Wednesday. Most Americans have no savings. Source: Bloombrg, Global Markets Investor

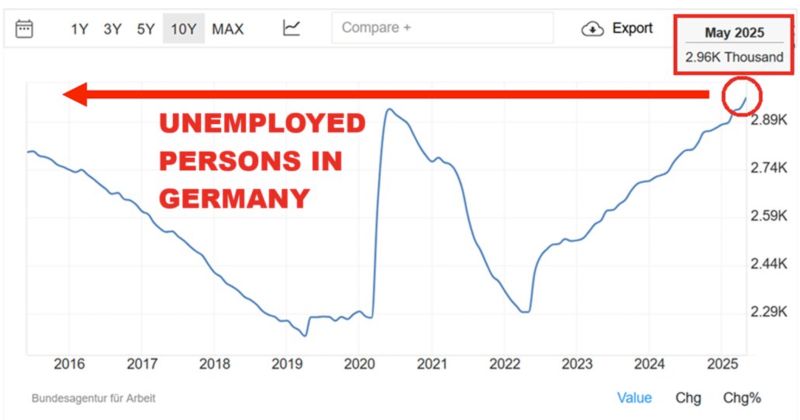

German job market is deteriorating:

The number of unemployed people in Germany hit 2.96 MILLION in May, the highest in at least 10 YEARS. This is even higher than at the 2020 CRISIS peak. The unemployment rate sits at 6.3%, the second-highest in 10 years. Source: Global Markets Investor

Investing with intelligence

Our latest research, commentary and market outlooks