Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

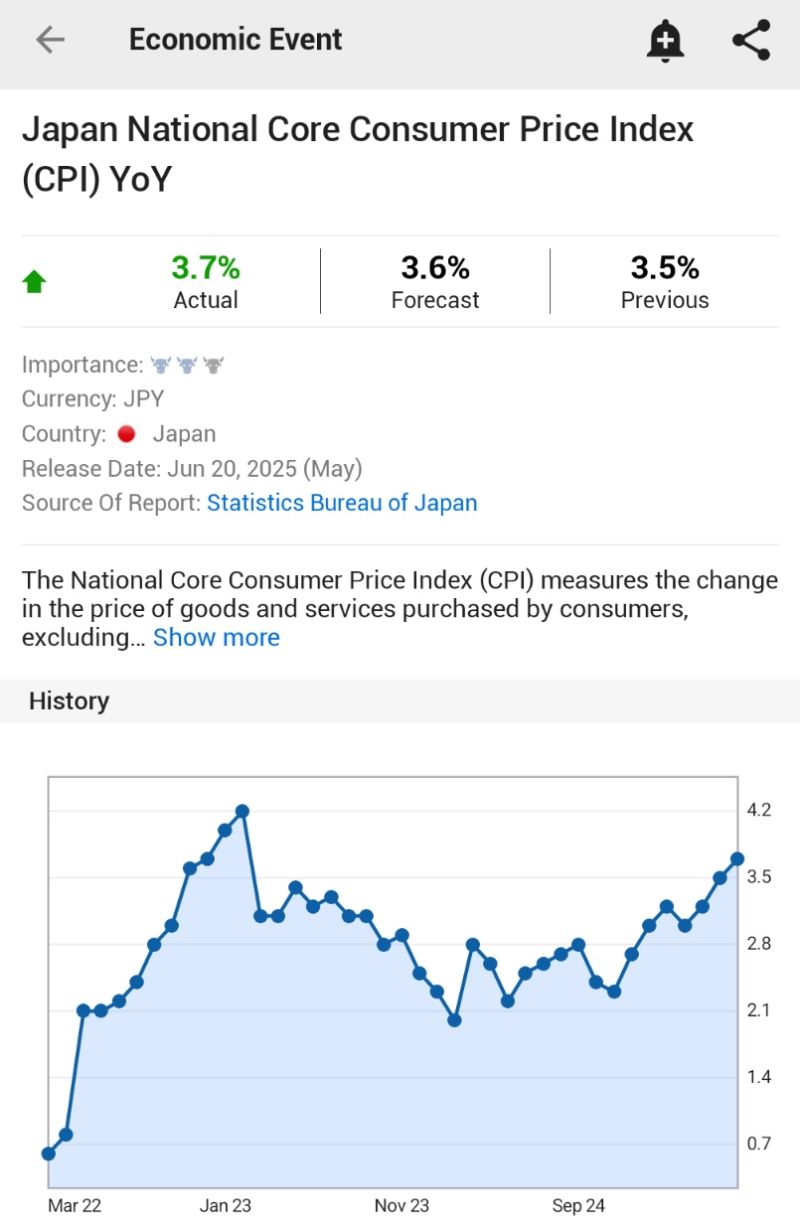

JAPAN MAY CORE CPI INFLATION RISES 3.7% Y/Y; EST. 3.6%; PREV. 3.5%

HIGHEST SINCE JANUARY 2023 $JPY Source: investing.com

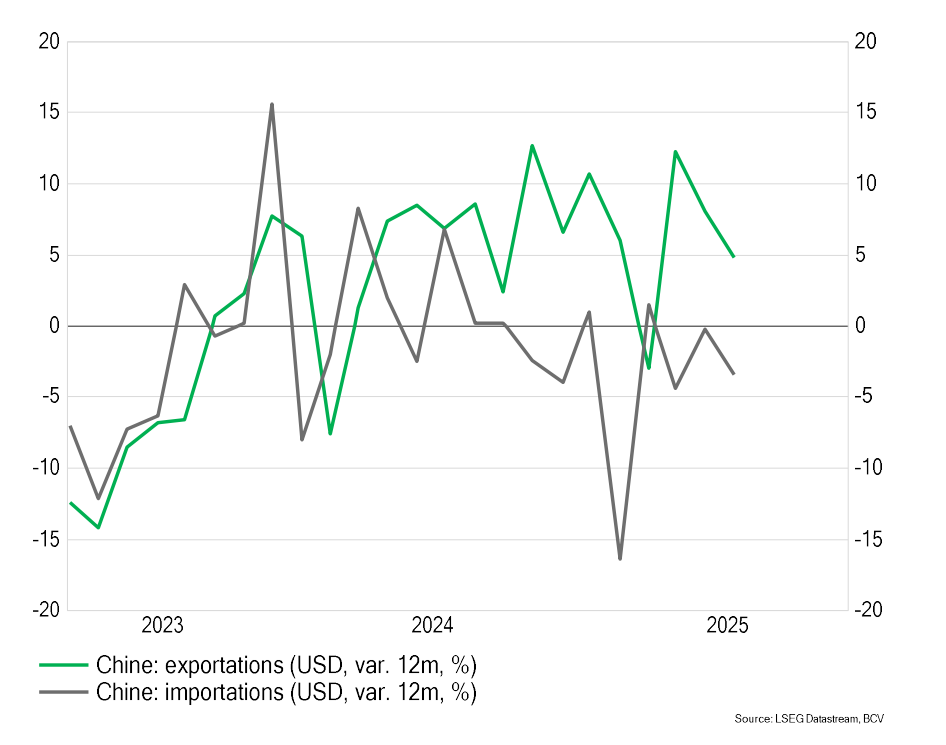

China: The trade war is starting to weigh on activity

Trade balance figures for the month of May reveal a notable slowdown in exports. Source: BCV

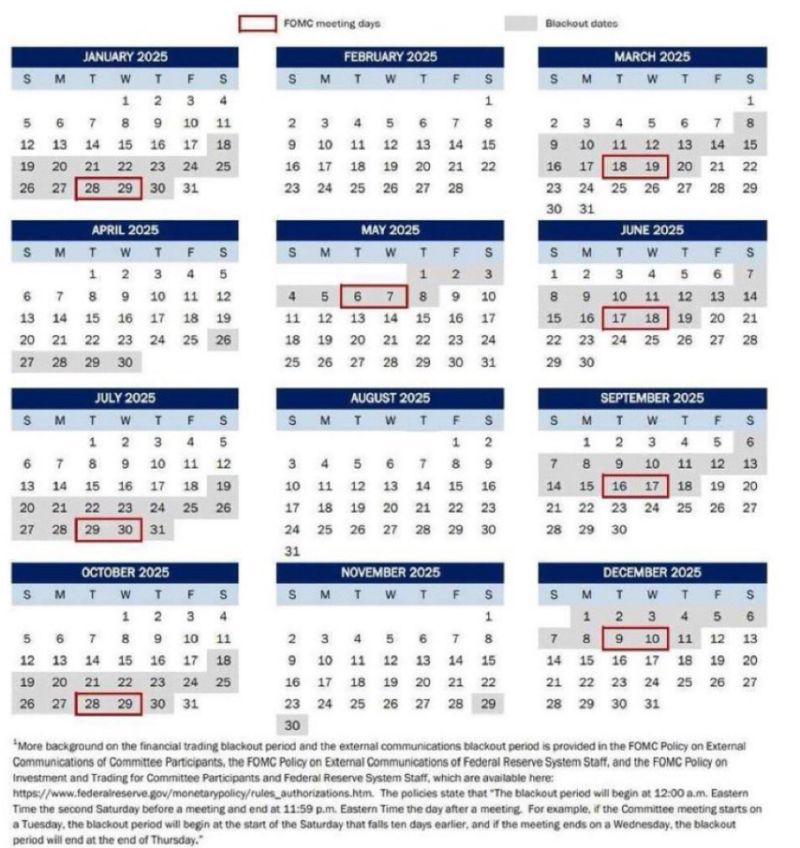

Blackout Period

Watch out for Jerome Powell's remarks this Wednesday.Then — the Fed enters a new phase:The blackout period ends Thursday, meaning Fed officials will be free to speak again starting Friday. source : evan

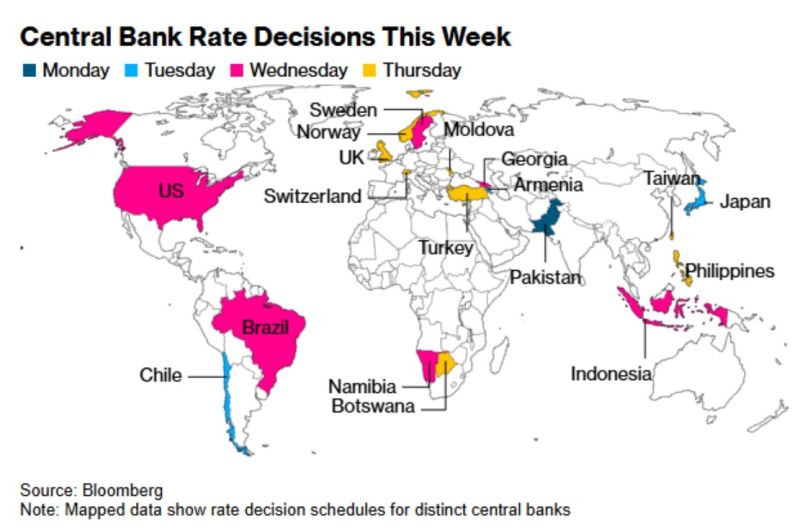

Central Bank Rate Decisions This Week

source : Bloomberg

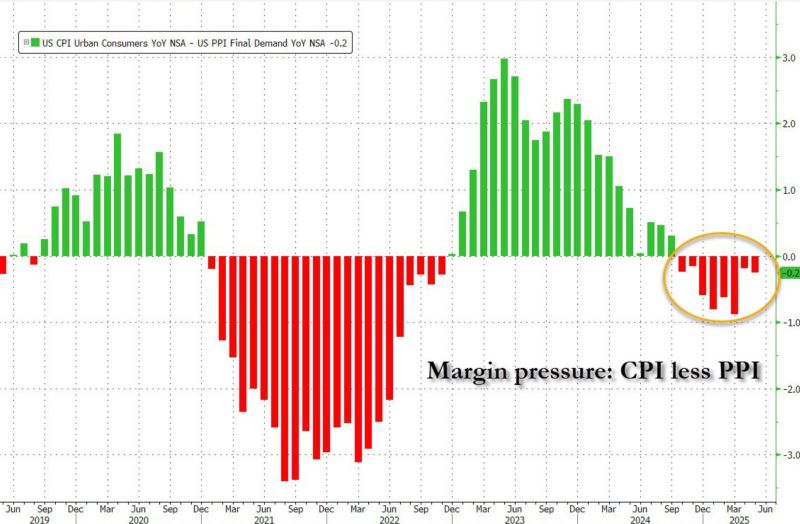

US companies are eating tariff costs, as margin pressures persist for an 8th straight month.

Source: zerohedge

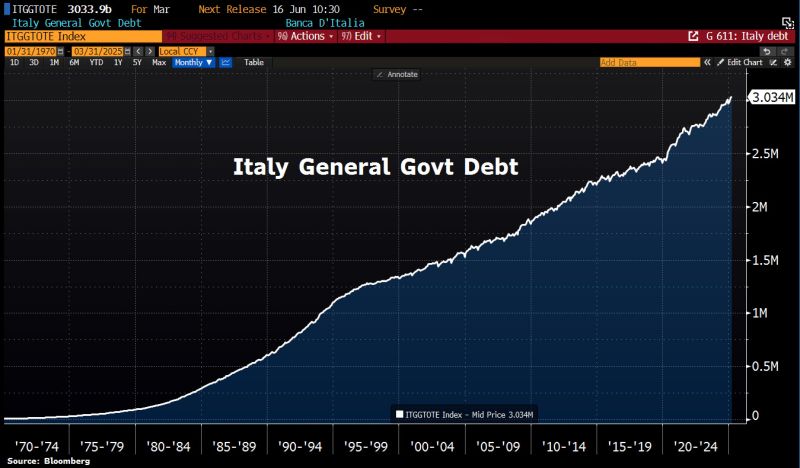

In case you missed it: Italy's total government debt has topped €3tn, for the 1st time ever.

Source: HolgerZ, Bloomberg

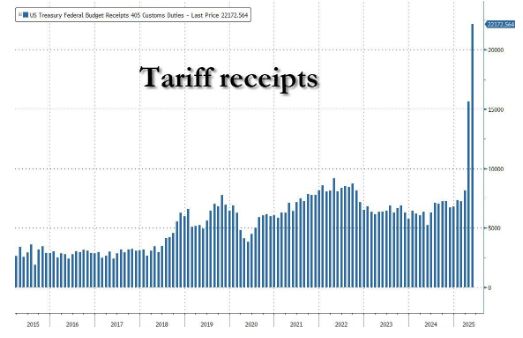

U.S. Tariff Revenue soared to $22.2 Billion during May, an all-time high 🚨🚨

Source: zerohedge

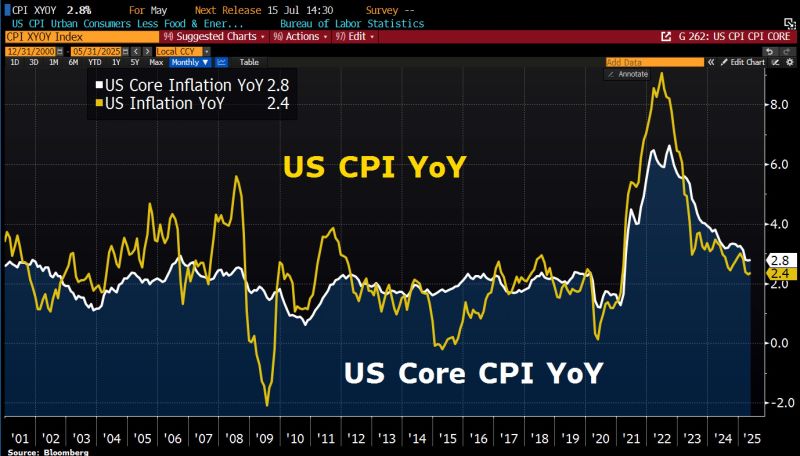

May US inflation slightly cooler than expected. Core CPI rose by 2.8% YoY, just below forecast of 2.9%, while headline inflation at 2.4%, matching expectations.

Both figures remain above Fed's 2% target, but Trump’s tariffs have not yet significantly impacted overall inflation. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks