Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

China’s exports growth missed expectations in May

dragged down by a sharp decline in shipments to the U.S., with analysts saying effects of a Beijing-Washington trade truce will be visible in June data. 🟥 Chinese exports to the U.S. plunged 34.5% from a year ago, marking the sharpest drop since February 2020, according to Wind Information, when the Covid-19 pandemic disrupted trade. Imports from the U.S. dropped over 18%, and China’s trade surplus with America shrank by 41.55% year on year to $18 billion. Overall exports rose 4.8% last month in U.S. dollar terms from a year earlier, customs data showed Monday, shy of Reuters’ poll estimates of a 5% jump. 🟥 Imports plunged 3.4% in May from a year earlier, a drastic drop compared to economists’ expectations of a 0.9% fall. Imports had been declining this year, largely owed to sluggish domestic demand. That was largely offset by its shipment to the Southeast Asian bloc, which jumped nearly 15% from a year, and those to European Union countries and Africa, which rose 12% and over 33%, respectively. Source: CNBC

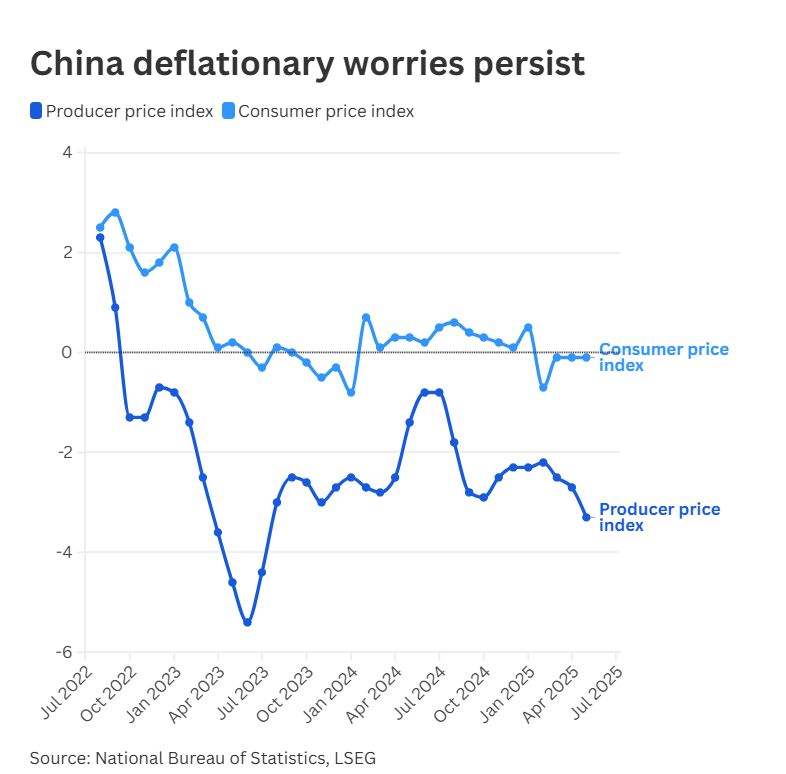

China’s consumer prices fell for a fourth consecutive month in May

Beijing’s stimulus measures appear insufficient to boost domestic consumption, with price wars in the auto sector adding to downward pressure. 🟥 The consumer price index fell 0.1% from a year earlier, according to data from the National Bureau of Statistics released Monday, compared with Reuters’ median estimate of a 0.2% decline. 🟥 CPI slipped into negative territory in February, falling 0.7% from a year ago, and has continued to post year-on-year declines of 0.1% in March, April, and now May. Core inflation, excluding food and energy prices, however, rose 0.6% in May — highest since January this year, according to Wind Information. Separately, deflation in the country’s factory-gate or producer prices deepened, falling 3.3% from a year earlier in May, marking the steepest decline since July 2023 and a sharper drop compared with analysts’ estimates of a 3.2% fall, according to LSEG data. Source: CNBC

U.S. May. Nonfarm Payrolls: 139K, [Est. 130k, Prev. 177K]

May. Unemployment Rate: 4.2%, [Est. 4.2%, Prev. 4.2%] May. Average Hourly Earnings (MoM): 0.4%, [Est. 0.3%, Prev. 0.2%] May. Average Hourly Earnings (YoY): 3.9%, [Est. 3.7%, Prev. 3.8%] Source: Bloomberg

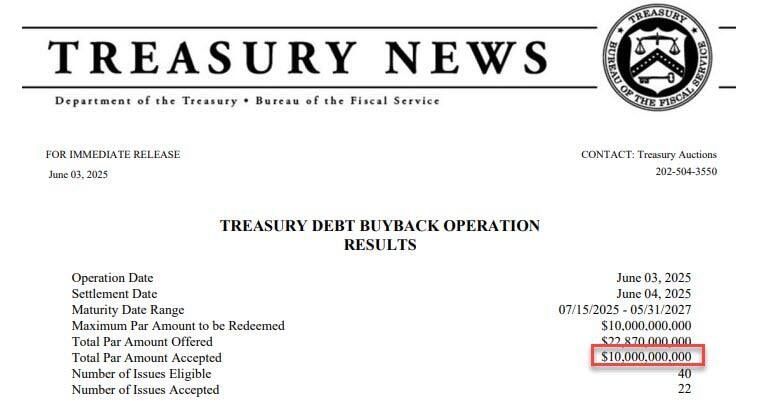

U.S. treasury just bought back $10 billion of its own debt, the largest buyback ever

Source: Department of the Treasury

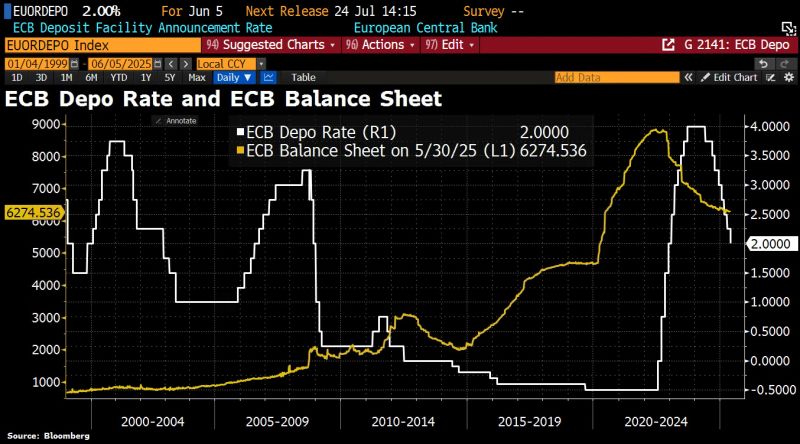

ECB lowered interest rates for the 8th time in a year after inflation dipped <2% and the economy suffered repeated blows from US tariffs.

ECB cut the deposit rate by 25bps to 2% and reiterated that it’s not pre-committing to a particular path. ECB balance sheet shrank to €6.3tn. Note that ECB deposit rate has fallen below the German inflation rate for the first time since September 2023. Source: HolgerZ, Bloomberg

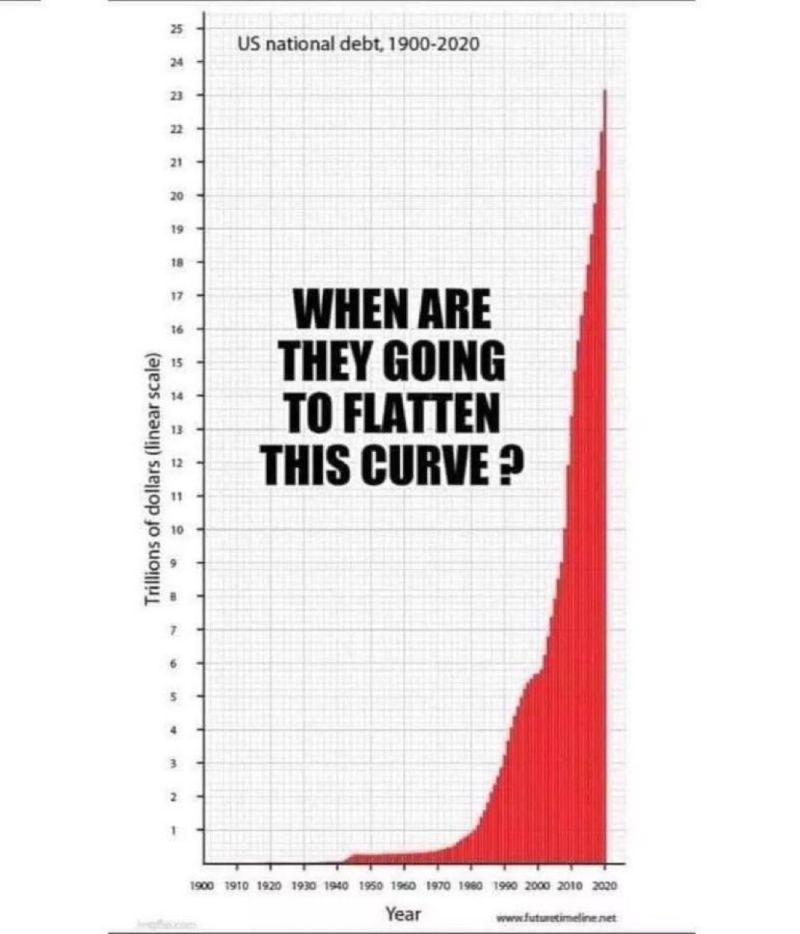

Elon Musk: "Flatten the curve"

Source: Future timeline

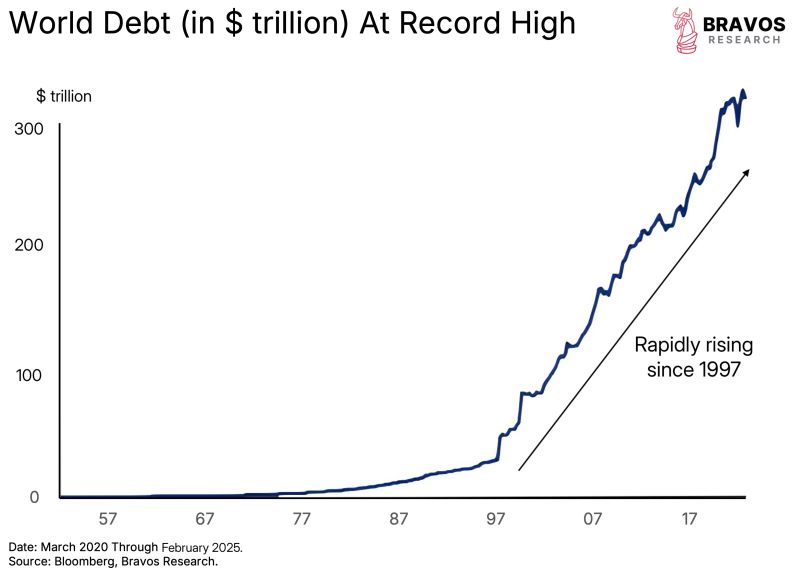

World debt has now officially crossed $300 trillion

And still continues to climb aggressively Source: Bravos Research

US private sector hiring rose by just 37,000 jobs in May, the lowest in more than 2 years… Trump had this to say 👇

Source: Stocktwits

Investing with intelligence

Our latest research, commentary and market outlooks

![U.S. May. Nonfarm Payrolls: 139K, [Est. 130k, Prev. 177K]](https://blog.syzgroup.com/hubfs/10-Jun-06-2025-02-36-54-5263-PM.jpg)