Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

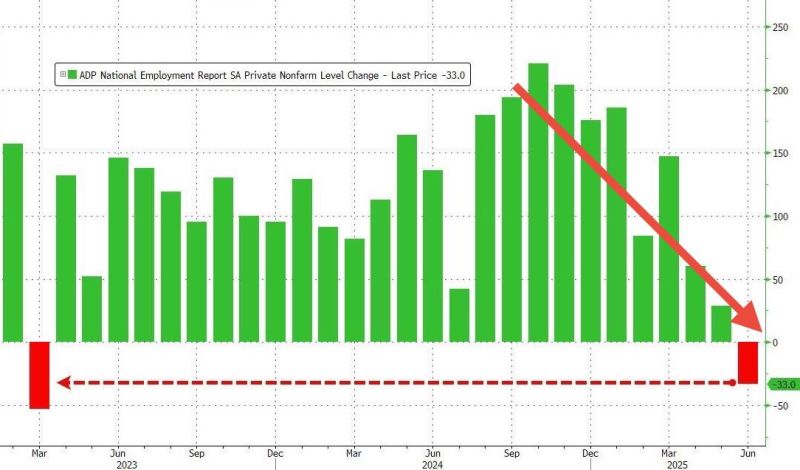

Huge ADP miss… the trend is clear.

*ADP PRIVATE PAYROLLS: -33K vs 98K exp. First negative print since March 2023. Private sector hiring unexpectedly contracted in June, payrolls processing firm ADP said Wednesday, in a possible sign that the economy may not be as sturdy as investors believe as they bid the S&P 500 back up to record territory to end the month. Private payrolls lost 33,000 jobs in June, the ADP report showed, the first decrease since March 2023. Economists polled by Dow Jones forecast an increase of 100,000 for the month. The May job growth figure was revised even lower to just 29,000 jobs added from 37,000. To be sure, the ADP report has a spotty track record on predicting the subsequent government jobs report, which investors tend to weigh more heavily. May’s soft ADP data ended up differing significantly from the monthly jobs report figures that came later in the week. Source: Zerohedge, Bloomberg, CNBC

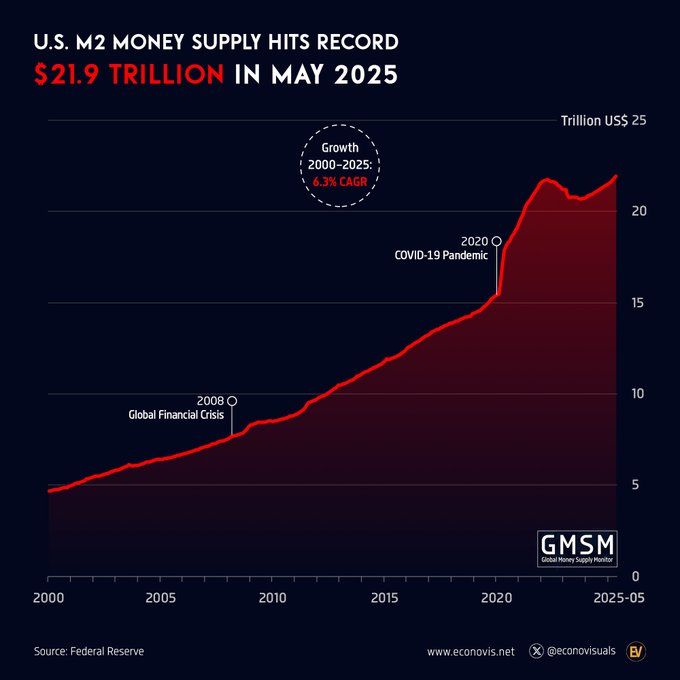

⚠️US money supply is re-surging:

US M2 money supply jumped 4.5% year-over-year in May, to a record $21.94 TRILLION. This has now surpassed the March 2022 record of $21.86 trillion For perspective, the 2000-2025 annual growth rate has been 6.3%. Chart @econovisuals thru Global Markets Investor

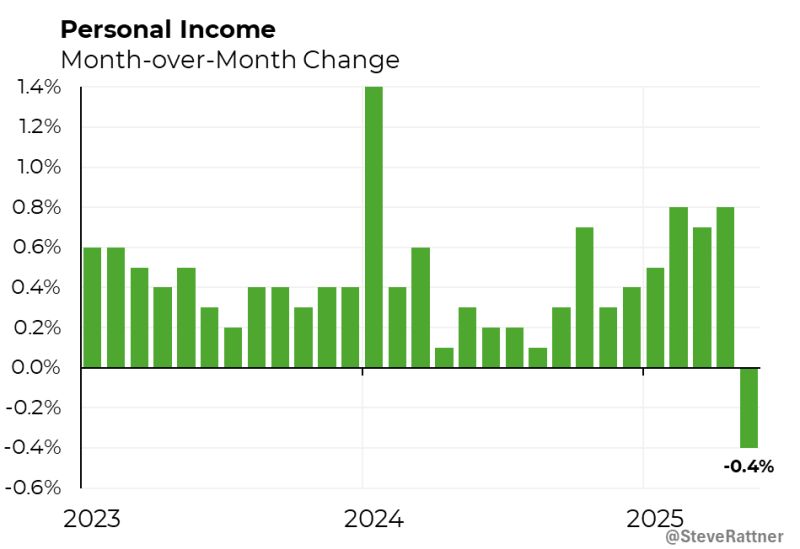

In May, US personal income dropped by 0.4%, the first month-over-month decline in almost 4 years.

Source: Steven Rattner @SteveRattner

President Trump says interest rates should be as low as 1% and we have a "stupid person" at the Fed.

Source: Stocktwits

In case you missed it: Germany’s private sector economy unexpectedly returned to growth in June.

The composite PMI rose to 50.4, up from 48.5 in May, signaling a move back into expansion territory. Manufacturing – a key sector for Germany – saw its PMI climb to 49, the highest level since 2022. While still below the long-term avg of 51.6, it's a notable improvement. The sector appears to be benefiting strongly from falling interest rates, which may help explain why Germany is currently outperforming much of the rest of the Eurozone. Source: HolgerZ, Bloomberg

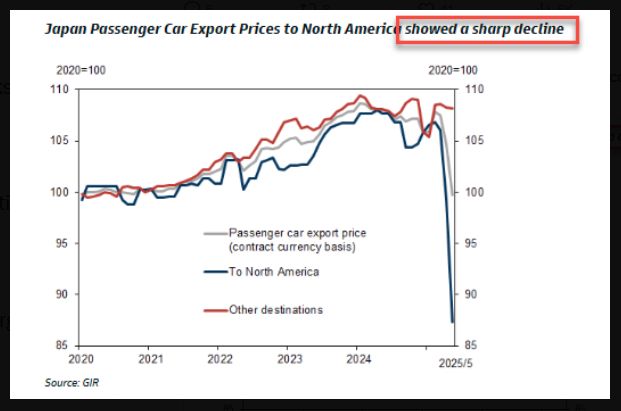

US Tariffs have massive negative consequences on Japan's car exports

Source: GIR, zerohedge

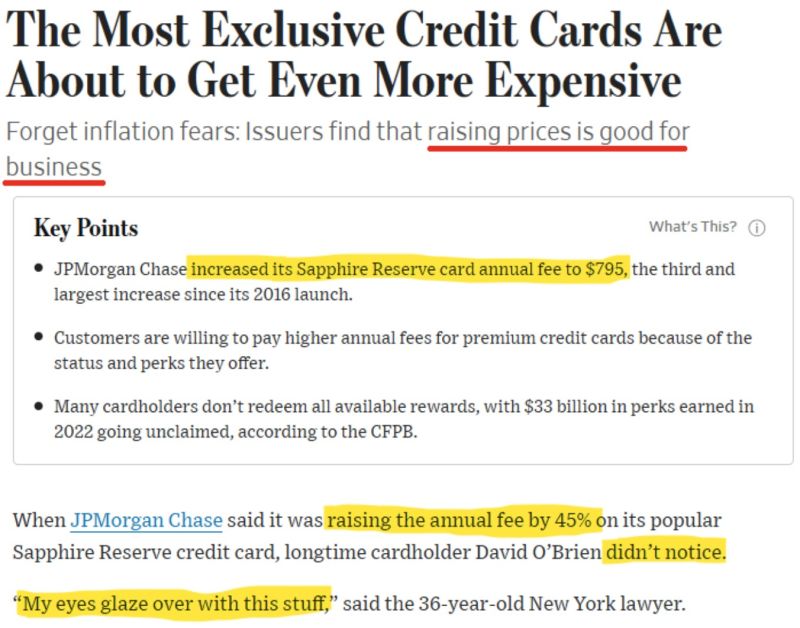

In case you missed it... here's another potential source of inflation

Source: Charlie Bilello

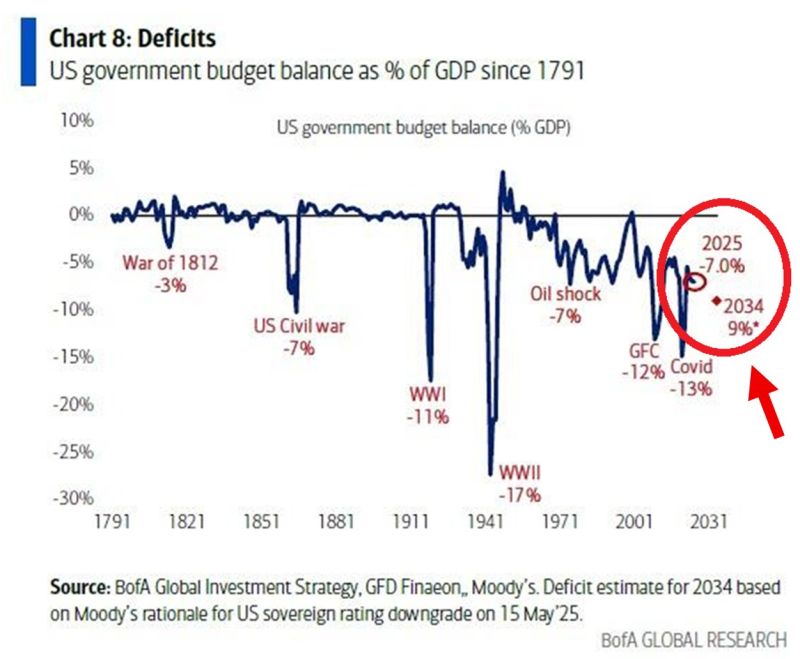

The US fiscal deficit is projected to hit a MASSIVE 9% of GDP by 2034.

Such deficits have never occurred outside of major crises and wars. This projection also assumes no recession and lower interest rates than currently. Source: BofA, Global Markets Investor, Moody's

Investing with intelligence

Our latest research, commentary and market outlooks