Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

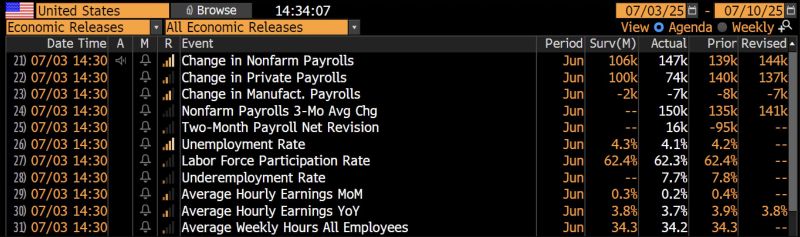

Notable: Coming back to yesterday's US non farm payrolls

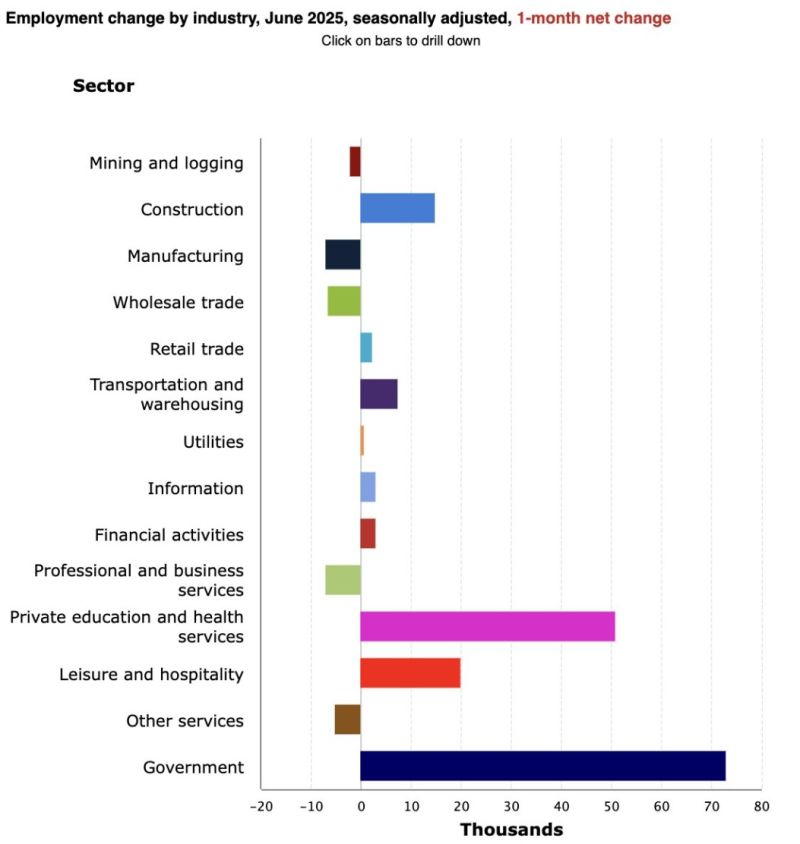

-> The 147,000 job gains in June were almost all (over 75%) in healthcare and government. Government: +73,000 Healthcare: +39,000 The government job gains looked like this: State gov't education +40,000 State gov't non-education +7,000 Local gov't education +23,000 Local gov't non education +10,000 Federal gov't -7,000 Source: Heather Long on X

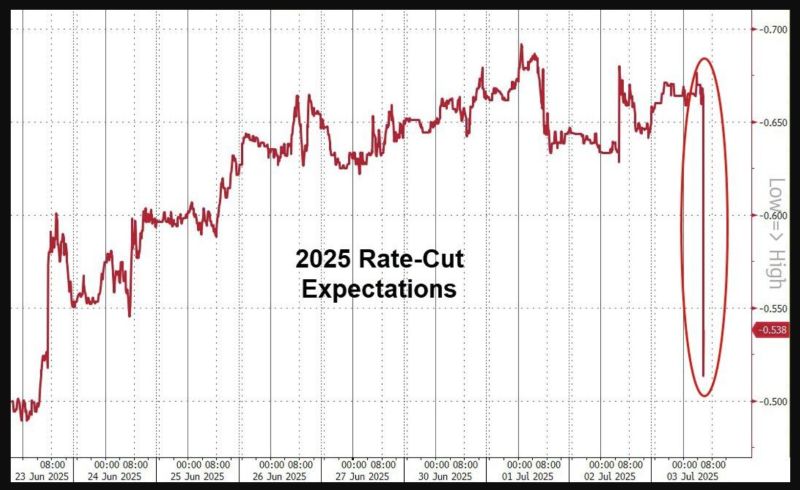

Overall 2025 fed rate cut expectations tumbled on "Big Beautiful Bill" being passed & better us payrolls

Source: www.zerohedge.com, Bloomberg

⚠️YOU CAN'T MAKE THIS UP

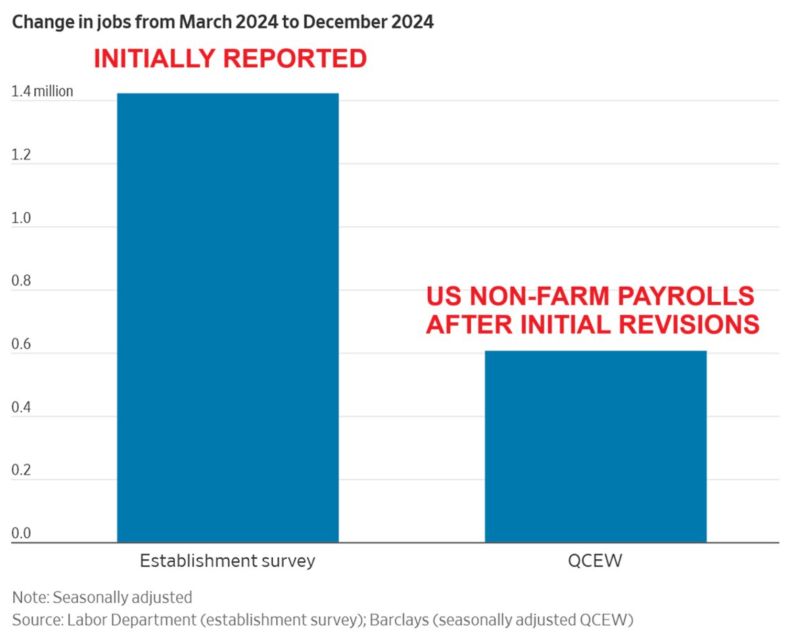

‼️ The US job numbers will likely be REVISED DOWN by nearly 800,000 for the 9-month period ending December 2024, according to QCEW data. ▶️ This means non-farm payrolls were OVERSTATED by ~88,888 jobs each month during this period. Source: Global Markets Investor

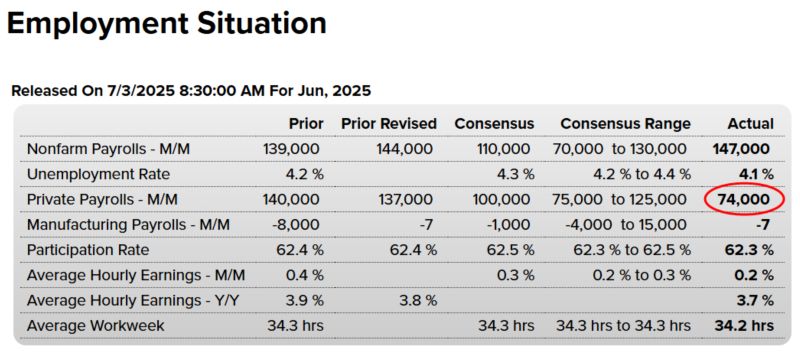

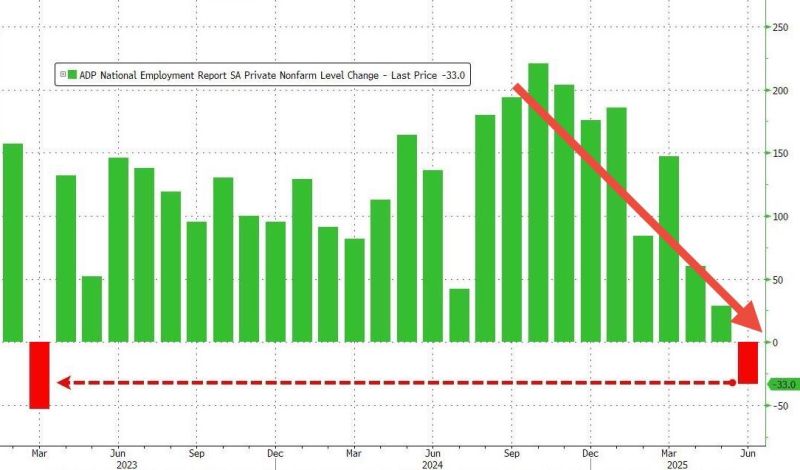

ADP Yesterday -- "We use social security numbers and we process paychecks. Private sector lost -33,000 jobs in June."

NFP Today -- "You're wrong! We do phone survey. Sometimes they answer, sometimes they don't. We show private sector created +74,000 jobs in June." Source: Jaguar Analytics

▶️ A "pro-growth" job report ‼️stocks surged and bonds sold off after the US economy blew past expectations, adding 147,000 jobs in June (vs 106k expected).

▶️The unemployment rate fell to 4.1% from 4.2% as the private-sector survey showed 93,000 new jobs created, and labor force participation rate dipped slightly to 62.3%, suggesting fewer people are actively working or looking for work. ▶️Meanwhile, wage growth came in softer than expected, with average hourly earnings rising 3.7% year-over-year. Source: HolgerZ, Bloomberg

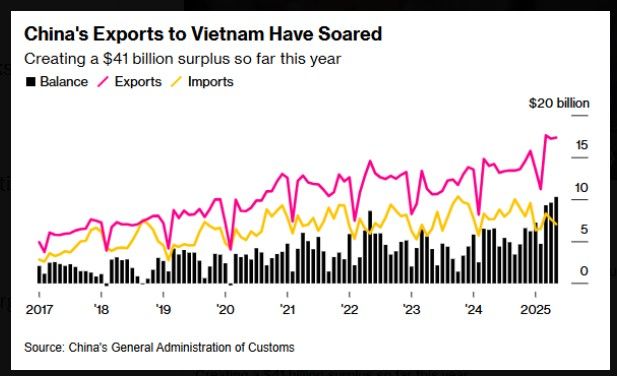

Beijing Braces for US Trade Deals That Aim to Shut Out China - Bloomberg

The US-Vietnam trade deal is aimed at isolating China primarily by targeting the use of Chinese components in goods exported from Vietnam to the US. The deal imposes a tiered tariff system where Vietnamese exports containing Chinese inputs face higher tariffs—20% generally, and up to 40% on goods suspected of being transshipped from China through Vietnam with minimal processing. This is designed to prevent Chinese products from bypassing US tariffs by routing them through Vietnam, a practice that increased after earlier US-China trade tensions led companies to relocate production to Vietnam. The US strategy behind this deal is part of a broader effort to reshape global supply chains into "trusted" networks that exclude Chinese firms and reduce China's role in international trade. The Trump administration has pushed trading partners like Vietnam to cut back on imports from China and control their supply chains more tightly to avoid facilitating Chinese goods entering the US market indirectly.

Huge ADP miss… the trend is clear.

*ADP PRIVATE PAYROLLS: -33K vs 98K exp. First negative print since March 2023. Private sector hiring unexpectedly contracted in June, payrolls processing firm ADP said Wednesday, in a possible sign that the economy may not be as sturdy as investors believe as they bid the S&P 500 back up to record territory to end the month. Private payrolls lost 33,000 jobs in June, the ADP report showed, the first decrease since March 2023. Economists polled by Dow Jones forecast an increase of 100,000 for the month. The May job growth figure was revised even lower to just 29,000 jobs added from 37,000. To be sure, the ADP report has a spotty track record on predicting the subsequent government jobs report, which investors tend to weigh more heavily. May’s soft ADP data ended up differing significantly from the monthly jobs report figures that came later in the week. Source: Zerohedge, Bloomberg, CNBC

The bill’s passage through Congress’s upper chamber now leaves its fate in the hands of the House of Representatives, where it could still face considerable opposition

Donald Trump’s landmark tax and spending legislation moved a step closer to becoming law on Tuesday after the US Senate ended days of haggling and narrowly passed the so-called big, beautiful bill. The bill’s passage through Congress’s upper chamber now leaves its fate in the hands of the House of Representatives, where it could still face considerable opposition ahead of a looming July 4 deadline. The Senate approved the sweeping legislation, 51-50, after vice-president JD Vance cast the tiebreaking vote. The president celebrated the legislation’s progress and turned up the pressure on the House to approve it by the end of the week. He urged Republicans in the lower chamber to ignore “GRANDSTANDERS” and do “the right thing, which is sending this Bill to my desk” to be signed into law. Source: FT

Investing with intelligence

Our latest research, commentary and market outlooks