Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

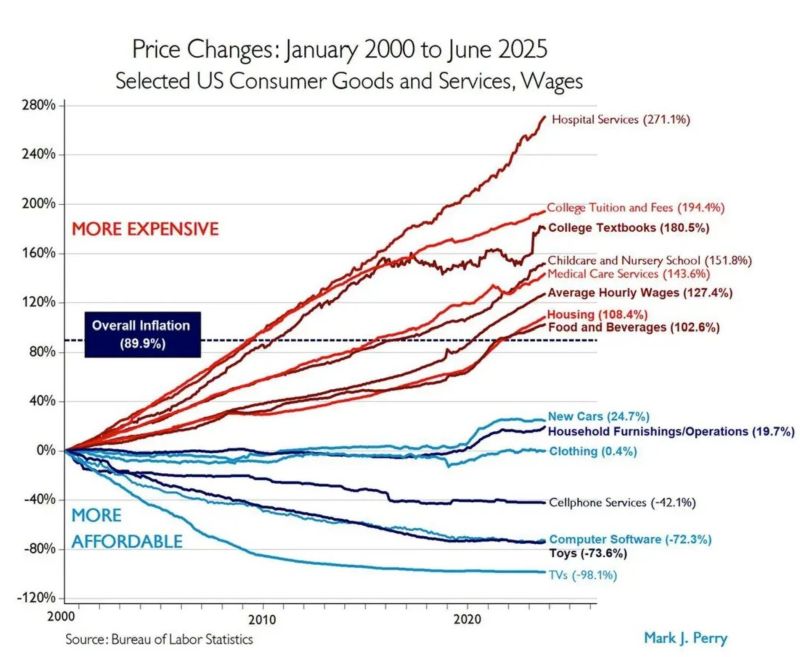

Anthony Pompliano:

"Technologists make prices go down, while the government makes prices go up".

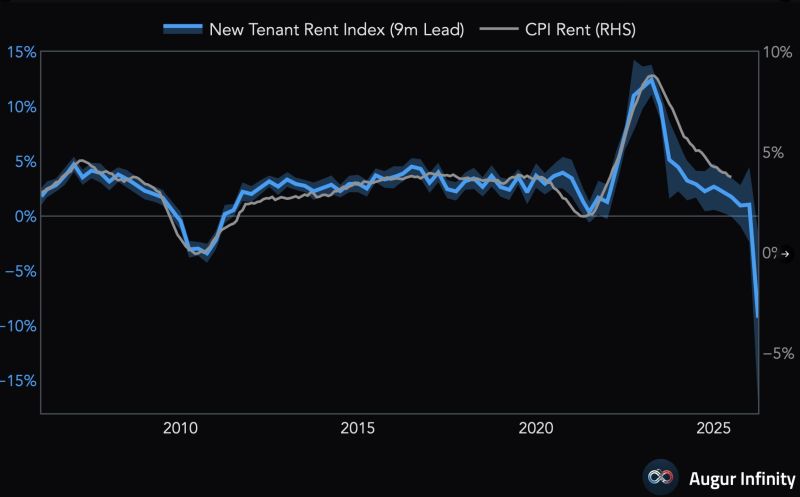

The New Tenant Rent Index, which leads CPI Rent, declined by an unprecedented -9.3% Y/Y in Q2 (with a confidence interval of -17.1% to -1.5%).

Caution should be applied when interpreting these numbers as the series tends to experience very large revisions. In fact, all the negative readings in prior releases were subsequently revised away. However, it is probable to assume that disinflation in shelter CPI, which is ~30% of the Core CPI bucket, will help offset rising inflation concerns as a result of tariffs ✅ Source: Augur Infinity, Bloomberg

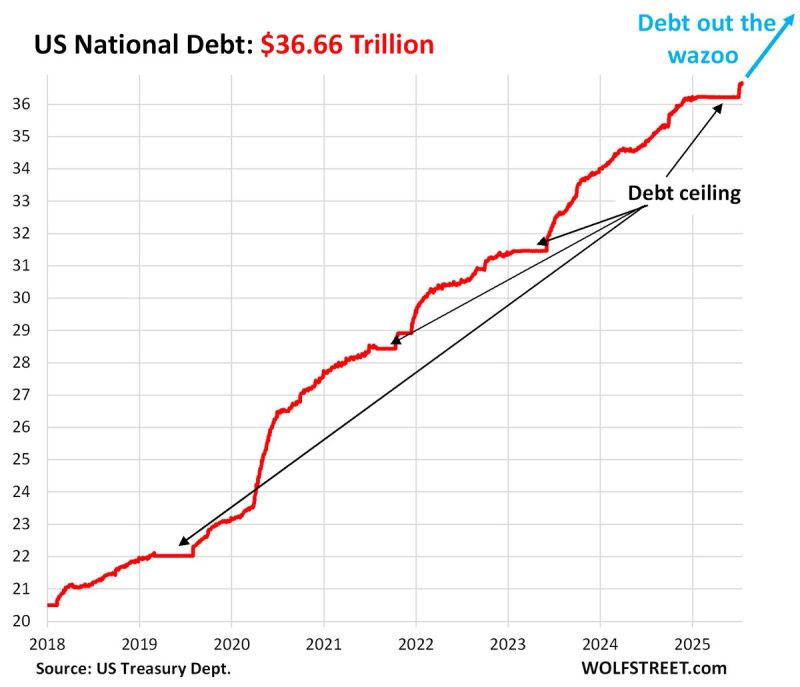

🔴 The US debt crisis is getting worse:

The US federal debt has hit $36.66 TRILLION, an all-time high. The public debt has skyrocketed $441 billion over the last 2 weeks after the statutory debt limit was extended. Over the last 2 years, the US debt has risen $5 TRILLION. Source: Global Markets Investor, Wolfstreet

🚨Earlier today, just before Bloomberg/CNBC/CBS reported that Trump wants to fire Powell asap, June US Producer Inflation came in below estimates

It came lower than expectations of all 50 forecasters in Bloomberg’s survey. ▶️ June US PPI annual inflation rises 2.3%, below expectations for 2.5%. ▶️ Core PPI inflation increased 2.6% Y/Y, compared to forecasts for a gain of 2.7%. THIS IS THE LOWEST LEVEL SINCE SEPTEMBER 2024 The last time PPI was at this level, the Fed was cutting 50bps before the election. Source: Bloomberg, Geiger Capital

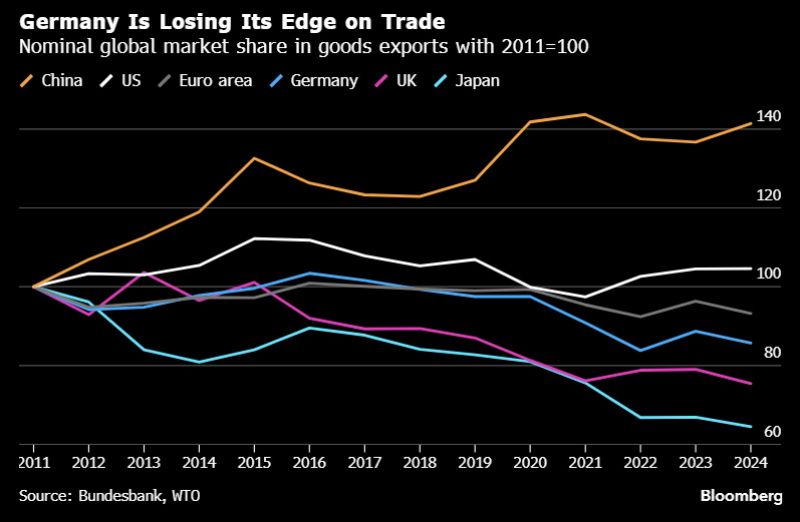

Germany is losing its edge on trade. The country’s share in global trade has been shrinking since 2017, w/losses accelerating after 2021, according to Bundesbank.

Over three-quarters of the decline from 2021 to 2023 was due to falling competitiveness – not Trump’s tariffs Source: HolgerZ, Bloomberg

US CPI report is out - and it is a rather MIXED one

1) Core CPI comes in cooler than expected (2.9% vs. 3.0% expected). Note however that this is the highest level since February. On a sequential basis, U.S. core CPI rose 0.2% M/M, below estimates for a 0.3% increase. 2) Headline CPI inflation increased 2.7% Y/Y, ABOVE forecasts for a 2.6% reading. This is also the highest level since February. On a sequential basis, US CPI rose 0.3% on the month, in line with estimates. 3) Looking at the various CPI components, it seems that tariffs are beginning to drive up prices for core goods like clothing, furniture, appliances, shoes & toys. However, falling car prices are helping to mask full impact. ▶️ All in all, today’s inflation report effectively eliminates any chance of a Fed rate cut at the July 30 FOMC meeting. And if subsequent inflation readings reiterate the rise in inflation, it could jeopardize future rate cuts as well. ✅ The CME Group’s FedWatch tool showed only a 2.6% probability of a fed rate cut at the meeting. 👉 Yes, indeed. The us inflation outlook remains highly uncertain. And so is the US tariff policy. On our side, we believe that the Fed might cut rates only once in 2025. Source: Bloomberg

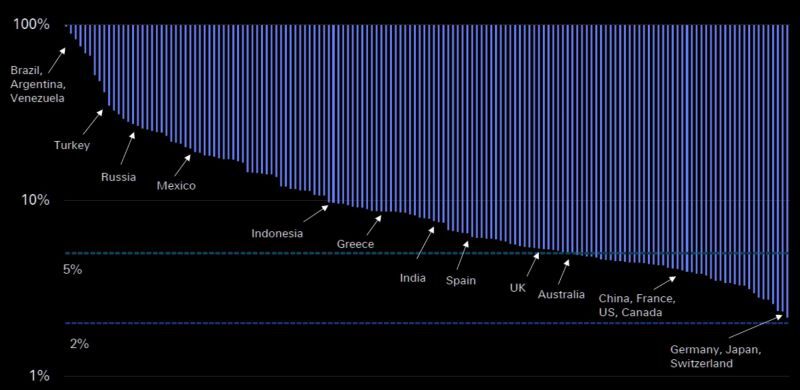

Average annual inflation of 152 economies since 1971 when Bretton Woods collapsed.

No economy has averaged less than 2% inflation but Switzerland at 2.2% comes closest. Source: The Market Ear

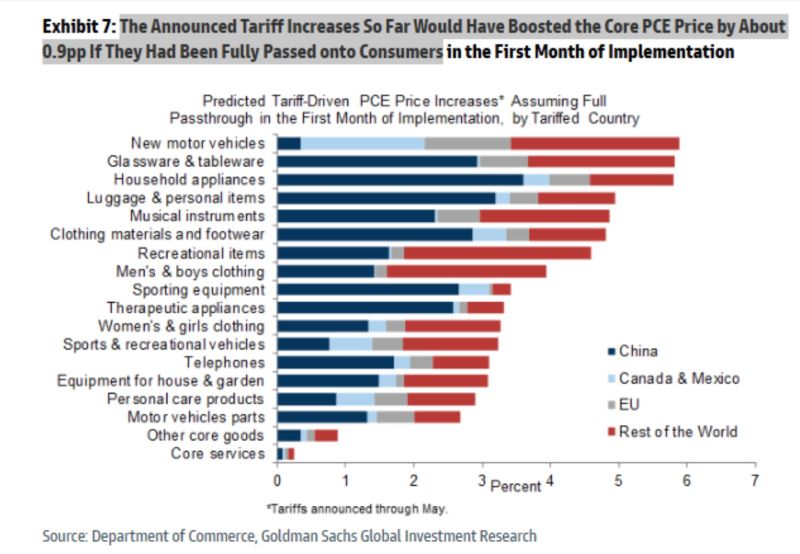

GS: The Announced Tariff Increases So Far Would Have Boosted the Core PCE Price by About 0.9pp If They Had Been Fully Passed onto Consumers

Source: Goldman, Mike Zaccardi, CFA, CMT, MBA

Investing with intelligence

Our latest research, commentary and market outlooks