Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

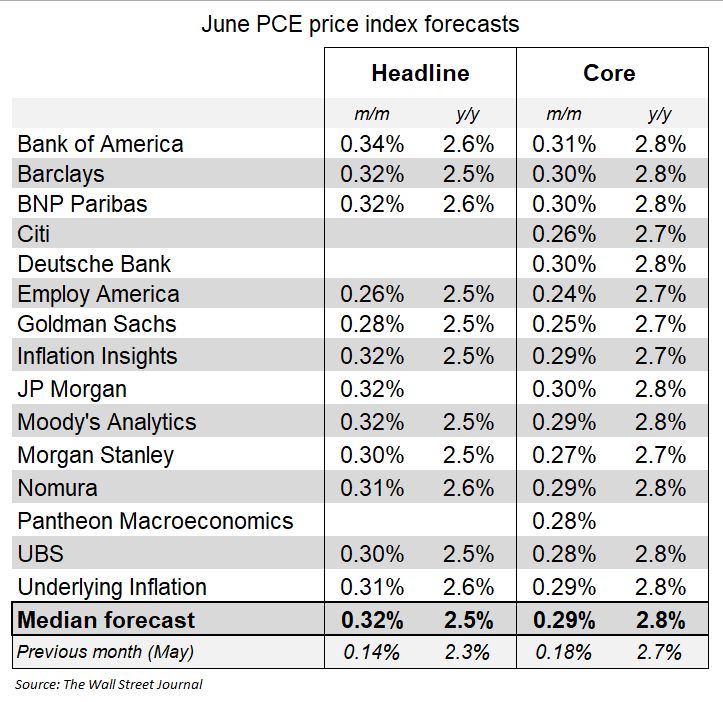

Economists who translate the CPI and PPI into the PCE expect monthly core inflation firmed in June. BEA reports this on Thursday.

Core PCE estimate: +0.29% (highest since February), which would push the year-over-year to 2.8% Headline PCE: +0.32% (y/y rises to 2.5%) Source: Nick Timiraos @NickTimiraos

The US has got the softest inflation surprises on Earth...

Could this influence the FOMC tomorrow??? Source: Andreas Steno Larsen @AndreasSteno, Macrobond

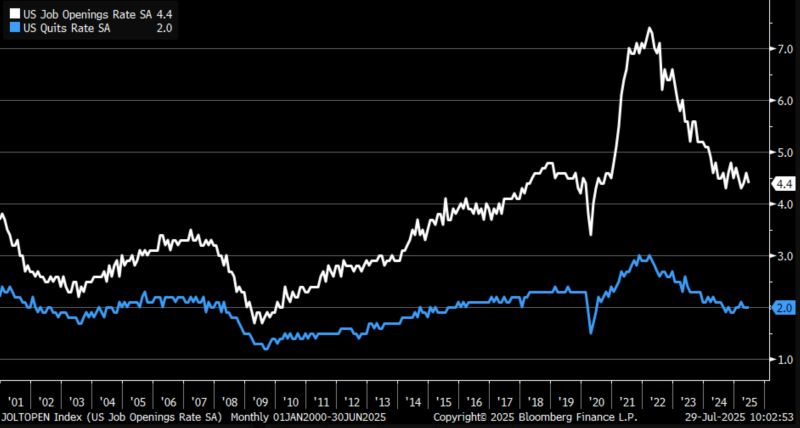

June JOLTS job openings rate (white) down to 4.4% vs. 4.6% prior ... quits rate (blue) unchanged at 2%

Source: Bloomberg, Kevin Gordon

The IMF has upgraded its global growth forecast amid signs that Donald Trump’s trade war will do less damage to the world economy than initially feared, helped by a weaker US dollar

Source: FT

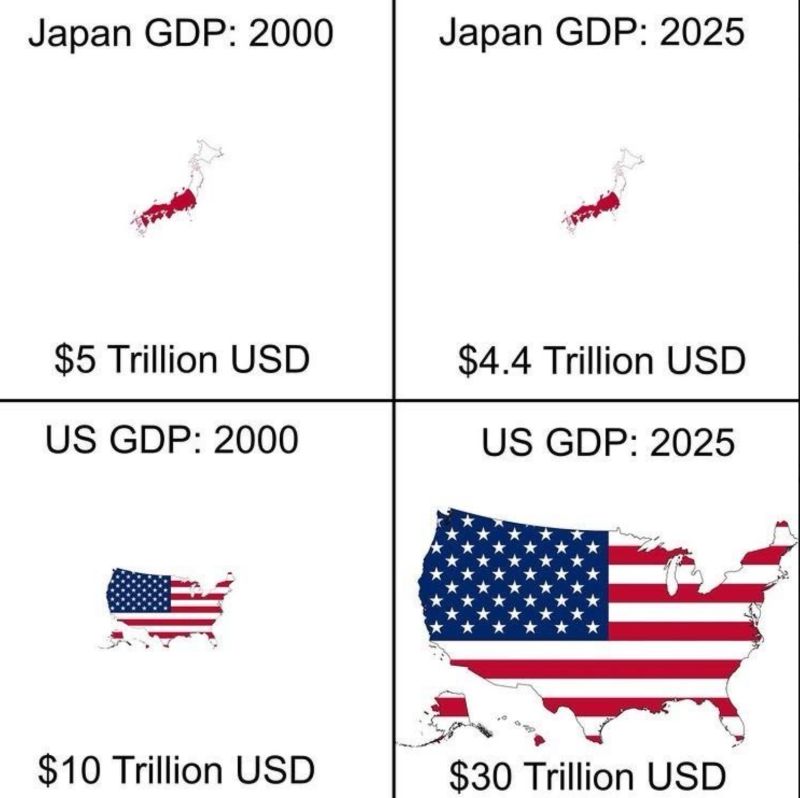

"Never bet against America" said Warren Buffet. Innovation, free market and truly entrepreneurial spirit always win in the long run.

Source: Michel A.Arouet

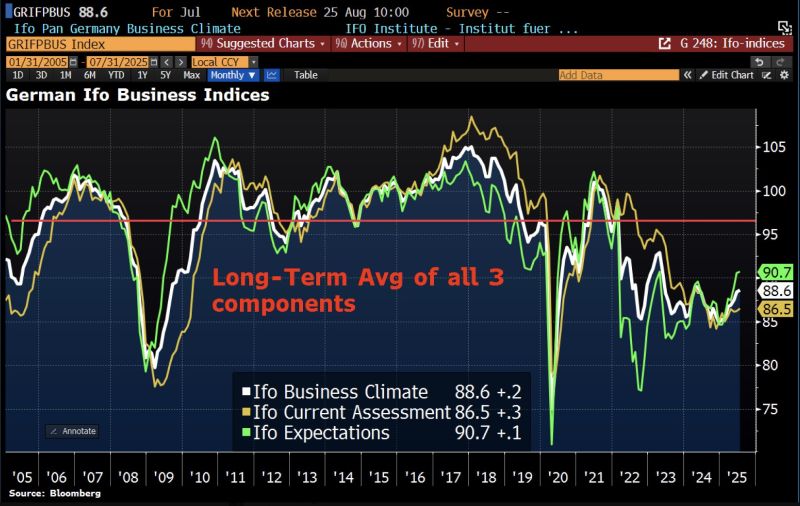

In Germany, the latest Ifo Business Climate Index suggests the economy is holding up surprisingly well despite rising tariffs.

The index edged up from 88.4 in June to 88.6 in July – slightly below expectations (89.0). This marks the 7th consecutive monthly improvement, this month driven mainly by better assessments of current business conditions. However, underlying growth remains weak. According to Capital Economics, the survey results remain consistent w/a GDP contraction based on long-term historical patterns. That said, the Ifo has not been a reliable predictor of GDP in recent years. Source: Bloomberg, HolgerZ

German business activity continued to grow marginally in July, though at a slightly slower pace than in June.

The German flash composite PMI fell to 50.3 points in July, down from 50.4 in June and below the 50.7 forecast in a Reuters poll. Source: Bloomberg, HolgerZ

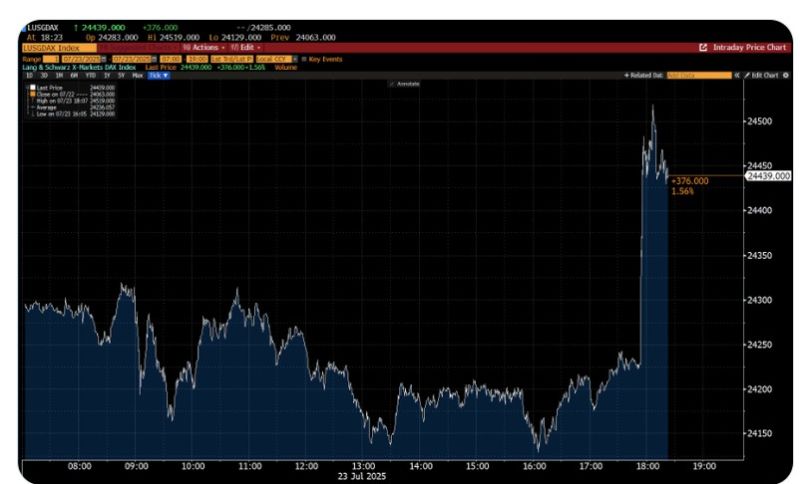

German benchmark index Dax jumps in AH trading after headlines the EU and the US are progressing toward an agreement that would set a 15% tariff for most products.

Member states could be ready to accept a 15% tariff and EU officials are pushing to have that cover sectors including cars. Steel and aluminium imports above a certain quota would face the 50% duty. Source: Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks