Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

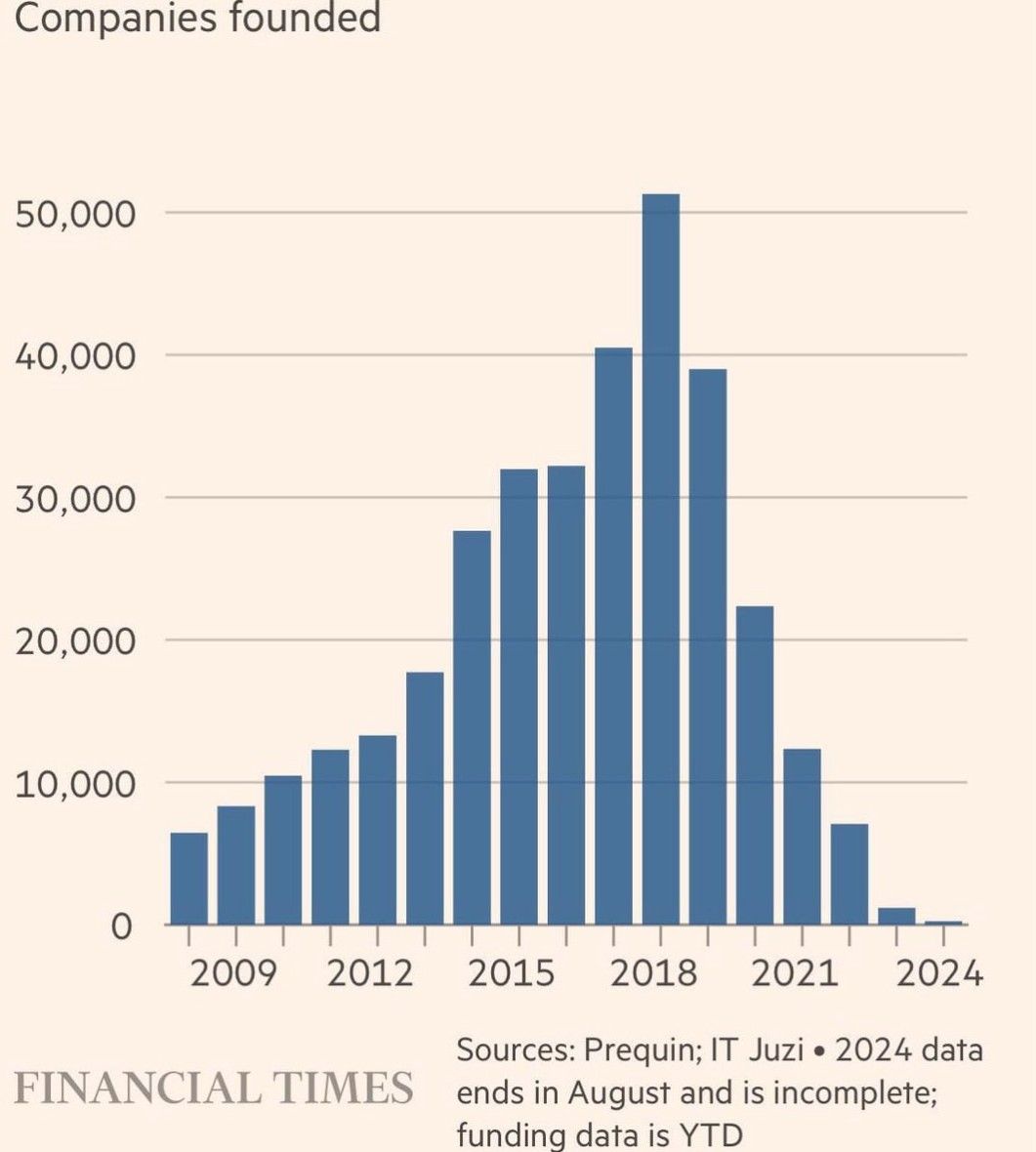

The chart below shows the number of companies founded in China each year.

Private entrepreneurialism fueling China’s economic rise has come to a full stop there. Time will tell what will be the consequences of a pivot to a state run economy again. Source: Michel A.Arouet, FT

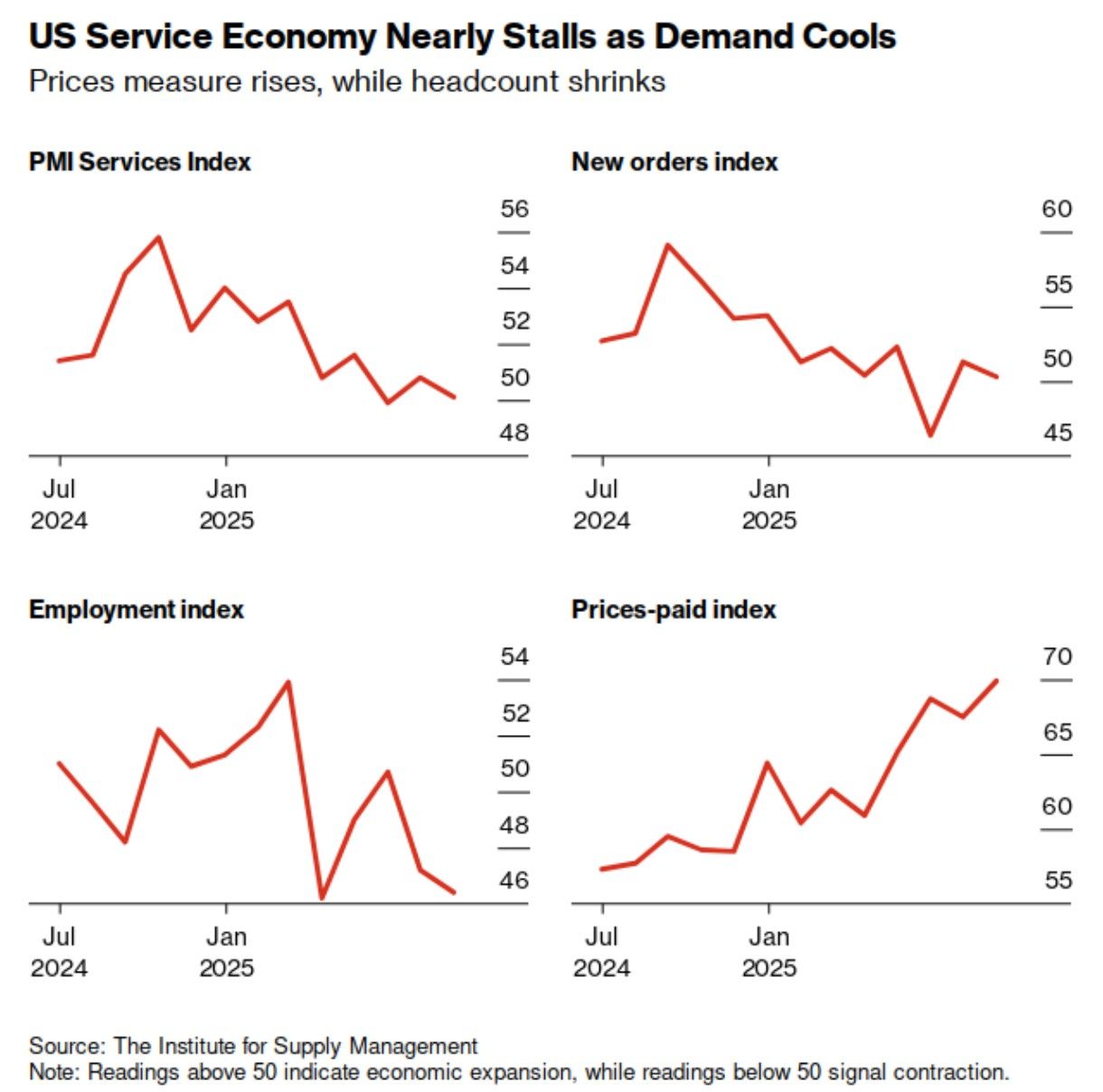

ISM Services numbers yesterday clearly brought stagflation fears back to the table.

However, the Goldman Sachs Stagflation basket barely moved. Still, this one needs to be monitored closely as periods when this basket moves up are generally not good ones for US equities broader index. Source: Bloomberg, GS

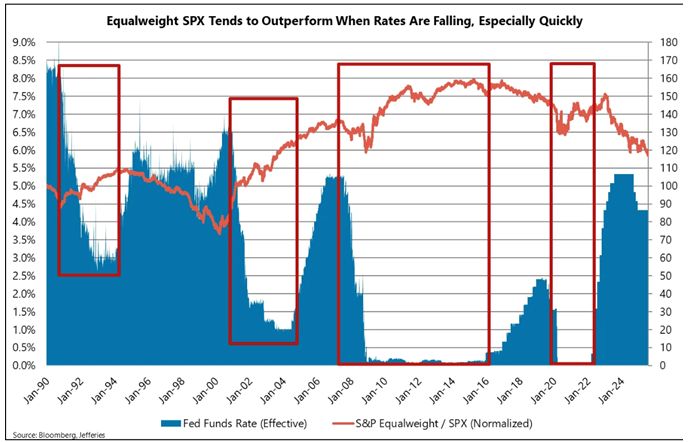

S&P Equal Weight has outperformed S&P Cap Weight during easing cycles

Source: Jefferies thru RBC

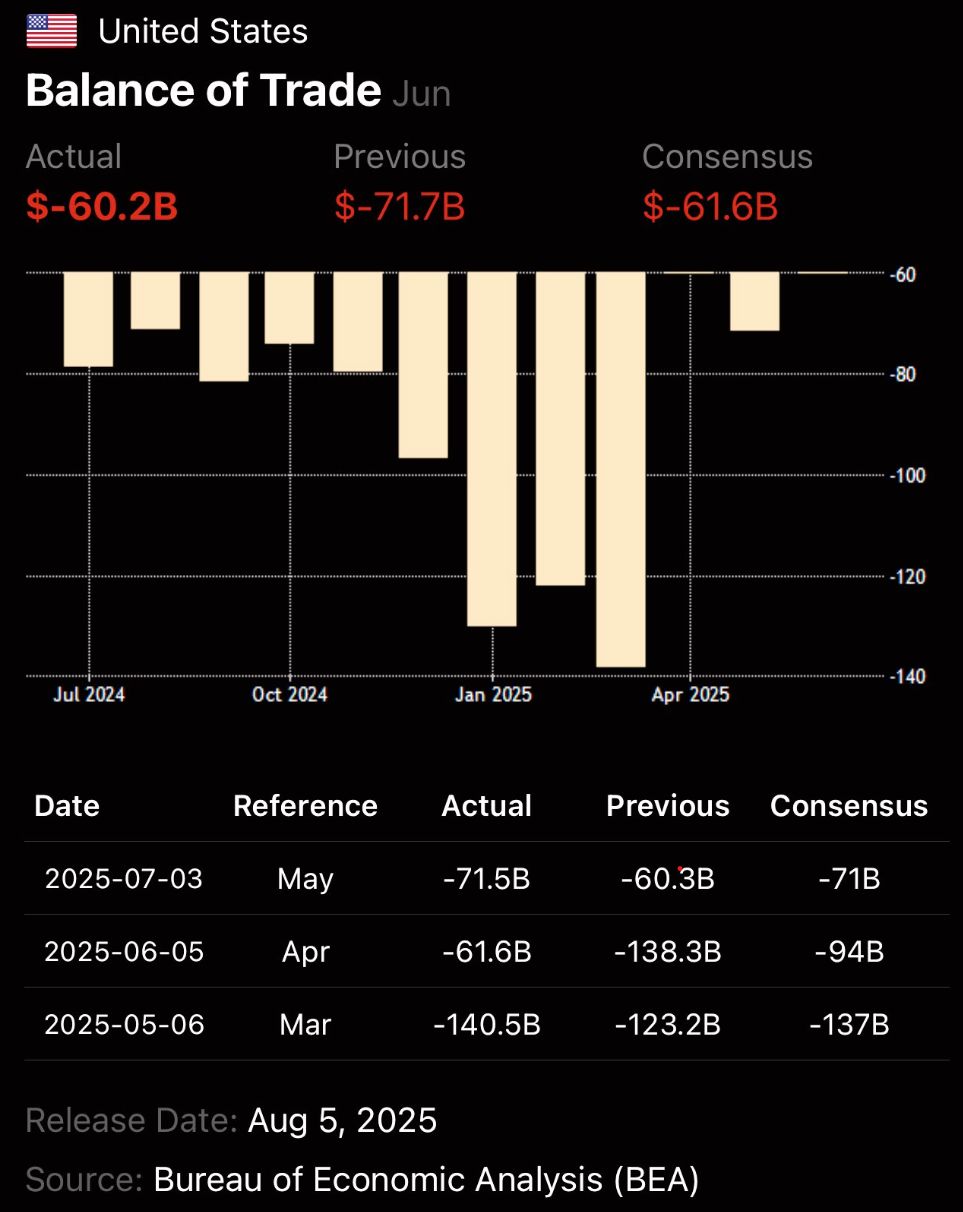

US Trade Deficit Plunges 16% in June to $60.2B – Lowest Since 2023!

Sharp import drop drives the narrowing, beating economist forecasts of ~$61-62B. Positive boost for GDP as net exports rise! Source: Andrea Lisi, CFA @Andrea_Texas_82, BEA

Nasty print on the US ISM services... sounds "stagflationary"

US ISM Services PMI Actual 50.1 (Forecast 51.5, Previous 50.8) US ISM Services Prices Paid Actual 69.9 (Forecast 66.5, Previous 67.5) US ISM Services Employment Actual 46.4 (Forecast -, Previous 47.2) US ISM Services New Orders Actual 50.3 (Forecast -, Previous 51.3) Source: ISM

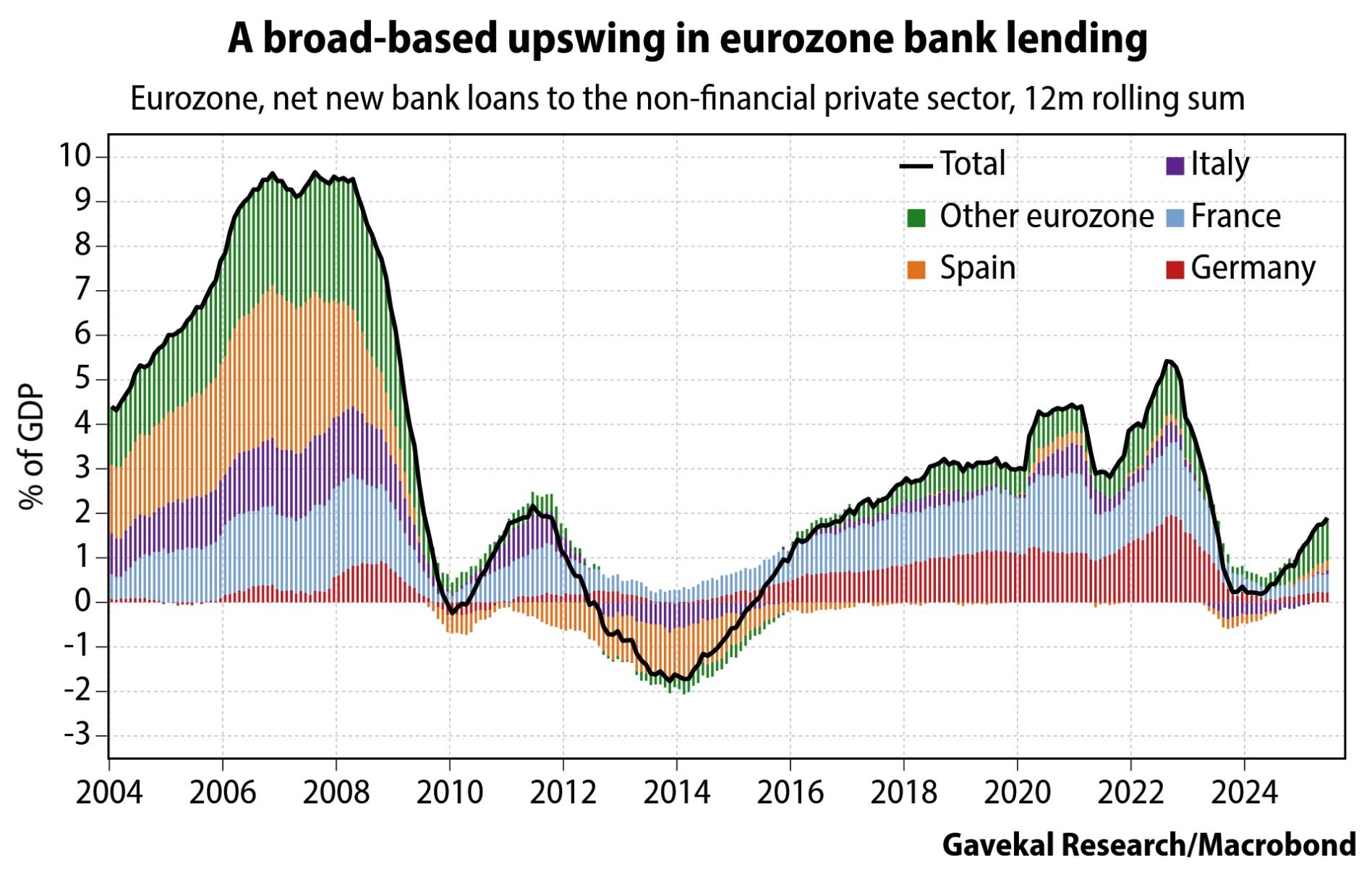

An interesting view on europe by Gavekal

"The 15% tariff rate on US imports from the European Union will hit the old continent's exporting sector. But the broader economy can count on its domestic segment to mitigate the shock. Notably, the effect of the ECB’s interest rate cuts is becoming visible in a bank lending recovery across the eurozone". Source: Gavekal, Macrobond

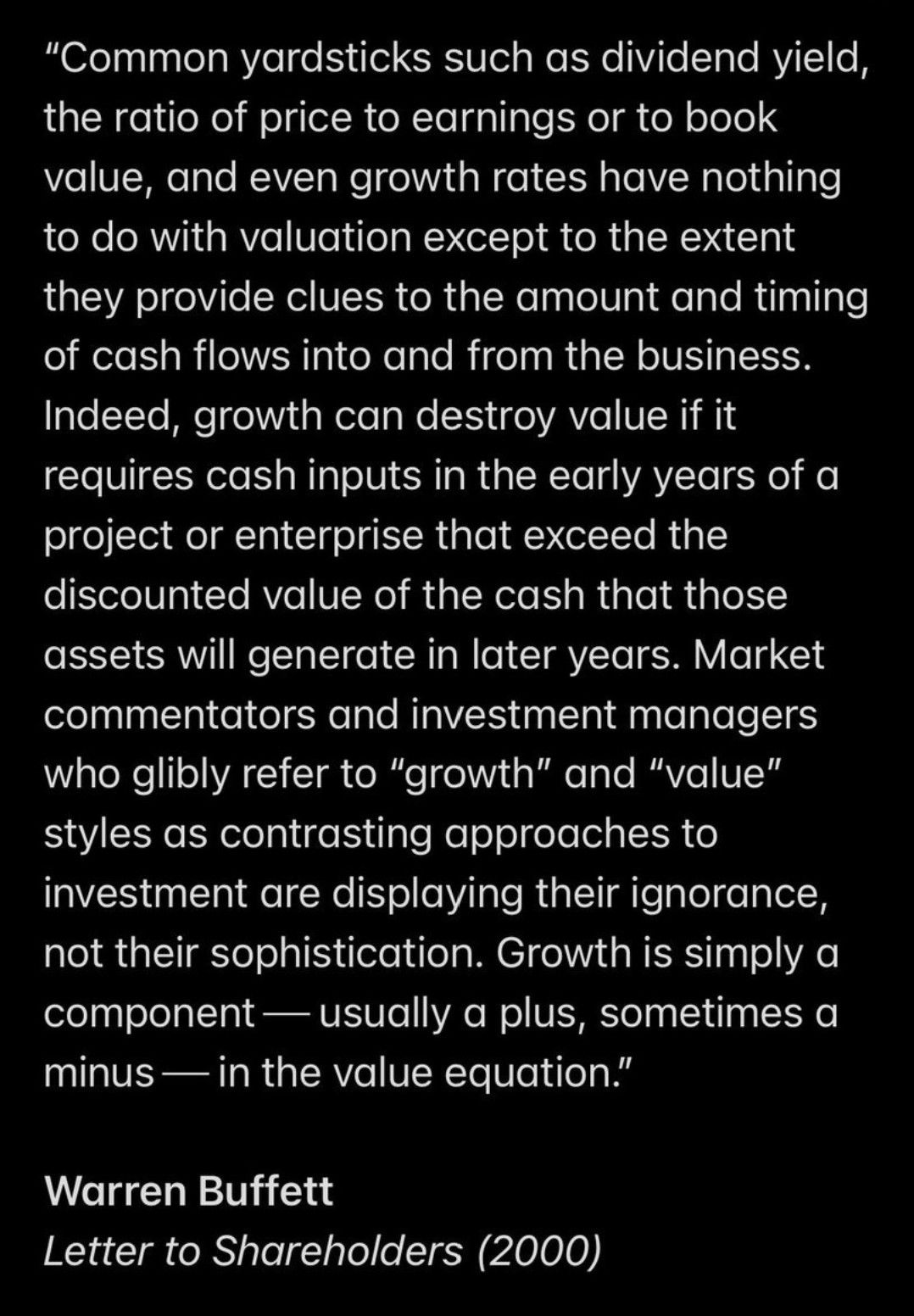

Buffett explains how growth impacts valuation

Source: Brian Feroldi

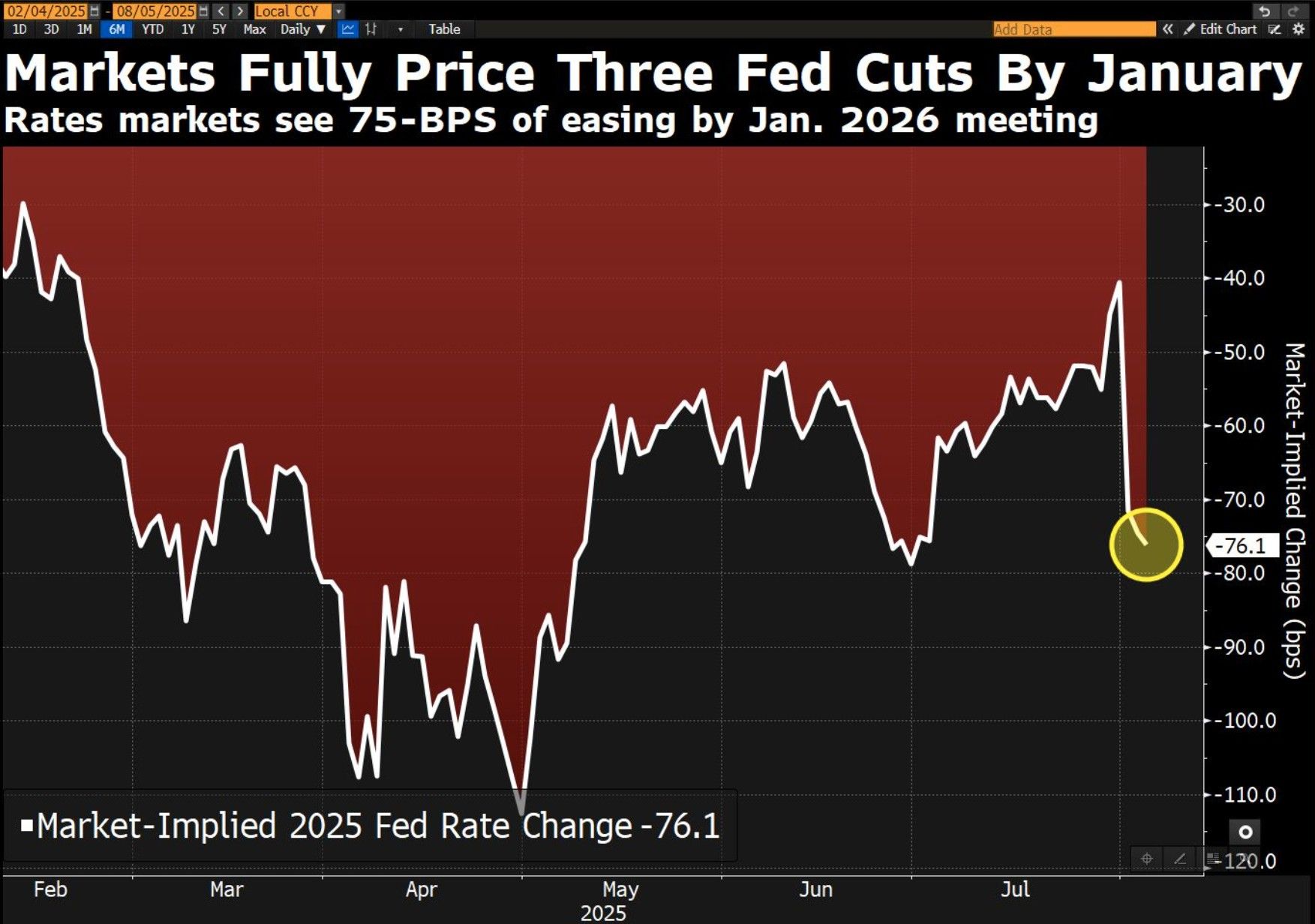

Markets have fully priced three Fed rate cuts by the January meeting. That's a cut at three of the next four FOMC meetings.

Source: David Ingles @DavidInglesTV, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks