Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

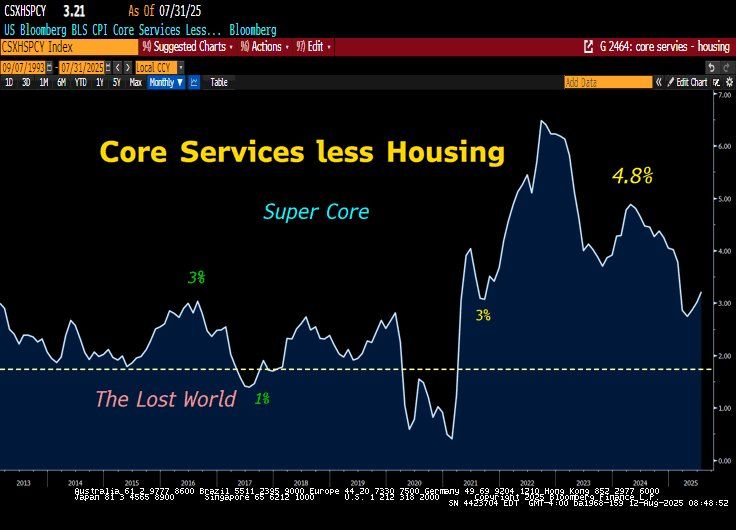

‼️ An important item of today's CPI

The super-core measure, which is probably the Fed's most closely watch component, did increase further in July: +0.48% MoM (prior +0.21%) and +3.21% YoY (prior +3.02%). This is the largest annual increase since February. ▶️ As highlighted by Lawrence McDonald on X, the Supercore has been higher than 3% for four years vs. below 3% for the previous 8 years pre-2020. Source: Lawrence McDonald, Bloomberg

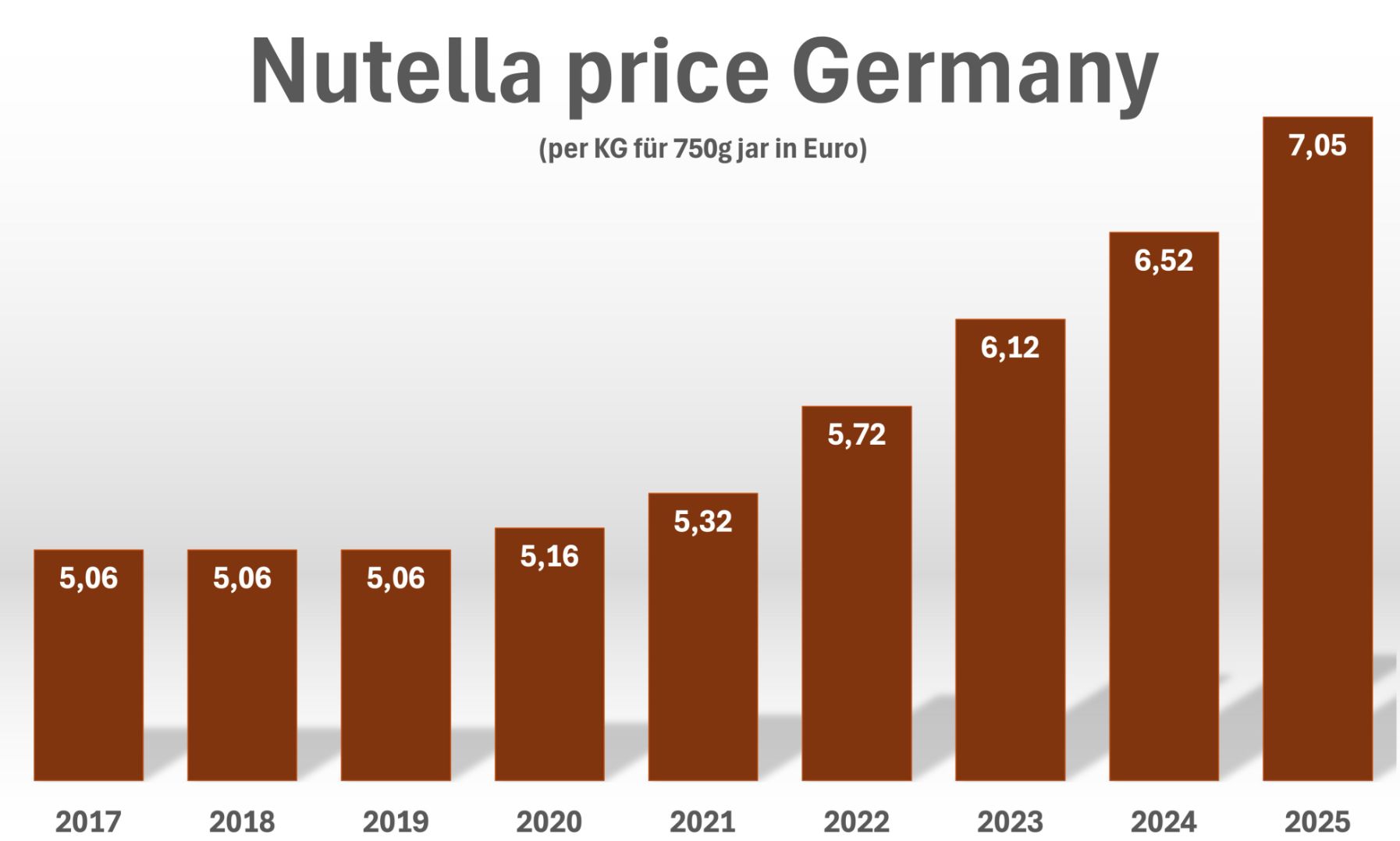

The cost of Nutella in Germany is rising faster than overall inflation.

A 750g jar has gone up by nearly 40% since 2019, far outpacing Germany’s general inflation rate of 21.8% over the same period. But this isn’t just about hazelnut spread: food prices in Germany as a whole have climbed by 38.4% since the end of 2019, according to Eurostat’s Food CPI. That’s much higher than in Italy (+29.5%) or France (+25.9%), highlighting how sharply grocery bills have risen in Germany. Source: Bloomberg, HolgerZ

The US president said he was nominating the 'Highly Respected Economist' EJ Antoni from the right wing Heritage Foundation to chair the agency

After firing the former commissioner for a gloomy jobs report he claimed was 'rigged' https://on.ft.com/3UkAOWG Source: FT

Apollo's Sløk says the U.S. remains the most dynamic economy in the world — and he uses one simple chart to make his point: the number of new business applications.

Source: Apollo, HolgerZ

Watch out US CPI electricity today

Recent BBG article cites the recent 2x increase in electricity vs. broader inflation. Source: Bloomberg

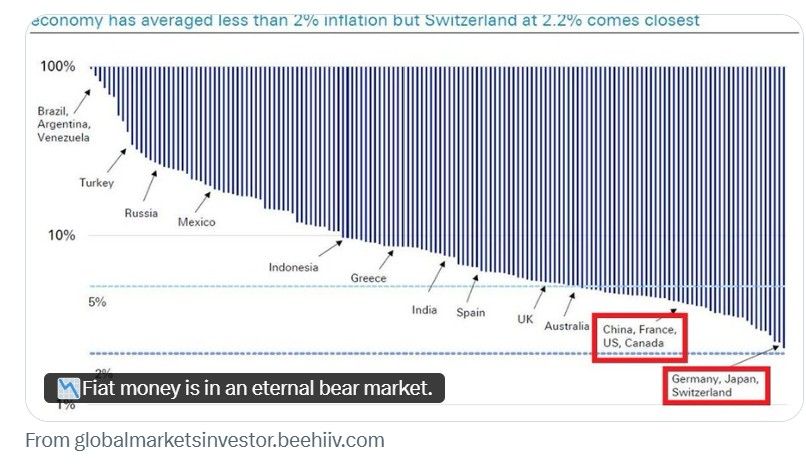

Currency debasement is not a bug — it’s a feature of the fiat system.

Since Bretton Woods collapsed in 1971, not one of 152 countries has kept average inflation below 2%. Even Switzerland averaged 2.2%. Source: Global Markets Investors

China’s July exports top expectations, rising over 7%; imports record biggest jump in a year ‼️

▶️ Exports climbed 7.2% in July in U.S. dollar terms from a year earlier, customs data showed Thursday, exceeding Reuters-polled economists’ estimates of a 5.4% rise. ▶️Imports rose 4.1% last month from a year earlier, marking the biggest jump since July 2024, according to LSEG data. The data also indicated a recovery in import levels following June’s 1.1% rebound. Economists had forecast imports in July to fall 1.0%, according to a Reuters poll. ▶️On a year-to-date basis, China’s overall exports jumped 6.1% from a year earlier, while imports fell 2.7%, customs data showed. China’s trade surplus this year, as of July, reached $683.5 billion, 32% higher than the same period in 2024. Source: Augur Infinity @AugurInfinity, CNBC

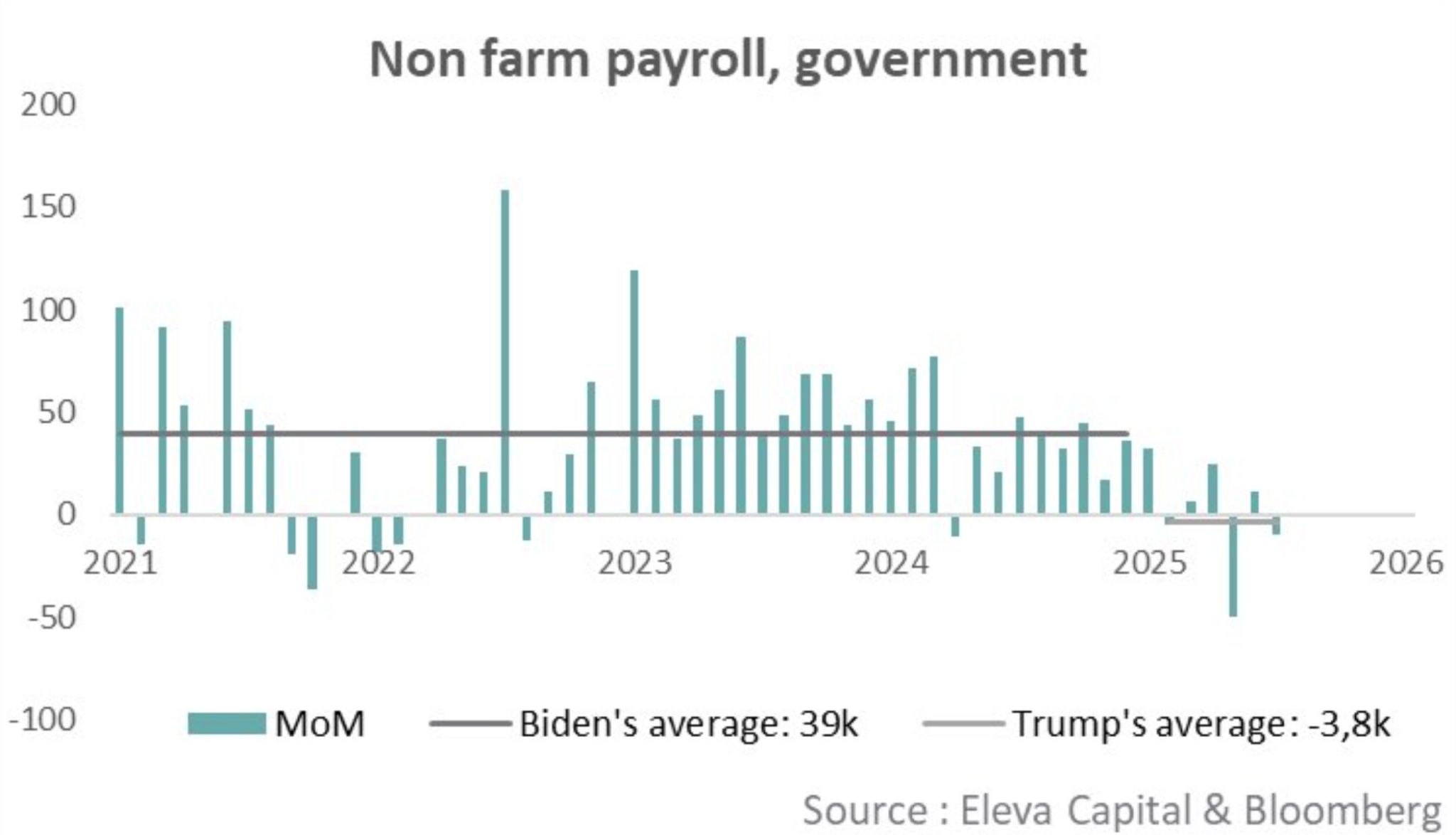

Government jobs created/eliminated under Biden and Trump.

Probably too early to call it a trend change, but worth being highlighted. Source: Chart Eleva Capital, Bloomberg thru Michel A.Arouet

Investing with intelligence

Our latest research, commentary and market outlooks