Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

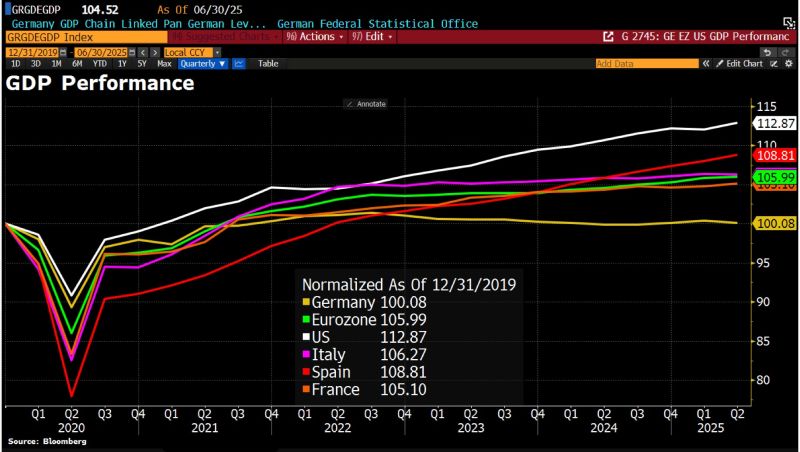

Germany economic growth has been lagging behind other European countries.

And Chancellor Friedrich Merz is looking for excuses: “This task is bigger than some may have imagined a year ago – and I say that self-critically,” Merz admitted in a speech on Saturday in Osnabrück. “We’re not just facing a phase of economic weakness; we are in a structural crisis.” Germany’s economy contracted by 0.3% in Q2, more than expected, as consumer spending fell short. But the root of the malaise lies closer to home: While Merz enjoys the spotlight abroad, he’s been slow to deliver reforms at home; and that’s dragging down the national mood. Source: Bloomberg, HolgerZ

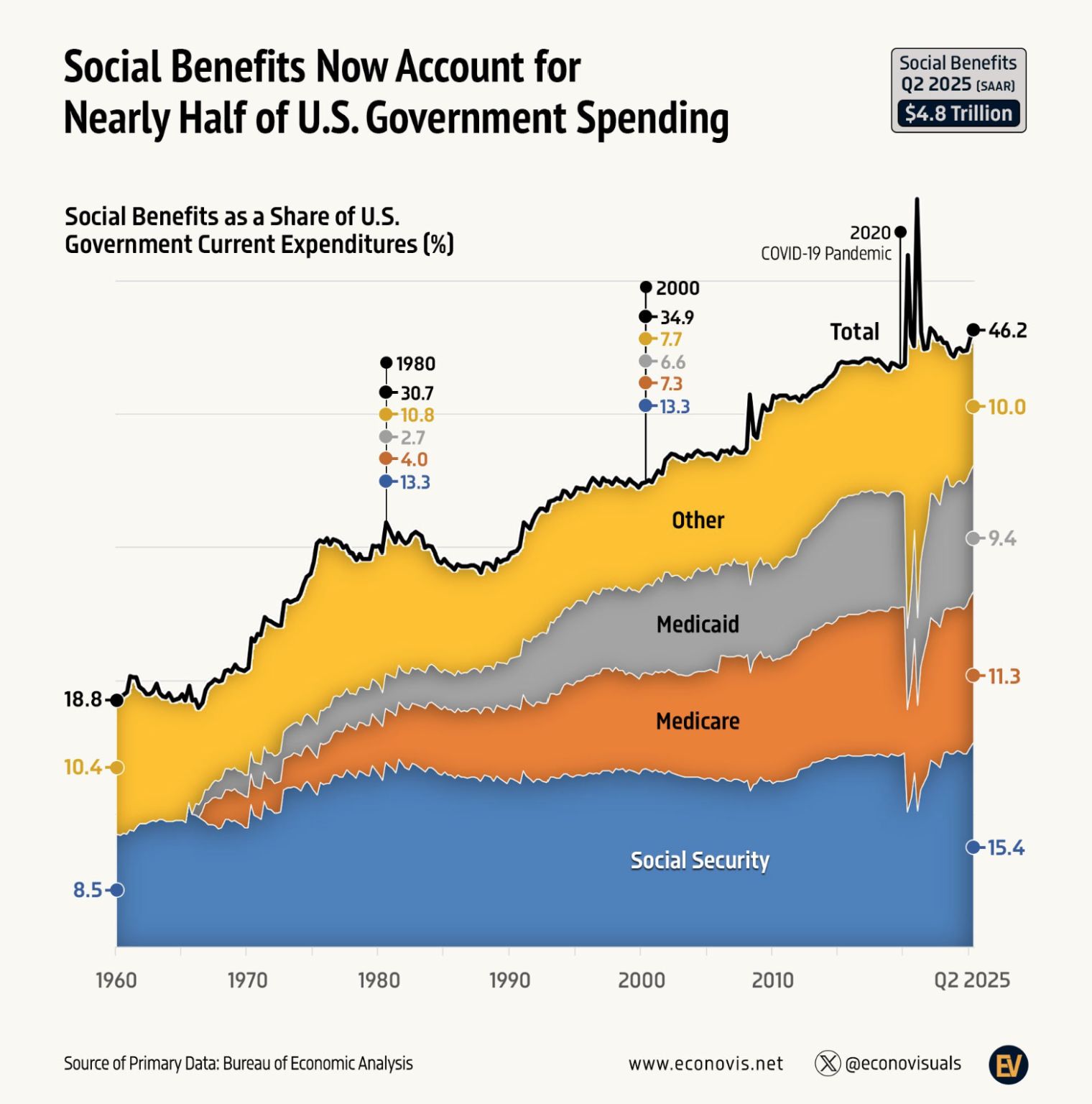

⚠️US government spending is constantly rising

Social benefits now reflect 46% of all US government expenditures, an all-time high, excluding the 2020-2021 crisis. Social Security alone is accounting for 15.4%. This will only rise further as the US population is aging. Source: Global Markets Investor

The economic slump in Germany worsened in Q2.

GDP fell by 0.3% in Q2 QoQ, worse than the initial estimate of -0.1%, mainly due to a sharp drop in capital investment, which declined 1.4%. Consumer spending rose by 0.1% QoQ, contributed less than previously thought, while government spending rose 0.8% QoQ. The size of the German economy is currently still slightly below its 2019 level, ING's @carstenbrzeski has calculated: "It looks increasingly unlikely that any substantial recovery will materialise before 2026," he says. Source: Bloomberg, HolgerZ

‼️US freight shipments are sliding fast

The Cass Freight Index, a key measure of freight volumes in the US, has fallen to its lowest since the Great Financial Crisis, when excluding 2020. This signals weakening demand for shipping and goods movement, and a slower economy. Source: Global Markets Investor

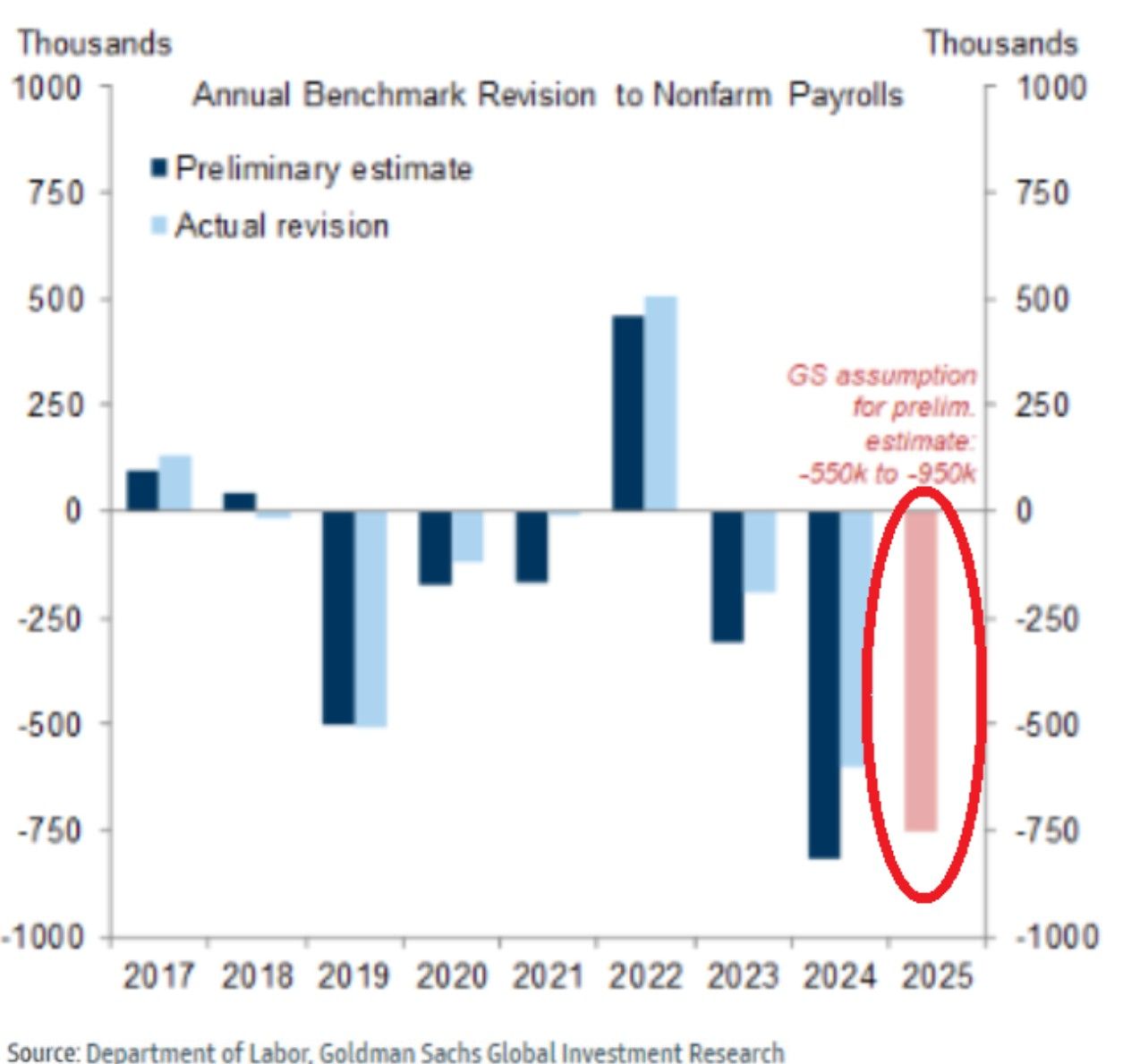

⛔ The BLS is set to revise down US job numbers by 550,000-950,000 for 12 months ending March 2025 on September 9, according to Goldman Sachs estimates.

That’d be the biggest 12-month downward revision in 15 YEARS. Total cut over 2 years would reach 1.5M jobs. Source: Goldman Sachs, Global Markets Investor

Red or Blue, the us national debt goes up.

The only thing both parties can agree on is sending the bill to future generations. Next stop: $38 trillion. Source: Peter Mallouk

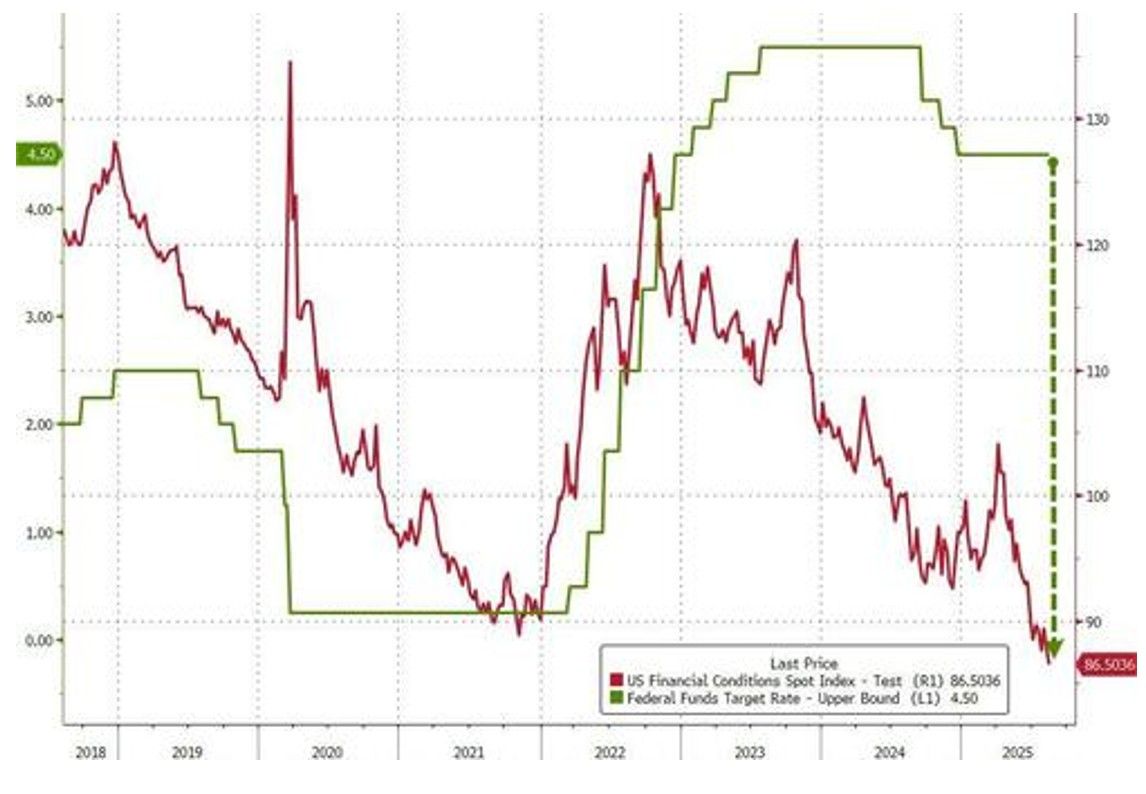

Ahead of Jackson Hole this week, we note that US Financial Conditions are basically at their loosest in the post-COVID era...

Source: zerohedge

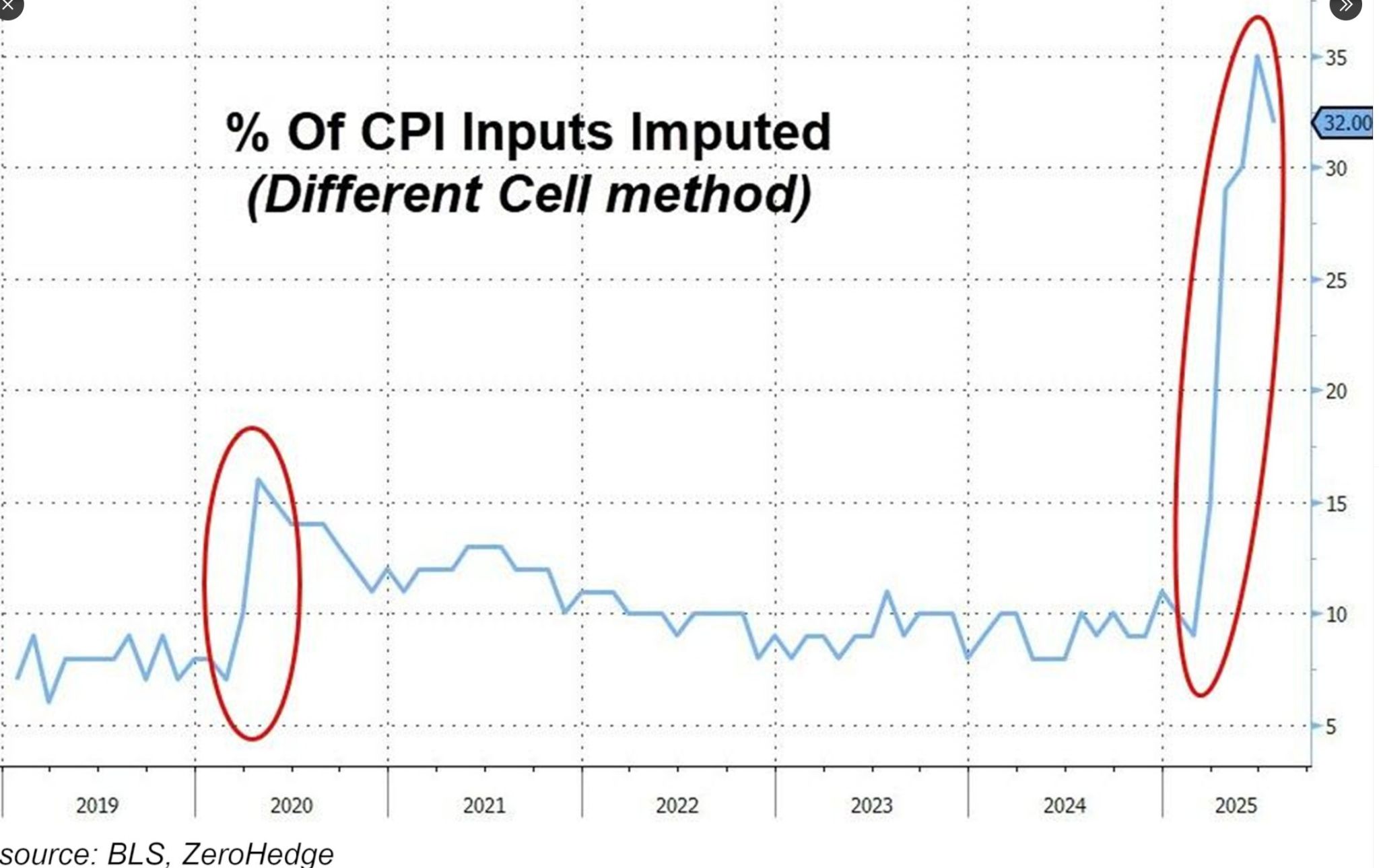

🚨A very interesting chart: The BLS collects roughly 90,000 price quotes each month across 200 categories to calculate CPI.

Normally, about 10% of prices are estimated when data is missing. Now around 32% are MADE UP, based on assumptions, not real prices, double the share seen in the 2020 Crisis... Source: Global Markets Investors, BLS, zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks