Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

⚠️ The United States (US) Bureau of Labor Statistics (BLS) will publish the 2025 preliminary benchmark revision to the Establishment Survey Data on Tuesday, September 9

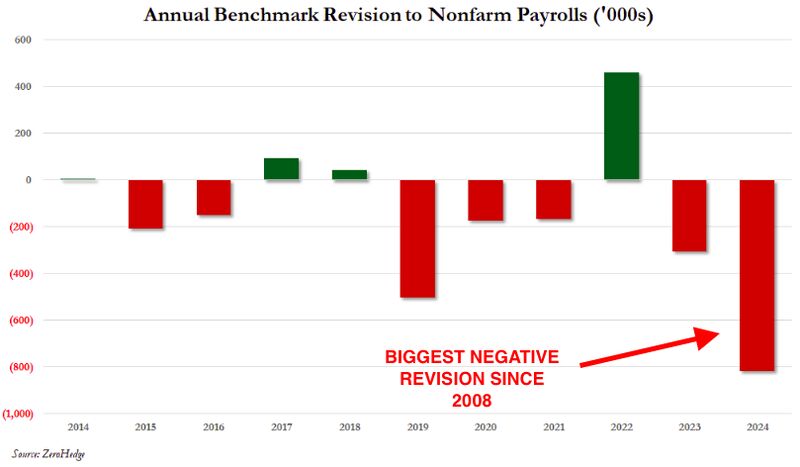

The preliminary revision will cover the 12-month period through March 2025 before the final benchmark revision is reported within the employment report of February 2026. The chart below puts the revisions in perspective: ➡️ 2024 just delivered the biggest downward benchmark revision since 2008 nearly -800k jobs erased. ➡️ That’s exactly why the BLS revision matters: if 2025 takes another -550k to -950k hit, it won’t just mark back-to-back historic revisions. ➡️ It will prove the labor market was overstated for years, not months. Source: StockMarket.News, zerohedge

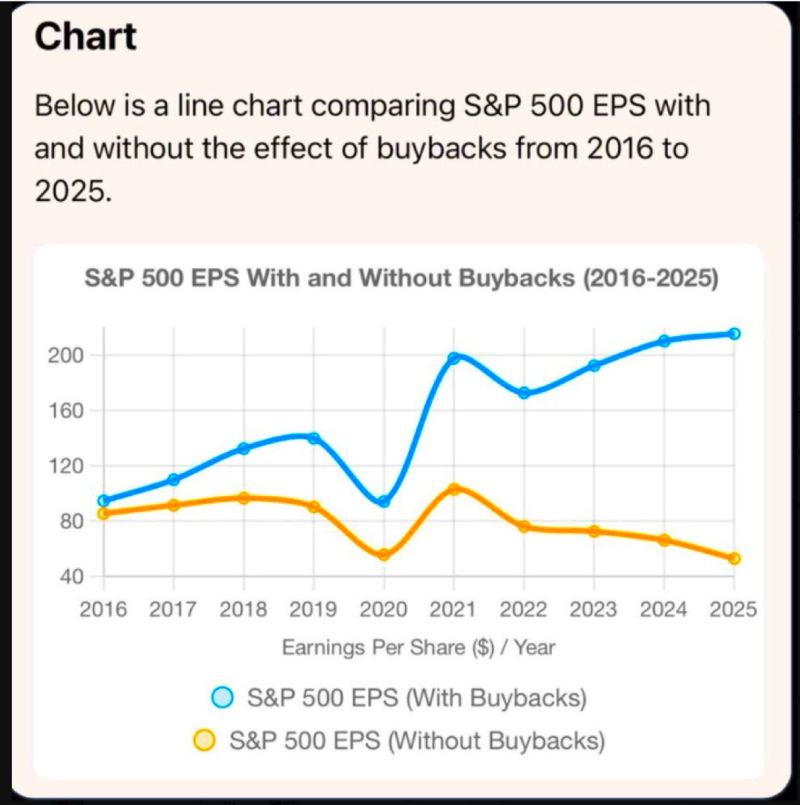

Buybacks are inflating earnings per share

By shrinking share counts, companies make profits look stronger on paper even when most firms show flat or declining growth. The top 10 companies are the only ones delivering real growth. Indexes keep climbing because of them, while the S&P 490 and the broader economy remain weak. This is one of the disconnect driving the market. Source: StockMarket.news

Treasury Secretary Scott Bessent said Sunday that he is “confident” that President Donald Trump’s tariff plan “will win” at the Supreme Court

But he warned his agency would be forced to issue massive refunds if the high court rules against it. If the tariffs are struck down, he said, “we would have to give a refund on about half the tariffs, which would be terrible for the Treasury,” according to an interview on NBC’s “Meet the Press.” He added, however, that “if the court says it, we’d have to do it.” Source: CNBC

Scott Bessent now says the Biden-era jobs tally will be revised down by ~800,000 next week

Goldman Sachs is calling for a 550k–950k cut in the BLS benchmark revision. If it lands, the labor market narrative gets rewritten and it could swing the Fed between a 25bps trim and a 50bps shock in September. Source: StockMarket.News

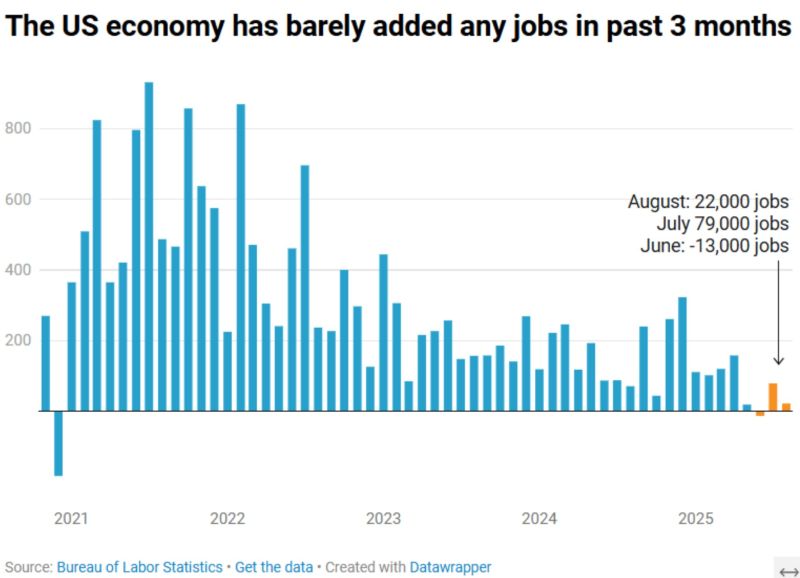

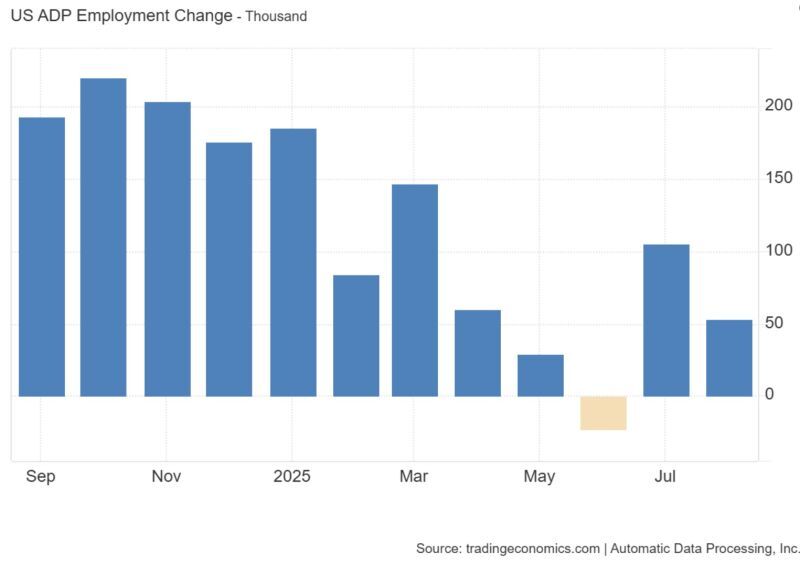

‼️ JUST IN: Another WEAK jobs report

The US economy added only 22,000 jobs in August ➡️ That’s much weaker than expected. 1) The unemployment rate rose to 4.3% --> Highest since October 2021. 2) June job growth was revised down to -13,000 (!). July was revised up slightly to 79k (from 73k). 🌈 Wages grew 3.7% in the past year (above 2.7% inflation). Source: Heather Long @byHeatherLong on X

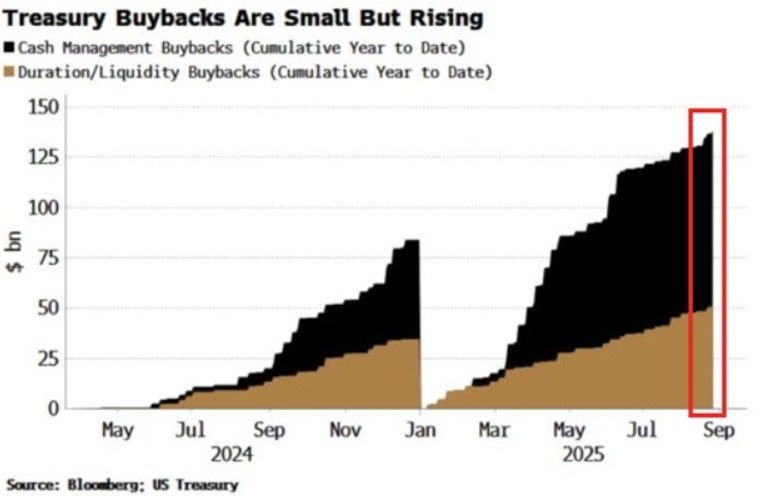

Treasury buybacks are accelerating

As highlighted by The Kobeissi Letter on X: " The US Treasury has bought back a record $138 billion in bonds YTD. This significantly surpasses the $79 billion repurchased during the entire 2024. This buyback program aims to boost liquidity and manage cash, as deficit spending continues to surge. In July, the Treasury said it would buy back 10- to 30-year Treasuries TWICE as often. As a result, Bloomberg’s measure of Treasury liquidity has materially improved over the last year. The world’s largest bond market can no longer function without intervention". Source: The Kobeissi letter, Bloomberg

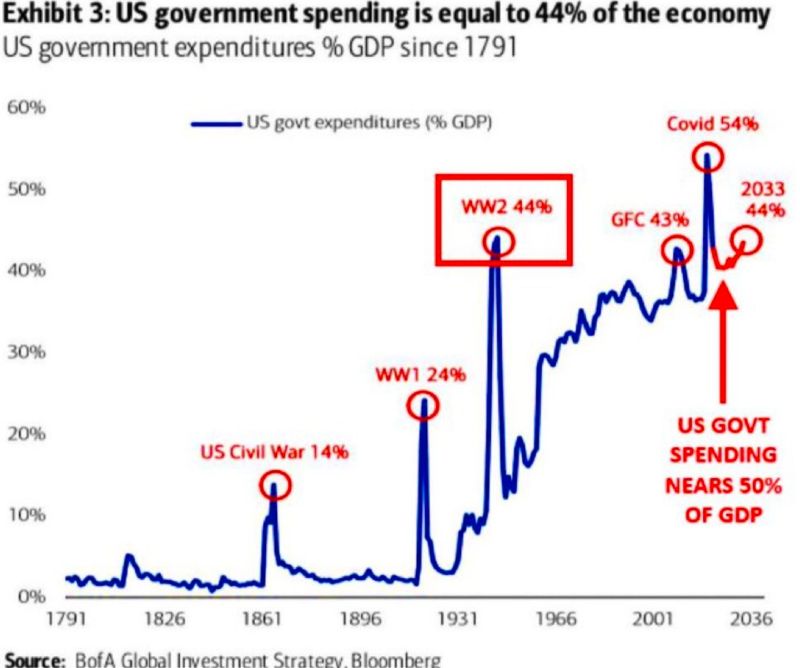

Debt in the U.S. is spiraling faster than ever

On July 2nd, the national debt was $36.2 trillion. By September 4th, it hit $37.4 trillion. That’s $1.2 trillion in just two months over $21 billion added every day. At the same time, government spending is running at levels we used to only see during wars or crises like 2008 and Covid. The difference? Today’s economy is still called “strong.” Source: stockmarket.news on X

ADP: US private payrolls rose just 54K in August, down from 106K in July

That's below consensus estimates of 68k, that’s well below the 2010–2025 average of 148K. For context: the series hit a record 1.25M in Aug ’21 and plunged to -6.1M in April ’20.

Investing with intelligence

Our latest research, commentary and market outlooks