Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

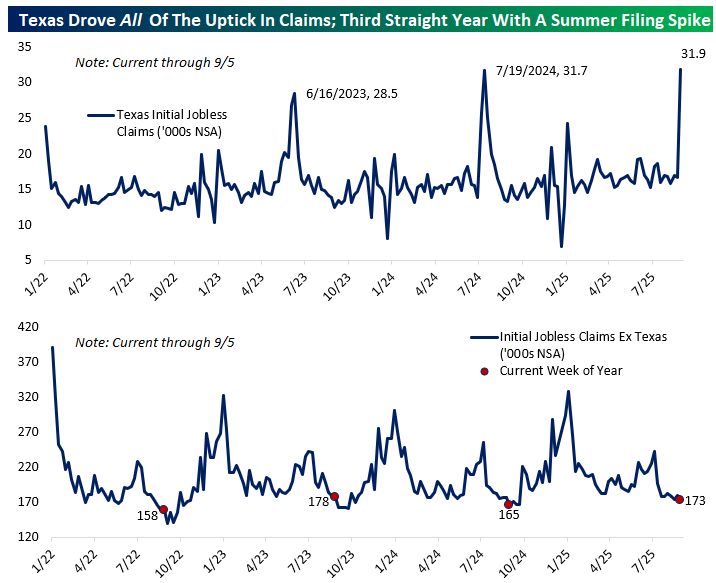

Initial jobless claims spiked today, but ex Texas, they look normal for this time of year

Per the Texas Workforce Commission, filings for Disaster Unemployment Assistance related to the lethal floods in the Texas Hill Country earlier this summer were due by September 4... Source: Bespoke

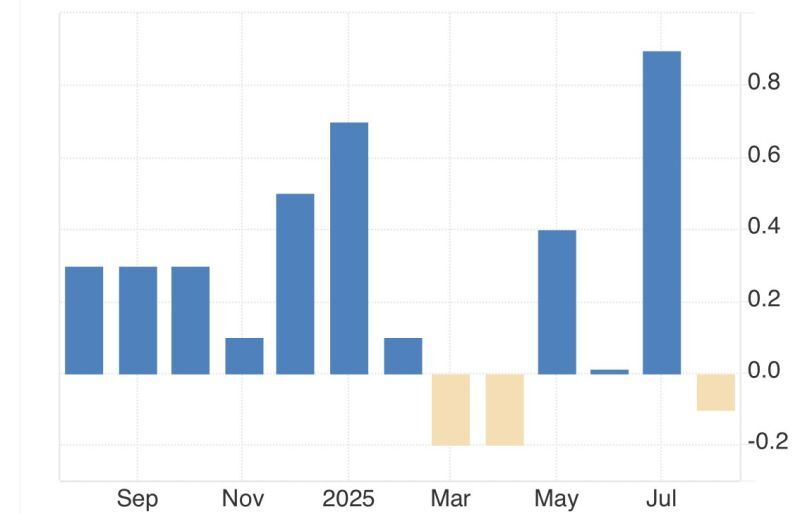

So now we have producer deflation?

US wholesale prices unexpectedly declined in August, a welcome development for investors clamoring for a Fed rate cut next week to boost the economy. Here are the details: PPI MoM: -0.1% vs 0.3% exp. PPI YoY: 2.6% vs 3.3% exp. PPI Core MoM: -0.1% vs 0.3% exp. PPI Core YoY: 2.8% vs 3.5% exp. We had producer deflation in August. Let see what the CPI report will look like tomorrow…

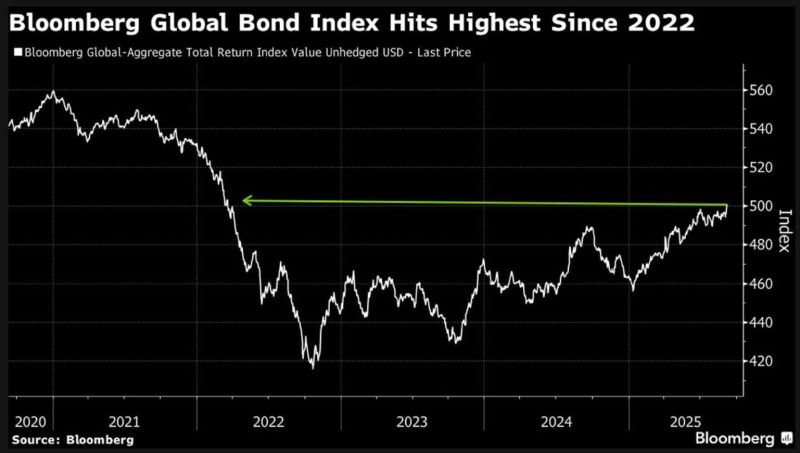

Bloomberg frames the latest bond rally (with yields falling) in a wider context:

“Three years after a surge in inflation pummeled fixed-income markets all around the world, global bonds have finally re-entered bull market territory. Bloomberg’s Global Aggregate Index, which tracks returns on sovereign and corporate debt across developed and emerging markets, has surged more than 20% from its 2022 trough to its highest level since March 2022 amid a broad fixed-income rally. The latest leg higher came as cooling US labor data fueled bets the Federal Reserve would step up policy easing.” Source: Bloomberg, Mo El Erian on X

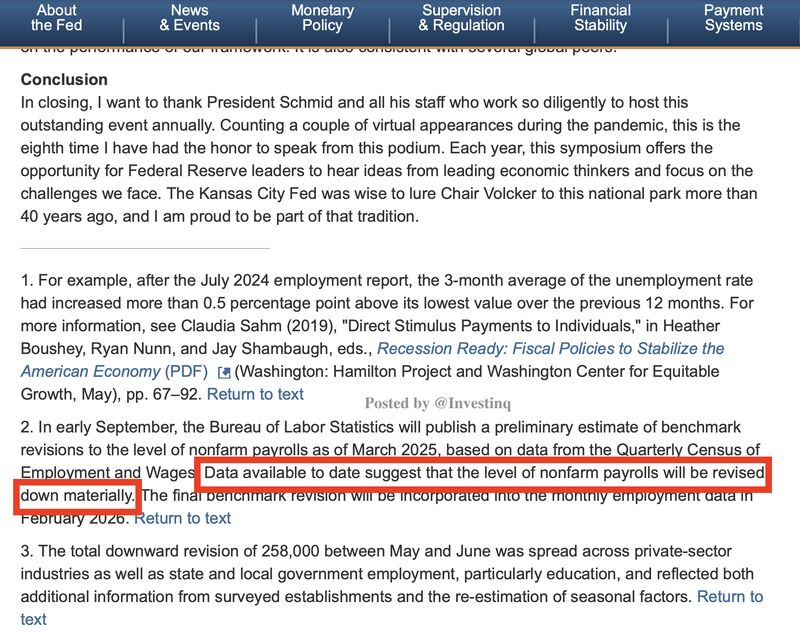

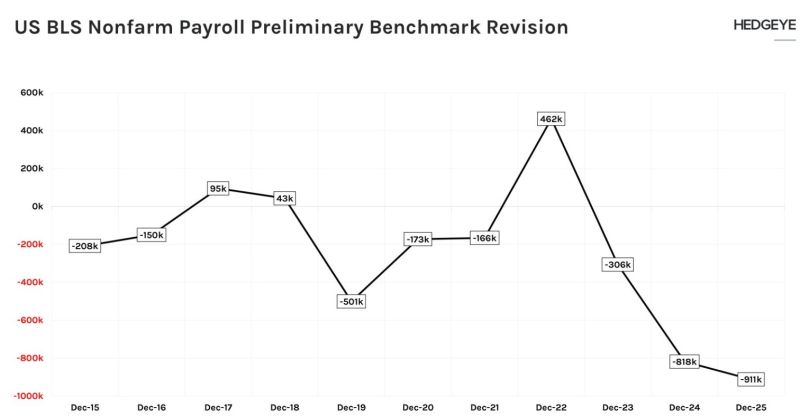

As highlighted by StockMarkets.news, the payroll downward revision was actually flagged by Powell weeks ago, sneaking it into a footnote in his Jackson Hole speech:

“Data available to date suggest that the level of non-farm payrolls will be revised down materially.” On Sept 9, that’s exactly what happened: -911,000 jobs erased. ➡️ The question now is was this worse than he expected, and does it warrant a 25 or 50 bps cut? Source: StockMarket.news

BLS preliminary benchmark revision comes in way worse than expectations at -911k jobs

That's -229k below consensus -682k and exceeds last year's -818k revision. Two years, 1.7 million phantom jobs erased. The labor market has been far weaker than anyone realized. Source: Matt Cooper @HedgeyeFins

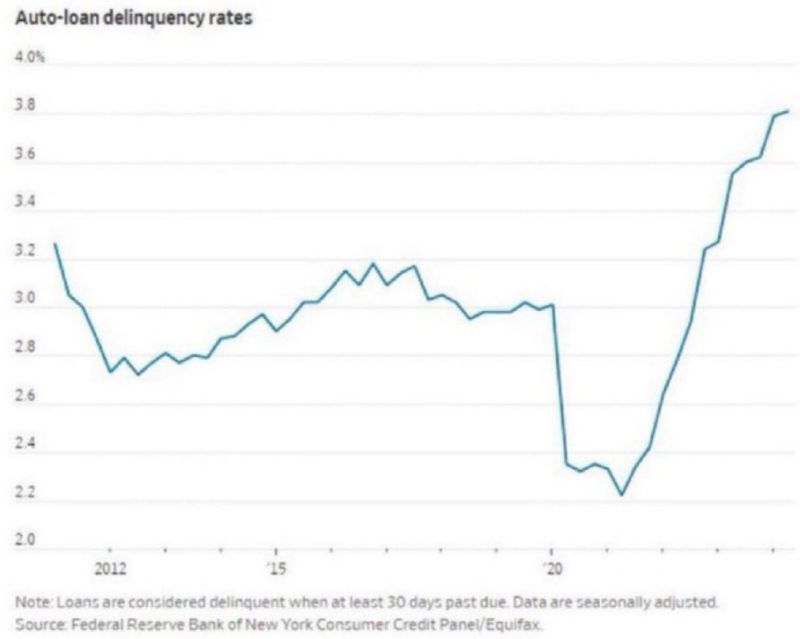

⚠️ Auto Loan Delinquency Rate is at its highest level in 14 years

Source: Barchart

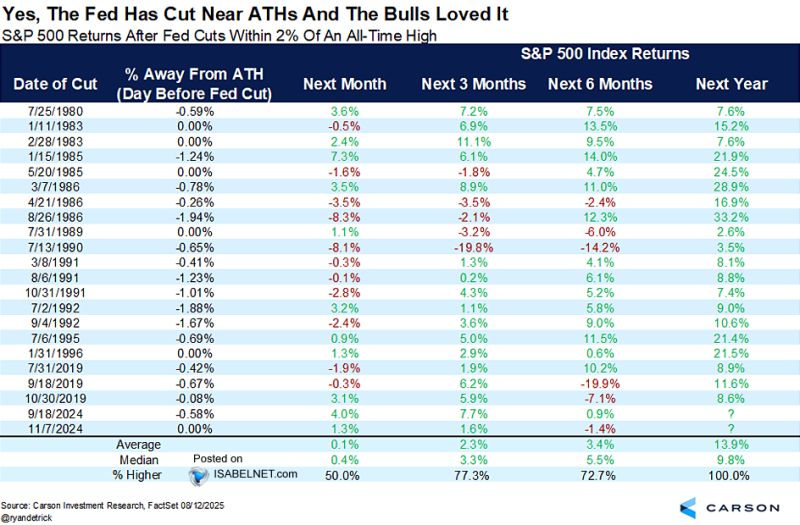

This chart shows how the SP500 has performed since 1980 when the Fed cut rates near all-time highs

On average, the index gained 3.3% over 3 months, 5.5% over 6 months, and 9.8% over the next year with markets higher 100% of the time after 1 year. Since 1980, Fed cuts near highs haven’t stopped bull runs. Source: StockMarket.News, Carson Investment Research

Key dates for France sovereign rating

Macron still needs to find a new PM who then needs to form a government who should submit its budget bill to parliament by the first Tuesday of October, which this year is October 7. Good luck... Source: French Debt Agency

Investing with intelligence

Our latest research, commentary and market outlooks