Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

As highlighted by Jim Bianco, isn't the "Fed consensus" just an illusion?

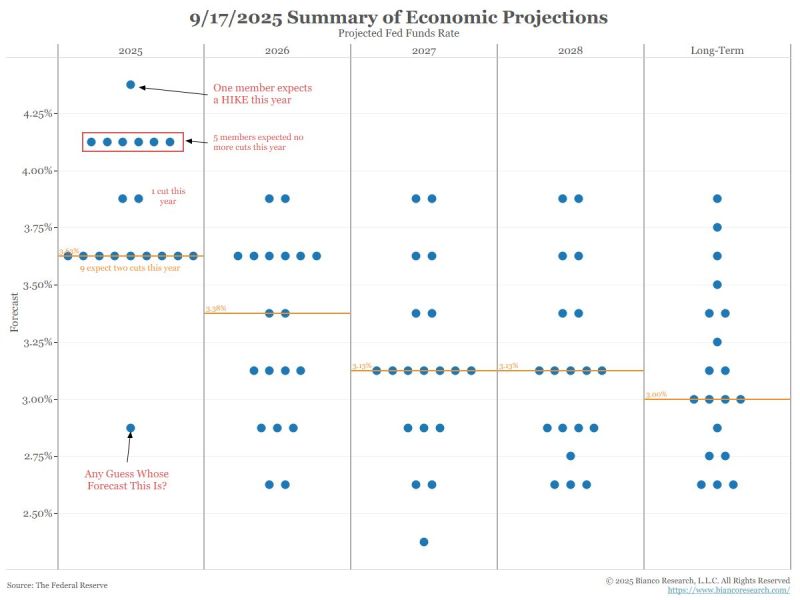

See the labels in the dot plot below: one member of the FOMC thinks the Fed is going to HIKE rates this year. One (Stephen Miran) thinks it is going to cut 1.25% this year (5 cuts over two meetings). And see the spread of dots above (from highest to lowest), the FOMC is showing little to no agreement on what they should do. So on one hand there is an 11-1 vote On the other hand they published a wide dot plot... Add to this is Powell using the term "Risk Management" to describe this cut... It could thus be that "Risk Management" cut is a political decision. As Jim Bianco said "he wants to get Trump off his back". Source: Bianco Research

From yesterday's Financial Times article, “EU economy falls behind global rivals due to complacency.”

“One year on, Europe is . . . in a harder place,” Draghi told a news conference on Tuesday. “Our growth model is fading. Vulnerabilities are mounting . . . and we have been reminded, painfully, that inaction threatens not only our competitiveness but our sovereignty itself.” “Too often, excuses are made for this slowness. We say it is simply how the EU is built. Sometimes inertia is even presented as respect for the rule of law,” Draghi added. “That is complacency.” https://lnkd.in/e3facfZk

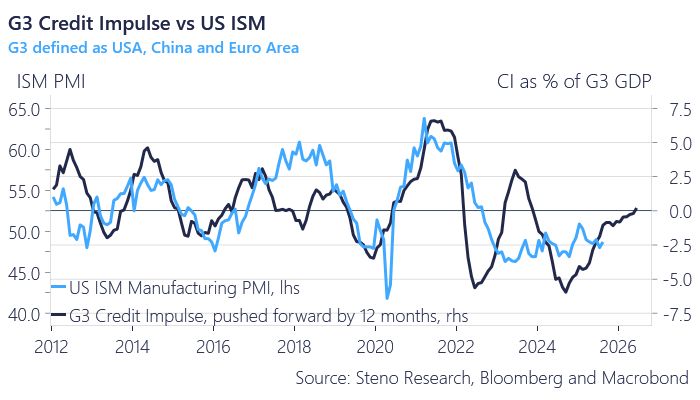

As highlighted by @AndreasSteno on X, the credit impulse is turning positive.

That is not what you normally see in a slowdown...

Happy FOMC day.

Stocks: all-time high Home Prices: all-time high Gold: all-time high Money Supply: all-time high National Debt: all-time high CPI Inflation: 4% per year since Jan 2020, 2x the Fed's "target" Time for the Fed to cut rates. Let's get this party started. Source: Trend Spider

Atlanta Fed is now projecting that Q3 GDP will be +3.4%… a massive expansion

The US economy is running HOT. But the fed is going to cut rates... Source: Federal Reserve Bank of Atlanta

China economic slowdown deepens in August

➡️ Retail sales rose 3.4% in August from a year earlier, missing analysts' estimates for a 3.9% growth and slowing from July's 3.7% growth. ➡️ China’s industrial output growth slipped 5.2%, the worst performance since August last year. ➡️ Fixed-asset investment, reported on a year-to-date basis, expanded just 0.5%, a sharp slowdown from the 1.6% expansion in the January to July period. ➡️ China's survey-based urban unemployment rate in August came in at 5.3%. Source: CNBC

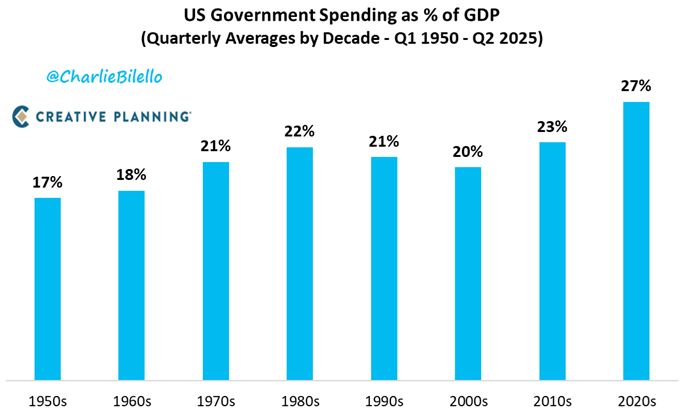

US Federal Government Spending as % of GDP...

1950s: 17%, 1960s: 18%, 1970s: 21%, 1980s: 22%, 1990s: 21%, 2000s: 20%, 2010s: 23%, 2020s: 27%. Source: Charlie Bilello

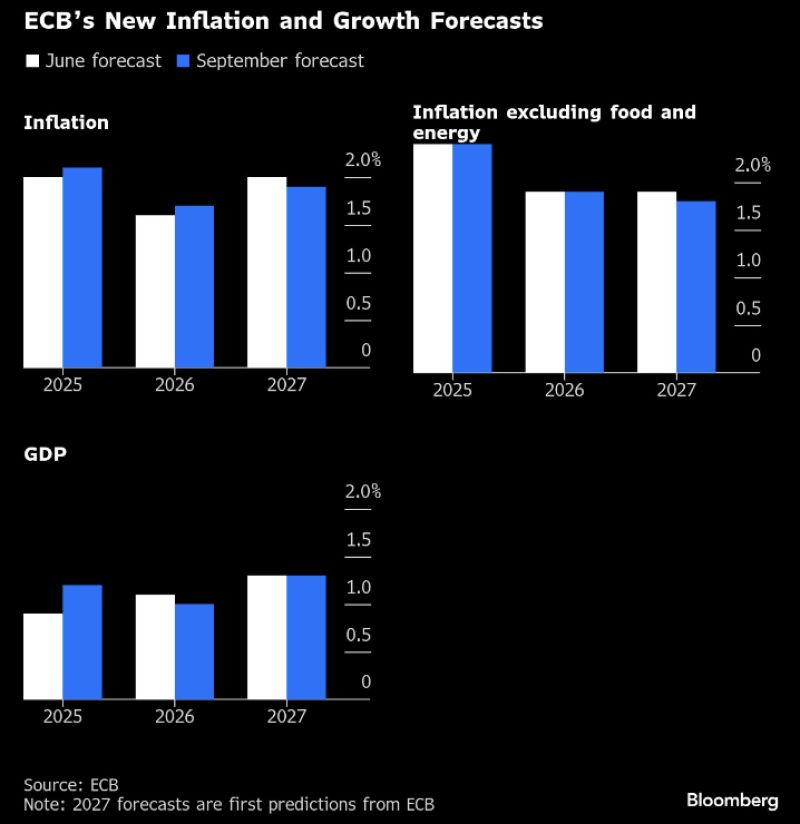

Yesterday, ECB ups inflation outlook for 2025, 2026, cuts it for 2027

2025 Inflation forecast now 2.1% (from 2%), 2026 inflation forecast now 1.7%; (prior forecast 1.6%). ECB sees 2027 at 1.9% (prior estimates 2%). Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks