Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

US government shutdowns can last weeks...

The longer the shutdown, the higher the impact on GDP Source: Bloomberg

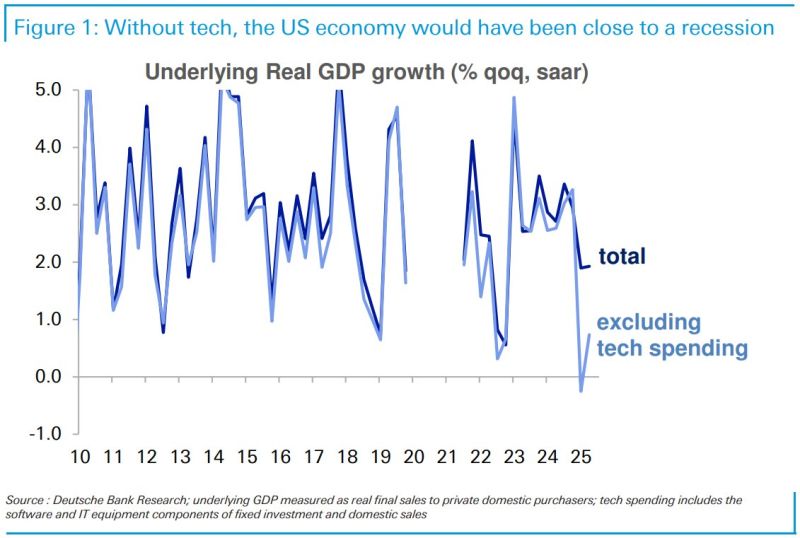

Without tech spending, the US would have been close to, or in, a recession earlier this year:

DB's Saravelos. "Perhaps Nvidia, which employed only 36,000 people at the last update earlier this year, holds the keys to all global macro in 2026:" Source: DB, Lisa Abramowicz

A "too much growth" scare on Wall Street?

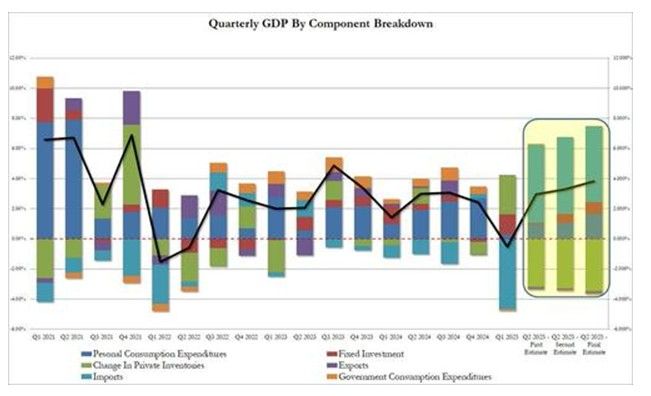

Interesting to see that yesterday's pullback was NOT prompted by bad US macro data: on the contrary, Thursday's economic number beat expectations across the board: 👉 Initial jobless claims unexpectedly tumbled to YTD lows, proving that the Texas-driven spike 2 weeks ago was indeed a one-time event... 👉 Durables goods ex-transports rose for a 5th straight month.... 👉 US Q2 GDP was unexpectedly revised sharply higher, printing at a whopping 3.8%, above all estimates, and the highest in 2 years driven by a bizarre surge in consumption - see chart below 👉US home sales were also well above expectations. In other words 4 for 4 on the data front. So much for those stagflation concerns... ‼️ But good (macro) news become bad news for the markets as the market quickly priced out odds of 2 rate cuts by December, closing the day at 1.56 rate cuts expected, down from 1.7 at the start of the day. It also pushed the 10 year yield and the greenback higher... At the time when equity valuations are extended, a rise in bond yields could indeed trigger some profit taking on US stocks Source chart: zerohedge

🚨 BREAKING:

➡️ US PCE Price Index (Aug) YoY 2.7% vs 2.7% Est PCE MoM 0.3% vs 0.3% Est ➡️US Core PCE Price Index (Aug) YoY 2.9% vs 2.9% Est (Highest PCE reading since February) MoM 0.2% vs 0.2% Est EXACTLY AS EXPECTED. BULLISH 🚀 FOR MARKETS

The Swiss National Bank is pursuing a steady monetary policy and leaving its key interest rate at 0%, which is reasonable given the current economic and political situation.

The Swiss economy is performing relatively well despite the US tariff shock, core inflation remains within a healthy range, and the ECB is also keeping key interest rates constant for the time being and is likely to continue to do so, meaning that the Swiss franc has hardly changed against the euro since the end of June. The hashtag#SNB mentions the great uncertainty surrounding the Swiss export sector, which is also the biggest question mark in our economic outlook for Switzerland at present. Should a significant deterioration manifest itself here, the SNB could come under greater pressure to lower interest rates below zero after all. The SNB's inflation forecasts also remain stable compared with the June forecast and are even rising slightly in the second quarter of 2028, which was forecast for the first time. Today's decision is therefore understandable across the board and should come as no surprise to the stock markets.

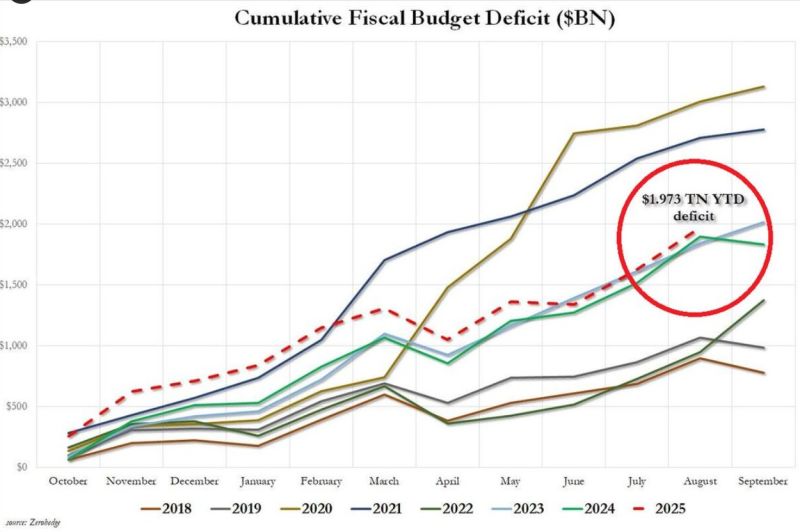

For the first 11 months of FY2025, the U.S. deficit has already hit $1.97 trillion.

That’s the 3rd-largest in history and the year isn’t even over yet. Source: StockMarket.News @_Investinq

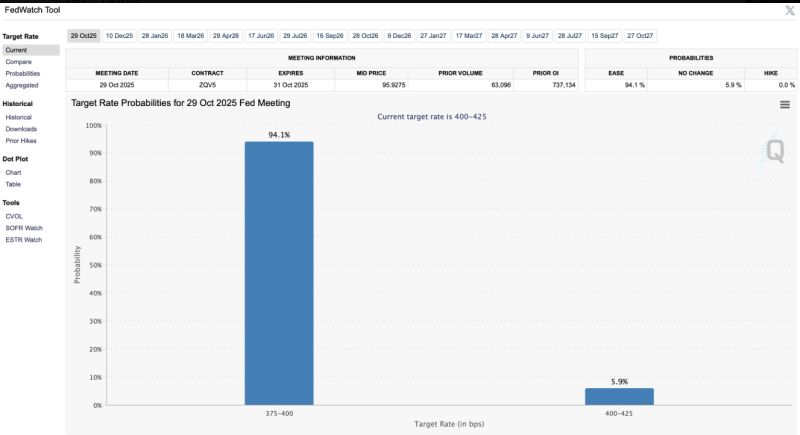

The odds of an October rate cut have jumped to 94% 🚨🚨🚨

Source: CME Fed Watch tool, Barchart

Investing with intelligence

Our latest research, commentary and market outlooks