Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

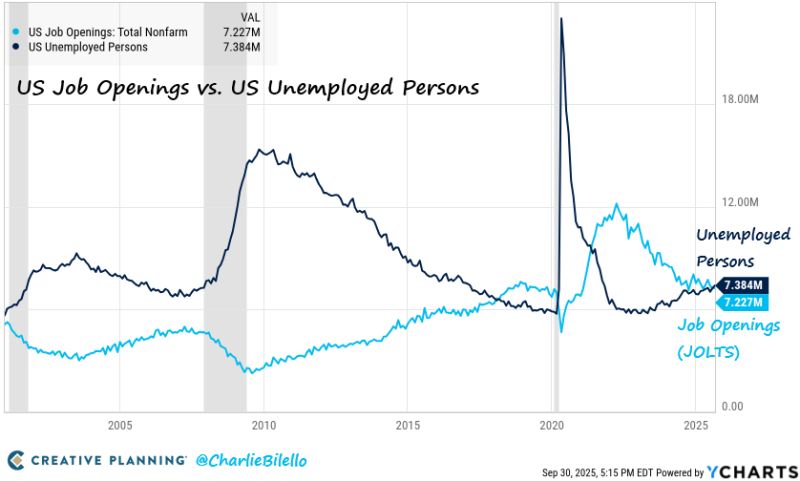

There are now 157k more Unemployed Persons than Job Openings in the US.

Excluding the 2020 recession, this is the widest spread we've seen since 2017. Labor market continues to cool... Source: Charlie Bilello

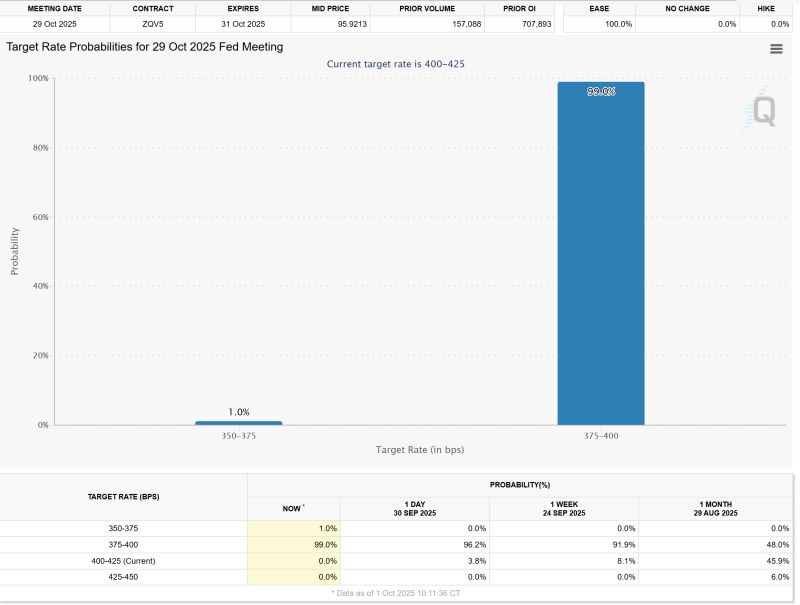

According to CME Fed watch tool, odds of a Fed rate cut in October are now 99%...

So done deal after the poor ADP payrolls numbers...

FedWatch shows a 92.5% chance of a 25 bps Fed rate cut in October.

Source: CME FedWatch

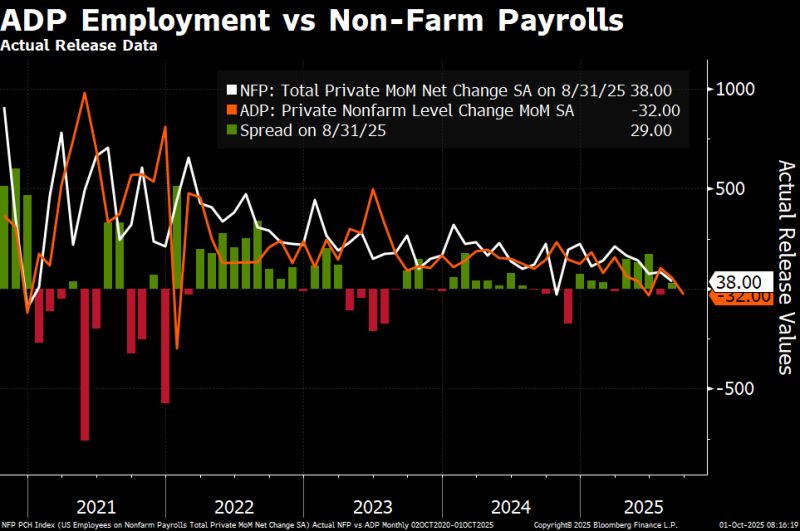

This morning’s surprisingly negative ADP data comes at a tricky time, with Friday’s jobs report at risk from the shutdown.

Private payrolls saw their biggest decline in two-and-a-half years during September, a further sign of labor market weakening that compounds the data blackout accompanying the U.S. government shutdown. Companies shed a seasonally adjusted 32,000 jobs during the month, the biggest slide since March 2023, payrolls processing firm ADP reported Wednesday. Economists surveyed by Dow Jones had been looking for an increase of 45,000. In addition to the drop in September, the August payrolls number was revised to a loss of 3,000 from an initially reported increase of 54,000. The report comes as the funding impasse in Washington, D.C. has led to the first government closure since late 2018 into early 2019. Failing a deal over the next two days, the Bureau of Labor Statistics’ nonfarm payrolls report for September will not be released, nor will the Labor Department put out the weekly jobless claims count on Thursday. The last time the BLS payrolls report was delayed was in 2013. Source: CNBC, Bloomberg, @M_McDonough on X

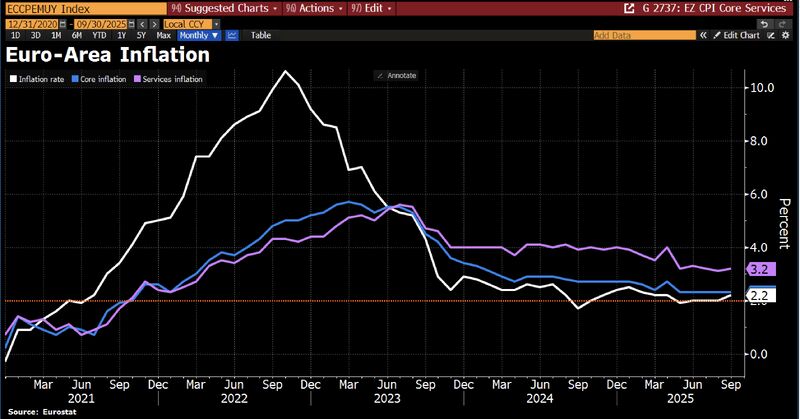

In case you missed it... Eurozone inflation picked up in Sep, with CPI rising 2.2% YoY, driven by hashtag#energy base effects and higher service costs.

Core inflation, which excluding volatile items like energy & food, remained steady at 2.3%, in line with expectations. Source: Bloomberg, HolgrZ

Rate cuts aren’t created equal.

Goldman’s data shows that when the Fed cuts outside of a recession, stocks usually surge, non-recessionary cuts have historically lifted the S&P 500 by 50%+ over two years. But if cuts arrive during a recession, the story flips. Equities struggle, with the index falling 20–30% on average. The takeaway is simple: it’s not just about cuts, it’s about the backdrop. Cuts in calm waters boost markets. Cuts in storms don’t. Source: StockMarket.news on X

Government shutdowns all have the same cause:

Congress fails to approve new spending when previous spending bills expire. But their impact can vary based on timing, duration and quirks of the budget process that can make money available to some agencies but not others. Here's what shuts down in a shutdown - Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks