Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Finally some US data... And it might please the markets... The September CPI was indeed softer than expected.

CPI MoM: 0.3% vs 0.4% exp. CPI Core MoM: 0.2% vs 0.3% exp. CPI YoY: 3.0% vs 3.1% exp. CPI Core YoY: 3.0% vs 3.1% exp. It’s still the hottest YoY print since January, but overall confirms inflation is easing again. Gasoline drove most of the increase, rising 4.1%, while electricity and natural gas fell. Food prices barely moved at +0.2%, with only small upticks in bakery and beverage costs. Shelter continues to cool. Rent inflation dropped to 3.4% YoY, the lowest since 2021 and monthly rent growth was the smallest in more than two years. Shelter overall rose just 0.28% MoM, signaling that housing, one of the biggest drivers of sticky inflation, is finally loosening its grip. Core CPI rose just 0.2% MoM, bringing the annual rate down to 3.0%, its lowest since June. Airline fares and apparel climbed, but used cars, insurance, and communication costs all declined. “Supercore” services ex-shelter fell to 3.3%, the lowest since May, showing that inflation pressure in service-heavy areas like travel, insurance, and recreation is softening across the board. Source: Charlie Bilello, StockMarket.news on X

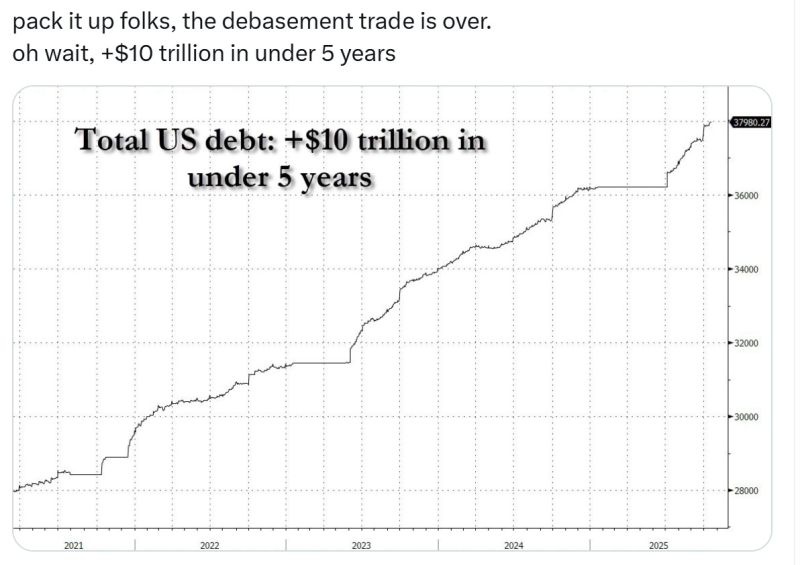

U.S. debt has surged by over $10 trillion in less than five years, largely due to massive pandemic-era spending.

Beginning in 2020, the government unleashed trillions through stimulus checks, unemployment aid, and small business loans under the CARES Act, followed by the $1.9 trillion American Rescue Plan in 2021. Although borrowing briefly slowed in 2022, new spending on infrastructure, social programs (Inflation Reduction Act), and defense reignited debt growth. Meanwhile, rising interest rates from the Federal Reserve’s inflation fight made servicing the debt far more expensive, pushing annual interest payments into the hundreds of billions. Despite strong tax revenues, the U.S. has run trillion-dollar deficits every year since 2019. Repeated debt-ceiling battles have failed to curb borrowing, as Congress consistently raises or suspends the limit. For investors, the result is a surge in Treasury supply that keeps long-term yields and borrowing costs high, while inflation expectations remain elevated—driving continued interest in gold, TIPS, and real assets as inflation hedges. Source: StockMarket.news, www.zerohedge.com

China’s gross domestic product expanded by 4.8% in the third quarter from a year ago, a slowdown from 5.2% in the second quarter, and the weakest in a year.

👉 Fixed-asset investment, which includes real estate, unexpectedly FELL by 0.5% in the first nine months of the year (Analysts polled by Reuters had forecast a 0.1% growth). This drop is alarming. The last time China recorded a contraction in fixed-asset investment was in 2020 during the pandemic, according to data going back to 1992 from Wind Information. The single-month September FAI declined by 9.8% based on estimates !!! 👉 Industrial production grew by 6.5% year-on-year in September, faster than the 5% forecast and 5.2% growth in the prior month. 👉 Retail sales rose 3% in September from a year ago, matching analyst forecasts. Source: CNBC, Augur Infinity

Liquidity back to normal? Standing Repo facility (SRF) usage from $8.35BN to $0

Note however that SRF dropping to zero doesn’t mean liquidity is back to normal. It just means no one tapped it today. The stress can still be there, just shifted elsewhere. Time will tell.

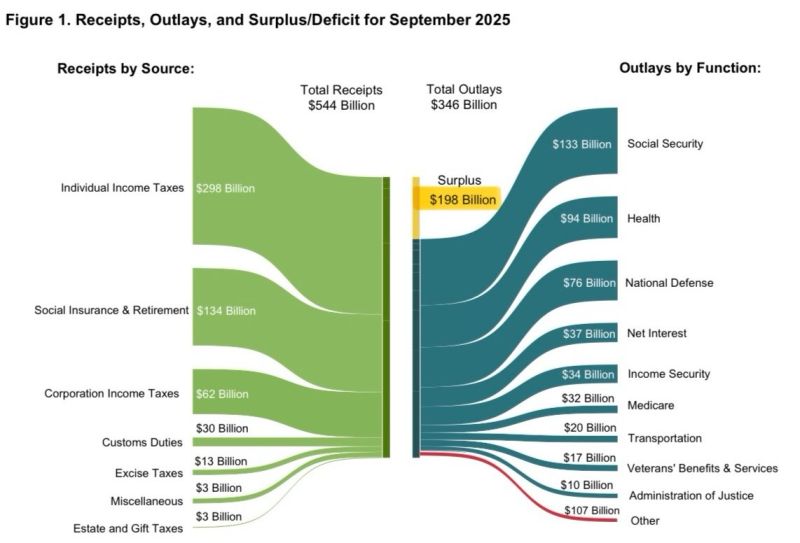

The US just posted a massive surplus of +$198 Billion for the month of September.

Total Receipts: $544B Total Outlays: $346B $30 Billion in tariffs collected. Source: Geiger Capital

Interesting comment on X by @Andreas Steno on X about a worrying development that took place yesterday.

As financials and regionals are getting hammered with signs of stress in USD money market, the SOFR - Fed funds spread keeps widening… Maybe the Fed will be involved earlier than they think on the QT ending stuff...

US funding market stress >>> Surging SOFR rates signaling a liquidity shortage

The most important indicator, as always, remains the SOFR rate: should the recent drift higher continue, the self-fulfilling cascade of a liquidity shortage will almost certainly be activated. And it did worsen... Source: zerohedge

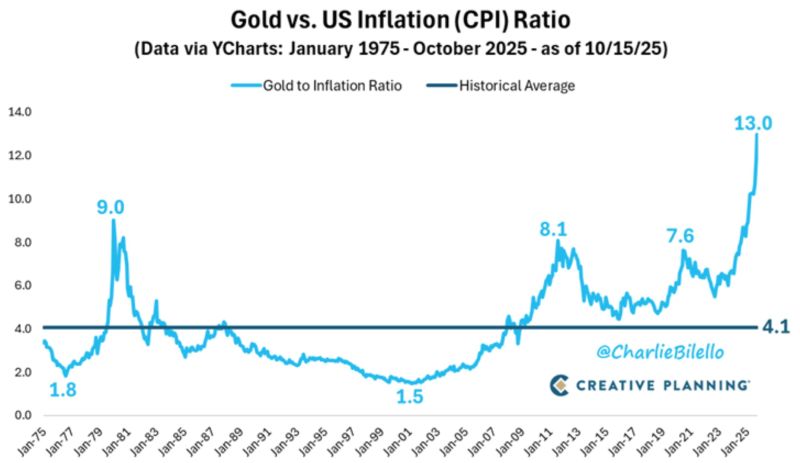

Relative to inflation, Gold has never been higher than it is today. 13x vs. 9x at the peak in 1980.

Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks