Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

US Manufacturing Recession:

The ISM Manufacturing Index fell to 48.7 in October, marking the 8th STRAIGHT month of contraction. The US manufacturing sector has been in recession for 34 of the last 36 months. Backlogs of orders have been contracting for 3 years STRAIGHT. Source: Global Markets Investor @GlobalMktObserv

Lots of questions on the back of the recent stress we have been seeing in markets over the last few sessions

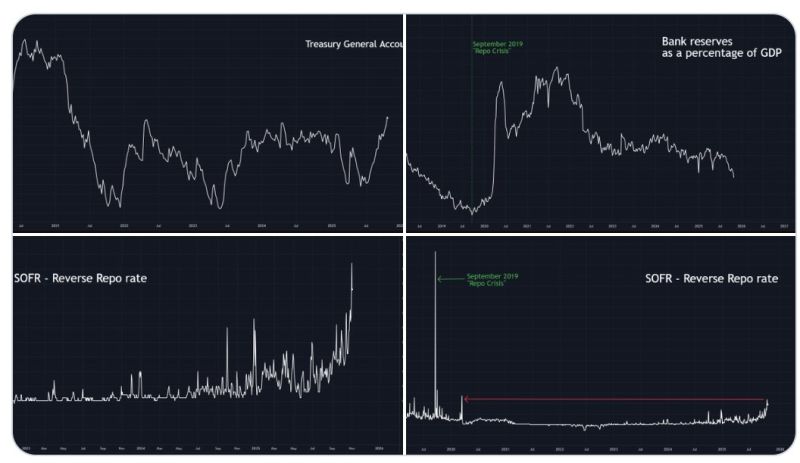

💥 Is there a banking crisis? Nope. 💵 A dollar funding crisis? Not really — at least, not yet. 🏦 Is the Fed secretly doing QE again? Also no. So… what’s actually going on? Here’s the real story 👇 After the U.S. government raised the debt ceiling in June, it started rebuilding its Treasury General Account (TGA) — basically Uncle Sam’s checking account at the Federal Reserve. The target? $850 billion. When money flows into that account, it’s pulled out of the financial system. Think of it as a liquidity drain — cash that could’ve been circulating in markets is now just… sitting there. 💧 Roughly $700 billion has been drained so far. And when that happens, bank reserves fall — which is exactly what we’re seeing today. Reserves are now sitting near multi-year lows (as a % of GDP). Less liquidity = more pressure in dollar funding markets. We can actually see that stress: ➡️ SOFR (the Secured Overnight Financing Rate — basically what banks pay to borrow short-term dollars) has ticked higher. Is it panic time? Not really. The current move is small compared to the September 2019 Repo Crisis, when the entire funding market froze and the Fed had to pivot hard from QT to QE overnight. So no, there’s no crisis — but there is a tightening squeeze in the plumbing of the financial system. Source: Tomas @TomasOnMarkets

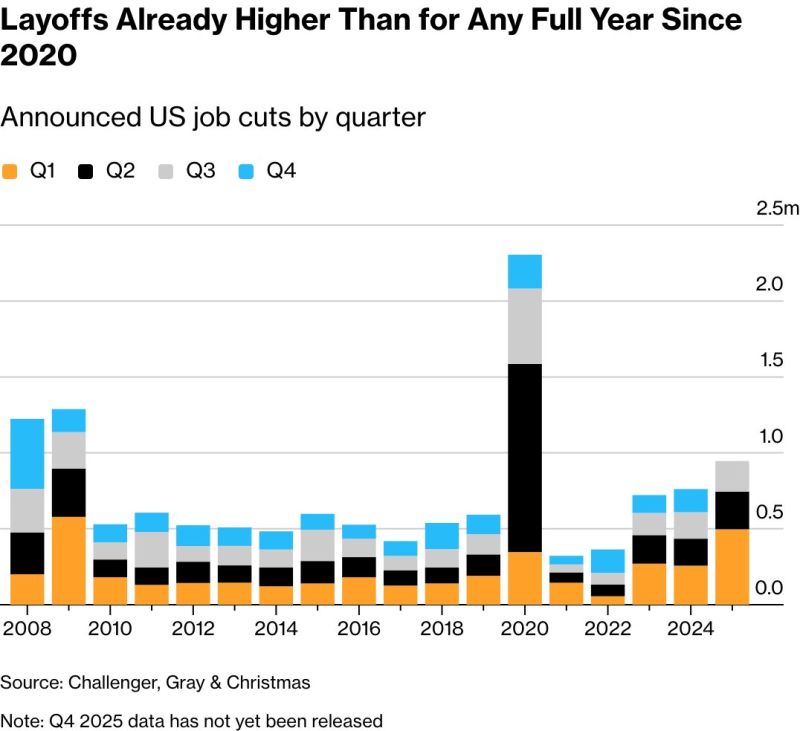

🦔 Layoffs are back — and they’re bigger than you think.

Through September, U.S. companies cut nearly 950,000 jobs — the highest year-to-date total since 2020 and worse than any full year since the Great Recession (excluding COVID). October alone brought headlines: 💻 Amazon – 14,000 corporate roles gone (AI cited as a factor) 🏪 Target – 1,800 jobs cut ☕ Starbucks – 900 employees laid off 🎬 Paramount – 1,000 roles eliminated Even Southwest Airlines announced its first major layoffs ever. Government jobs made up ~300,000 of those cuts, but tech and retail are taking the brunt. “We’re not just in a low hire, low fire environment anymore. We’re firing.” – Dan North, Allianz Trade The new pattern? AI is accelerating restructuring. 60%+ of executives on LinkedIn say AI will replace entry-level tasks. Companies are trimming labor to protect profits amid tariffs and cost pressures. Job security is no longer guaranteed — even in stable sectors. Source: zerohedge, Bloomberg

📉 China’s manufacturing slowdown deepens.

October’s PMI came in at 49.0 — hitting a 6-month low and missing expectations of 49.6 (Reuters poll). That’s down from 49.8 in September. 🇨🇳 China’s manufacturing sector has now been in contraction since April, underscoring persistent weakness in global demand and domestic investment. ⚙️ The country’s manufacturing activity has remained in contraction since April. Source: CNBC

China’s economy is hitting an imbalance wall. It keeps building, but people aren’t buying.

🧱 Investment eats up 42% of GDP — nearly double the global average. 🛒 Household spending? Just 37% — vs. 60% in most economies. The result: too many factories, not enough consumers. Property prices are still falling, savings rates are sky-high (20%+), and deflation has taken hold. Consumer prices are down, producer prices have been negative for years, and exports are doing all the heavy lifting — but even that’s cracking under U.S. tariffs. Instead of fixing the imbalance, Beijing is doubling down on the old playbook: more infrastructure, more state-led projects, little direct help for households. Economists say China needs a massive rebalancing — trillions in fiscal transfers to boost consumption and rebuild trust in the safety net. But that would mean loosening state control… and that’s not the direction things are heading. 📉 Without change, growth could slow to ~3% a year. 🧊 Deflation lingers. ⚙️ Factories hum, but consumers stay quiet. China’s still building the world’s factories — but it’s running out of people to sell to. Source: StockMarket.news

Yesterday we saw another $3 billion FED pump into the banking system.

The use of the facility is now a daily occurrence; the regional banking sector obviously has a liquidity issue. That's a total of $21 billion in 4 weeks. Source: The Great Martin on X

🚨 Is Quantitative Tightening (QT) about to end?

GoldmanSachs, JPMorgan, and BofA now see the Fed flipping course as liquidity gets dangerously tight. 💧 Bank reserves have dropped below $3 trillion again, a critical threshold for financial stability. 🏦 The reverse repo balance, which acted as a key liquidity buffer for the past 4 years, is now basically zero. That’s a big deal. With more Treasury bill settlements coming — and no reverse repo cushion left — the Fed may soon have no choice but to end QT and pivot back toward liquidity support. Both Goldman and JPMorgan have moved up their forecasts: they now expect the Fed to halt balance sheet runoff this month, well ahead of earlier expectations. Why? Because dollar funding costs are rising, and the system is flashing early signs of liquidity stress. 🧩 QT may have done its job. Now the Fed’s next move could be about stabilizing, not draining. Source: www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks