Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Japan's economy contracted 1.8% annualized in Q3, the first decline in six quarters.

You can pin most of it on a hit to exports from U.S. tariffs hammering demand. Consumer spending barely moved at 0.1% growth. Business investment held steady at 0.3%, suggesting corporate confidence hasn't completely evaporated yet. Source: StockMarket.news

🚀 Japan just dropped a $110 BILLION economic stimulus — its boldest move in years.

And it’s coming with a major shift in strategy. New Prime Minister Sanae Takaichi isn’t tiptoeing around slow growth or budget pressure. She’s going all-in with: ✅ Tax cuts ✅ Help with rising utility bills ✅ Direct support to local communities — even food aid But here’s the real story 👇 Japan isn’t just trying to ease short-term pain. It’s placing massive strategic bets on the industries that will define the next decade: 💡 Artificial Intelligence 🔧 Semiconductors 🚢 Shipbuilding 🛡️ Defence & advanced manufacturing This is about future-proofing Japan’s global competitiveness — especially in Asia’s fast-moving tech ecosystem. 💼 What does this mean for investors? This stimulus could be a major tailwind for: 📈 Japanese equities 🛍️ Consumer-focused sectors 💻 Tech, AI, and semiconductor plays But there’s a twist: expect some yen volatility. With the government coordinating closely with the Bank of Japan to keep interest rates low, markets will be watching every move. 🔍 The big question Will this $110B push spark sustained long-term growth — or just a short-lived burst of momentum? The world is watching closely. Because how Japan executes this plan could reshape Asia’s tech supply chains and become a blueprint for how far government spending can go in revitalizing an economy. Source: StockMarket.news

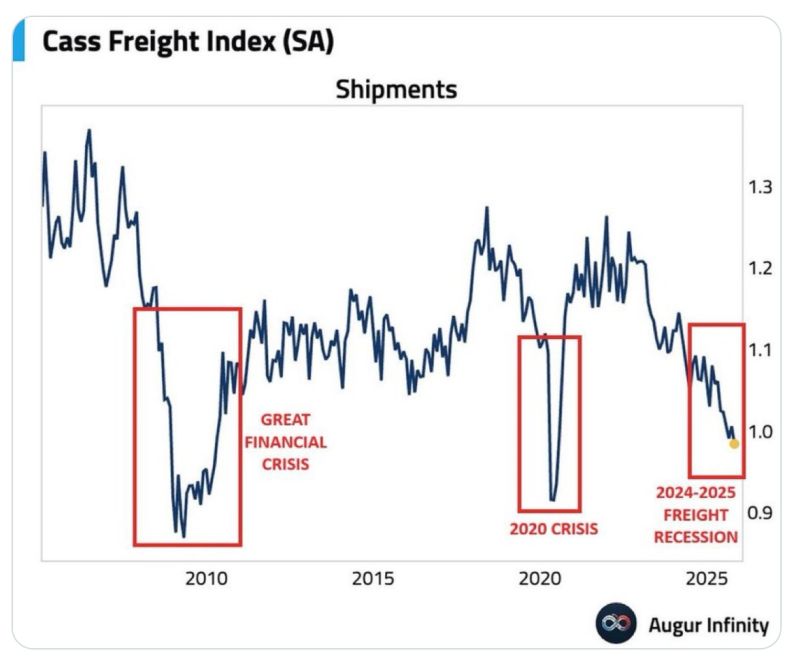

🚨 The Cass Freight Index just fell to 2009 crisis levels — should we worry?

Freight doesn’t care about narratives, headlines, or vibes. If shipments collapse, the real economy is hurting. Period. We’re now 3 years into a freight recession, and the index is still down 7%+ YoY. That means the actual movement of goods — the stuff that reflects real production and real demand — has stalled out. Here’s what’s driving the downturn: Consumer spending shifted from goods → services after the pandemic Retailers are still clearing the bloated inventories from 2021–2022 Manufacturing has been contracting for 8 straight months Tariff uncertainty is freezing new orders Trucking added too much capacity during the pandemic, and now rates are too low for carriers to survive A recovery will come… but only after: - Excess trucking capacity clears - Inventories normalize - Manufacturing turns back up The big takeaway: The freight collapse is telling us the goods recession is real — even if the stock market looks unstoppable. Source: Election wizard on X, StockMarket.news, AUgur Infinity

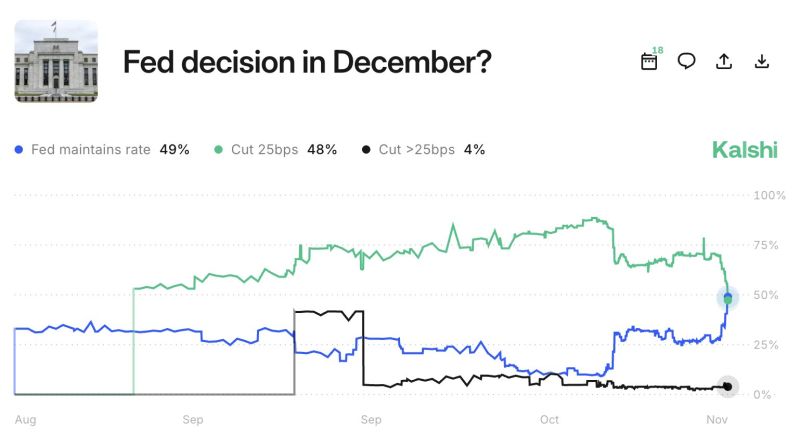

"NO CUTS" IS NOW MORE LIKELY THAN 25 BPS CUT IN DECEMBER

Mid-October, it was almost a done deal Source: Kalshi @Kalshi

While we might not get any data on CPI this week, it is worth highlighting that alternative data seems to indicate a meaningful deceleration of CPI amid big drop in rents

(Note: over 33% of the inflation calculation is based on rental cost estimates). According to CoStar, there was -0.31% rent "growth" in October, his was the biggest drop in over 15 years. What is behind this sudden drop in rents? The plunge in immigration into the US, and the resultant drop in demand for rental properties. Reventure CEO Nick Gerli points out in the following thread, "the weakness in the rental market right now is alarming. It suggests there's much more deflationary pressure in housing/economy than people understand." And, as the Fed's Stephen Miran echoes now, "2026 will be a year where CPI drops" even more. But the disinflationary trend is not just visible in rents. OpenBrand, which tracks prices daily from online marketplaces, retail websites, and brick-and-mortar store listings, said price growth slowed across all groups but communications devices. Source: zerohedge

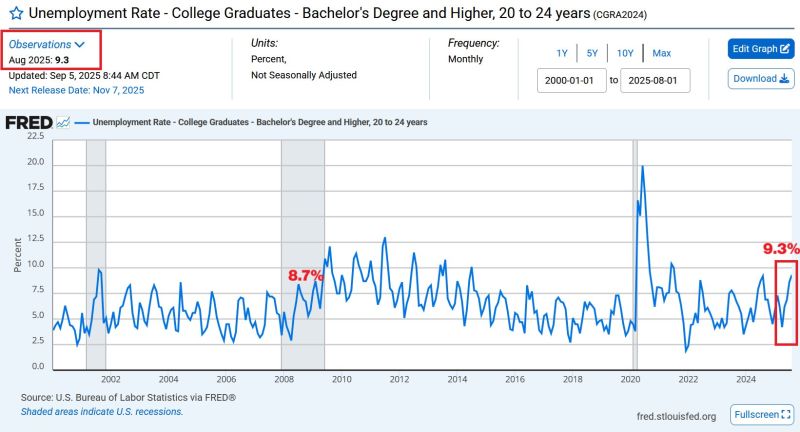

⚠️US college graduates' unemployment is now higher than during the Great Financial Crisis:

The unemployment rate for college graduates with a Bachelor's degree or higher hit 9.3%, the highest since 2021. This almost matches the 2001 recession peak of 9.5%. Source: Global Markets Investor @GlobalMktObserv

Auto loan delinquencies hit record for riskiest borrowers.

The share of subprime borrowers at least 60 days past due on their auto loans rising to 6.65% in October. Source: Bloomberg, HolgerZ

Germany creates a substantial infrastructure package and then allocate 50% of it to other purposes.

At least, that's what a study finds. Source: FT

Investing with intelligence

Our latest research, commentary and market outlooks