Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

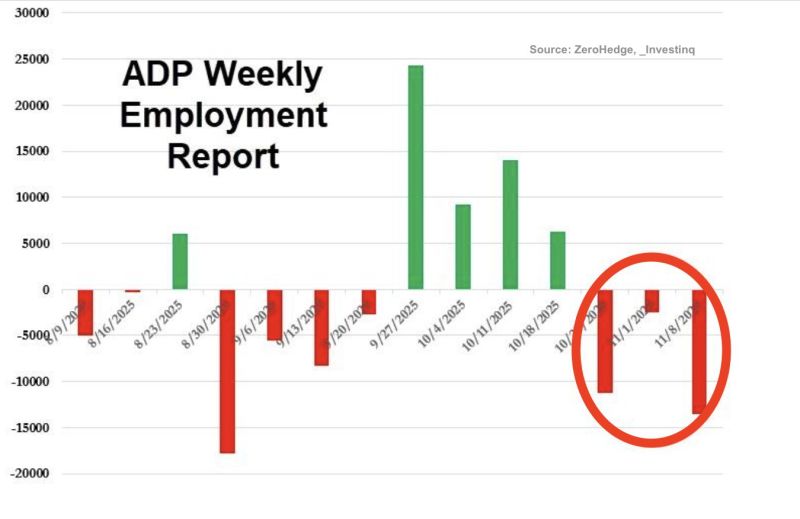

The latest ADP numbers are out and show that over the four weeks ending November 8, 2025, US private employers shed an average of 13,500 jobs per week.

📉 Inflation Isn’t the Story Anymore The Fed’s dual mandate is price stability + maximum employment — and the employment side is flashing red for the first time in years. 💡 And the Market Is Catching On Just 1–2 weeks ago, a December rate cut was basically dismissed. Markets were pricing in 30–42% odds. Then NY Fed President John Williams spoke on Friday — and he all but signaled, in classic Fed-speak, “We need to cut.” He pointed to rising downside risks in employment and fading risks in inflation. 🔍 Fast forward to this yesterday’s data: prediction markets now show an 85% chance of a December rate cut. Source: StockMarket.news

Fed Rate-cut odds for December are on the rise...

Hopes of another rate cut in December were initially boosted by Fed's Williams dovish comments on Friday and then encouraged by Goldman over the weekend. Yesterday, San Francisco Fed's Daly added to the sudden dovish pivot (from the rampant hawkish pivot mid-last week): "On the labor market, I don't feel as confident we can get ahead of it," she said in an interview on Monday. "It's vulnerable enough now that the risk is it'll have a nonlinear change." An inflation breakout, by contrast, is a lower risk given how tariff-driven cost increases have been more muted than anticipated earlier this year, she said. Daly's comments pushed the odds of a December cut back above 80%... Source: zerohedge, Bloomberg

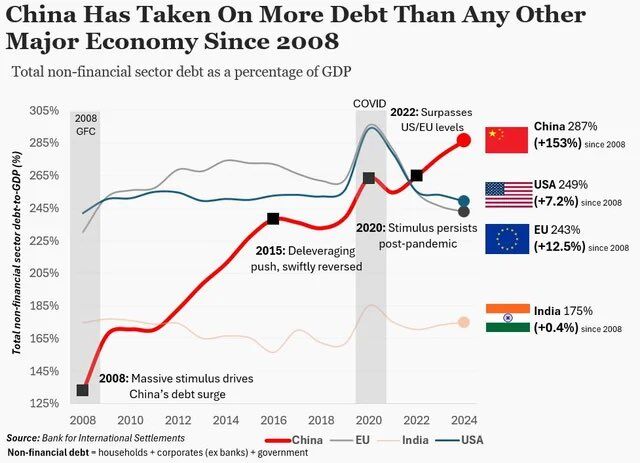

China’s $18.7T Debt Problem… Isn’t the Same as America’s

China’s government debt has exploded — up to $18.7 trillion in 2025, growing 13.6% a year. But here’s the twist: 👉 98% of that debt is owed to China’s own banks, companies, and citizens. Not to foreign governments. Not to global investors. Compare that to the U.S., where ~24% of public debt is held overseas. And that one difference changes everything. 🔍 Why China’s Debt Works Differently Because the debt is domestic: China can control its crisis responses Beijing can extend payments, adjust rates, restructure debt There’s no risk of foreign investors dumping Chinese bonds The currency is less exposed to sudden global panic In other words: China can fix China’s debt. The U.S. can’t always fix U.S. debt. 🇺🇸 The U.S. Advantage — and the Weak Spot The U.S. benefits because the dollar is the world’s reserve currency, so global demand keeps borrowing costs low. But the trade-off? America depends on continued trust from foreign buyers. If that confidence ever wobbles, financing gets harder — fast. ⚖️ The Trade-Off China = more control, less external risk… but must fix its own bubbles internally. U.S. = global trust, cheap borrowing… but more exposed if the world’s confidence cracks. Two superpowers, two debt systems, two very different risk profiles — and both will shape the next decade of global finance. Source: StockMarket.news

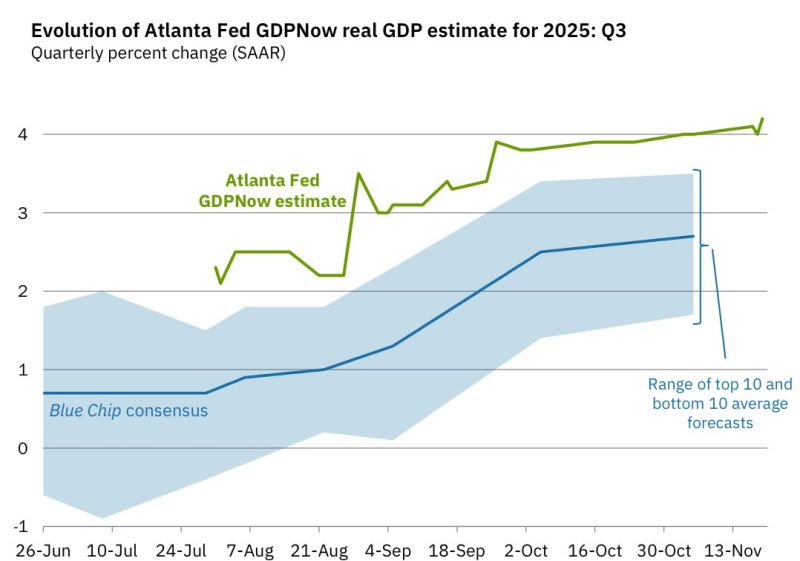

🔥 In Case You Missed It… Here's the latest update by Atlanta Fed GDPNow forecast?

👉 US Q3 real GDP: +4.2% Yes, you read that right. The US economy isn’t just growing — it’s running HOT. 🚀 And Here’s the Wild Part… Policy is about to get even more supportive: ✔ QT likely ending ✔ Rate cuts expected next year (or maybe in December but that looks less and less likely...) ✔ Fiscal stimulus coming (think: checks, tax cuts, more spending) ✔ Looser financial regulation to expand bank lending This is the opposite of tightening. This is fuel on an already burning fire.

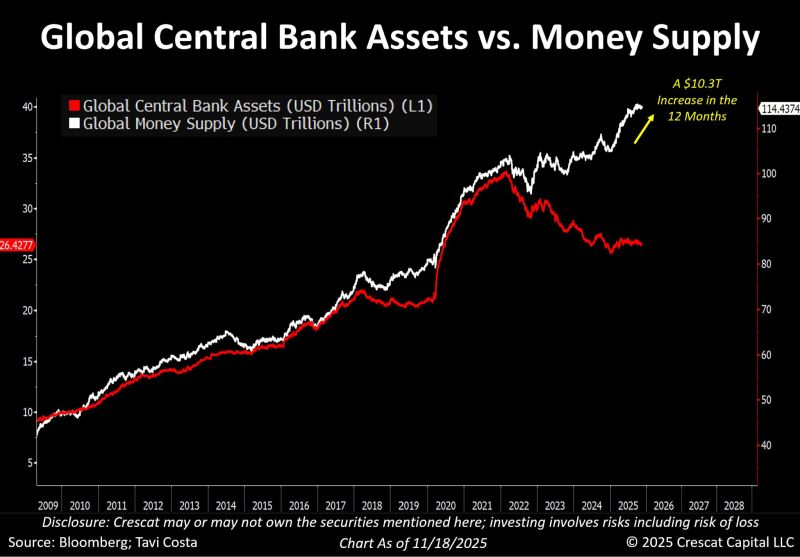

Very interesting to see money supply expanding this aggressively even as global central bank balance sheets have been contracting.

What will happen once central banks inevitably need to expand their balance sheets again? Source: Tavi Costa, Bloomberg

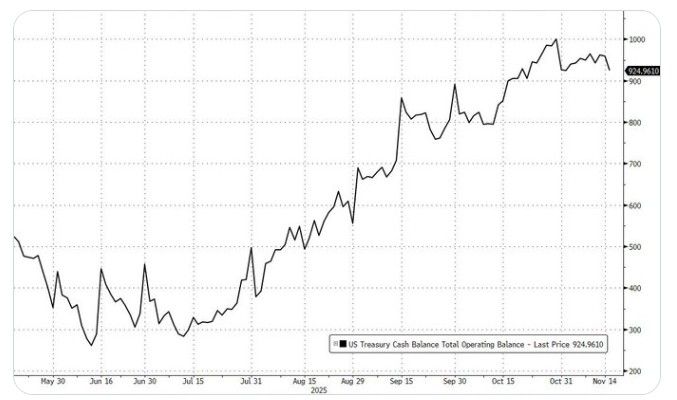

First notable slide in TGA (Treasury General Account):

Treasury cash is down $34BN to $925BN from $959BN Source: www.zerohedge.com, Bloomberg

We actually got some US macro data yesterday.

Better than expected survey data for the New York Manufacturing sector along with a jump in construction spending (handily beating the expectations of a small decline), both prompted a further decline in rate-cut odds for December (down to less than 40%)... Source: www.zerohedge.com, Bloomberg

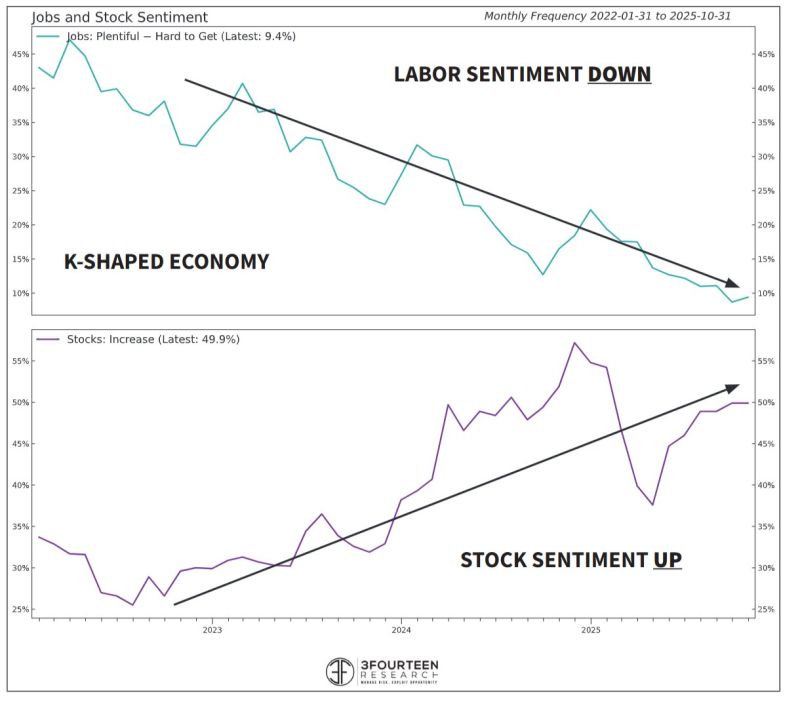

WALLER: Supports a December cut...citing "a weak labor market and mon pol that is hurting low and middle-income consumers."

Waller has been a Fed leader and, whether his view of a Dec cut prevails, the Fed will eventually be forced to respond to the lower-K. Source: 3fourteenresearch

Investing with intelligence

Our latest research, commentary and market outlooks