Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

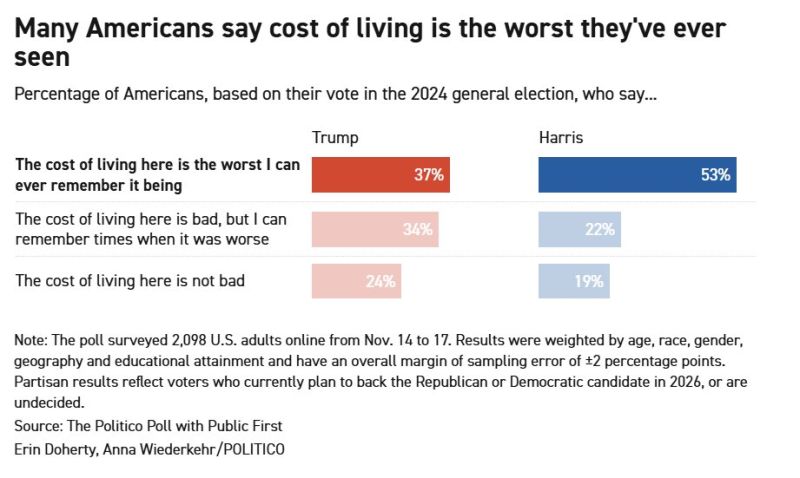

Politico released a poll yesterday with these alarming results:

Almost half — 46 percent — say the cost of living in the U.S. is the worst they can ever remember it being, a view held by 37 percent of 2024 Trump voters. Americans also say that the affordability crisis is Trump’s responsibility, with 46 percent saying it is his economy now and his administration is responsible for the costs they struggle with. Source: Bianco Research

Is the US economy in the early innings of re-accelerating?

Temporary hiring has re-accelerated, which is an early cycle indicator. Source: Steno Research, Macrobond

In Germany, Chancellor Merz is under growing pressure as business leaders warn that the country is in “free fall.”

Peter Leibinger, head of the powerful BDI industry group, cautioned that every month w/o real structural reforms costs Germany jobs & prosperity – and sharply limits the government’s ability to act in the future. Source: Bloomberg, HolgerZ

The US lost an average of 4k private-sector jobs per month over the last 3 months (ADP data), the first 3-month decline since the 2020 recession.

A year ago, the US was adding over 200,000 jobs per month. Source: Charlie Bilello @charliebilello

🛑 In case you missed it... Swiss Inflation Just Hit ZERO! What will the SNB do ??? 🤯

Just days before their final 2025 rate decision, Switzerland threw the central bank (SNB) a curveball. Consumer prices came in UNCHANGED in November from a year ago. That's ZERO inflation. What does this mean for money managers and global markets? 📌 The Core Dilemma: Core inflation slid to its weakest in over four years. The SNB's 0.4% inflation forecast for this quarter is now officially dead in the water. 📌Negative Rates... Again? No yet. While the headline number is scary, it's unlikely the SNB will panic-cut rates back into negative territory next week. The market's real focus is the 2026 Inflation Forecast. Will the SNB slash its current 0.55% projection? That’s the real tell. 📌The Franc's Resilience: Despite the low inflation and fears of negative interest rates ahead, the CHF (Swiss Franc) is shrugging it off and staying strong. The SNB might wish for a weaker currency to "kindle" inflation via intervention, but we continue to think the Franc is UNLIKELY to weaken much and will rather remain strong. The Bottom Line: Low inflation is back in the spotlight for the safe haven currency. Watch the SNB's forward guidance, not just their rate decision Source: Bloomberg

🚨 U.S. Treasury just bought back $12.5 Billion of their own debt, the largest Treasury buyback in history

Source: Barchart

Another strong tailwind for the US economy as we head into 2026...

The price of gas at the pump has tumbled to $3.00 - the lowest since May 2021... If you add to this Fed cutting rates (and soon re-launching QE), fiscal stimulus and financial deregulation, that's a lot of stimulus! Source: Zerohedge

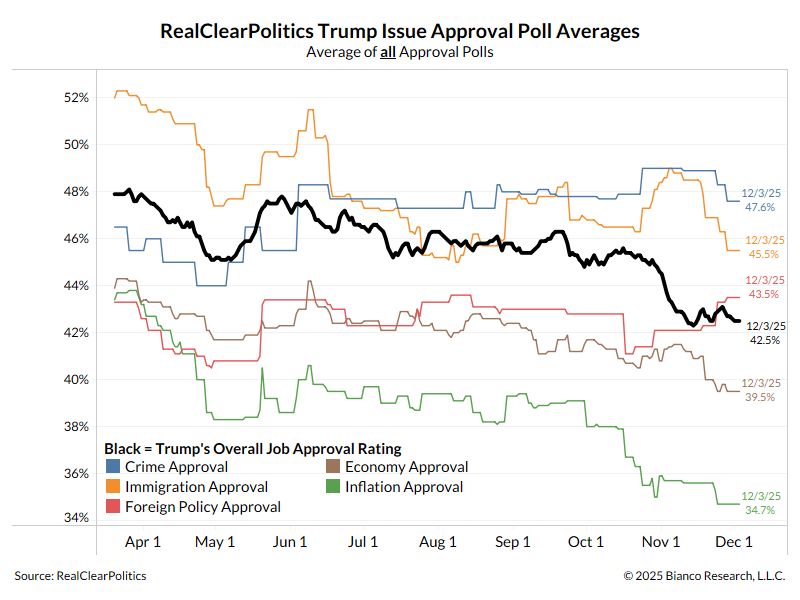

The chart below - courtesy of Jim Bianco - shows Trump's approval rating (black) and his approval rating on various issues.

The green line is his approval rating on inflation. It's at the lowest of his presidency, and far lower than everything else, even the economy (brown). Inflation is THE ISSUE. So how is cutting rates and pumping up the stock market going to fix this? Source: Bianco Research

Investing with intelligence

Our latest research, commentary and market outlooks