Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

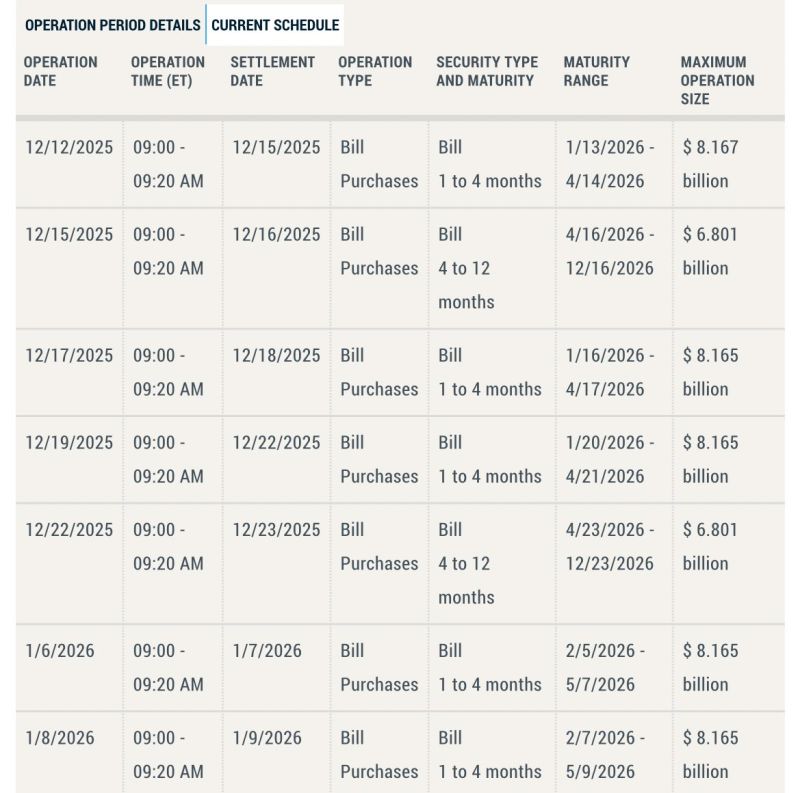

Here it is…

Fed’s first month of T-Bill purchases. $40 BILLION over the next month. Starts today at 9am.

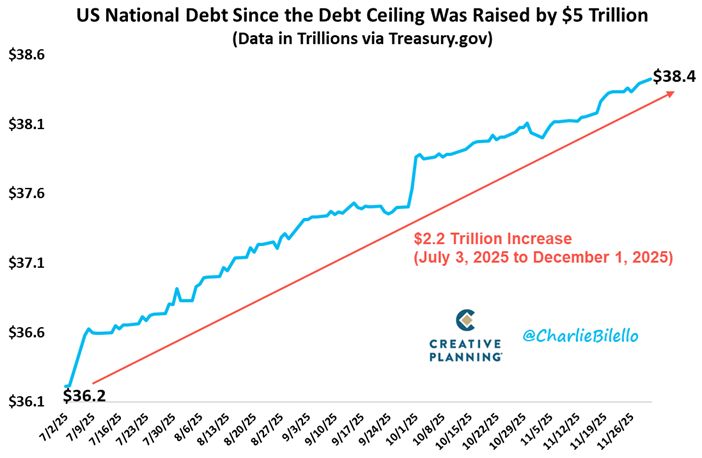

The US National Debt has now increased by $2.2 trillion since the Debt Ceiling was raised back in July.

Source: Charlie Bilello

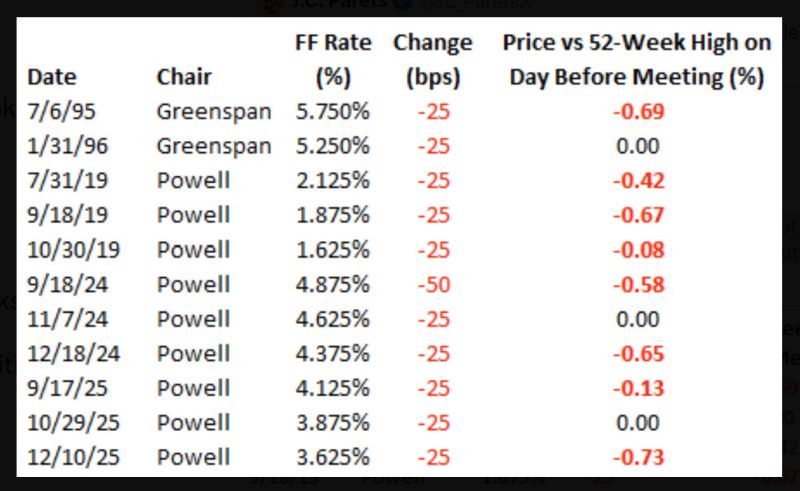

Powell the Provider.

Today was the 11th time since 1994 that the Federal Reserve cut rates when the S&P 500 was within 1% of a 52-week high. Nine of those cuts have occurred under Powell. Source: Bespoke @bespokeinvest

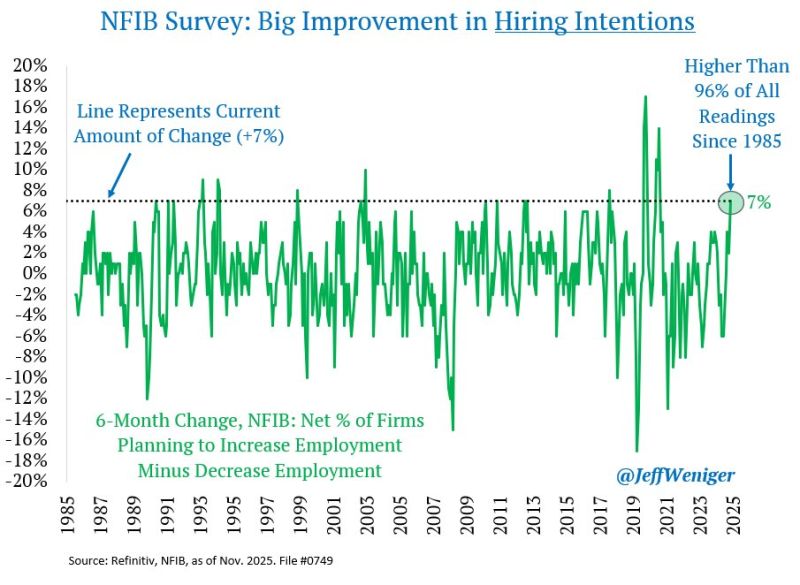

Here's a chart that shows the US labor market is improving - and not deteriorating.

The NFIB Small Business Optimism survey saw a rise in the number of firms who plan to increase employment versus decrease employment. Over the last 6 months, the rate-of-change exceeds 96% of all periods since 1985. Source: Jeff Weniger

"Low hire, low fire... low quitting"

In the US, number of quits plunges to 5 years low, as hiring slide accelerates Source: zerohedge

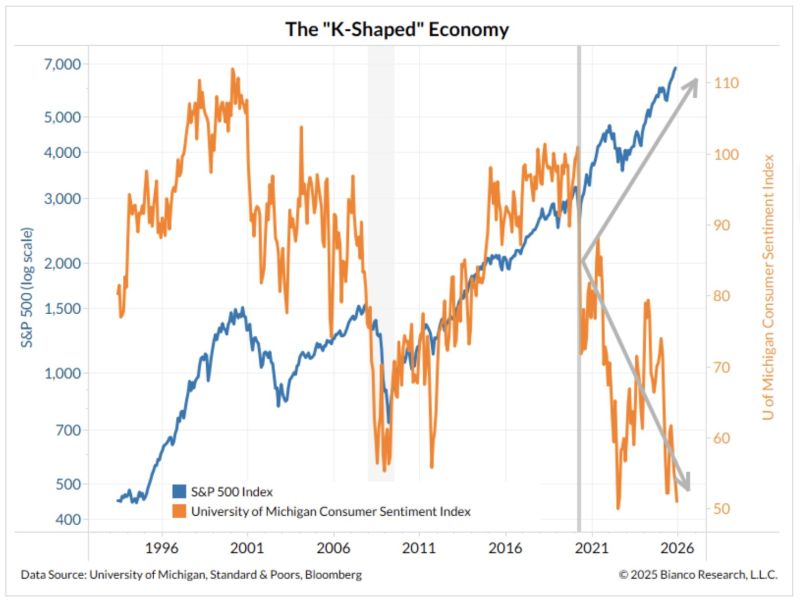

Consumer confidence down, stock market up

A K-shaped economy captured in one chart. (via Bianco Research thru HolgerZ)

Federal Reserve expected to begin buying back an all-time high $45 billion of debt each month beginning in January 🤯👀

Source: Barchart

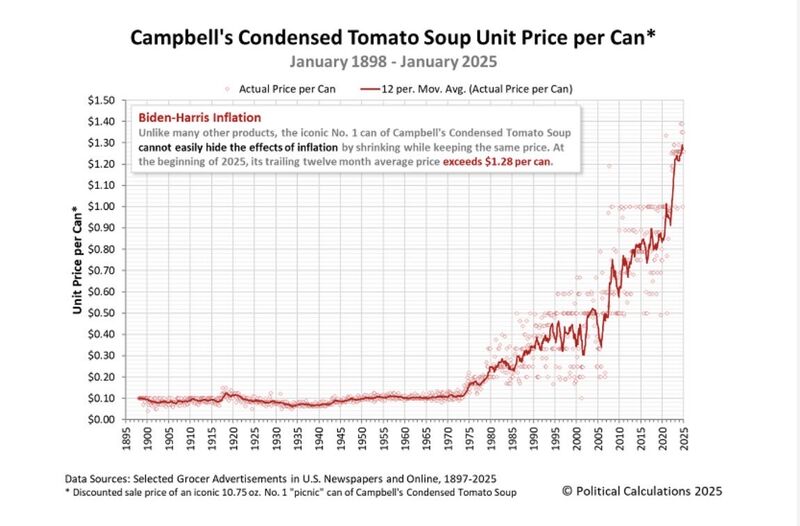

"One of the more straightforward ways to show debasement is via the price of Campbell’s tomato soup."

"Rather than relying on a complex set of estimates and substitutions, it’s just a history record of what the same can of soup cost over time.” Source: Lyn Alden thru The Long View @HayekAndKeynes

Investing with intelligence

Our latest research, commentary and market outlooks