Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

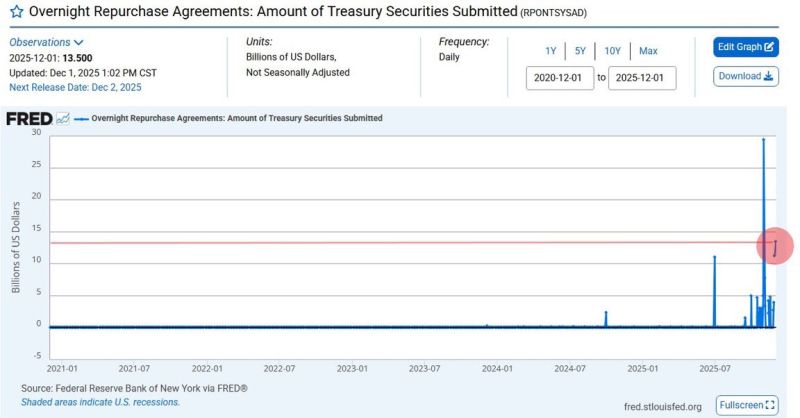

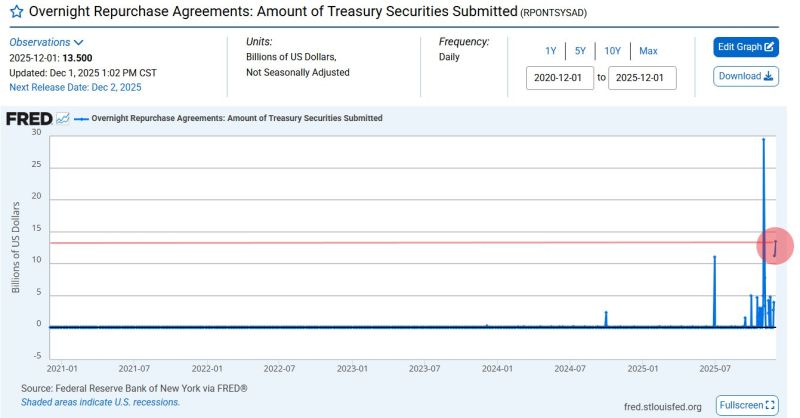

⚠️ The $13.5 Billion Fed Repo Operation: Ignore the Noise, Understand the Signal

The headlines are running wild, calling the massive overnight liquidity injection "The Biggest Since COVID!" and predicting the return of Quantitative Easing (QE). Here is the objective truth: ➡️ The Problem: Banks ran into simultaneous, acute, and unexpected shortfalls of overnight cash. This created an immediate, sharp spike in inter-bank borrowing rates (liquidity stress). ➡️ The Fed's Role: The Federal Reserve stepped in not as an asset purchaser (QE), but as the essential backstop. The $13.5B was a tactical operation to stabilize the overnight lending market and prevent a systemic spike in financing costs. ➡️ The Historical Precedent: This scenario is not a predictor of a new bull cycle. It happened in 2019 after Quantitative Tightening (QT) ended. It's a structural issue in the funding markets, not a macroeconomic pivot. 👉 Conclusion: This is not QE. This happened when QT ended in 2019 as well. This is a clear indication of financial plumbing stress. Treat it as a warning light within the system, signaling potential underlying friction. Source: FRED, Brett

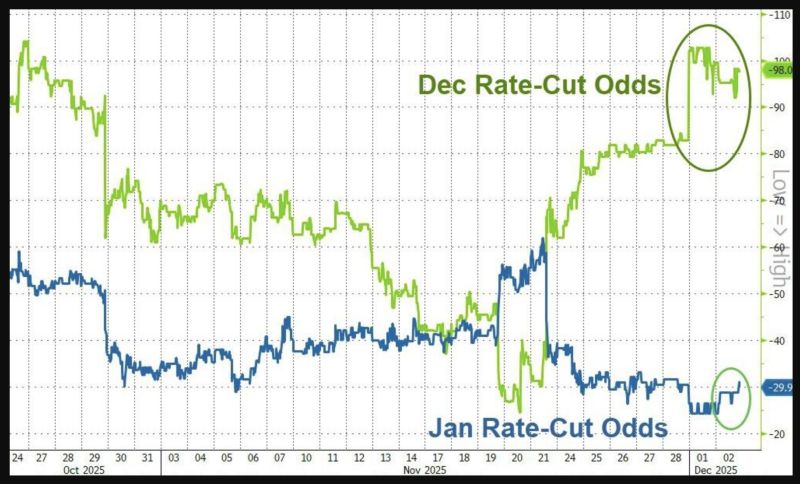

Rate-cut odds seem to indicate December meeting is a done deal.

But we also note that January odds are rising... Source: zerohedge

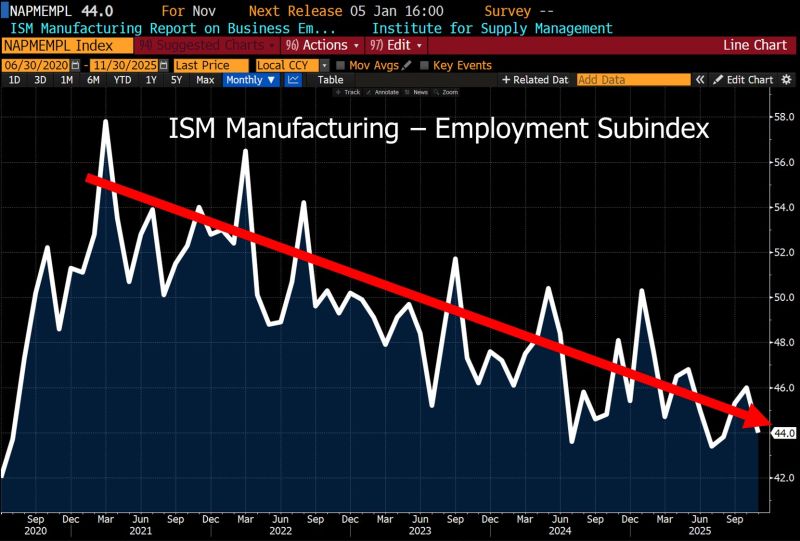

This might force the hand of the Fed...

Powell may have floated the idea of a pause, but the cooling U.S. labor market tells a different story — and it’s opening the door to lower policy rates. Here’s the twist: Inflation is holding around 3.0%, dipped to 2.3%, and is averaging 2.7% for the year. GDP? Still strong. Demographics? Warping the job market. And yet… rate cuts are coming. Why? Because the other half of the Fed’s mandate is screaming for it. Lower rates conveniently support: Debt sustainability Financial-sector stability Liquidity across the system Central banks want lower rates — and their messaging shows it. That’s why we’re hearing nonstop about financial-sector risks, bond-market volatility, and liquidity needs… and far less about headline inflation.

Fed Reserve just pumped $13.5 Billion into the U.S. Banking System through overnight repos.

This is the 2nd largest liquidity injection since Covid and surpasses even the peak of the Dot Com Bubble Source. Barchart

🔥 Big Shift Today: The Fed Just Ended QT - What This Means For Overall Liquidity according to Goldman 🔥

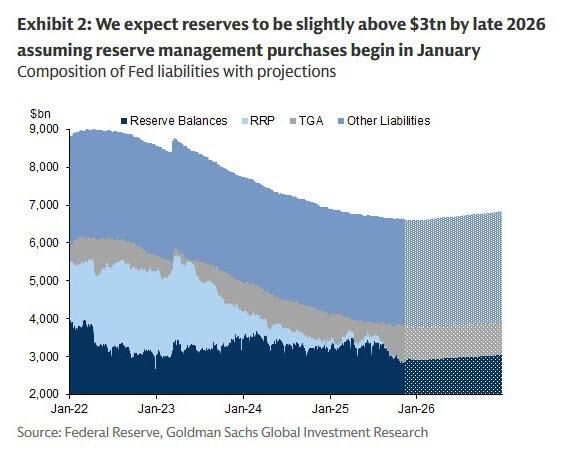

After months of draining liquidity and a one-month delay that tightened markets, the Fed’s quantitative tightening officially ends today. Here’s what Wall Street is watching: 💧 Reserves Are Scraping Bottom Fed reserves hit a low in October, but should end 2025 around $2.9T - still uncomfortably close to “not enough.” Repo markets have already shown stress, with Standing Repo Facility usage hitting its 2nd-highest level since COVID. 🏦 Goldman’s Call: QT Ends, Balance Sheet Growth Returns Fast Goldman expects the Fed to start buying ~$20B/month in T-bills starting Jan 2026, plus reinvesting MBS runoff - together adding ~$40B/month back into the system. Reserves could climb back above $3T by late 2026. 💣 Why the Pivot? Liquidity Is Too Tight Repo rates (TGCR, SOFR) are trading well above where they “should” be. Funding markets keep flashing red. The Fed is quietly preparing to reflood the pipes. 📈 Treasury Supply Stays Heavy - But the Fed Becomes a Buyer Again With massive deficits ahead, Treasury issuance remains huge. But thanks to the shift in policy: Fed is expected to absorb ~$480B of next year’s T-bill issuance Non-Fed buyers only take ~$390B — the lowest since 2023 🍃 But There’s a Catch… The Fed will let $2T of MBS roll off, pushing a wave of mortgage-backed supply into markets. That means: ➡️ More pressure on housing and mortgage rates ➡️ A slow-motion shift from MBS → Treasuries in the system ⚠️ Bottom Line: QT ends today, but the liquidity story is far from over. Funding markets are strained, repo is volatile, MBS supply is surging - and the Fed may be forced to restart balance sheet expansion faster than anyone expected. The next big test? April tax season. If liquidity cracks again, the Fed’s “reserve management purchases” may turn into something much bigger. Source: Goldman Sachs, zerohedge

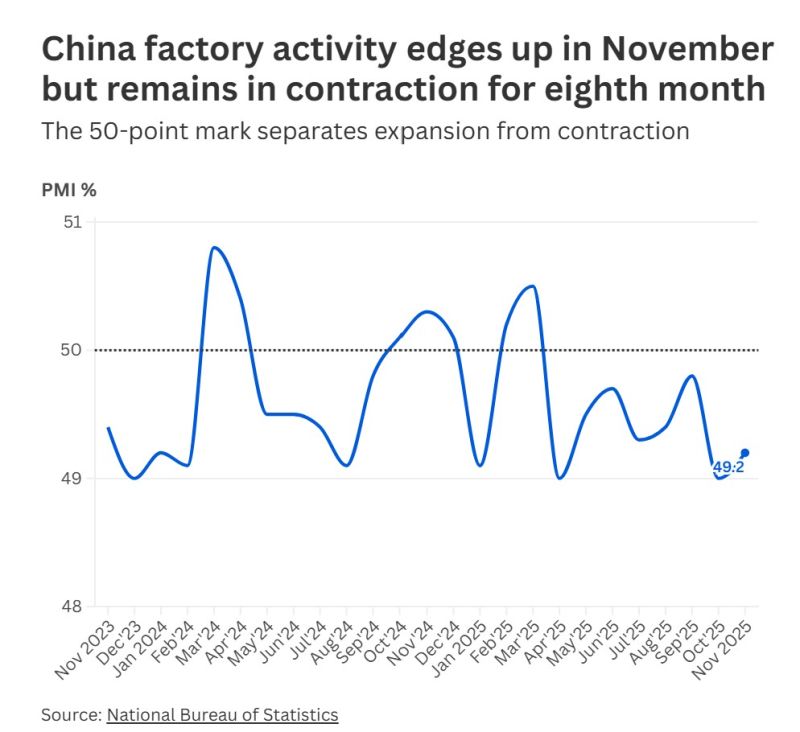

China’s factory activity edged higher in November but remained stuck in contraction for the eighth consecutive month

Services weakened as the boost from earlier holidays faded, according to official data released Sunday. The manufacturing purchasing managers’ index rose to 49.2, up 0.2 points from October, the National Bureau of Statistics said. The figures were in line with economists’ expectations in a Reuters poll, but remained below the 50-point mark that separates expansion from contraction. The non-manufacturing business activity index fell to 49.5, down 0.6 points from October, while the composite PMI output index eased to 49.7, indicating a slight pullback in both manufacturing and services activities. Supply and demand in manufacturing improved modestly, said Huo Lihui, chief statistician at the bureau’s Service Industry Survey Center, with the production index reaching the 50 threshold and new orders rising to 49.2. Source: CNBC

As a remainder, The FED ends QT tomorrow !

For years, they've been pulling money out of the system Tomorrow, that drain stops... Source: @PaulGoldEagle

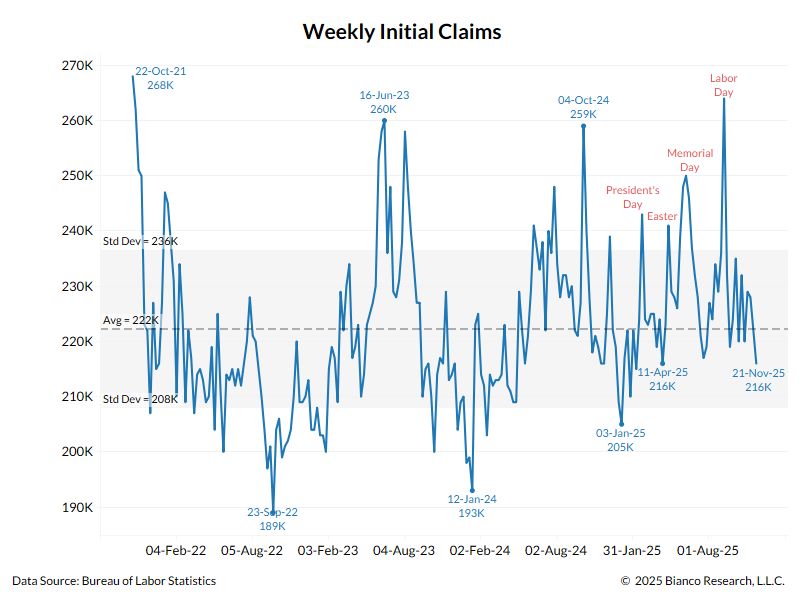

🚨 Fresh data just dropped and it’s sending mixed signals about the job market.

📉 Weekly jobless claims fell by 6,000 to 216,000, beating expectations of 225,000. 👉 Translation: fewer people filed for unemployment last week. Layoffs remain relatively low. But here’s the twist: 📈 Continuing unemployment claims rose by 7,000 to 1.96 million. 👉 That means more people are staying on unemployment longer. What does this combo really signal? While companies may not be cutting large numbers of workers, the economy doesn’t seem to be creating enough new jobs to absorb people who are already unemployed. In short: 🔹 Layoffs are low. 🔹 Hiring isn’t high enough. 🔹 Workers are getting stuck in unemployment longer. A cooling job market… or the calm before a bigger shift? Source: Truflation, Bianco Research

Investing with intelligence

Our latest research, commentary and market outlooks