Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Odds of a rate cut at Fed December meeting have increased again (70%+) but Fed officials remain divided on three questions that come down to judgment calls:

1. Will tariff-driven cost increases truly be a one-off? 2. Does weak hiring reflect a demand slump or reduced supply? 3. Are rates still restrictive?

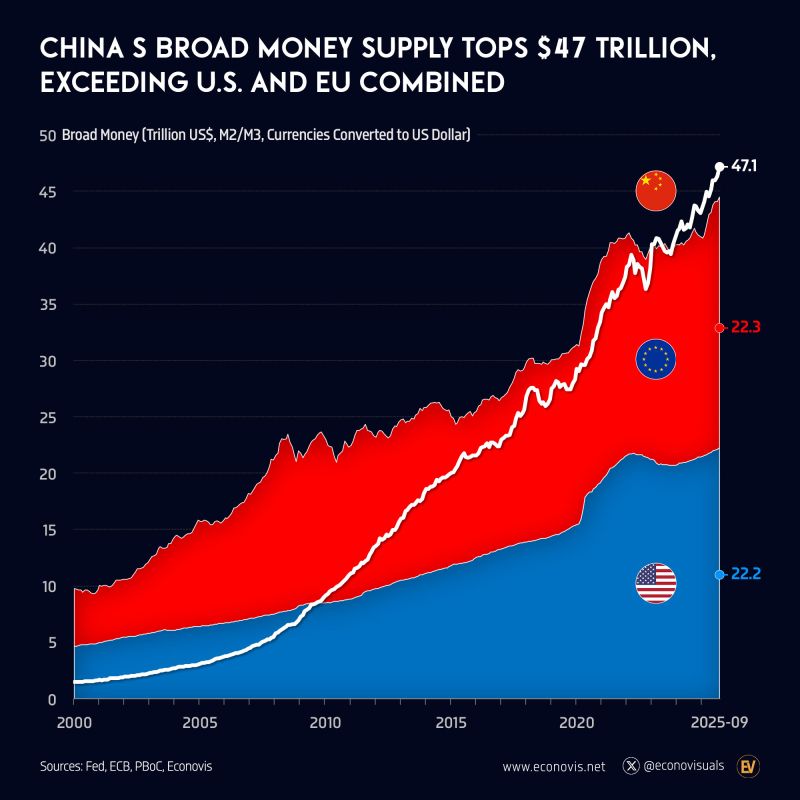

📈 China’s Broad Money Supply Surpasses Combined U.S. and EU Since 2023

China’s broad money supply (M2) reached $39.7 trillion in September 2023, surpassing for the first time the combined total of the United States and the European Union ($39.6 trillion). By September 2025, China’s M2 had expanded further to $47.1 trillion—5.9% higher than the combined $44.5 trillion of the U.S. ($22.2 trillion) and EU ($22.3 trillion). This reflects the continued rapid expansion of China’s financial system and credit base relative to Western economies. Source: Econovis

US companies announced 153k job cuts in October, a 175% increase from a year ago.

This was the highest number of layoffs for any October in over 20 years and the most for any single month in Q4 since 2008. Source: Charlie Bilello, LSEG

🌍 G7 vs BRICS: The Global Power Shift Is On ⚖️

1️⃣ 💰 Debt: G7’s debt-to-GDP is 120%+, while BRICS sits around 60% — more fiscal freedom, less dependence on borrowing. 2️⃣ 👶 Demographics: G7 is aging fast, but BRICS nations enjoy a younger, growing workforce driving productivity and innovation. 3️⃣ ⚡ Energy Advantage: BRICS benefits from lower energy costs — a huge edge as AI ⚙️ and data centers drive up global power demand. 4️⃣ 📊 Fiscal Models: G7 relies on asset inflation & deficits to sustain wealth, while BRICS focuses on real income, production, and investment. 5️⃣ 🌏 Economic Gravity: At PPP, BRICS’ share of global GDP is set to surpass G7, shifting the world’s economic center eastward. 6️⃣ 🏅 Monetary Resilience: BRICS is exploring gold-backed systems and private gold ownership — a hedge against the West’s paper-asset dependence. 💡 Bottom line: The future of growth, energy, and real wealth is tilting east — and the world order is quietly being rewritten. ✨ Source : The Economist

Challenger Job cuts was one of the reasons for the equity market weakness yesterday..

Given the lack of government data, any report gets huge attention... Source: RBC, Bloomberg

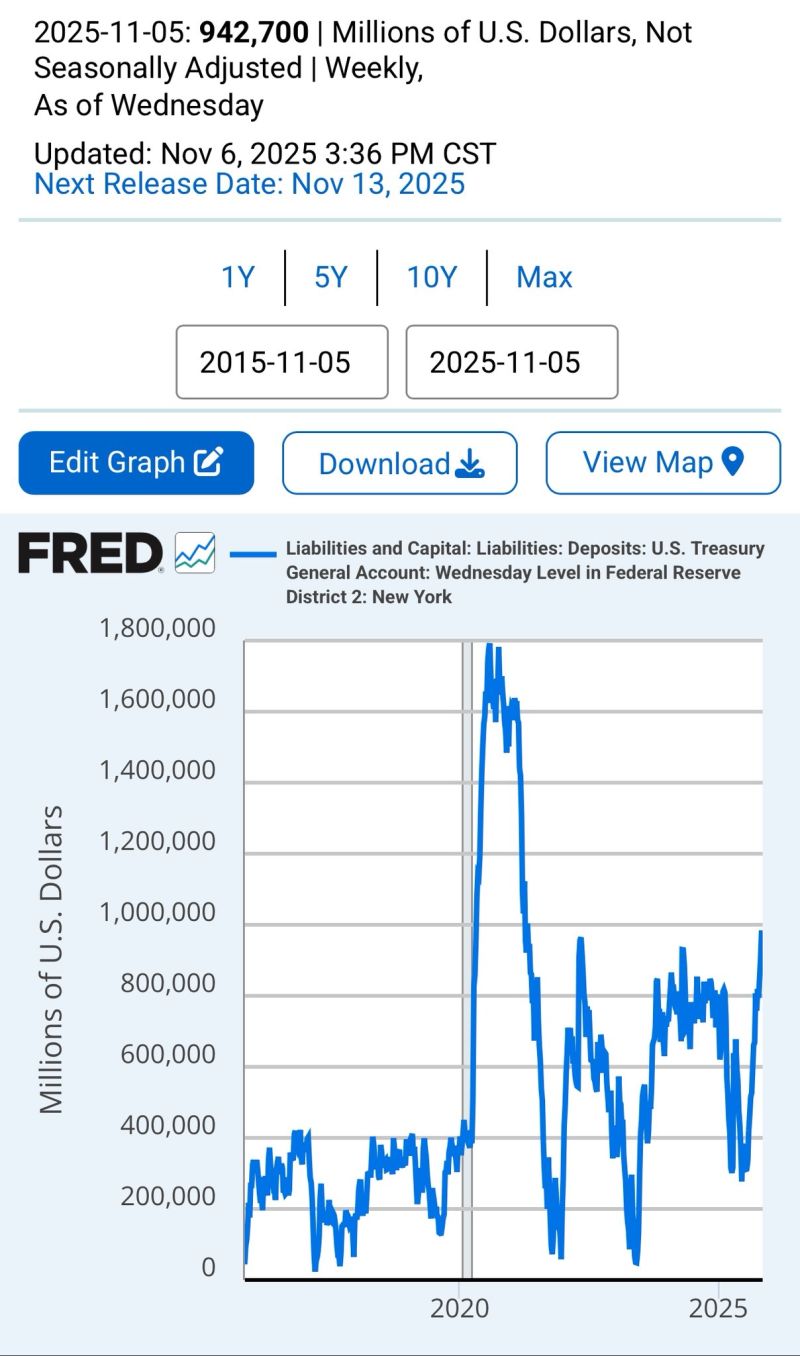

Treasury TGA is about to break $1T. Only time bigger was during C-19.

Treasury can’t spend because of shut down. QT ends in December, $70B of buying per month. Potential liquidity tsunami is about to hit the system

💥 U.S. household debt just hit another record.

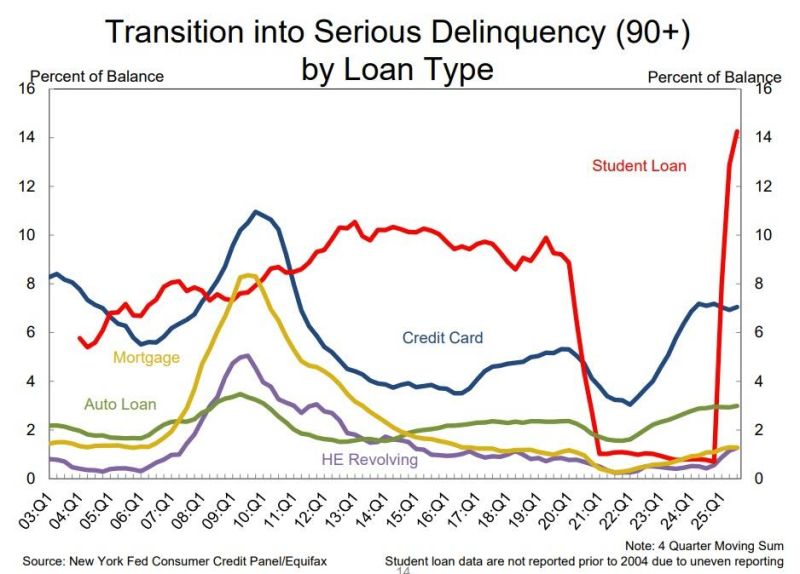

The New York Fed’s Q3 2025 report shows total household debt rising $197 billion (+1%) to a new all-time high of $18.59 trillion. Here’s the breakdown 👇 🏠 Housing debt: $13.5T 💳 Non-housing debt: $5.1T Key highlights: 🏡 Mortgage balances up $137B → now $13.07T Delinquency: 0.83% (barely up from 0.82%) 💳 Credit card balances up $24B → now $1.23T Delinquency: 12.41%, highest since 2011 🚨 🚗 Auto loans steady at $1.66T 🎓 Student loans up $15B → $1.65T 90+ day delinquencies at 9.4% — surging after repayment resumed 🏡 HELOCs up $11B → $422B 🧾 In total: Non-housing balances rose 1% from last quarter. 📉 Consumer bankruptcies: 141,600 — the most since 2020. 🔍 What’s happening: “Household debt balances are growing at a moderate pace, with delinquency rates stabilizing,” said the NY Fed’s Donghoon Lee. True — but under the surface, cracks are widening. Credit card delinquencies are the highest in 14 years. Student loan defaults are accelerating — especially among borrowers 50+, where 1 in 5 loans is now delinquent. Mortgage resilience is holding — for now — but that may change if housing prices slip and credit tightens. 🧠 Big picture: Consumers are tapped out. The pandemic-era cushion is gone. Credit limits are rising, but so are missed payments.

🚨 "Stimulating into a bubble" by Ray Dalio - here are the key takeaways 👇

The Federal Reserve announced it will end Quantitative Tightening (QT) and begin Quantitative Easing (QE) again — calling it a “technical adjustment.” But let’s be honest: That’s easing. And easing into this environment is something we’ve rarely seen in history. Let’s unpack what this means 👇 📉 Normally, QE happens during crisis. Low valuations, weak growth, wide credit spreads, and falling inflation. QE was meant to stimulate into a depression. 📈 This time is different. Stocks are near record highs AI and tech valuations are in bubble territory Unemployment is near record lows Inflation is still above target Credit and liquidity are abundant So if the Fed starts buying bonds and adding liquidity now — while deficits stay huge — it’s essentially monetizing government debt during a boom. That’s not “technical.” That’s a classic late-stage Big Debt Cycle move — where monetary and fiscal policy collide to keep the system afloat. 🧩 The mechanics: QE pushes real yields down Financial assets inflate (especially tech & gold) Wealth gaps widen Inflation reawakens — eventually forcing the Fed to tighten again ⚠️ And that’s when bubbles pop. So yes — the Fed may be stimulating into strength, not weakness. Into a bubble, not a bust. Into risk, not safety. This is the kind of pivot that separates traders from historians.

Investing with intelligence

Our latest research, commentary and market outlooks