Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

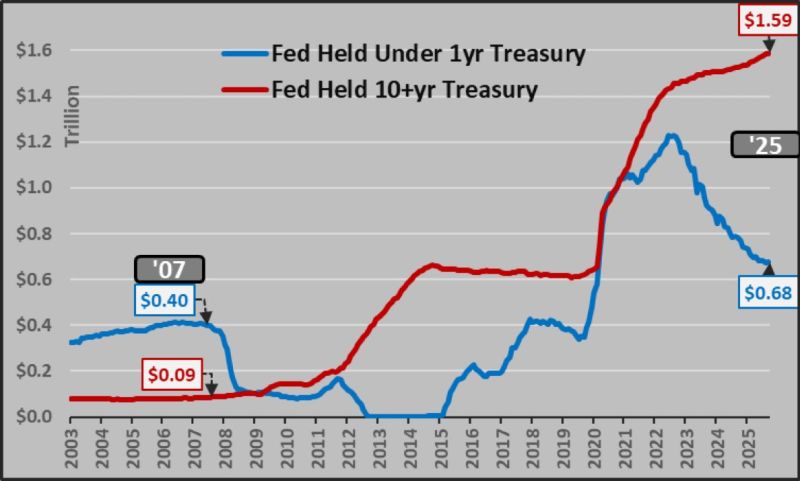

Really important chart from @Econimica

QT NEVER happened in 10+yr USTs post-2022. The Fed still holds a large amount of long-term debt. The QT mainly took place through short-term Treasuries (the blue line). As explained by StockMarket.news, over the last few years, the Fed has been draining some money out of the system but doing it in a very controlled way. It’s avoiding a big sell-off in long-term bonds because that could cause interest rates to spike and hurt the economy. So while it looks like the Fed is being tough with QT, the reality is softer the real tightening is happening with short-term bonds, while the long-term side still has a safety net. It’s a reminder that even when the Fed says it’s tightening, it’s still making sure the markets don’t fall apart.

China's deflationary vortex is getting worse:

*CHINA SEPT. CONSUMER PRICES FALL 0.3% Y/Y; EST. -0.2% *CHINA SEPT. PRODUCER PRICES FALL 2.3% Y/Y; EST. -2.3%

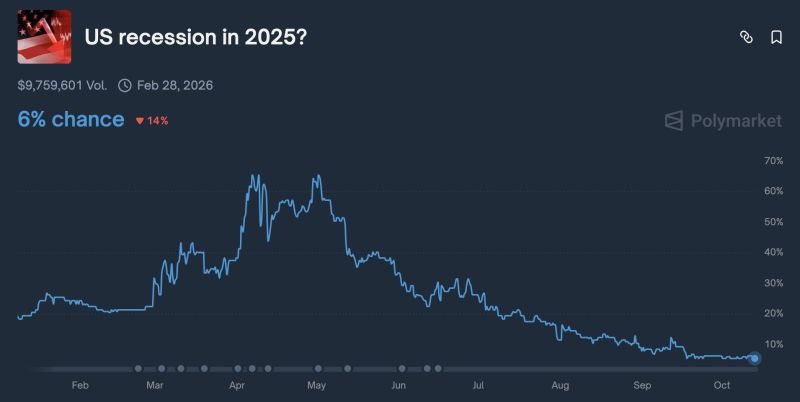

US recession odds have cratered from over 65% earlier this year to only 6% today.

Source: Anthony Pompliano @APompliano

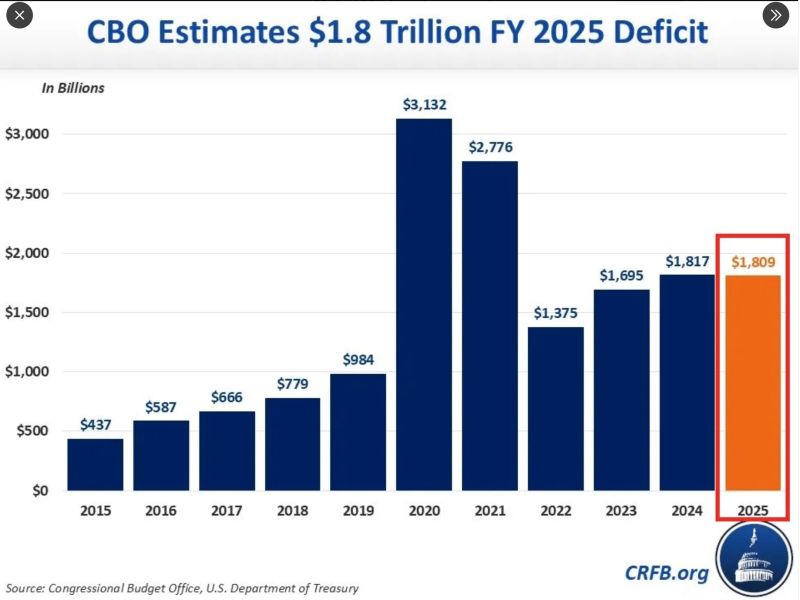

🔴 The US government posted a $1.8 TRILLION (6% of GDP) budget deficit in Fiscal Year 2025, which ended in September.

This matches the 3rd-largest budget gap in HISTORY. Revenues hit $5.2 trillion while spending $7.0 trillion. Source: Global Markets Investor

Without data centers, GDP growth was 0.1% in H1 2025, Harvard economist says.

The US economy growth is a tale of 2 worlds with a "K-shape". On one hand, genAI / tech spending and upper income consumers. They are in great shape. On the other hand, all the rest (low/mid income, manufacturing, etc.). They are struggling Will deregulation, fiscal & monetary stimulus + low oil prices help to make growth more balanced? Or will it end boosting even more the upper part of the K???? How long can it last?

In August '25, German industrial production collapsed 4.3% m/m.

Germany is headed for the third consecutive recession year. To Dr Polleit, the "Great Reset" is destroying industrual production and economic growth in Germany. ➡️ Polleit is a German economist affiliated with the Austrian School of economics, and president of the Ludwig von Mises Institut Deutschland. Mises Institute. He is strongly skeptical of state intervention, central banking, fiat money, and what he sees as coercive economic planning ➡️Polleit general critiques on Germany are the following: 👉 Heavy regulation, strong state involvement 👉Germany’s ambitious transition from fossil fuels to renewables may cause disruptions in energy supply, cost volatility, grid stresses, and increase production costs 👉Export dependence and global competition 👉Monetary and fiscal pressures reduce real returns on capital and discourage long-term investment. 👉Uncertainty and investment risk 👉With more government programs, state investment, subsidies, and oversight, private actors may be crowded out or discouraged. Polleit would claim that entrepreneurship and innovation decline. 👉Central planning or incentive distortions lead to misallocation of capital. Polleit warns that “green subsidies” or mandated transitions may favor politically connected actors rather than the most efficient ones. 🚨 Hence, under Polleit’s logic, Germany — already having high regulation, energy transition burdens, export dependency, and significant state involvement — would be particularly vulnerable to further growth suppression from Great Reset-type policies. He would argue that growth is slowly being “destroyed” by compounding layers of regulatory, monetary, and fiscal drag. Source: Thorsten Polleit @ThorstenPolleit on X

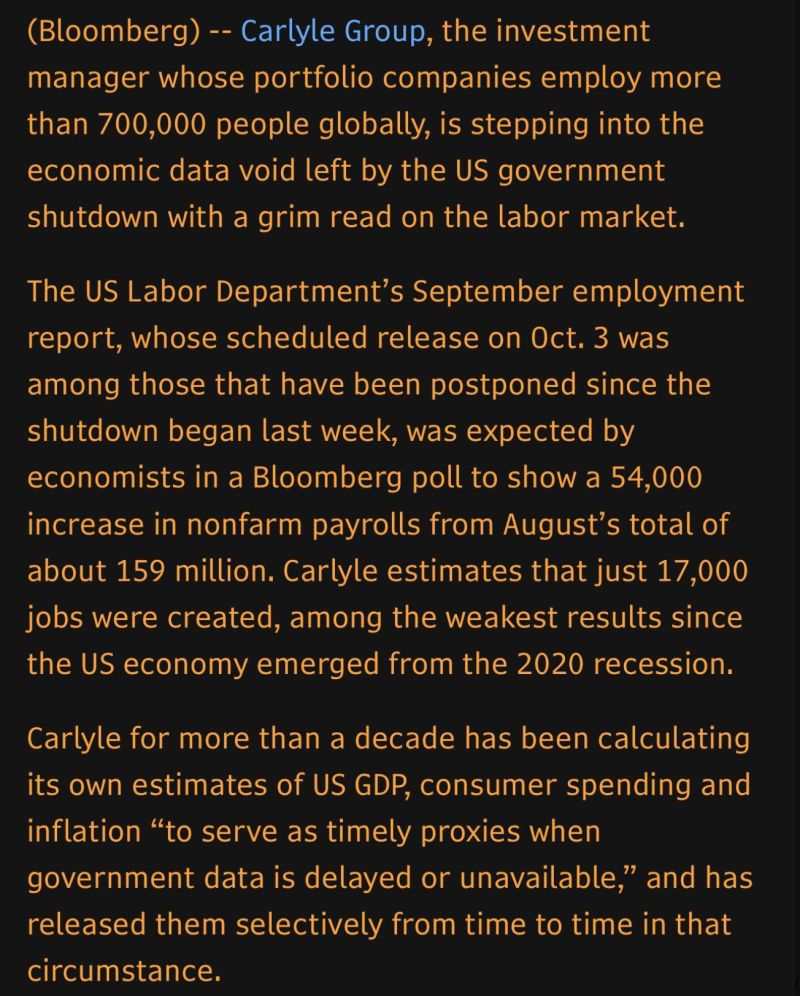

Carlyle Group says the US job market is absolutely finished.

Source: Bloomberg, Spencer Hakimian

From the FT article on “Labour markets stuck in a ‘low hire, low fire’ cycle”:

“Labour markets in many leading economies are freezing up as uncertainty over trade, tax and artificial intelligence causes employers to put off hiring and firing and employees to stick with their jobs.”

Investing with intelligence

Our latest research, commentary and market outlooks