Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

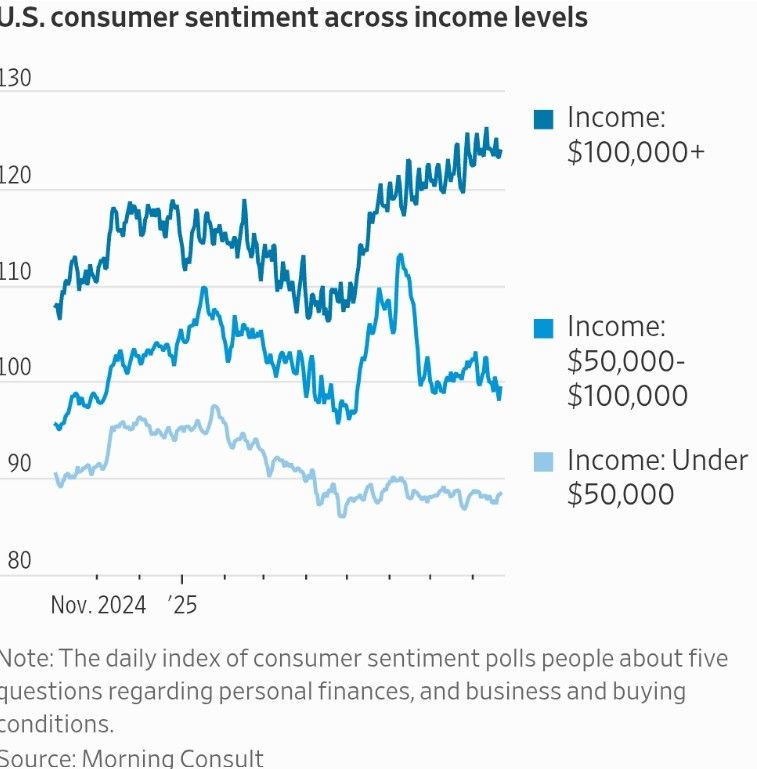

The gap in 🇺🇸 consumer confidence is widening.

Wealthier households remain upbeat, while middle-income sentiment has slumped sharply since June — now looking closer to lower-income pessimism. It’s the middle class that’s starting to feel the squeeze.

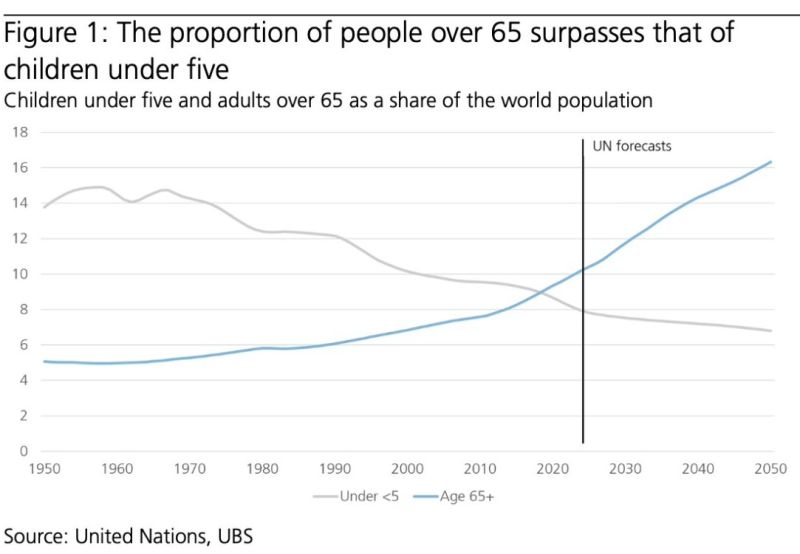

More seniors than toddlers — a turning point in demographics

Slow, steady, and unstoppable—like a glacier—demographic shifts are quietly transforming economies and societies. UBS highlights how changing age structures, migration, and longevity are not just slow-moving backdrops but fundamental forces that will define markets, growth models, and policy choices for decades to come. A reminder that some of the most profound transformations happen quietly, in plain sight. source : ubs

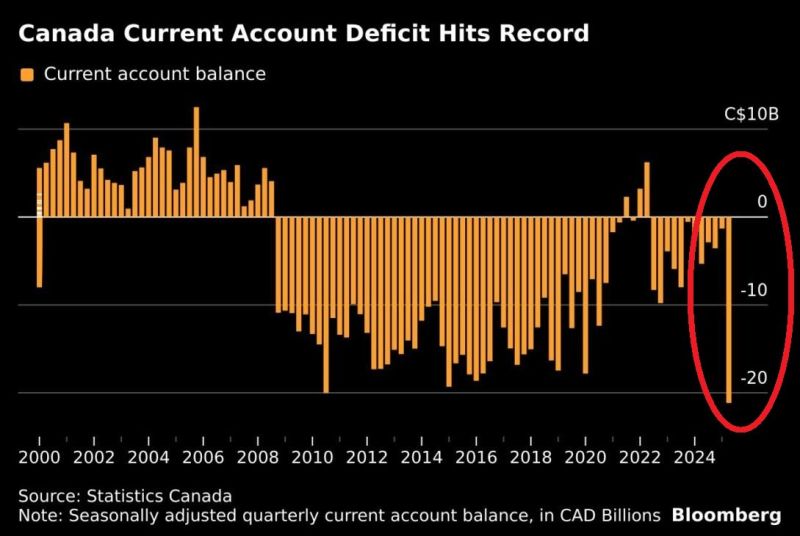

⚠️ Way more more money is flowing out of Canada than coming in

Canada’s current account deficit reached C$21.16 billion in Q2 2025, AN ALL-TIME HIGH. Additionally, trade deficit in goods widened to a record C$19.6 BILLION. US tariffs seem to be hurting Canada's economy. Source: Global Markets Investor, Bloomberg

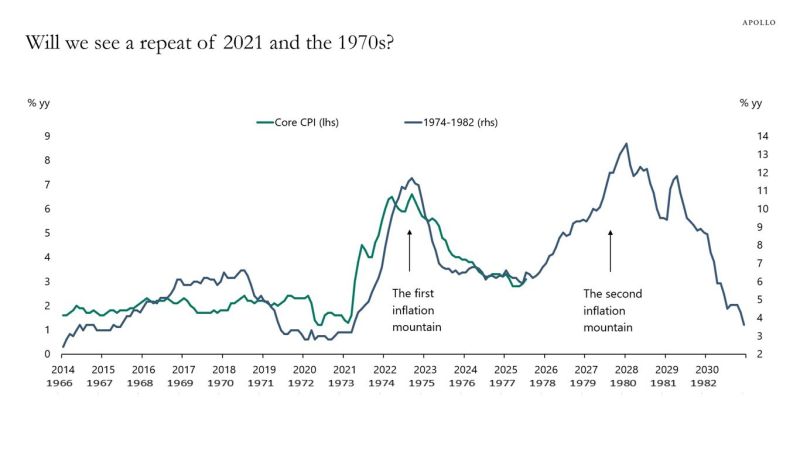

Apollo: "Yes tariffs are inflationary - so too is a US dollar depreciation - that results in a coming inflation mountain"

See chart below inflation 2021 cycle relative to 1970s. Source: Apollo, Samantha LaDuc on X

2 similar headlines in the same week... but by the way, could the imf rescue them at the same time?

Can they really afford it???

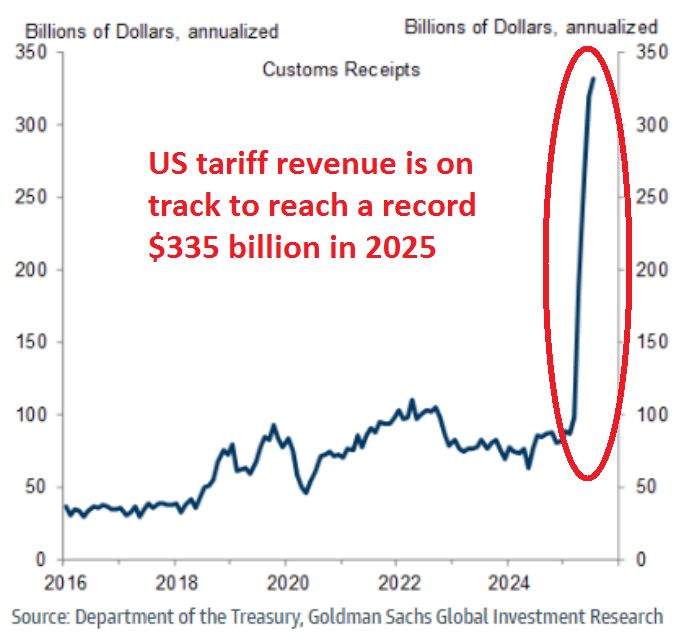

US tariff revenue is skyrocketing

Annualized tariff revenues have hit a record $335 billion. This is more than triple the average seen in previous years. So far in August, collected customs and duties have reached $22.5 billion. Source: Global Markets Investor @GlobalMktObserv

In case you missed it...

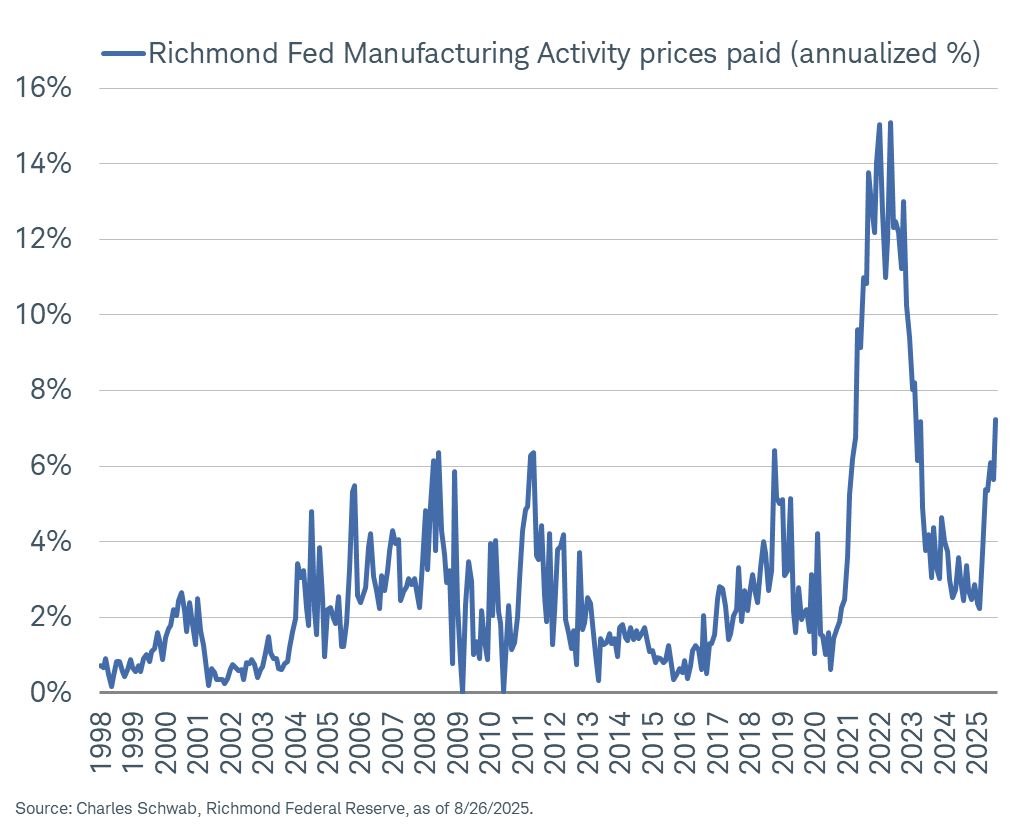

Prices paid component in Richmond Fed Manufacturing Index spiked in August... highest since February 2023. Source: Kevin Gordon @KevRGordon

Investing with intelligence

Our latest research, commentary and market outlooks