Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

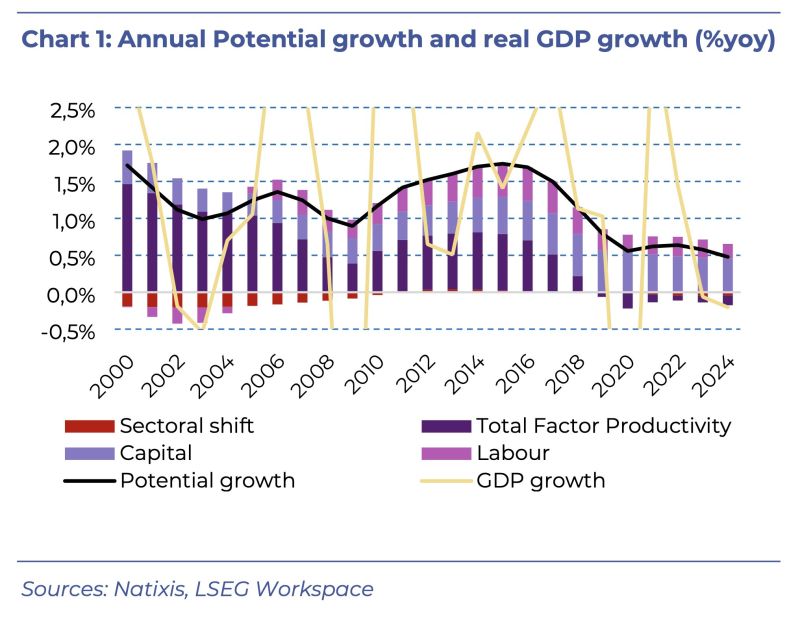

In Germany, potential economic growth has dropped to just 0.5%, mainly because of falling productivity.

The last time Germany saw potential growth above 1% was back in 2018 — also the last year when productivity made a positive impact. For the new government to hit its target of lifting potential growth above 1% again, reviving productivity will be crucial, especially as the workforce continues to shrink. (Source: Natixis thru HolgerZ)

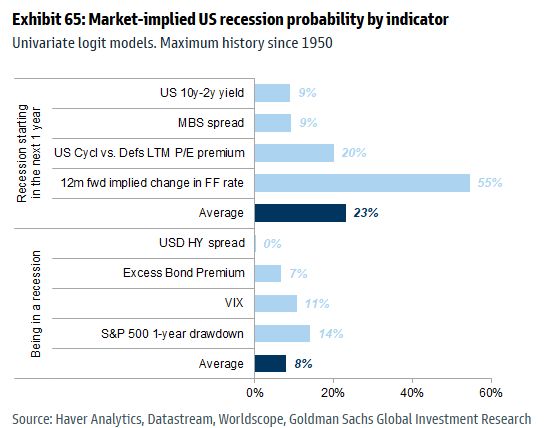

Market-implied US recession chance: 23% (within the next year)

Source: Mike Zaccardi, CFA, CMT, Goldman Sachs

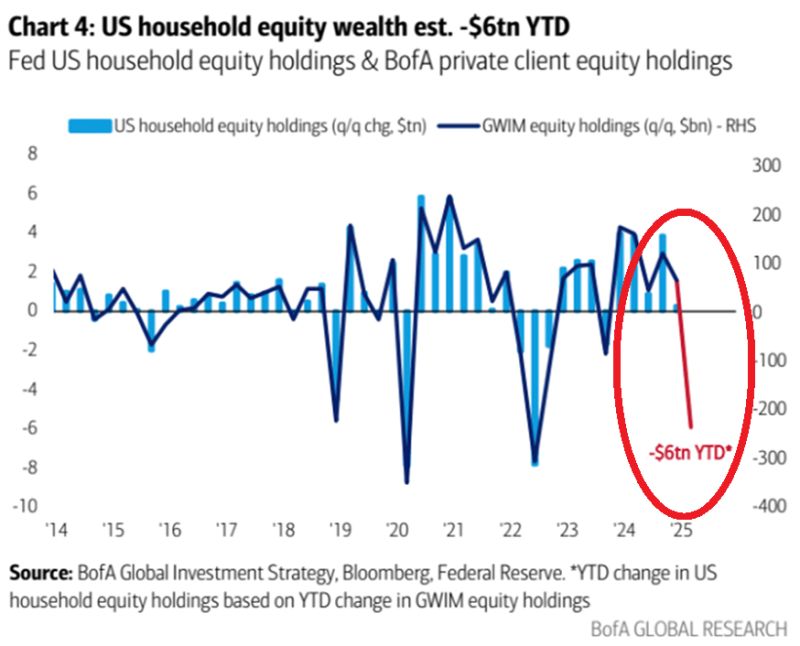

⚠️MASSIVE amount of US household wealth has been lost:

US household equity wealth has likely dropped by $ TRILLION year-to-date, the most in 3 YEARS. This may lead to further pullback in consumer spending as the top 10% account for 50% of total consumer expenditures. Source: BofA

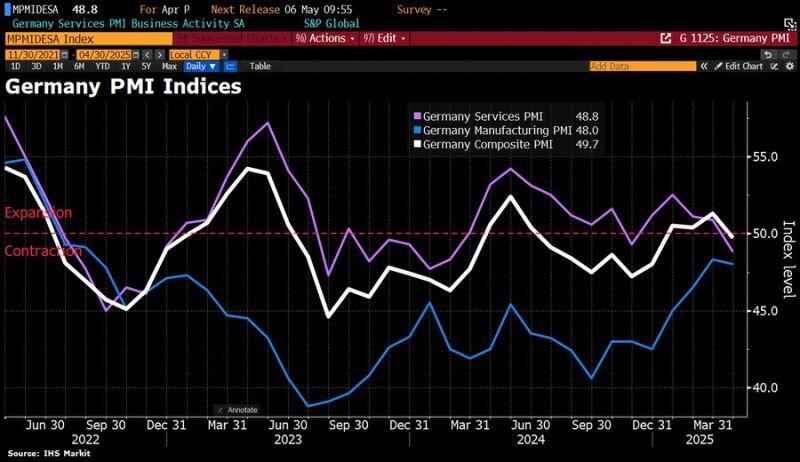

In Germany, the private sector just shrank for 1st time in 4 months.

According to S&P Global, the Composite PMI (a key economic indicator) fell to 49.7 in April, dropping below the critical 50 mark that separates growth from contraction. The services sector was hit especially hard, with its index tumbling to 48.8 – the lowest in 14 months. This drop reflects growing worries about tariffs, as well as broader concerns around Germany’s economic and political future. This unexpected decline adds to an already grim outlook for the German economy, which is considered particularly exposed to global trade tensions. The IMF is now forecasting stagnation for Germany this year. Source: HolgerZ, Bloomberg

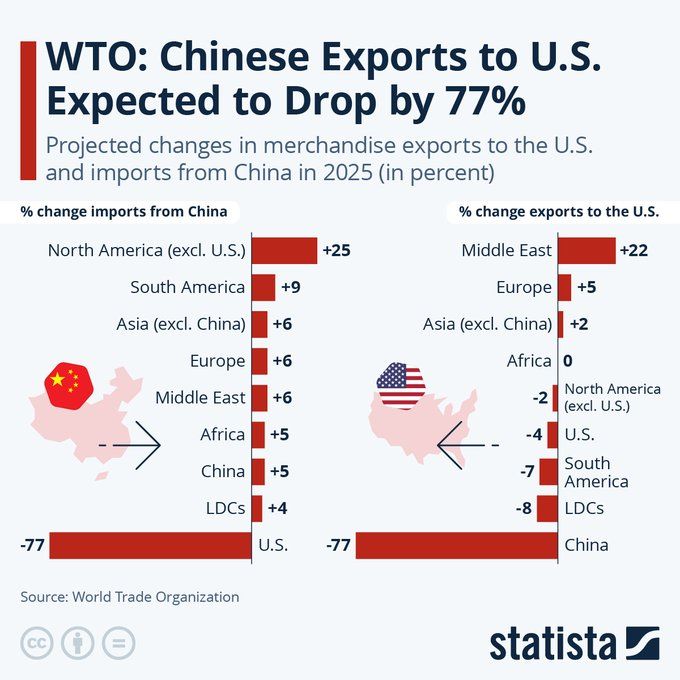

Chinese exports to the United States are expected to fall by 77 percent in 2025, according to World Trade Organization forecasts.

Meanwhile, Chinese imports are expected to increase to every other market, with the rest of North America predicted to see growth of 25 percent. Source: Statista @StatistaCharts

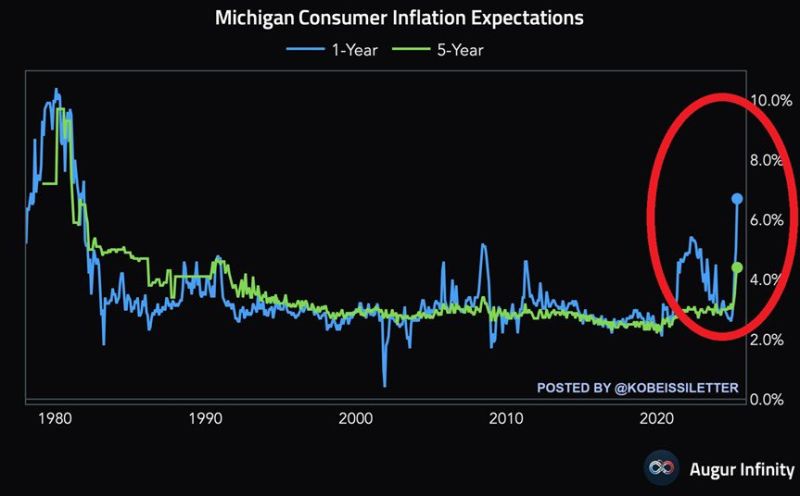

US inflation expectations continue to climb…

In April, 1-year inflation expectations surged by 1.7 percentage points to 6.7%, the highest level since November 1981 (h/t @KobeissiLetter), Augur infinity

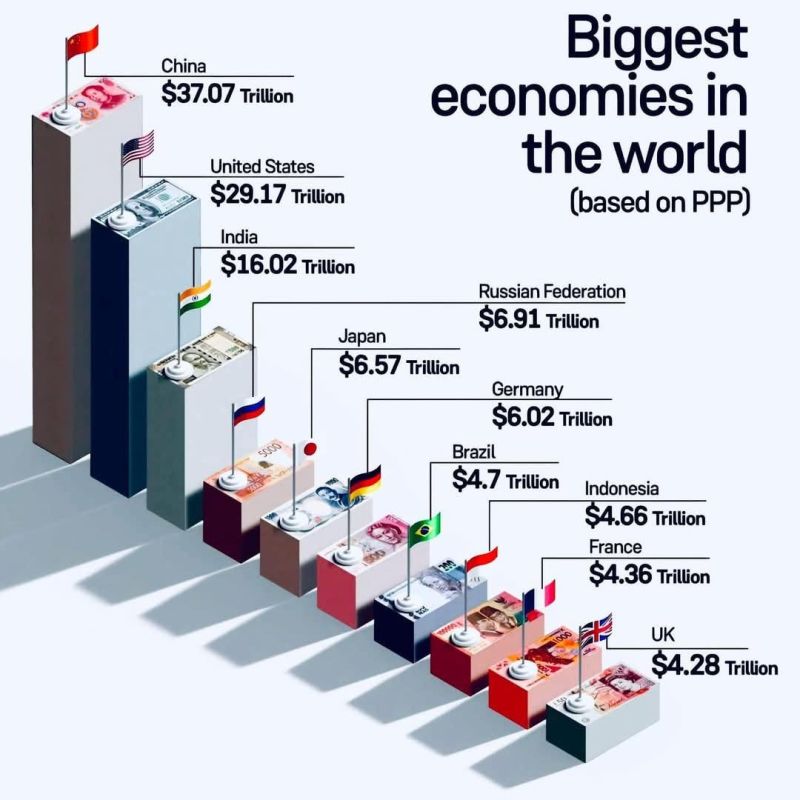

The world’s biggest economies based on purchasing power parity (PPP), not nominal GDP — according to the IMF.

(PPP adjusts for cost of living and inflation, so it reflects what people can actually buy in their own countries — not just raw dollar totals.) Source: Wall St Engine on X

Investing with intelligence

Our latest research, commentary and market outlooks