Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

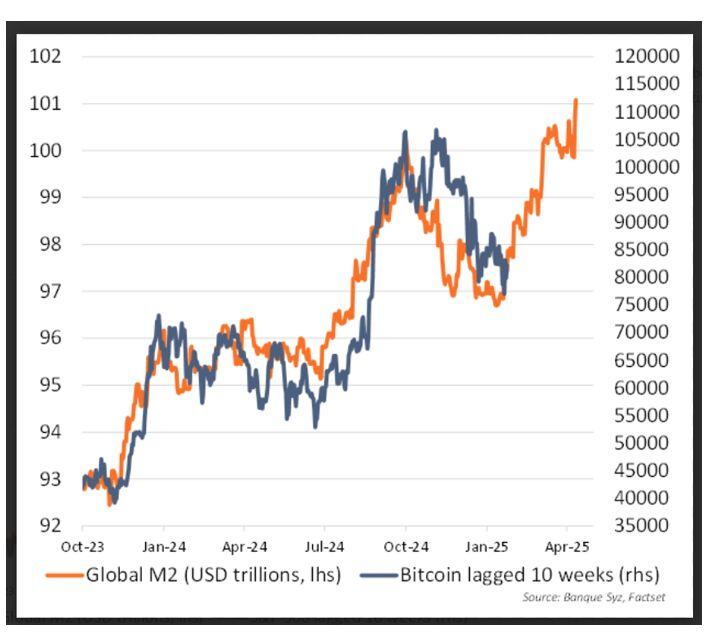

Global M2 (in orange) vs bitcoin lagged 10 weeks (in blue)

M2 proxy vs BTC continues to hold. Could the surge in Global M2 push $BTC to new highs?

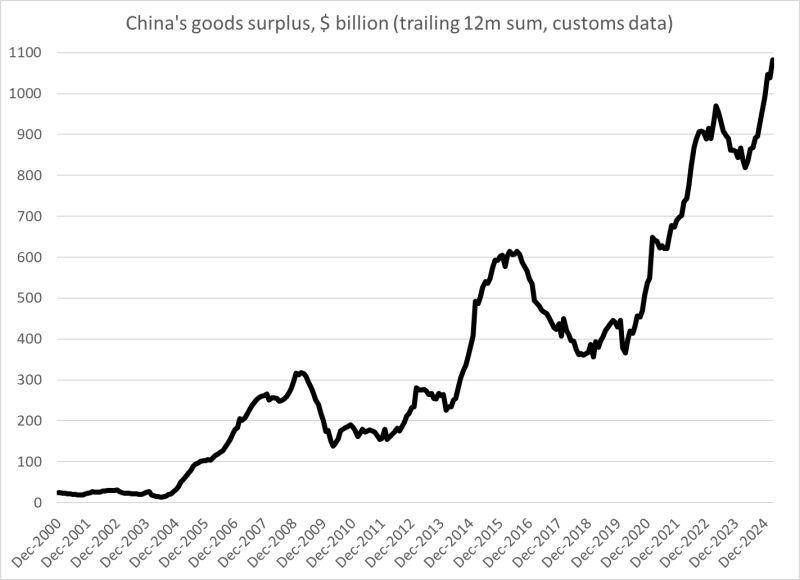

Crazy numbers coming out of China

A $100 billion (goods) surplus in March, a $275 billion goods surplus for q1 (up from $185 billion last year) and a surplus of nearly $1.1 trillion over the last 4 quarters... The easy explanation is tariff front running. But it seems "too easy" as an explanation. China's exports to the US and the EU look identical -- and there is no "reciprocal" tariff threat out of the EU. Same story with emerging markets: more exports and fewer imports. Source: Brad Setser @Brad_Setser on X

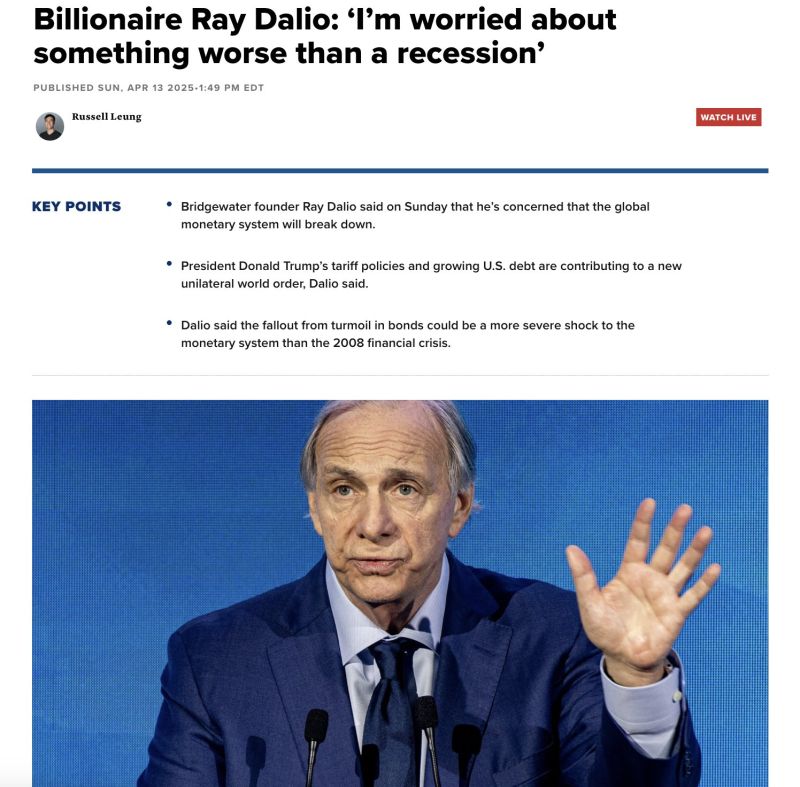

BILLIONAIRE RAY DALIO: ‘I’M WORRIED ABOUT SOMETHING WORSE THAN A RECESSION’ - CNBC

“Right now we are at a decision-making point and very close to a recession,” Dalio said on NBC News “And I’m worried about something worse than a recession if this isn’t handled well”

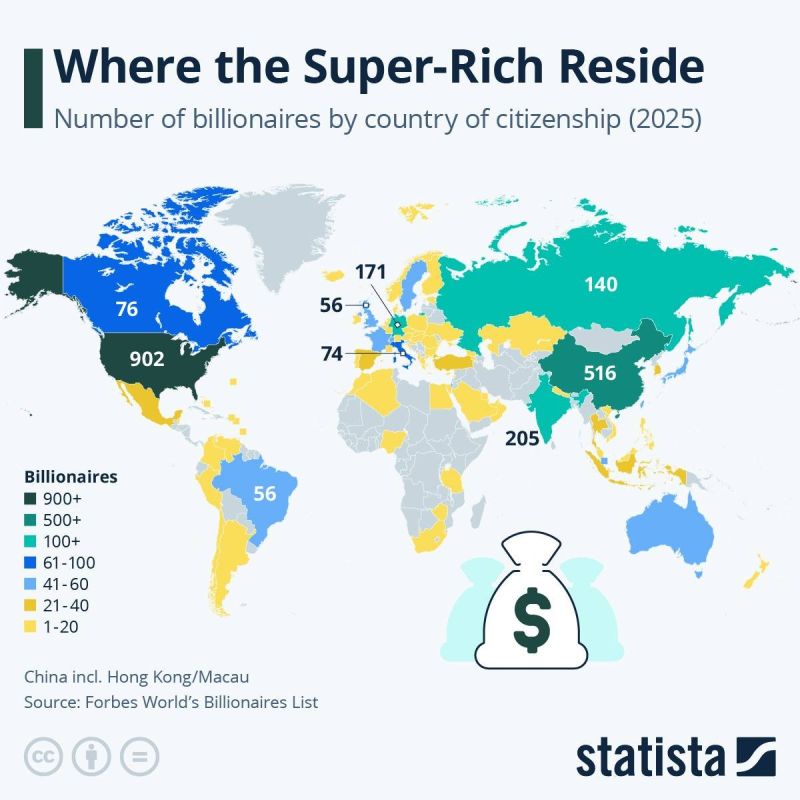

AMERICA STILL RULES BILLIONAIREVILLE—BUT LOOK WHO’S CLOSING IN...

The US has 902 billionaires in 2025, holding the crown as the planet’s top luxury zip code for the super-rich. But China (yes, including Hong Kong and Macau) isn’t exactly playing small—it’s up to 516 and catching up fast. India’s creeping in with 205, while the rest of the billionaire club is scattered across Europe, Russia, and a few surprise players like Brazil and Canada, each with 56. Moral of the story? The money’s global—but it mostly speaks English and Mandarin. Source: Statista thru Mario Nawfal

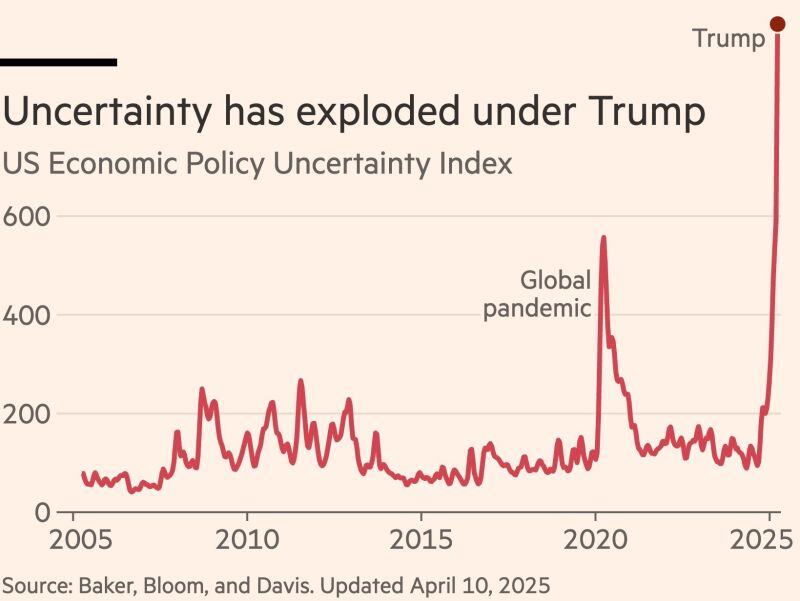

From the behavior of a Developed Market to that of an Emerging Market in just one week?

Witnessing such a rare disconnect between the USD index (dark line) and US Treasury yields (blue line) is truly intriguing. Source: Andreas Steno Larsen

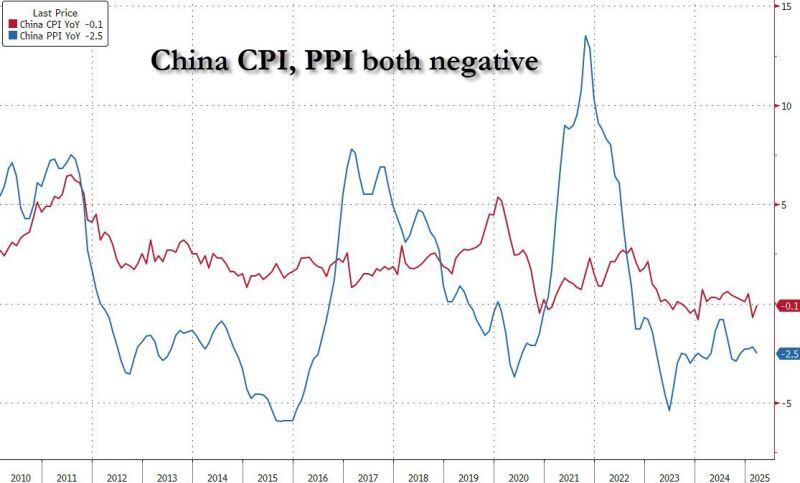

China remains in deflation

*CHINA MARCH CONSUMER PRICES FALL 0.1% Y/Y; EST. 0% *CHINA MARCH PRODUCER PRICES FALL 2.5% Y/Y; EST. -2.3% Trade war with the US won't help Source: zerohedge @zerohedge

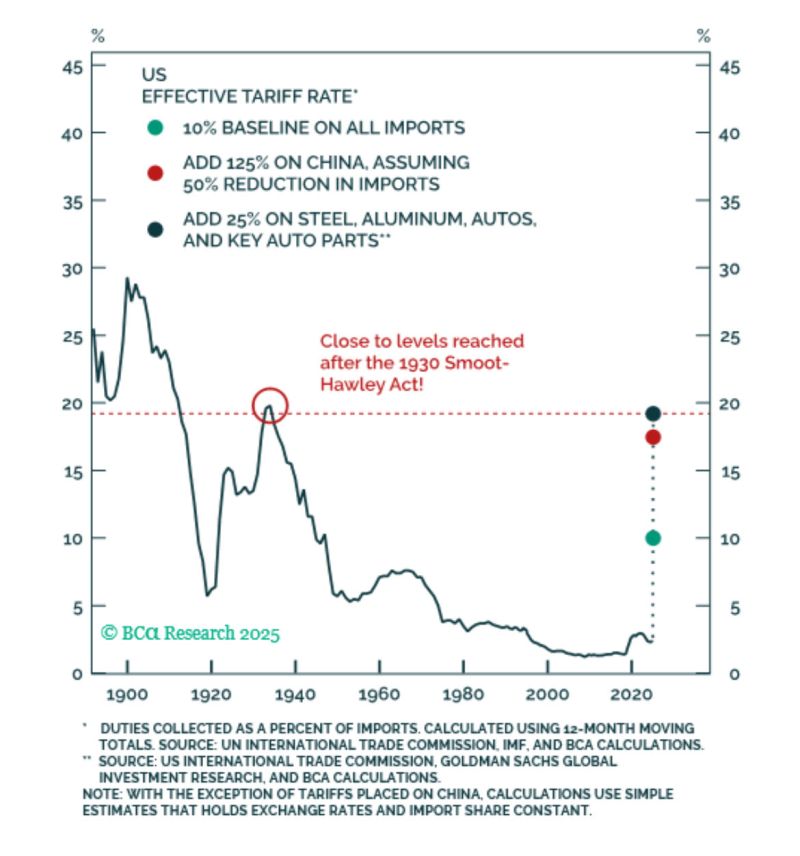

Sorry folks, but even after today’s flip-flop, we’re still looking at the biggest tariffs since the 1930s.

Source: BCA thru Peter Berezin

Investing with intelligence

Our latest research, commentary and market outlooks