Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

VanEck confirms that China and Russia are settling energy trades in Bitcoin.

Has De-dollarization already started?

The World's biggest Importers

Source: Visual Capitalist

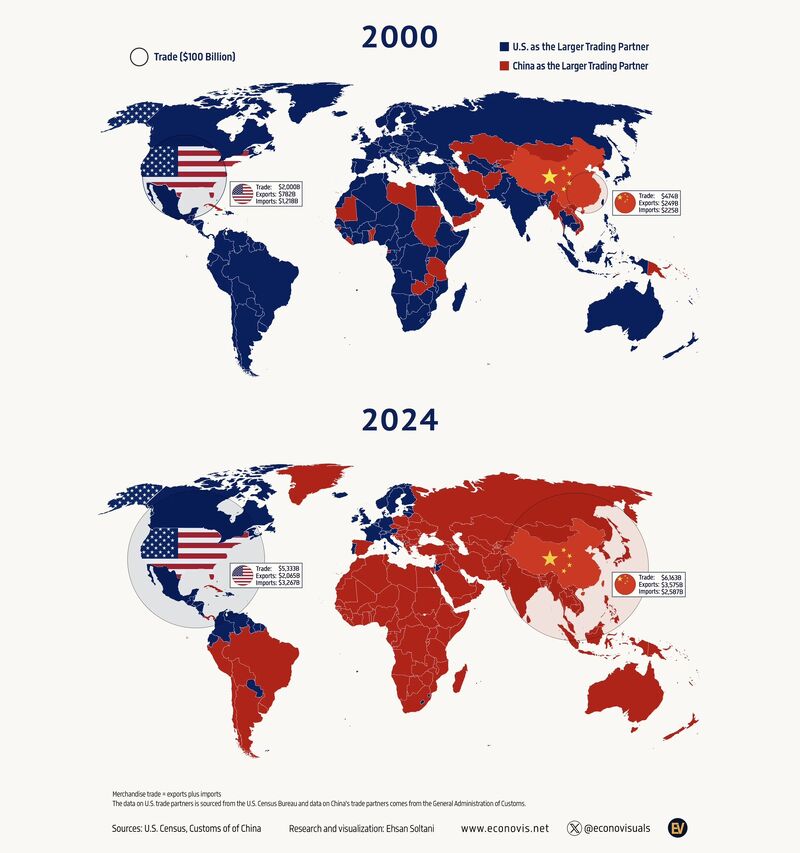

Today's global trade reality.

In Blue -> Countries for which the US is the largest trading partner In Red -> Countries for which china is the largest trading partner (as measured by exports + imports)

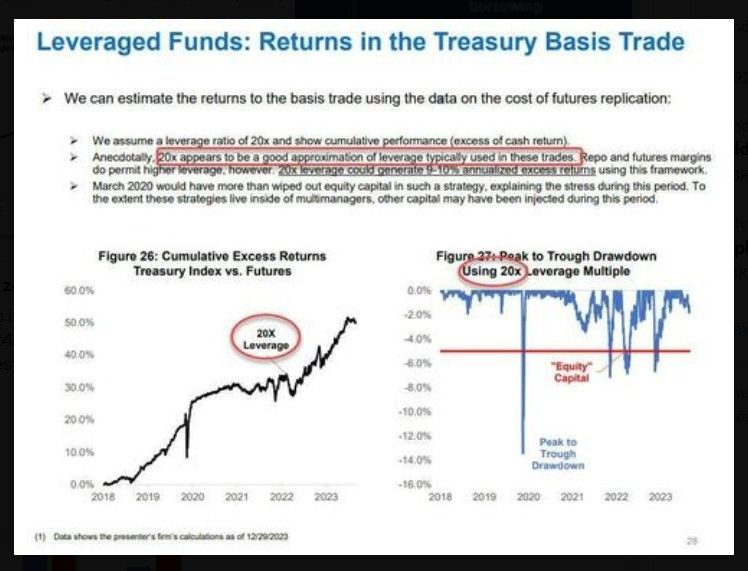

Do you remember LTCM???

According to a zerohedge article, the leverage on Treasury basis trades - which is by far the most popular trade among big hedge funds - is anywhere between 20x (Treasury Board Advisory Committee estimate) and 56x (Fed estimate); on a VaR basis LTCM was an amateur... Source: www.zerohedge.com

😨 What is the SOFR 3Y Swap spread trying to tell us???

➡️ The SOFR 3Y swap spread refers to the difference between the 3-year U.S. Treasury yield and the fixed leg of a 3-year SOFR interest rate swap. SOFR (Secured Overnight Financing Rate) is a benchmark interest rate based on overnight loans collateralized by U.S. Treasuries. It replaced LIBOR as the primary benchmark for U.S. dollar interest rate derivatives. 🔍 Why does it matter? 👉 A positive spread suggests higher credit/liquidity risk in the swap market relative to Treasuries. 👉 A negative spread can suggest technical factors, strong demand for Treasuries, or dislocations in the market. 🔴 Powell may pretend he doesn't need to get involved, but the market is about to force him doing so... Source: zerohedge

Ray Dahlio

"Don't Make the Mistake of Thinking That What's Now Happening is Mostly About Tariffs" "At the moment, a huge amount of attention is rightly being paid to the newly announced tariffs and their significant impacts on markets and economies. But very little attention is being paid to the circumstances that caused them—and to the even bigger disruptions likely still ahead. Don’t get me wrong: these tariff announcements are important developments. But most people are overlooking the much larger forces that are driving just about everything, including the tariffs. In my latest article, I discuss what I believe is far more important to keep in mind: we’re witnessing a classic breakdown of the major monetary, political, and geopolitical orders. This kind of breakdown happens only once in a lifetime—but it has happened many times in history, when similarly unsustainable conditions were in place".

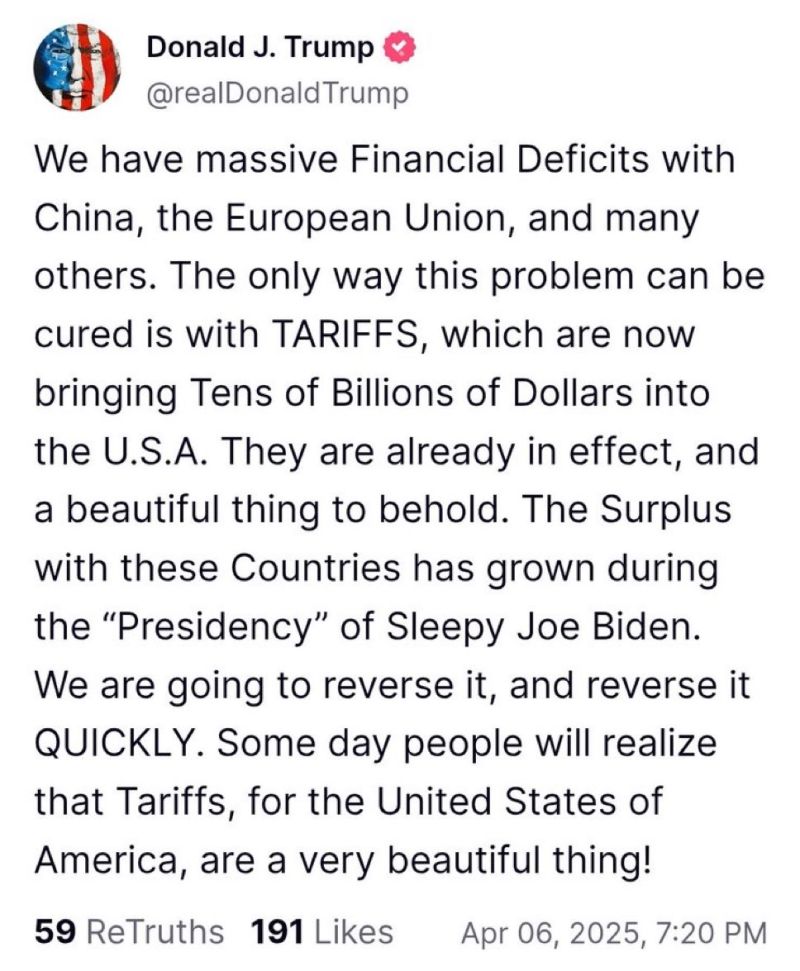

He seems to be going all-in...

And the market doesn't like it 😨 🔴 Dow Futures are down 1,000 points and Asia, Cryptos are a bloodbath

Investing with intelligence

Our latest research, commentary and market outlooks