Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

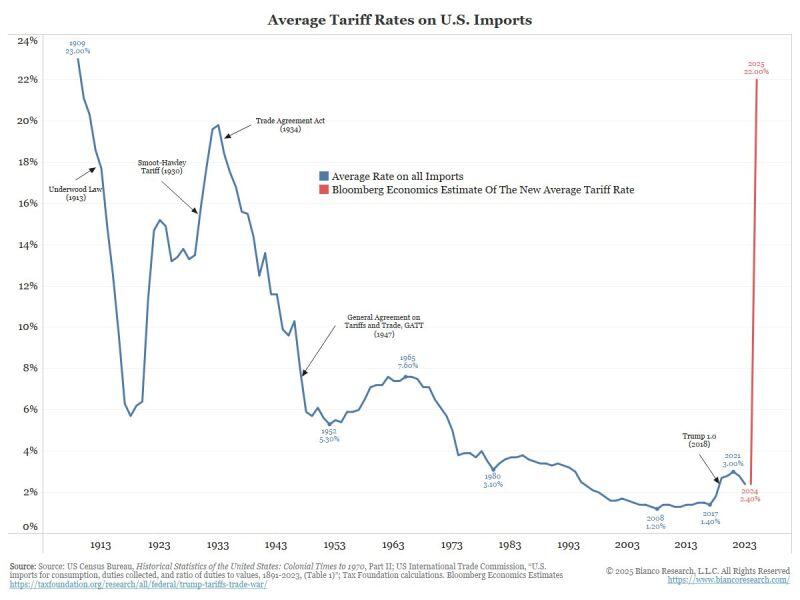

Bloomberg Economics estimates that the average tariff rate the US charges on around $3T of imported goods will now go up to 22%- the highest in a century

But remember, this is NOT a final number. Many things can happen. - China could negotiate a deal (or try to absorb the shock via more stimulus and weakening of the Yuan) - The EU could chose to retaliate - and the US escalates... - How will the rest of the world respond is very uncertain as well Expect a new high in the economic uncertainty index and lots of volatility ahead Source: chart: Bianco Research

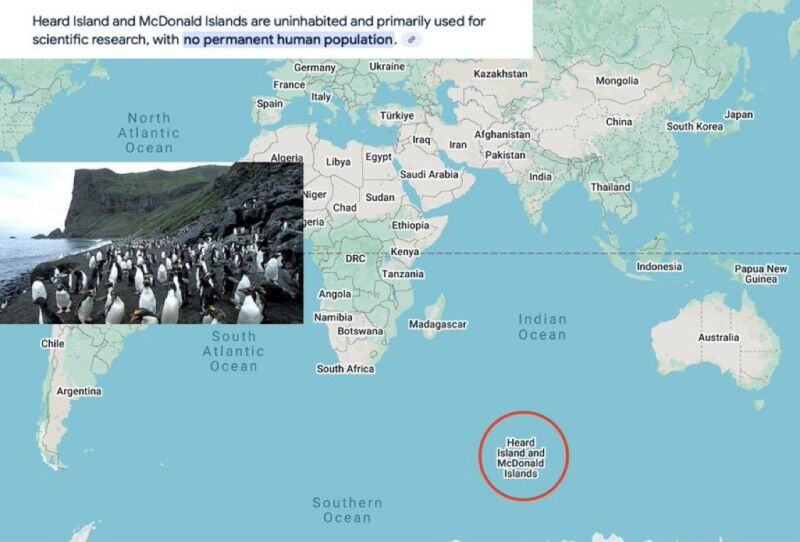

U.S. President Trump imposed a 10% tariff on Heard and McDonald Islands—uninhabited except for penguins.

Source: Clash Report @clashreport

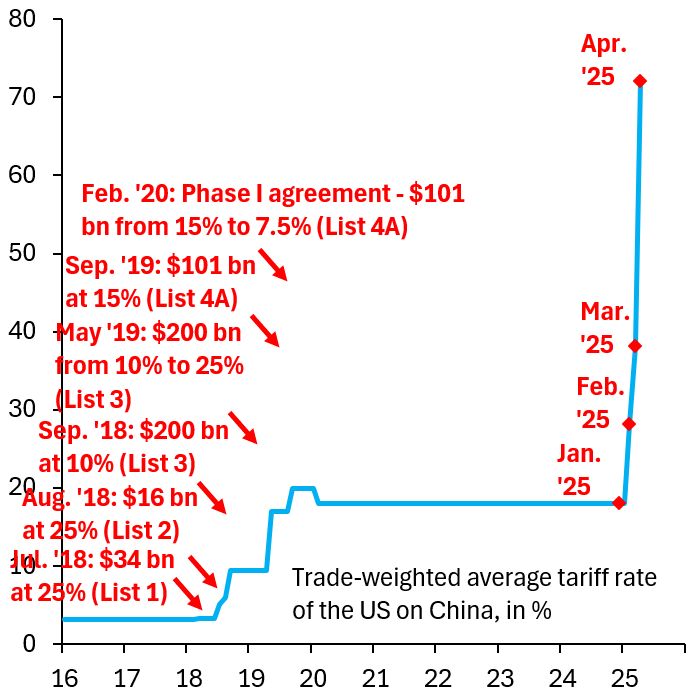

If the 34% tariff is on top of previous tariffs, China's average tariff rate is up 54 ppts this year, swamping what was done in President Trump's first term.

Question: How will China react? If China devalues the Yuan, that could trigger a major risk-off across the world... Source: Robin Brooks

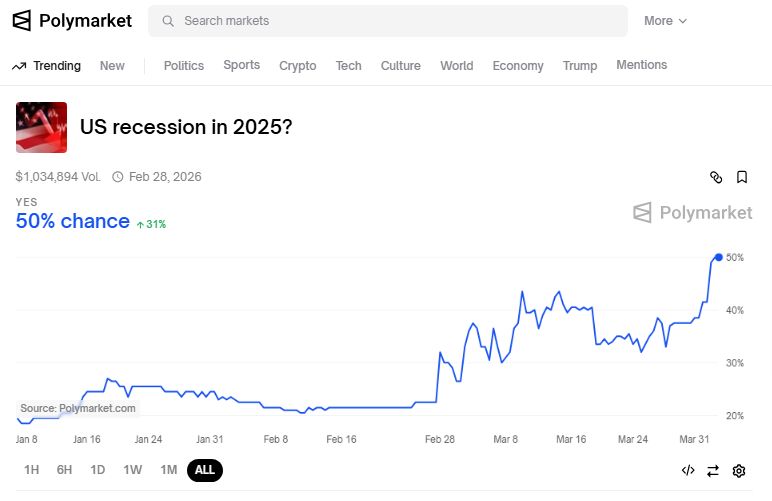

JUST IN 🚨:

The odds of a U.S. Recession occurring this year just soared to 50% on Polymarket 👀 Source: Barchart

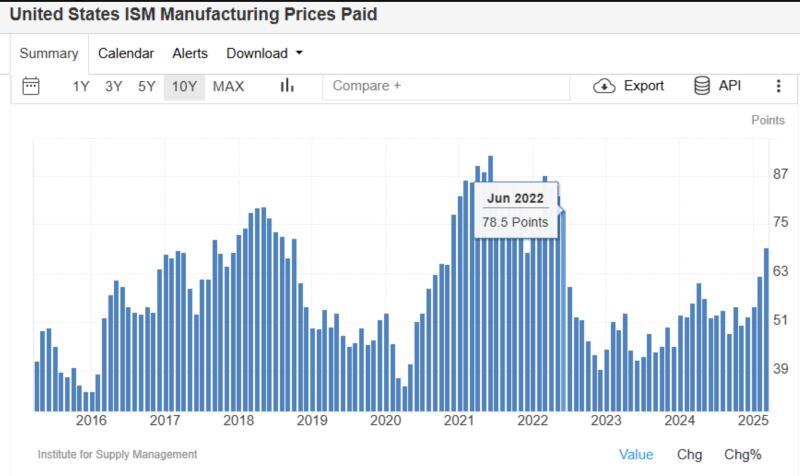

ISM Manufacturing Priced Paid at 69.4 - Highest since inflation's peak in June 2022

Source: Mike Zaccardi, CFA, CMT, MBA

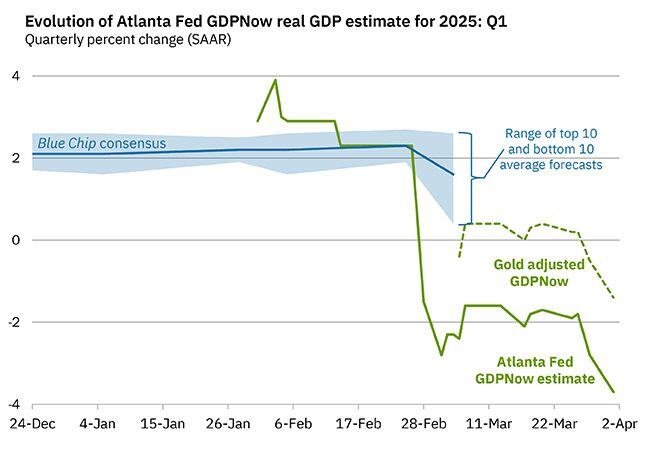

On April 1, the GDPNow model nowcast of real GDP growth in Q1 2025 is -3.7%.

Adjusting for gold imports, the model now sees -1.4% GDP contraction in Q1 2025. Just 2 months ago, they saw GDO growing by +3.8% in the same period...

The Truflation US YoY inflation rate dropped from 1.76% to 1.38% — a considerable decline driven by key categories.

Which categories and sub-categories are driving the drop? 👉 Housing – all 3 subcategories are cooling: • Rented dwellings • Owned dwellings • Other lodging 👉 Transport – vehicle prices and other vehicle expenses are falling, even as gasoline edges up. Truflation continues to capture shifts in inflation dynamics in real time — well ahead of official data. Reminder: Over the past 3 months, the Truflation index has dropped from 3.11% to 1.38%. Is the Fed paying attention?

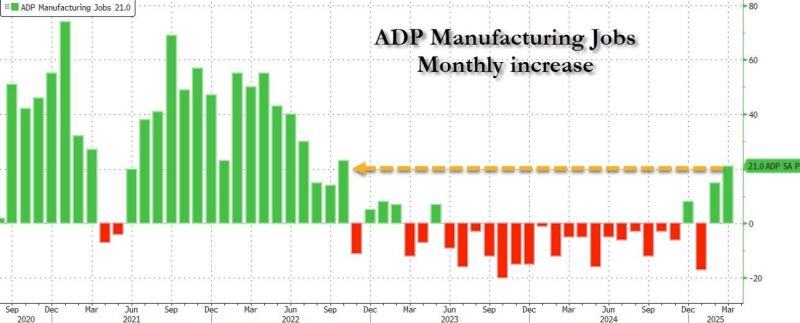

Is Trump's plan to reshore manufacturing already working?

This is the biggest increase in manufacturing jobs since October 22, which was followed by a 2 year manufacturing recession. Source: Bloomberg, www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks