Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

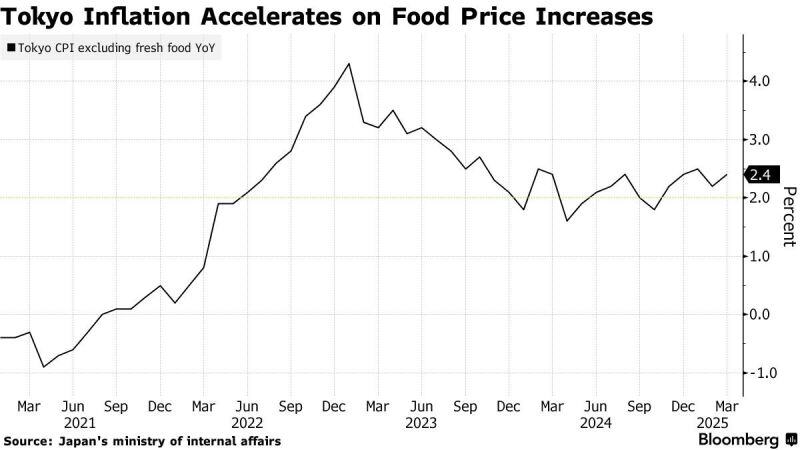

Japan | Tokyo inflation exceeds forecasts, keeping BOJ on rate hike path

- Bloomberg

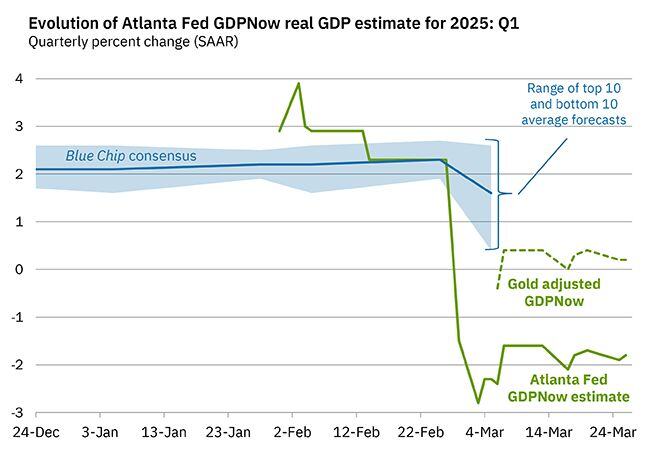

On March 26, the GDPNow model nowcast of real GDP growth in Q1 2025 is -1.8%

The alternative model forecast, which adjusts for imports and exports of gold, is 0.2%. Source: AtlantaFed

US tariffs on April 2nd: Will it be not as bad as expected?

A “Trump put” ahead? Some articles caught a lot of bullish notice this weekend. S&P Futures are going UP this morning Source: Bloomberg, WSJ

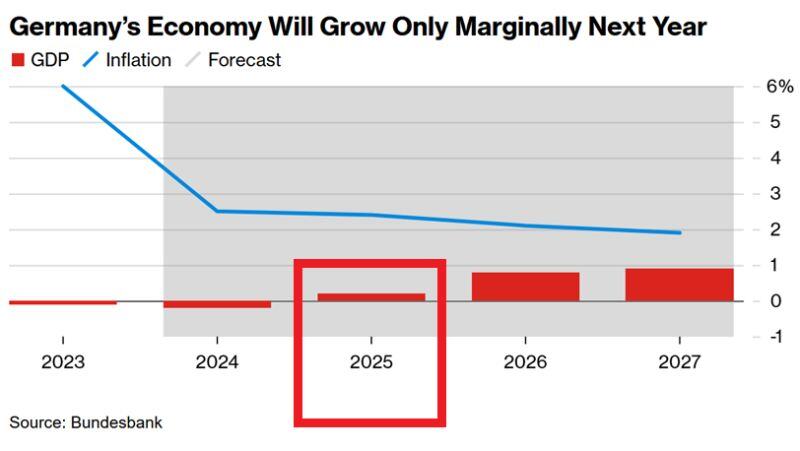

⚠️German economic outlooks remains DIRE:

In 2024 the world's 3rd largest economy FELL by 0.2% following a 0.3% decline in 2023. This is the 2nd time since 1950 that GDP contracted for 2 years in a row. German IFO Economic Research Institute expects just 0.2% growth in 2025. Source. Global Markets Investor

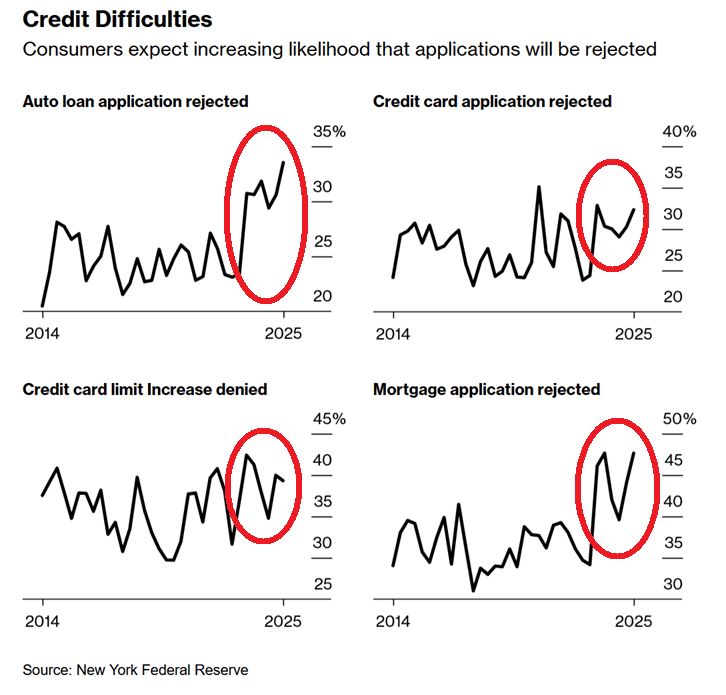

Americans expect credit application REJECTIONS at a higher rate than ever:

The perceived likelihood of credit application rejections: Auto loan: 34%, the highest on record Mortgage: 48%, the highest on record Credit card: 32%, the 3rd-highest ever Card limit increase: 39% Source: Global Market Investors, Bloomberg

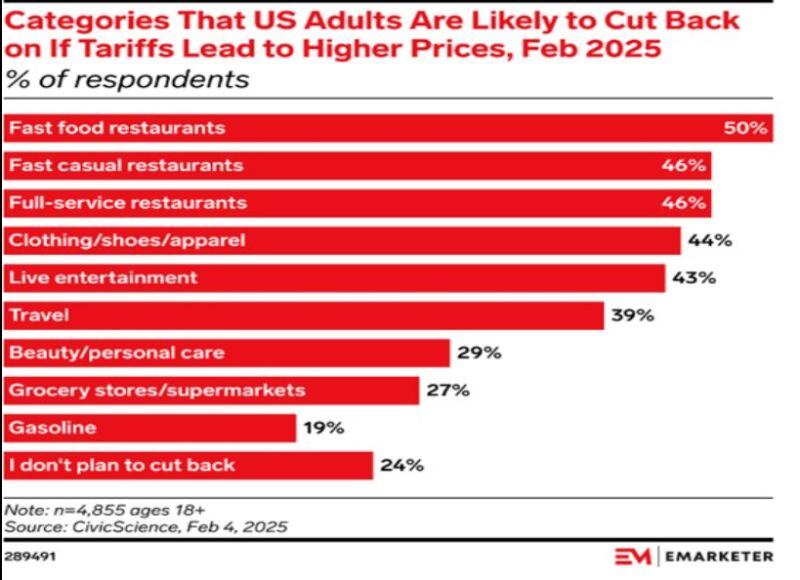

Categories that US adults are likely to cut back on if tariffs lead to higer prices

source : emarketer

The OECD published its latest economic outlook on Monday, downgrading its global growth projections for 2025 and 2026 in light of various political and economic uncertainties.

Source: Statista

Swiss Government Lowers Growth Forecasts Ahead of SNB Decision

The Swiss government has trimmed its economic growth outlook for 2025 and 2026, citing global trade tensions. SECO now expects: 📉 2025 GDP: 1.4% (previously 1.5%) 📉 2026 GDP: 1.6% (previously 1.7%) While growth remains below the long-term average of 1.8%, Switzerland is still expected to avoid a recession. This adjustment comes just before the Swiss National Bank’s policy decision on Thursday—a key event to watch. source : reuters

Investing with intelligence

Our latest research, commentary and market outlooks