Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

February inflation data is out…

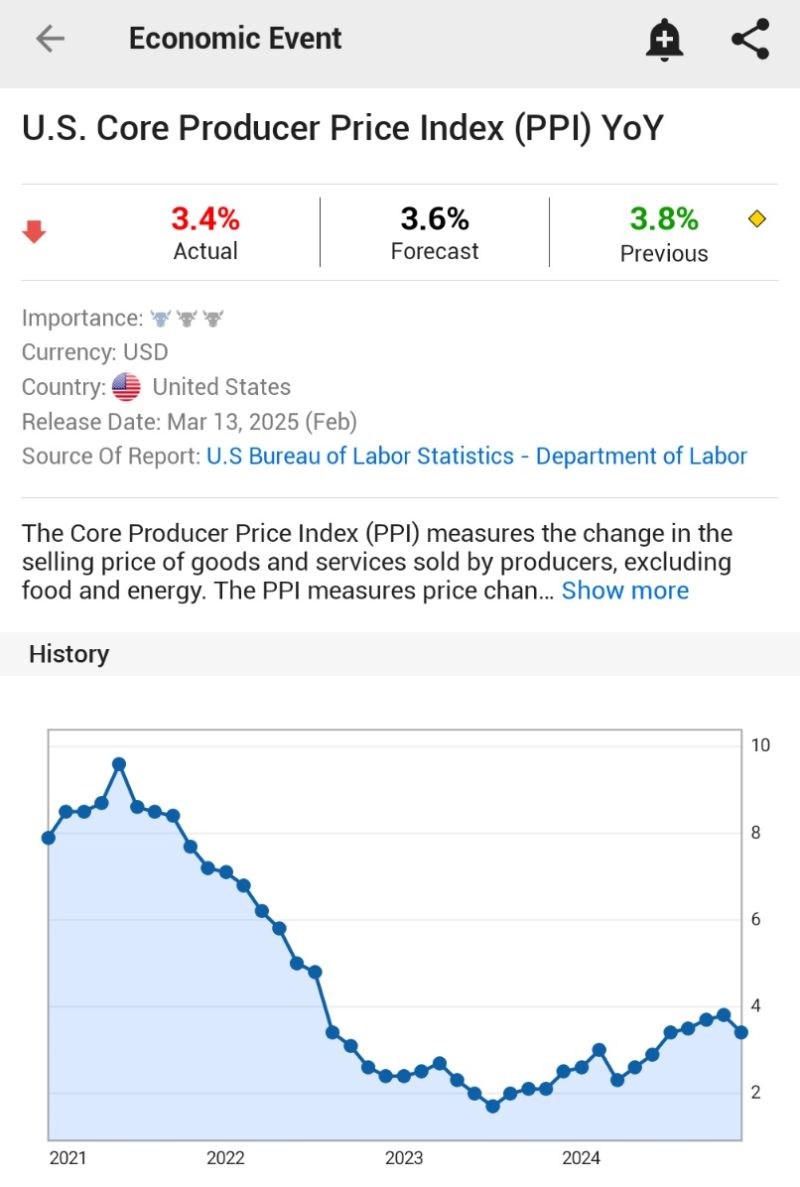

• PPI 3.2% YoY, (Est. 3.3%) • PPI 0% MoM, (Est. 0.3%) • PPI Core 3.4% YoY, (Est. 3.5%) • PPI Core -0.1% MoM, (Est. 0.3%)

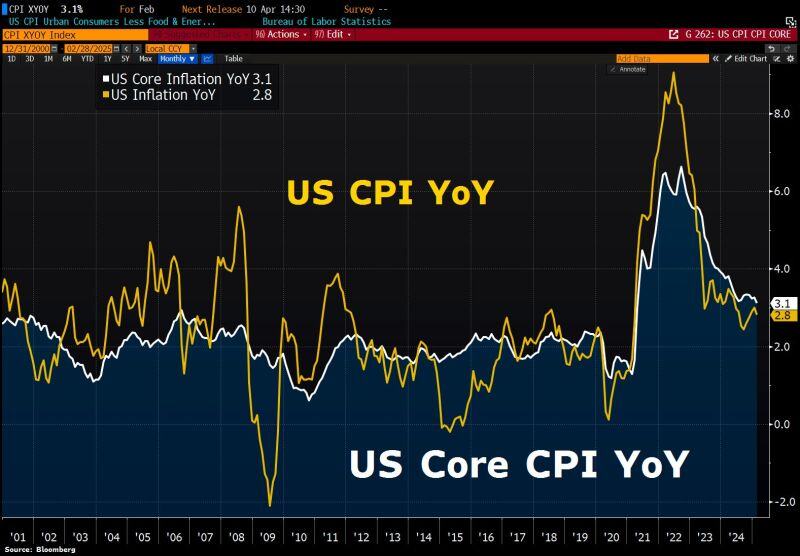

US inflation comes in lower than forecast:

Headline CPI slows to 2.8% in Feb from 3% in Jan, smallest since Nov2024, Core CPI cools to 3.1%, lowest since Apr2021. Housing inflation cools; airfares and pump prices drop. BUT: Inflation data doesn’t yet reflect tariff impact. Source: HolgerZ, Bloomberg

Here are the countries that own the most US debt

Source: Visual Capitalist

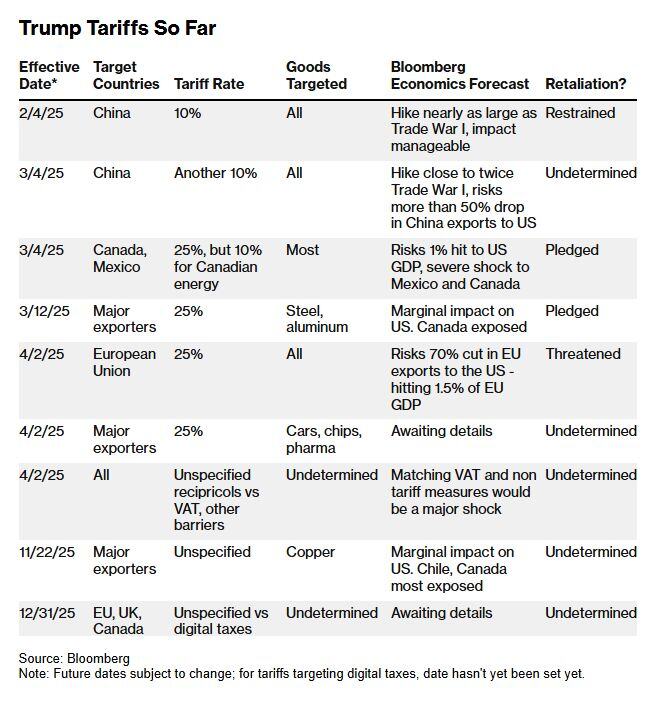

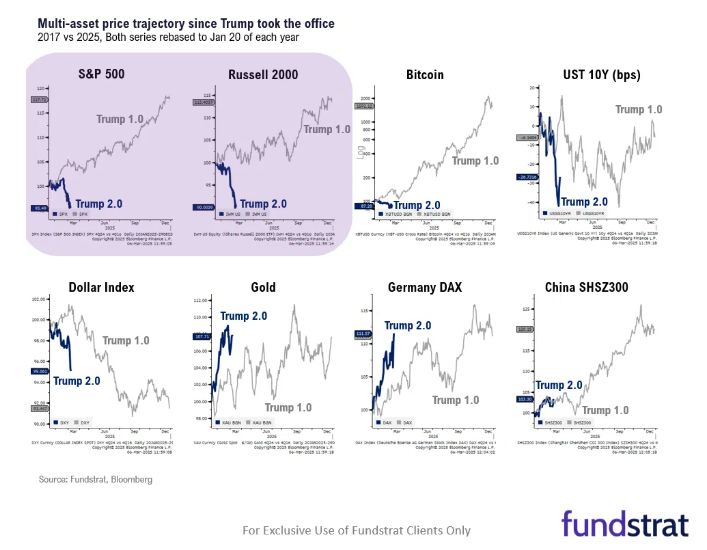

Trump 2.0 vs. Trump 1.0

The full market picture by Fund Strat Interesting to link this to Trump's comments yesterday on FoxNews: "There could be a little disruption (…) Look, what I have to do is build a strong country. You can't really watch the stock market. If you look at China, they have a 100 year perspective. We go by quarters. And you can't go by that”. Not the same kind of Trump's put than in 2017...

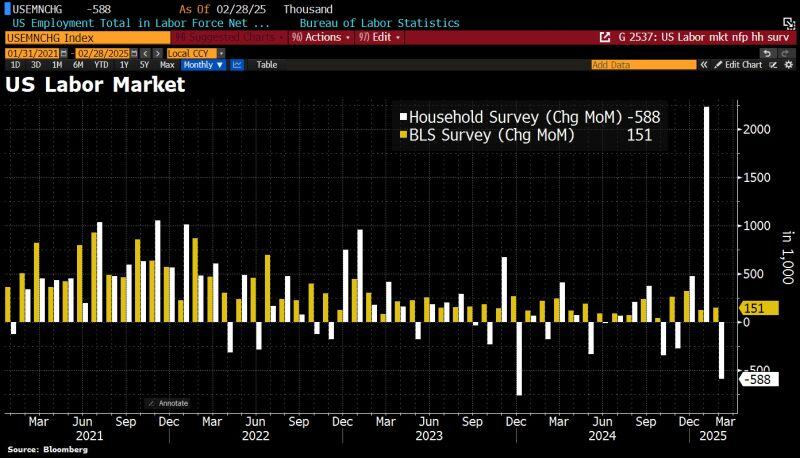

The US labour market is on recession alert as job market cools with large discrepancies between establishment survey and household survey.

👉 The establishment survey showed 151,000 new jobs in Feb, LESS than expected. 👉 According to the household survey, 588,000 jobs were cut in Feb, which is why the unemployment rate has risen to 4.1%, although the participation rate has also fallen from 62.6% to 62.4%. Source: HolgerZ, Bloomberg

BREAKING: US February NFP lower than expected!

➡️ Nonfarm Payrolls 151K (est. 160K, prev. 125K) ➡️ Private Nonfarm Payrolls 140K (est. 142K, prev. 81K) ➡️ Unemployment rate 4.1% (est. 4.0%, prev. 4.0%) ➡️ Average hourly earnings YoY 4.0% (est. 4.1%, prev. 3.9%) ➡️ Labor force participation 62.4% (est. 62.6%, prev. 62.6%) Source: Jayanth Ukwaththa on X, US Bureau of Statistics

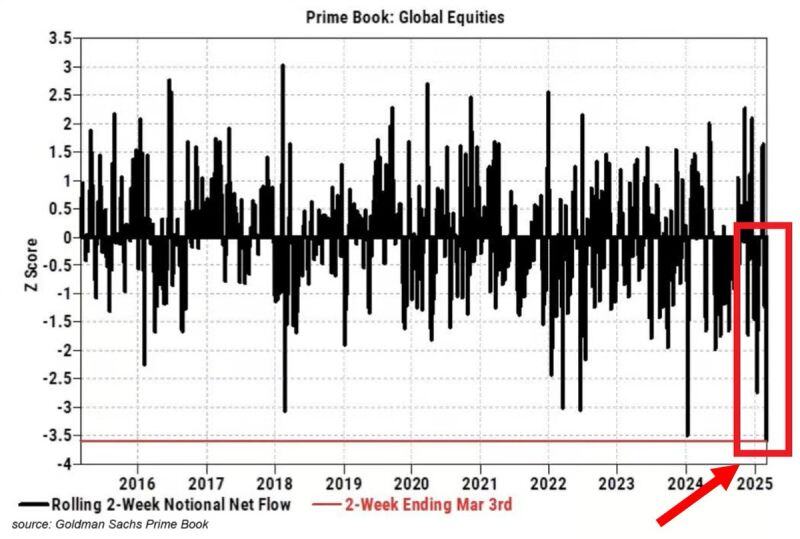

🚨HOLY COW: Hedge funds dumped global stocks at the fastest pace on RECORD over the last 2 weeks.

The majority of sales were in US equities and were even larger than during the 2022 BEAR MARKET. Meanwhile, sp500 and Nasdaq 100 are down 'just' 6% and 9% since their peaks. Source: Global Markets Investor

Investing with intelligence

Our latest research, commentary and market outlooks