Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Ray Dalio: debt crisis could cause 'economic heart attack' for US economy in the next 3 years

In an interview with Bloomberg's Odd Lots podcast published Monday, Dalio said the US is on the brink of experiencing an "economic heart attack" within the next three years if the administration does not commit to actively reducing the deficit, which now makes up about 7.5% of GDP.

It seems that the market didn't like this chart at all

(ISM Manufacturing New orders & Price Paid) Source: Bloomberg, RBC

Some much needed liquidity is coming...

The TGA (Treasury General Account) is finally getting depleted Here comes the flood: Treasury injects avalanche of cash into the economy ($170BN in 3 days, the most since covid) as debt ceiling extraordinary measures are exhausted. Could this prop up risk? What is the Treasury General Account and why it matters? The TGA is used by the Treasury to hold cash to fund government operations. When the TGA balance is high, it means the Treasury is holding more cash than it is spending. This cash accumulation can occur due to higher-than-expected tax receipts or issuance of Treasury securities. Conversely, when the Treasury spends this cash, it injects liquidity into the financial system. Therefore, the TGA balance is a significant determinant of liquidity in global financial markets. Source: zerohedge

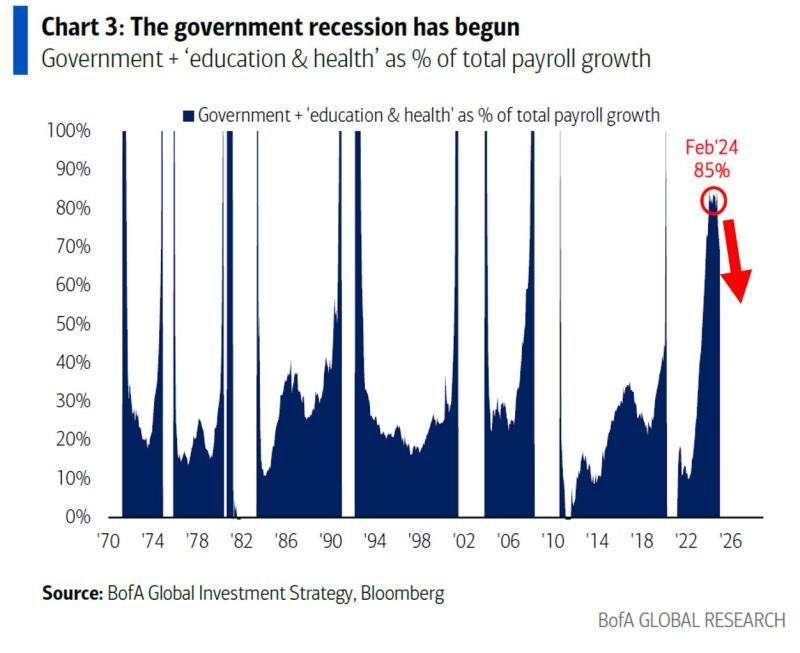

The US government RECESSION has begun:

Government + quasi-government education & health job addition accounts for ~70% of all payroll creation, down from ~85% in Feb 2024. It is expected this will fall even further in the coming months, meaning non-farm payrolls will weaken. Source: BofA

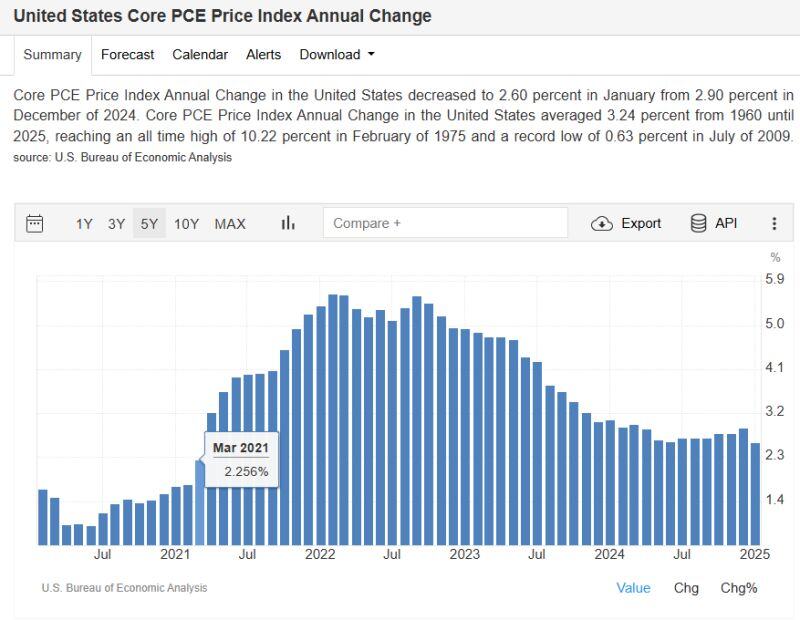

BREAKING - US INFLATION DATA RELEASED - Core PCE YoY 2.6% - lowest since March 2021

BULLISH! YoY Growth: PCE (Jan), 2.5% Vs. 2.5% Est. (prev. 2.6%) Core PCE, 2.6% Vs. 2.6% Est. (prev. 2.8%) MoM Growth: PCE (Jan), 0.3% Vs. 0.3% Est. (prev. 0.3%) Core PCE, 0.3% Vs. 0.3% Est. (prev. 0.2%) Source: @CyclesWithBach, Mike Zaccardi, CFA, CMT, MBA

U.S. pending home sales have fallen to a new all-time low

Worse than Covid. Worse than 2008. Source: Bloomberg

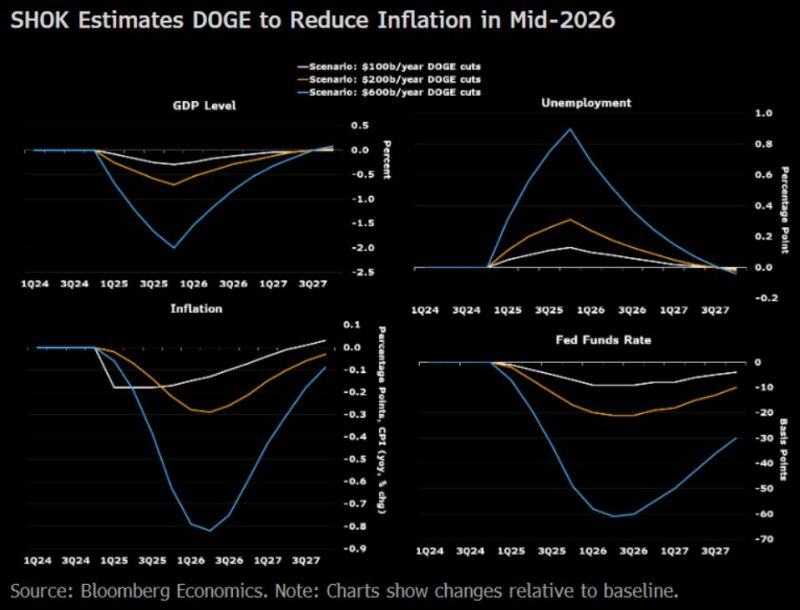

DOGE DEFLATIONARY EFFECTS?

Bloomberg Economics estimates that if hashtag#DOGE attempts to go for savings of $600B/year, GDP could take a -2% hit by the end of this year, the unemployment rate could rise by nearly a percentage point, and CPI y/y could fall by nearly 0.9 percentage points. Source: Kevin Gordon @KevRGordon on X

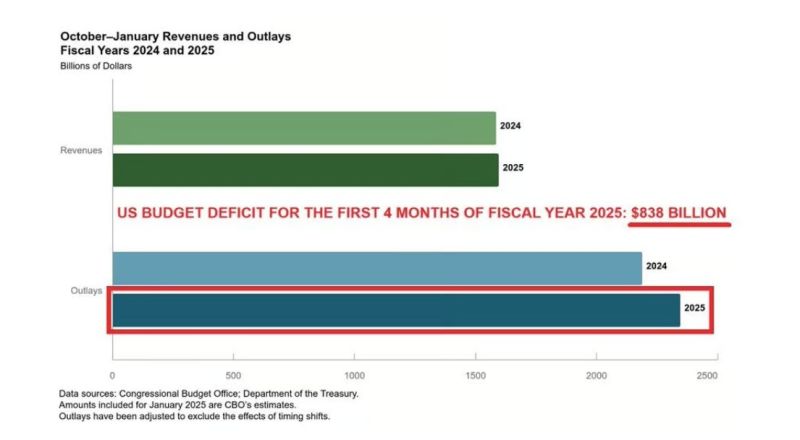

🚨US budget deficit is SKYROCKETING: The US borrowed $838 billion in the first 4 months of Fiscal Year 2025, or $7 BILLION A DAY.

This is $306bn HIGHER than the corresponding period last year, according to CBO👇 Source: Global Markets Investor @GlobalMktObserv

Investing with intelligence

Our latest research, commentary and market outlooks