Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

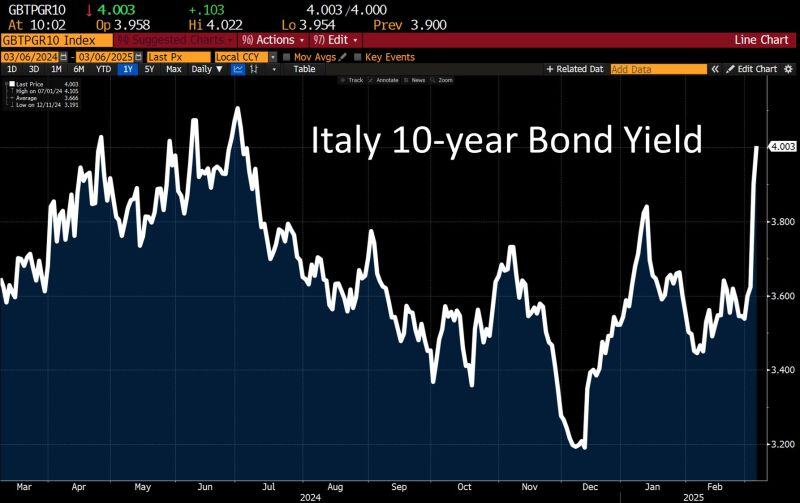

Italy's bond yield just crossed 4%! Thanks to Germany's embracement of debt to invest in defense and infrastructure.

Who remember what happened in 2011/2012? At the time the debt to GDP ratio was 108%. Today it is 140%... Source: Jeroen Blokland, Bloomberg

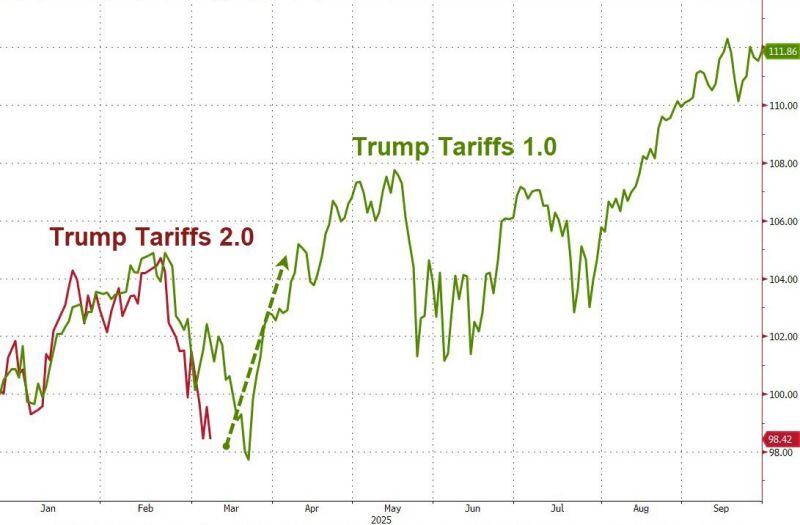

Deja vu all over again???

Source: www.zerohedge.com, Bloomberg

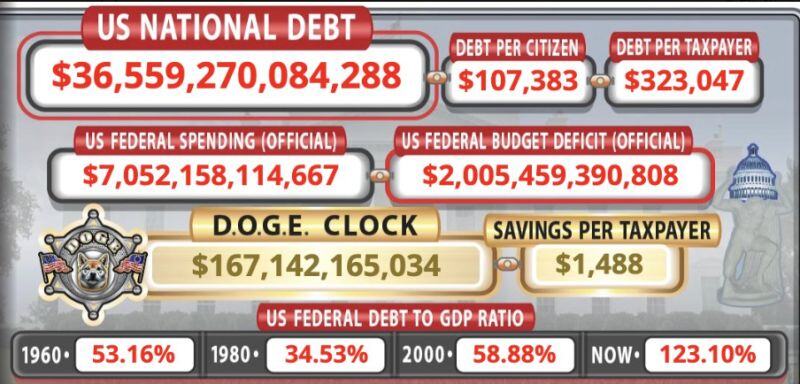

The US National Debt is currently at $36.6T or $323K per taxpayer

source : usdebtclock.org

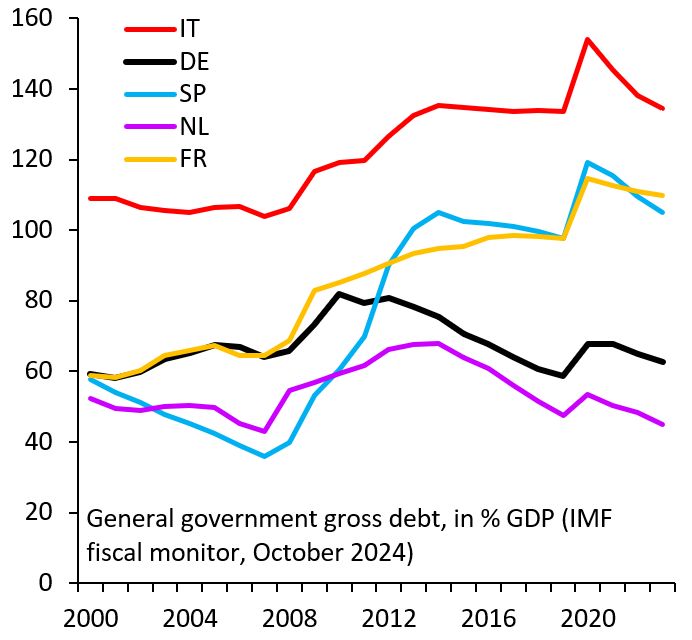

Europe's high-debt countries - like France, Italy and Spain - cheer Germany's fiscal expansion.

They're not doing that out of the goodness of their hearts. Germany now can't possibly say no to more joint EU debt issuance. A win for high-debt countries and their muddle through... Source: Robin Brooks

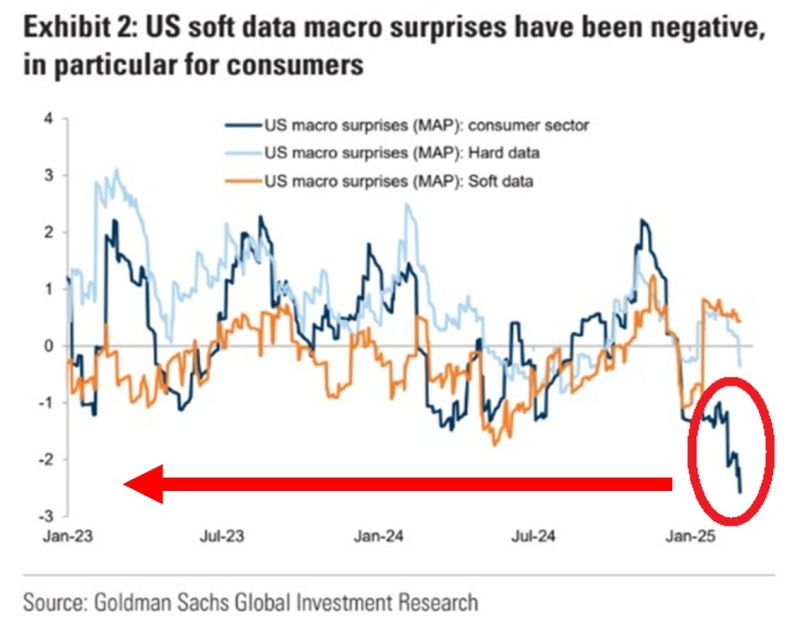

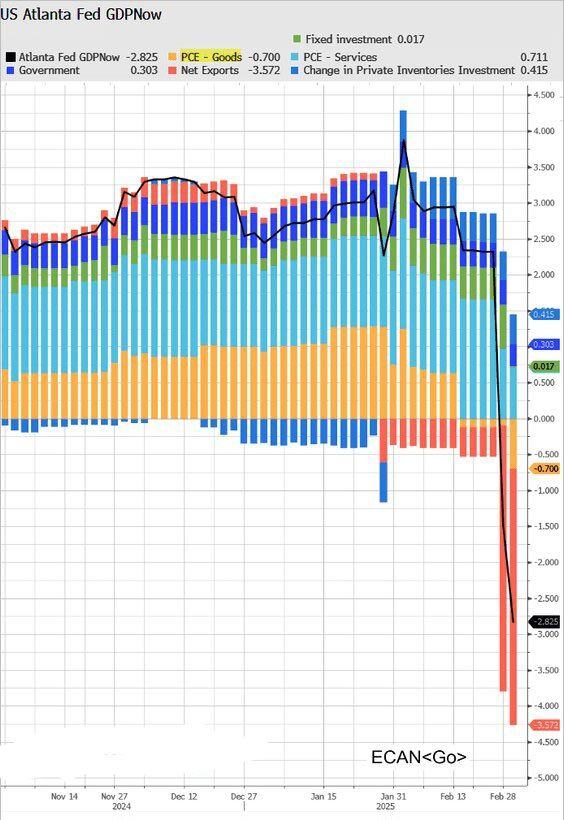

US economic data related to the CONSUMER has surprised to the DOWNSIDE by the most in over 2 years.

This comes as Americans pulled back on spending due to deteriorating labor market conditions and high inflation. 🚨Spending reflects 2/3 of the US GDP. Source: Global Markets Investor, Goldman Sachs

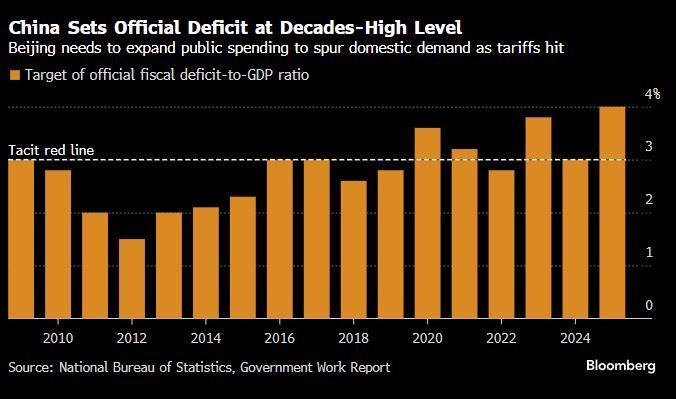

China's out with some proper fiscal firepower: Highest official deficit target in 30+ years

Plus... CNY1.3 trillion in ultra-long special sovereign bonds CNY4.4 trillion in new special local govt bonds CNY500 billion in special sovereign bonds China on Wednesday set its GDP growth target for 2025 at “around 5%” and laid out stimulus measures to boost its economy amid escalating trade tensions with the U.S. Beijing raised its budget deficit target to “around 4%” of GDP from 3% last year, according to the official report, as the country’s top legislative body held its annual meeting. The 4% deficit would mark the highest on record going back to 2010, according to data accessed via Wind Information. The prior high was 3.6% in 2020, the data showed. Source: Bloomberg, David Ingles on X, CNBC

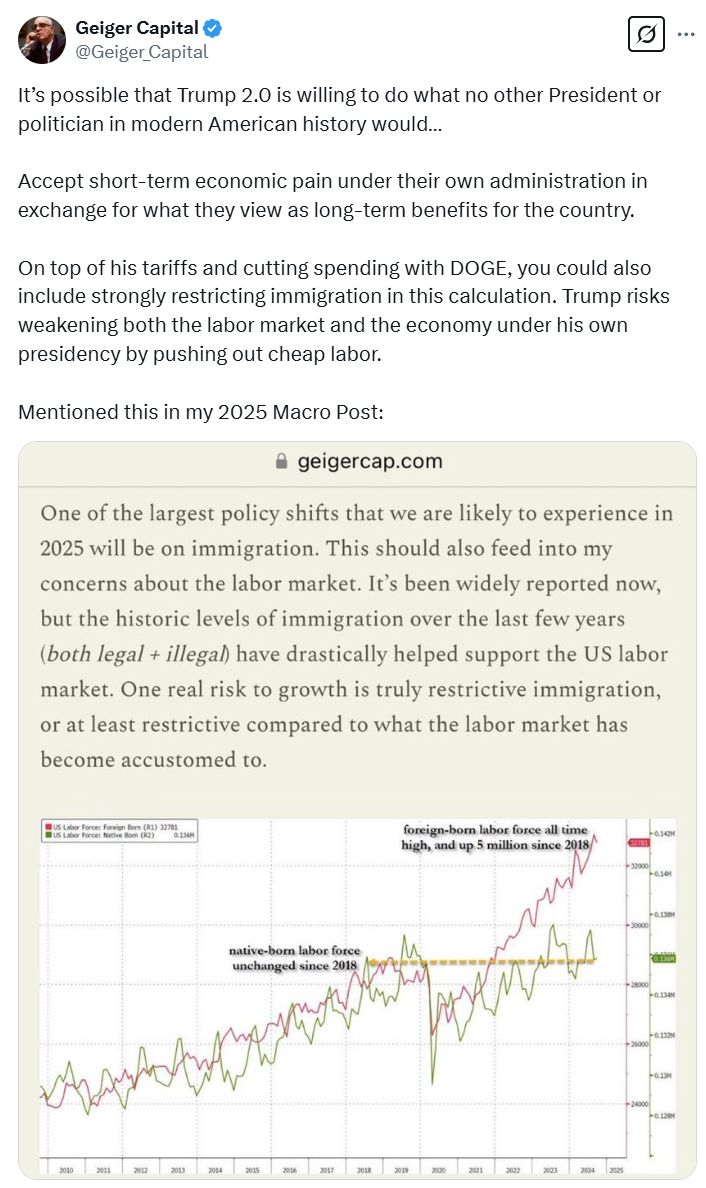

Short-term pain for long-term gain ???

Trump has mentioned both falling bond yields and a goal of balancing the budget… There will be an “adjustment period” and “some disturbance.” He is really going for it.

Investing with intelligence

Our latest research, commentary and market outlooks