Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

It's the liquidity stupid...

Bitcoin $BTC is finally catching up with the drop of liquidity (with a 10 weeks lag). The good news is that Global M2 is accelerating again (but due to the lag risk assets should resume uptrend later on - all other things being equal of course...) Source: Bloomberg, Joe Consorti

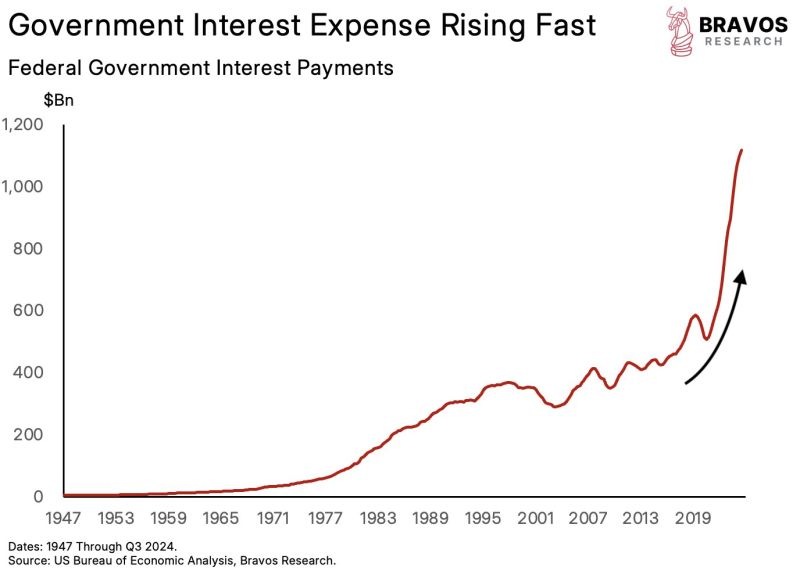

This is truly a historic moment for the US economy.

US government interest expense has gone parabolic in the past few years It has now crossed a staggering $1.1 TRILLION At this rate, it is expected to reach $1.7 trillion by 2034 US debt is now becoming a major concern Source: Bravos Research

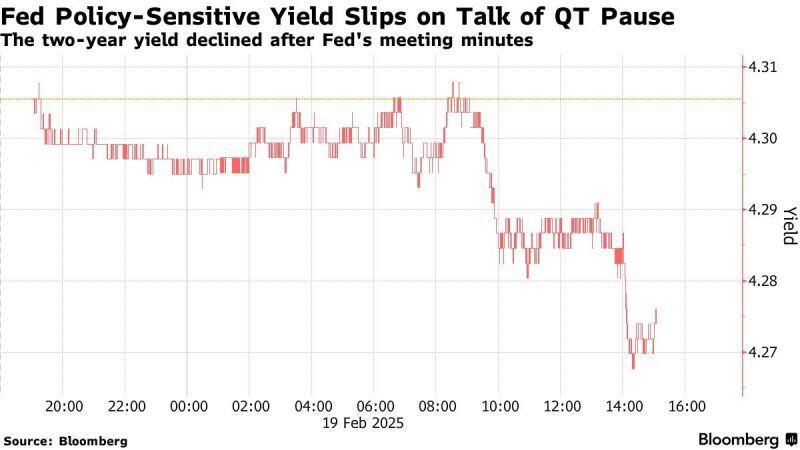

➡️ US Treasuries rose after the minutes from last month’s Federal Reserve meeting revealed policymakers discussed pausing or slowing the balance-sheet runoff ...

... until the government’s debt-ceiling drama is resolved. 👉 Various participants noted it may be appropriate to consider pausing or slowing balance sheet runoff until resolution of debt ceiling dynamics. 👉 Many participants noted after conclusion of balance sheet runoff it would be appropriate to structure asset purchases to move maturity composition closer to outstanding stock of Treasury debt. 👉 Reserves might decline quickly upon resolution of the debt limit and, at the current pace of balance sheet runoff, might potentially reach levels below those viewed by the Committee as appropriate. 👉 Fed survey respondents forecast balance sheet runoff process concluding by mid-2025, slightly later than previously expected. Source: Bloomberg, TalkMarkets

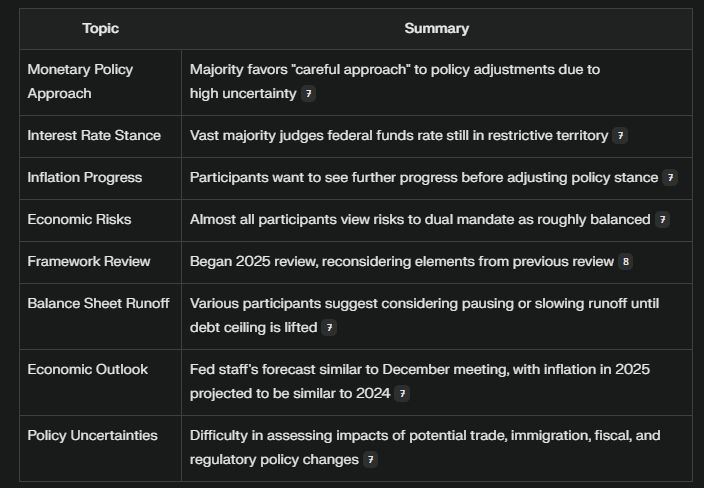

FOMC Minutes summary...

Source: Bloomberg, Mike Zaccardi

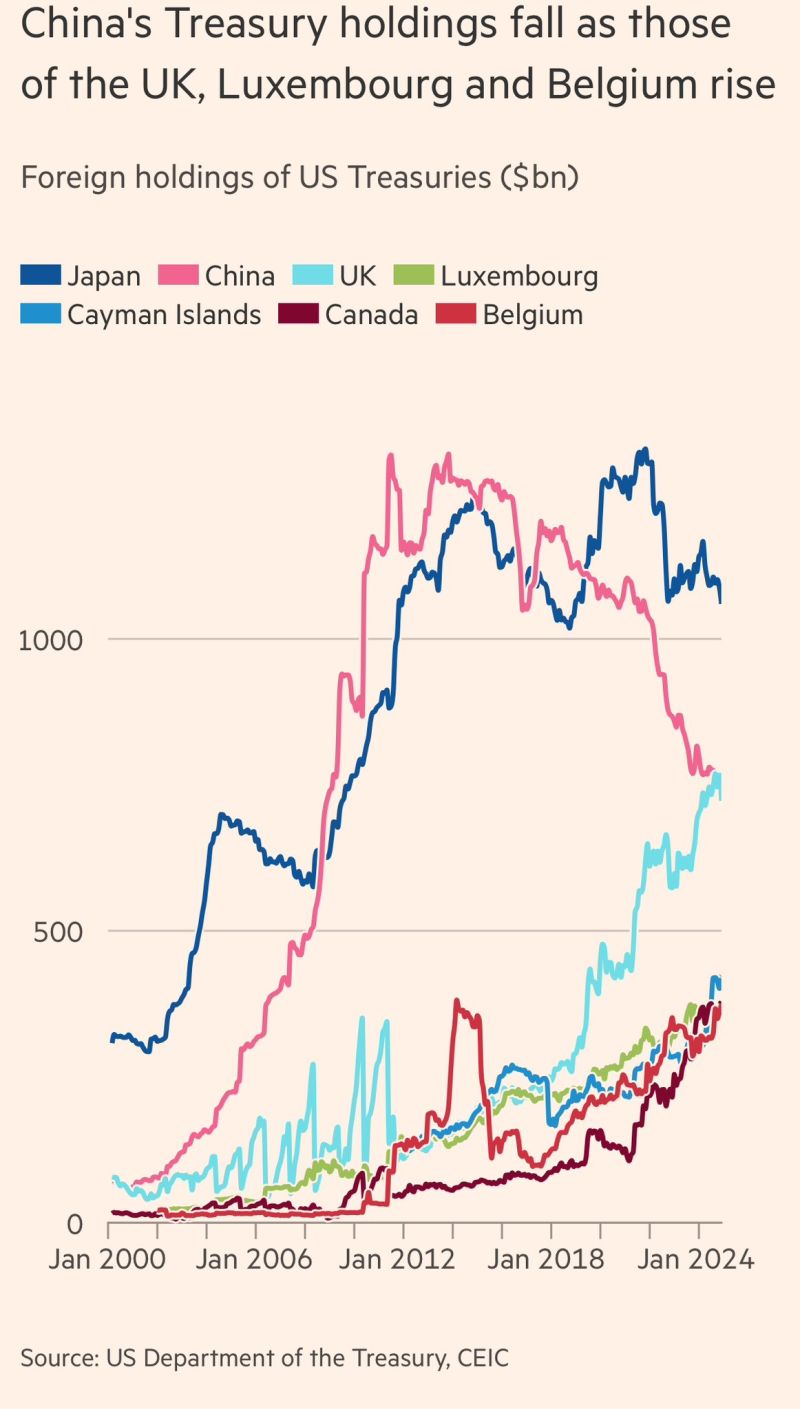

From the @FT article, “China’s holdings of US Treasuries fall to lowest level since 2009:”

“Analysts say the change partly reflects China’s desire to diversify its foreign reserves by buying assets such as gold. But they add that Beijing is seeking to disguise the true extent of its Treasury holdings by shifting them to custodian accounts registered elsewhere.” Source: FT, Mohamed El Erian

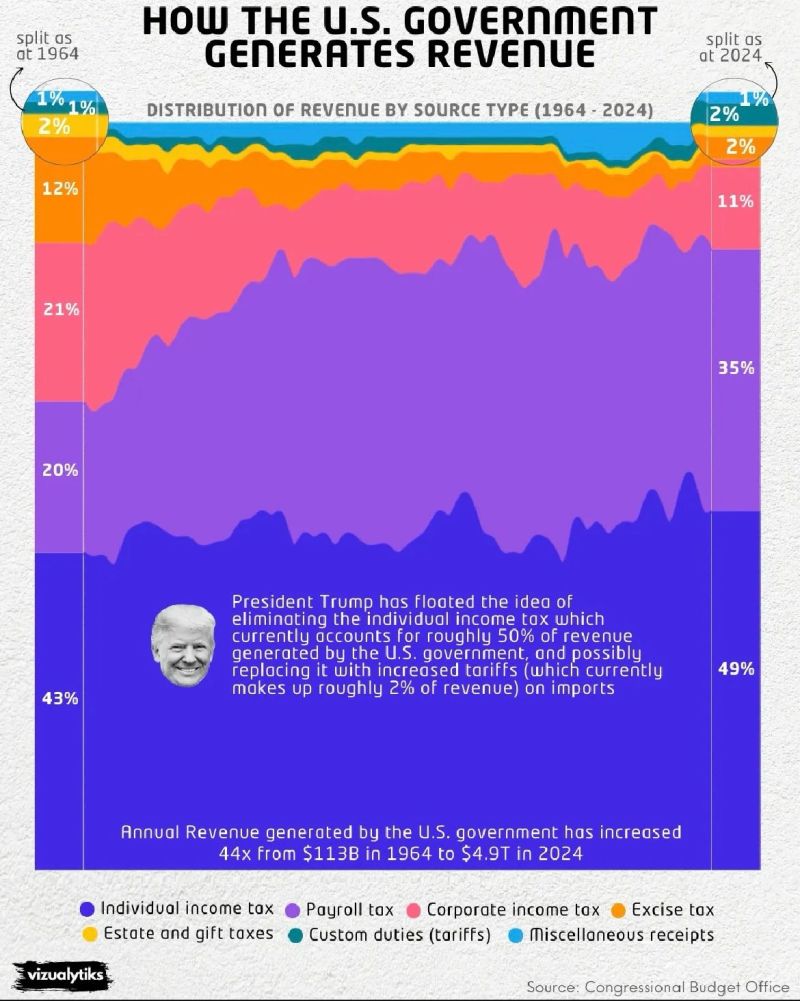

The composition of revenue for the U.S. government has evolved significantly over the decades.

Individual income % taxes represent the largest share (49% in 2024). Payroll taxes, which support programs like Social Security, contributes to 35% of federal revenue. Corporate income taxes have decreased as a percentage of total revenue, falling from 21% in 1964 to a mere 11% in 2024. This decline reflects shifts in tax policies and economic conditions. Other revenue sources, including excise taxes, tariffs, and miscellaneous receipts, remain relatively minor. Source: vizualitiks, CBO

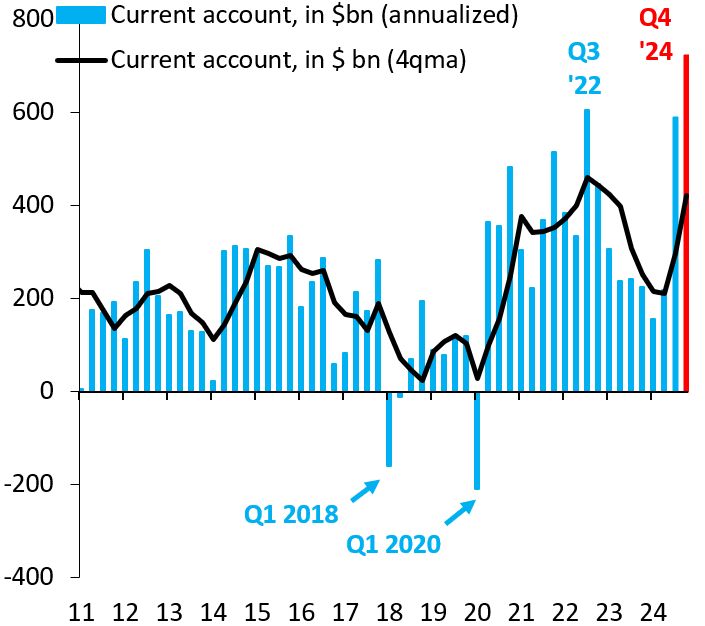

The US is being hard on Europe.

However, the true (economic) enemy for the US is not Europe but China. As shown on the chart below by Robin Brooks, China's current account surplus in Q4 '24 is the largest ever.

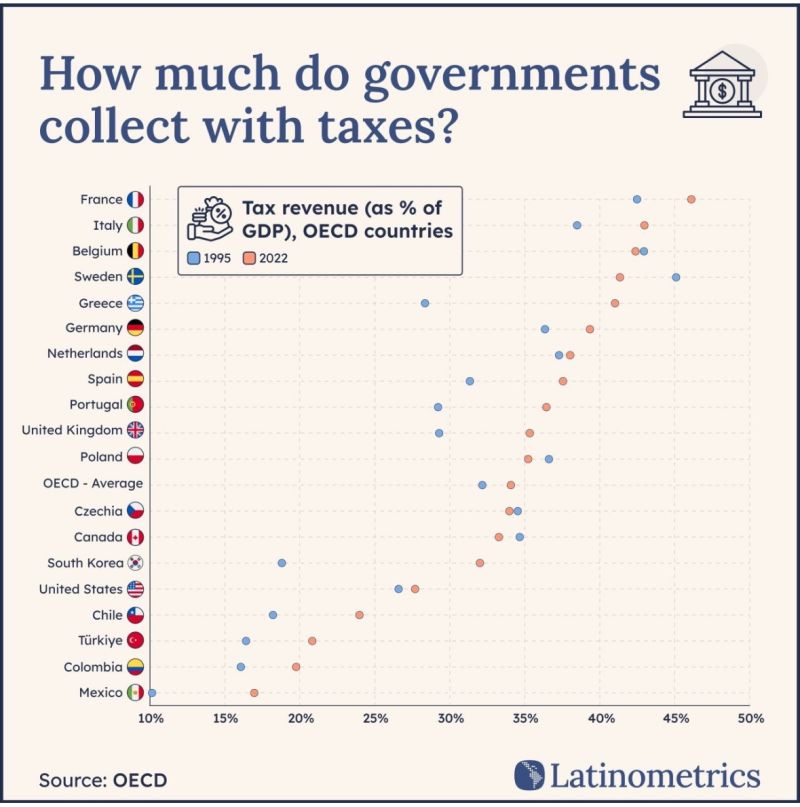

In France and Italy, governments impose taxes to the tune of almost 50% (!) of GDP.

In the US, that’s barely 30%. Not a fun experience for productive individuals and companies in Europe... Source: Alf Macro on X

Investing with intelligence

Our latest research, commentary and market outlooks