Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

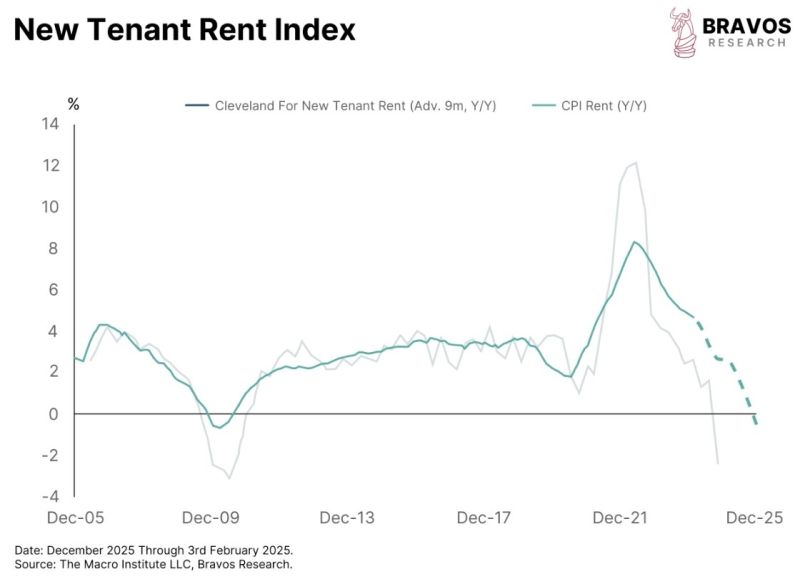

ALERT: New tenant rent data predicts CPI rent inflation by about 9 months

Currently, it’s pointing to a continued decline in rent inflation. And since rent is one of the biggest components of inflation, it suggests that inflation will keep trending lower Source: Bravos Research

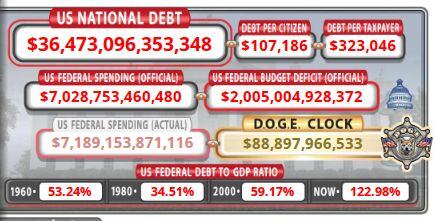

The D.O.G.E clock is ticking... 🚨‼️

JUST IN: President Trump commends Elon, announces a news conference set for Thursday (TODAY) — during which he will read list of names of recipients of waste, fraud and abuse. "I'm going to read to you some of the names that hundreds of millions and even billions of dollars have been given to." “I say it in front of our our attorney general. There's no chance that there's not kickbacks or something going on. When you give millions and millions of dollars to somebody that stands to look at something for 15 minutes and walks away with millions of dollars. That money's coming back in some form. And that's only one form of corruption." "I went through a list of 200 expenditures that were made, and I found three that looked like they were reasonable. Okay, three and, we'll be talking about that tomorrow (read TODAY)." Teh debt clock below now features a D.O.G.E clock with all the savings already planned through the D.O.G.E program.

ELON IS IN THE OVAL OFFICE AND WARNS: "IT’S NOT OPTIONAL TO CUT FEDERAL SPENDING—IT’S ESSENTIAL".

Elon said he wants to add "common sense controls" to the government, adding they haven’t been present. He says taxpayer dollars must be spent wisely. It’s just common sense, he says, not "draconian." Source: CBS, Mario Nawfal on X

As highlighted in a post by Spencer Hakimian on X: The United States has a $66B 10 Year Bond from February 2015 coming due tomorrow.

It had a 2.00% fixed coupon. It is going to be replaced with another $66B 10 Year Bond, but this time, with a 4.55% fixed coupon. This one single rollover will add an extra $1.67B per year to the national debt for the next 10 years. Bond auctions like these are happening every single day. After a decade of ZIRP, all of that debt now costs taxpayer money. No surprise that gold and bitcoin have been going to the roof Soruce: Bloomberg, Spencer Hakimian on X:

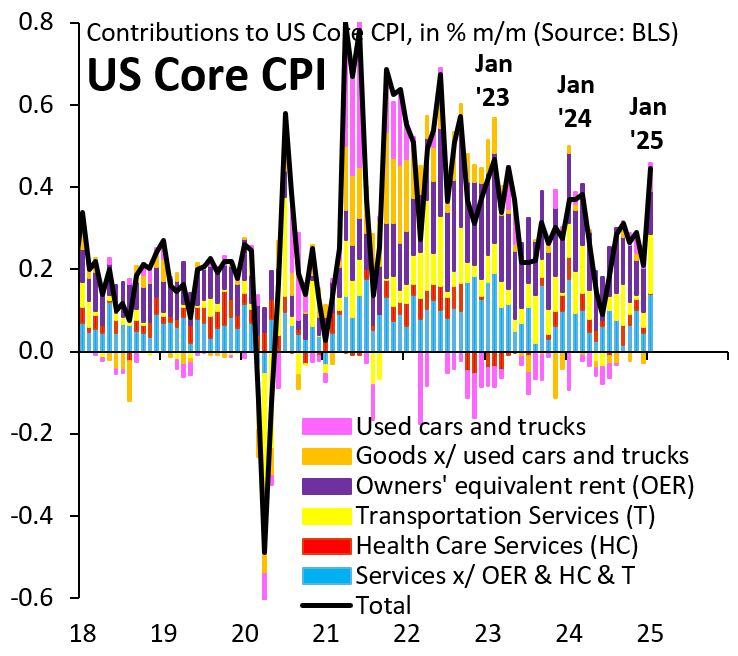

Ever since COVID, January inflation has come in "hot."

Today's core CPI is no different. A proxy for underlying inflation is "core" services (in blue on the chart below courtesy of Robin Brooks) and that looks well-behaved. So it could be that this "hot" reading is largely about noise and residual seasonality, as in 2023 and 2024... Source: Robin Brooks

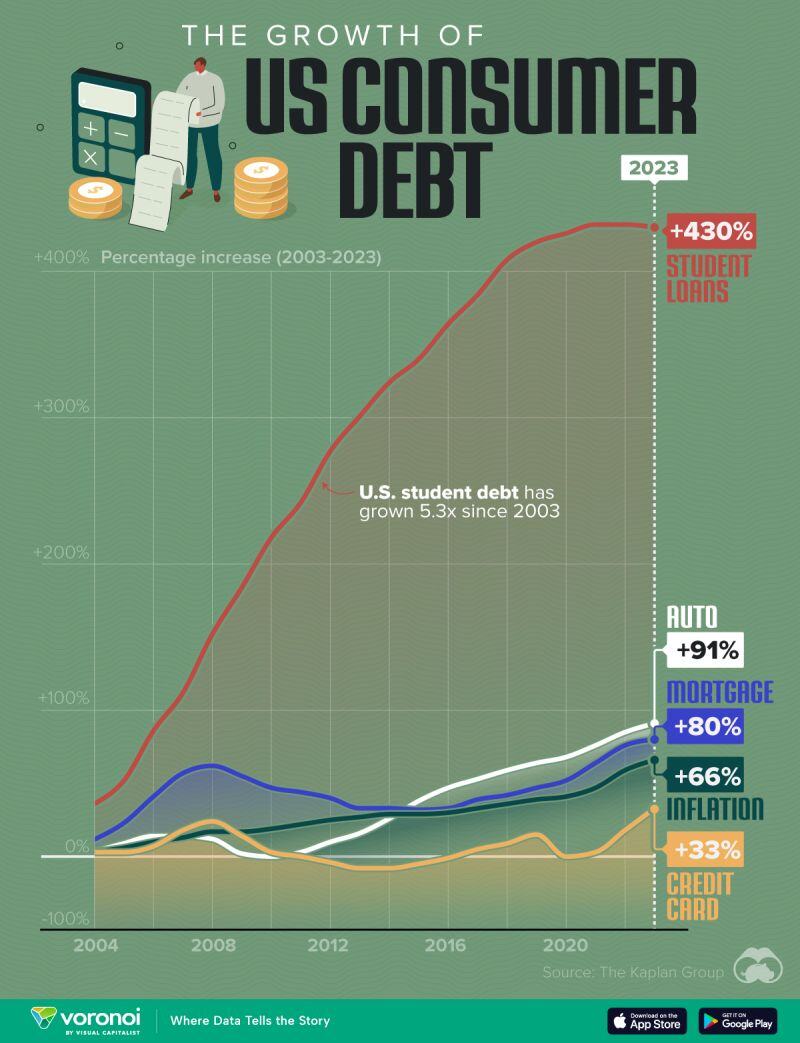

Visualizing the Growth of U.S. Consumer Debt

🚨 The Kaplan Group analyzed the State Level Household Debt Statistics from 2003 to 2023, sourced from the Federal Reserve Bank of New York. Data were retrieved for auto loans, mortgages, credit cards, and student loans since 2003. The evolution of each of these elements over the last 20 years was calculated. For inflation, the Consumer Price Index (CPI) was utilized. 👉 Key Takeaways - Student loan debt is five times larger than it was 20 years ago - Credit card debt has shown minimal growth since 2023; from 2010 to 2016, it was even lower than in 2003 - The total amount of debt has grown by 81.5% since 2003 Source: Visual Capitalist, Voronoi

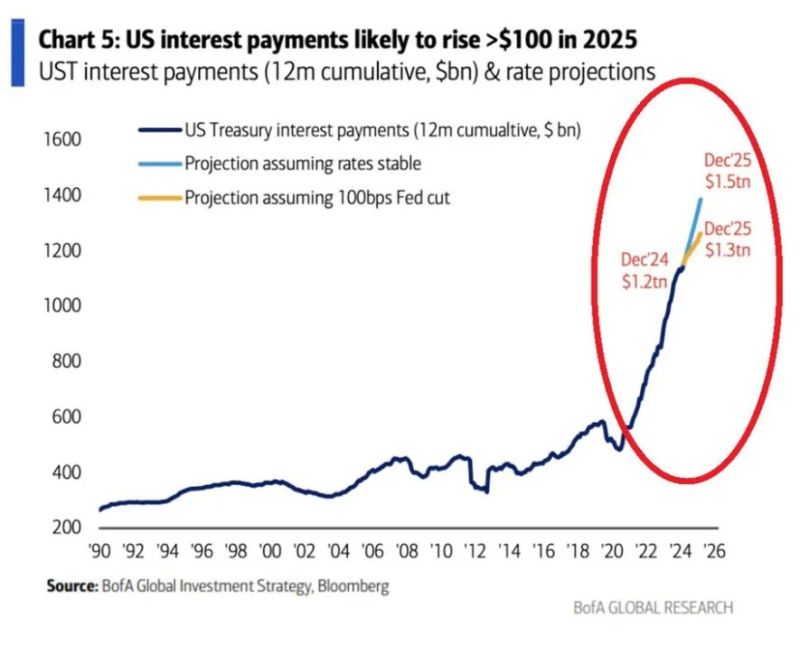

US Interest Costs Soar to $1.2 Trillion – Now Exceed Defense Spending

Over the last 12 months, US interest payments hit a record $1.2 trillion, surpassing defense spending ($900 billion) and now ranking as the second-largest government expense after Social Security. With trillions in debt maturing this year, the US government will have to refinance. If rates remain stable, total interest payments could skyrocket to $1.5 trillion by year-end. Even in a scenario where the Fed cuts rates by 100 bps (from 4.5% to 3.5%), interest costs are still projected to reach ~$1.3 trillion by the end of 2025. source : BofA

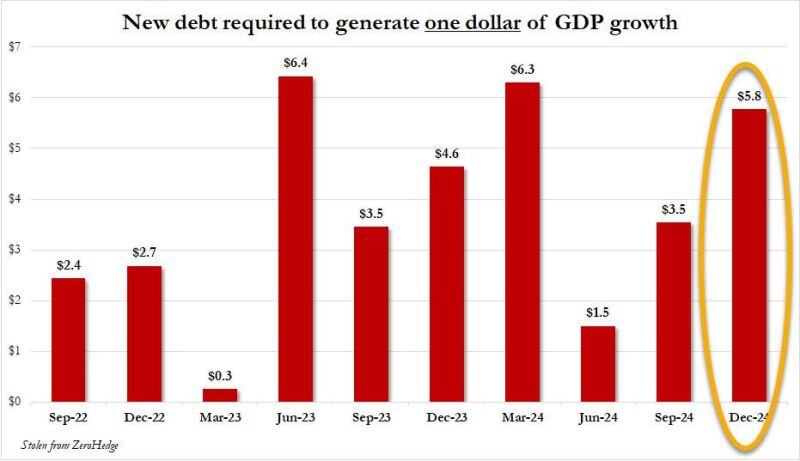

The US economy has been driven by a massive DEBT BUBBLE: In 2024, to generate 1 unit of GDP growth it took $3.8 of national debt...

In Q4 alone, it took $5.8 of debt to create $1 of economic growth. If not for the huge debt, the US economy would have been in a recession. Source: Global Markets Investor

Investing with intelligence

Our latest research, commentary and market outlooks