Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

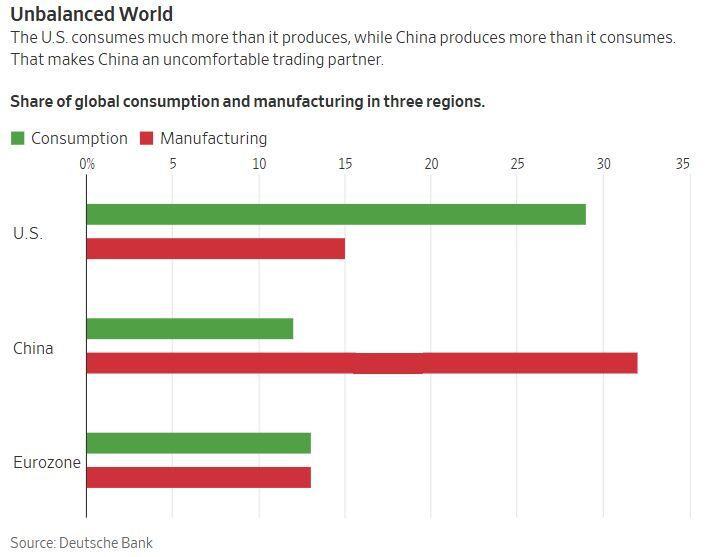

An unbalanced world...

▶️ Share of Global Consumption... US: 29% Eurozone: 13% China: 12% ▶️Share of Global Manufacturing... China: 32% US: 15% Eurozone: 13% Source: Charlie Bilello, Deutsche Bank

In case you missed it...

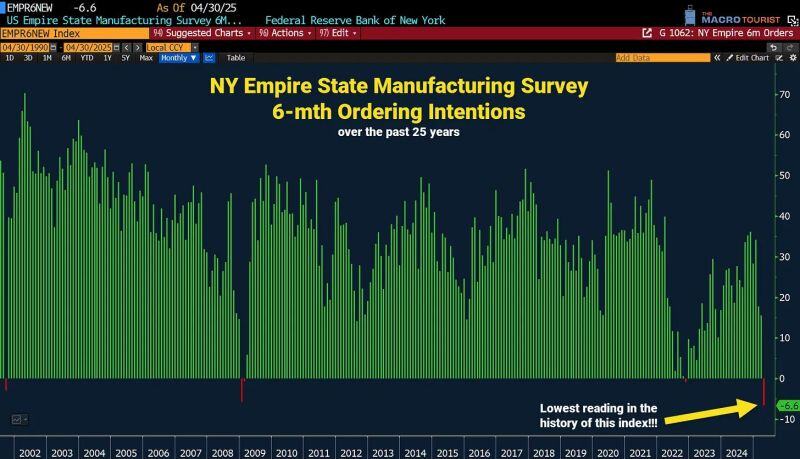

The NY Empire State Manufacturing Survey 6-month Ordering Intentions fell to the LOWEST READING IN THE HISTORY OF THE INDEX! Source: Ronnie Stoeferle @RonStoeferle @kevinmuir, Bloomberg

china first-quarter GDP topped Reuters poll expectations for a 5.1% growth year on year, building on a recovery that began in late 2024, thanks to a broad policy stimulus push.

▶️Retail sales in March rose by 5.9% year on year, sharply beating analysts’ estimates for a 4.2% growth. Industrial output expanded by 7.7% from a year earlier, versus median estimates of 5.8%. ▶️The urban unemployment rate slipped to 5.2% in March, following a two-year high of 5.4% in February. Source: CNBC

China has the largest manufacturing workforce on Earth, by far.

Source: UN, Markets & Mayhem

In Germany, investor confidence in the economy has taken a sharp hit following US President Trump's erratic trade policy.

The ZEW Institute’s expectations index plunged to -14 in April, down from 51.6 in March – a massive drop. Analysts surveyed by Bloomberg had expected a decline, but only to +10. The unpredictable shifts in US trade policy have fuelled global uncertainty, which is now weighing heavily on economic expectations in Germany. At the same time, any initial optimism about the new government's spending plans has quickly faded. Source: HolgerZ, Bloomberg

Last week’s trade data shows an incredibly bleak picture for the economy:

- 49% drop in global container bookings - 64% drop in U.S. imports. - 30% drop in U.S. exports. If this continues for more than a few weeks, there is no doubt that we are headed for tough times ahead. Source: Brian Krassenstein @krassenstein on X

$AAPL Apple gets upgrade at KeyBanc, Wedbush keeps bullish views amid Trump's tariffs scenario.

$APPL is up +4% Source: @DivesTech

Investing with intelligence

Our latest research, commentary and market outlooks