Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

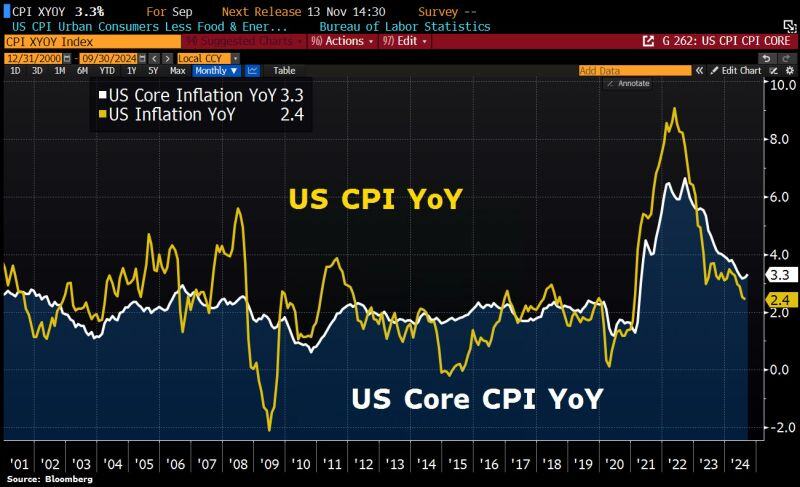

In case you missed it: US September CPI inflation falls to 2.4%, ABOVE expectations of 2.3%.

Core CPI inflation RISES to 3.3%, above expectations of 3.2%. For the first time since March 2023, Core CPI inflation is officially back on the rise. Same story on CPI as previous month: Total is “ok” at +2.4% because energy is collapsing, but core is still +3.3% and Services remain HOT & STICKY at +4.7%. Transport +8.5% Indeed, while September CPI inflation is at 2.4%, inflation is much higher in many basic necessities: 1. Car Insurance Inflation: 16.3% 2. Transportation Inflation: 8.5% 3. Homeowner Inflation: 4.9% 4. Car Repair Inflation: 4.9% 5. Rent Inflation: 4.8% 6. Hospital Services Inflation: 4.5% 7. Food Away From Home Inflation: 3.9% 8. Electricity Inflation: 3.7% Source: Bloomberg, HolgerZ, The Kobeissi Letter

JUST IN 🚨 : China expected to announce a new stimulus package of $283 Billion

Investors are on tenterhooks as Beijing prepares to deliver fresh policies over the weekend that could jumpstart its economy. China’s Finance Minister Lan Fo’an is set to hold a press conference at 10 a.m. on Saturday local time on “intensifying” fiscal stimulus policies, the country’s State Council Information Office said. With Beijing at risk of missing its full year economic growth target of 5%, some analysts are confident that authorities are ready to deliver major fiscal stimulus at the highly anticipated event, while others remain skeptical. Most economists expect some sort of additional stimulus, but there are many differing views on its size as well as the priorities of the package. Some have floated a figure between two and three trillion yuan (the equivalent of $282.8 billion to $424.2 billion), while others have suggested 10 trillion yuan ($1.4 trillion). Source: Barchart, CNBC

In case you missed it... Atlanta Fed President Raphael Bostic is okay with skipping rate cut in November 🚨

Source: Barchart

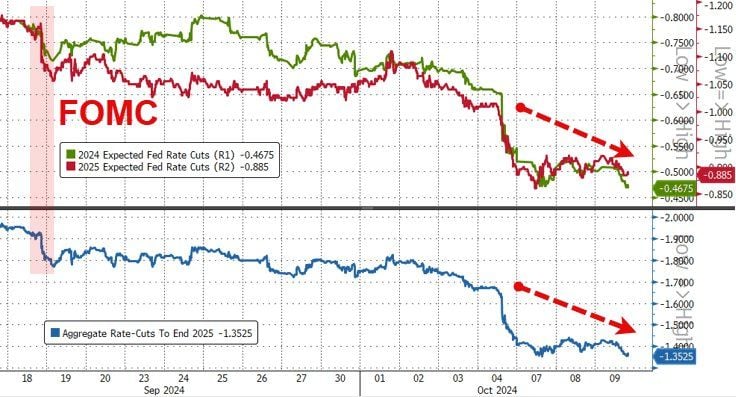

FOMC MINUTES WERE PUBLISHED TODAY, here are the highlights 👇

▪ ‘Substantial majority’ backed half-point rate cut ▪ ‘Some’ officials would have preferred quarter-point cut ▪ ‘Almost all’ officials saw higher risks to labor market ▪ ‘Almost all’ participants saw lower inflation risks The key takeaway >>> FOMC Minutes Show Fed Considerably More Divided Over Size Of Rate Cut While there was only one dissent, the FOMC Minutes show "some" officials preferred a 25bps cut. Despite the apparent dovish pivot, expectations for rate-cuts (this year and next) has plunged dramatically - see chart below Source: Stocktwits, zerohedge

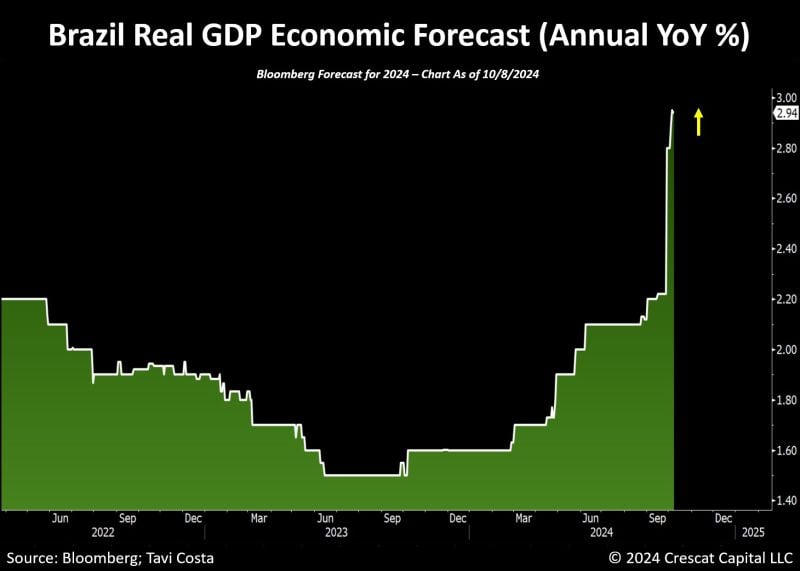

Meanwhile: Very significant upward revision in the real GDP forecast for Brazil this last month.

Source: Tavi Costa, Bloomberg

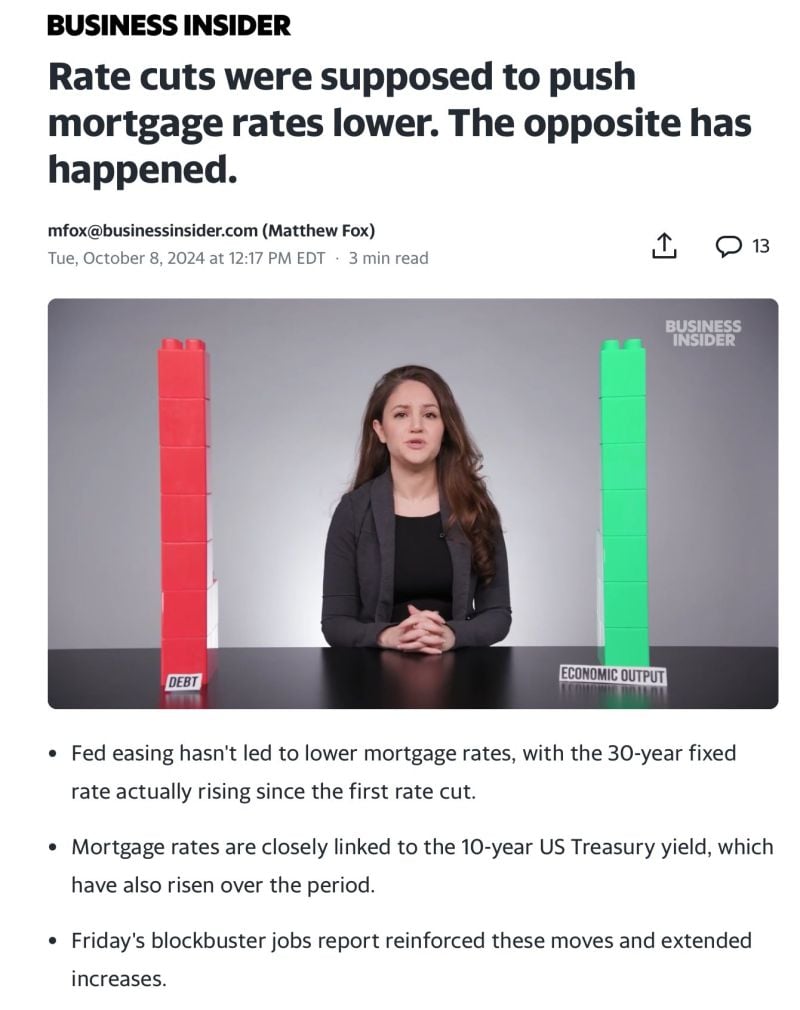

One of the reasons mentioned by many analysts to explain the aggressive rate cut (50bps) by the Fed in September was the following:macr

Shelter is the sticky component of inflation. If the Fed cut rates, we should see a drop in the mortgage rate which will enable more real estate supply and thus lower shelter inflation. Well, the Fed cut rates but mortgage rates are not declining. They are even moving higher? Has the Fed lost control of the bond market?

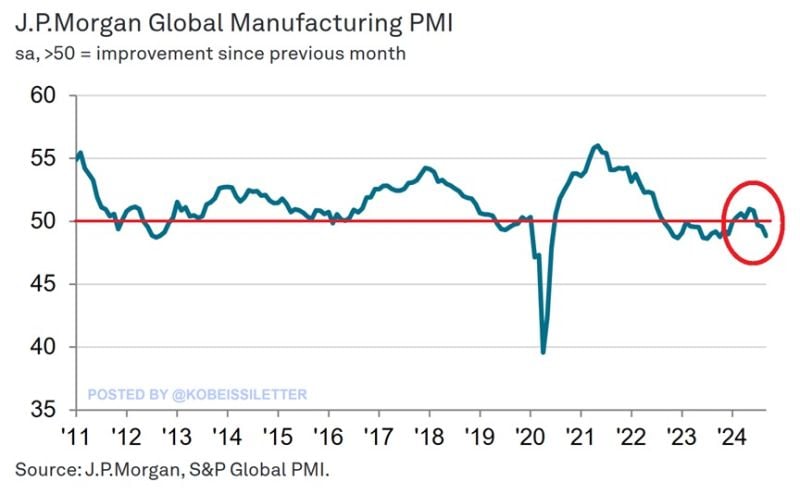

Global manufacturing is contracting:

The Global Manufacturing PMI index fell to 48.8 points in September, down from 49.6 in August, marking the 3rd straight monthly contraction. 4 of the 5 index components shrunk last month including output, new orders, employment, and stocks of purchases. Furthermore, new export orders declined at the fastest rate in 11 months. This implies that global trade volumes could be decreasing now by 3-4% year-over-year. Meanwhile, manufacturers' business optimism fell to a 22-month low, suggesting a grim outlook for the next few months. Source: JP Morgan, The Kobeissi Letter

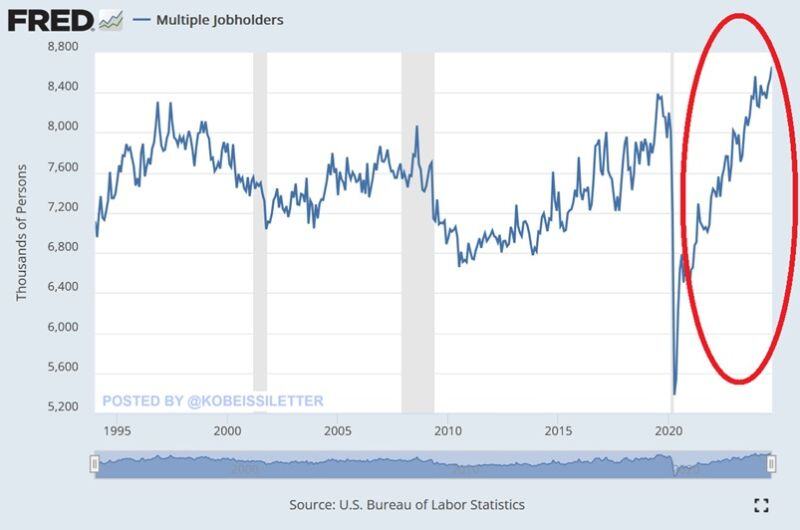

BREAKING: The number of people working MULTIPLE jobs in the US hit 8.66 million in September, a new record.

This is ~300,000 above the peak seen before the pandemic and ~600,000 above the 2008 peak. Furthermore, the number of part-time jobs has jumped by ~3 million over the last 3 years to a near-record 28.2 million. Concerningly, full-time employment has declined by 1 million since November 2023. Multiple jobholders have been rapidly rising over the last few years as Americans are fighting record-high prices. Millions of Americans are working multiple jobs to afford basic necessities. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks